Industry Engagement During the Early stages of Capability

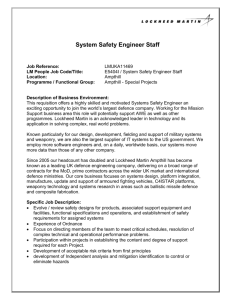

advertisement