Triathlon Growth & Demographics: USA Participation Trends

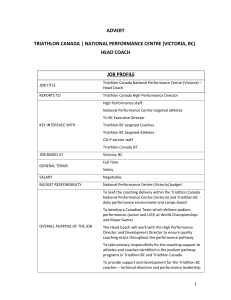

advertisement

Triathlon Participation, Growth Trends and Demographics •December 2010 USA Triathlon Membership Breakdown (PDF) (updated June 2011) Triathlon participation in the United States is at an all-time high, following unprecedented growth over the past decade. USA Triathlon can easily track the surge through its membership numbers, which surpassed 135,000 annual members in 2010. To put that into perspective, annual membership hovered between 15,000 and 21,000 from 1993-2000. Download the December 2010 USA Triathlon Membership Breakdown to view membership growth since 1993, look at the age breakdowns of USA Triathlon members, see what states have the most USAT members and much more. At the end of 1999, annual membership stood at 19,060. Those numbers had more than doubled to 40,299 by the end of 2002 and doubled again to 84,787 by the end of 2006. Much of the growth in 2006 could be owed to mandatory youth memberships, but adult memberships still soared at a 15 percent rate over the previous year. The growth during 2007 continued at close to a 16 percent rate, bringing membership to 100,674. After rising to 107,231 at the end of 2008, annual membership jumped nearly 20 percent to 128,653 to close 2009 and the total climbed to 133,876 at 2010 yearend. Additionally, 326,732 one-day memberships to compete in USA Triathlon sanctioned events were purchased in 2010, growing from just over 100,000 in 2000. Looking at the causes for this growth, one must first turn their attention to the 2000 Olympic Games, triathlon’s first appearance at this international event. This elevated the publicity of the sport on the national level. Through the first weekend, NBC's coverage of the 2000 Sydney Olympic Games, which included coverage of the women's triathlon, was the most watched non-U.S. Summer Games in history with 111 million people tuned-in to all or part of the broadcasts, according to NBC Sports research. Before, during and after the 2004 Olympic Games in Athens, Greece, USA Triathlon and its elite athletes appeared in such publications as the New York Times, the L.A. Times, Vanity Fair, Washington Post, USA Today, the Orlando Sentinel, the Denver Post, the Rocky Mountain News, the Detroit News, the Detroit Free Press and a host of others. Olympic bronze medalist Susan Williams was interviewed on NBC, the Today Show and did numerous interviews with NBC affiliates across the country. NBC's prime time Olympic coverage on Aug. 25, 2004, which included coverage of the women's Olympic triathlon, was the third most-watched prime time show for the week of Aug. 22, 2004. The first and second most-watched shows were also the prime time Olympic coverage. The women's triathlon was seen in 24.3 million households, according the Nielsen Media Research. It is difficult to pinpoint the exact causes of the continued growth of the sport, but the below factors all played a part: • Society’s interest in fitness and living a healthy lifestyle • The growth of the number of total races across the country, making races easier to get to • The growth in the number of the more accessible shorter sprint races, which made the sport more accessible to those with fewer hours to train each week • Media attention on the sport • Growth in the 30-49 age groups who are looking for varied outlets for fitness • Peer pressure from friends who have tried the sport • The ego reward of saying you “are a triathlete” • Increase in clubs, which create a community concept for men and especially women who enjoy the group training and support atmosphere • Increase in resources (websites, books, magazines) that provide assistance/education in getting started • Growth in multisport shops and triathlon specific training and racing gear • Marketing and communications efforts of USA Triathlon • Growth in the number of USAT certified coaches who are able to provide training plans and individual attention for athletes who need guidance and motivation On the event side, the number of races sanctioned through USA Triathlon continues to climb. Those numbers (which include camps and clinics) have more than doubled over the last six years, going from 1,541 in 2004 to 3,486 in 2010. The number of actual triathlon races during that time has grown from 897 to 2,456, while duathlon (run-bikerun) races have gone from 277 to 475. Youth events have nearly doubled from 193 to 320. Other multisport disciplines, such as aquabike (bike-swim-bike) and aquathlon (runswim-run) have also seen growth in the number of events offered across the United States. Looking at the distances of the races, the biggest growth continues to be at the shorter sprint distances, which have surged from 818 in 2004 to 1,507 in 2010, but growth at other distances (including Olympic, Ironman 70.3 and Ironman) has also been consistent during that time. Additionally, a number of events are not sanctioned by USA Triathlon are put on across the United States each year. The majority of these are offered through organizations with insurance and liability programs already in place, such as universities and YMCAs. Outside of growth trends gleaned through USA Triathlon membership numbers, the Sporting Goods Manufacturers Association (SGMA) has included triathlon in its participation studies since 2006. For years, SGMA has been conducting surveys of the U.S. population to see how many people are participating in what sports and how often. Aerobics, badminton, skateboarding, tennis, golf, ice skating, lacrosse, hunting, sailing, football, bowling – the list goes on. The SGMA uses the terms “casual” and “core” to divide the main frequency groups of sport participants. SGMA says the core participants are the main purchasers of “equipment, services and user fees” for a particular sport or activity. A casual participant for triathlon is someone who participated in just one triathlon in a given year, while a core participant was involved in two or more events. They even break down core into regular (2-9 events) and frequent (more than 10 events) participants. The most recent SGMA study — released in May 2010 — tells us that 1,208,000 Americans participated in at least one on-road (traditional) triathlon in 2009. This total represents 11.1 percent growth from 2008 (1,087,000) and 51.4 percent growth from 2007 (798,000). Additionally, the SGMA reports that 666,000 Americans participated in an off-road (nontraditional) triathlon in 2009. This total marked a 10.6 percent improvement over 2008 (602,000) and a 37.9 percent growth since 2007 (483,000). According to the SGMA, there are 694,000 core on-road triathlon participants in the United States and another 413,000 core off-road triathlon participants. The SGMA defined core participants as athletes that competed in at least two races per year. So, what does that mean for triathlon? The sport is growing and thriving. More and more people are getting active in the sport. But the better news is that people are sticking around, doing more events and becoming “core” participants. Who are Triathletes? In the late 1990s there was a slow increase in overall membership but a sizeable shift in the participation base from 30-34 to 35-39. Since that time the greatest growth has occurred in the 35-39 and 40-44 age groups. We believe that this growth will continue as those in these age groups are looking for new outlets of participation and fitness. Fortunately growth has been good in all age categories in the past decade and so the sport as a whole should continue to increase as more events are being started in smaller triathlon markets. Female Participation Since 2000 female USA Triathlon membership has grown from 27 percent of the total of the annual members to more than 37 percent at the end of 2010. Factors leading to this growth are society’s acceptance of “active” women, women feeling more comfortable living an active lifestyle, the growth of women’s-only events like the Danskin and Trek Triathlon Series, and races focusing on charity involvement and fundraising. Youth Growth USA Triathlon categorizes youth athletes as ages 7-17. At present, youth triathlon is still in a very organic, grassroots state. Many — if not most — races are organized by groups that already service young populations. We are seeing an increase in the number of “adult” triathlons that are adding youth events to their program in what is commonly called a “triathlon festival.” The idea is to provide a menu of events over the course of a weekend, from sprint to long course distances, to attract as many people as possible. Race directors have realized a growing demand to provide something for the young kids who may join mom and dad at the triathlon festival. In this way, triathlon is evolving into a multi-generational sporting event … all taking place on the same weekend. Today’s youngsters also have the advantage of recognizing triathlon as a “real” sport. It is not a fringe sport to them as it was when many adults got their start in the late-80s and early-90s. The sport is televised more often – including broadcasts on NBC, Versus and regional sports networks – and the web has made information much more accessible than it was even in 2000 when triathlon debuted in the Olympics. On the national level, USA Triathlon has been reaching out to the youth market through a variety of camps and events that cater to both recreational participants and those with aspirations of competing as a professional or on the Olympic stage. National championships are offered for both groups, and athletes with recognized skill and potential are invited to be a part of the USA Triathlon Athlete Development program, which targets youth 15 and under and juniors aged 16-19. The program serves as a feeder program to senior elite level, where athletes compete as professional on the international stage, including the Olympic Games. The Mind of the Triathlete A study initiated by USA Triathlon and conducted by the TribeGroup in early 2009 revealed exciting new data on the demographics and spending habits of multisport athletes in the United States. The Mind of the Triathlete study – which was conducted in October and November of 2008 – is the first of its kind to offer in-depth exploration of the social, emotional, demographic and lifestyle aspects of the people who participate in multisport. It provides a deep analysis and segmentation of the triathlete across new participants and long time veterans. More than 15,000 triathletes gave an average of 20 minutes describing their experiences, lifestyle, habits and backgrounds. Download the Executive Summary of the study. Download the full study, which includes more than 70 pages of analysis and charts, as well as additional cross tabs, in PDF format Part 1 Part 2 Part 3 Part 4 Key Findings The study grouped participants into seven distinct segments according to similarities in their demographics, psychographics and involvement in the sport. On average, triathletes are from high socio-economic backgrounds with median incomes of $126,000, however, their motivators and mindset are different, creating a significant opportunity for the triathlon community to serve them better and in more targeted ways. Unlike many consumers, they are spending cautiously but on average intend to spend as much in 2009 as they did in 2008. In fact, 45 percent would rather spend discretionary income on triathlon with three of seven segments exceeding 65 percent and one nearly 80 percent. General Participation Older athletes do more races 95% participate for the personal challenge 87% participate to stay in shape On average, they participated in 4.2 triathlons during the previous 12 months 86% plan to do longer races in the future Sprint triathlon remains the most popular, with those events attracting participation of more than three quarters of respondents What Distances? 78% participate in Sprint (approx. 500 meter swim, 12 mile bike, 5k run) 58% participate in Olympic (1.5k swim, 40k bike, 10k run) 39% participate in Half Ironman (1.2 mile swim, 56 mile bike, 13.1 mile run) 17% participate in Ironman (2.4 mile swim, 112 mile bike, 26.2 mile run) 15% participate in Short duathlon (approx. 5k run, 30k bike, 5k run) 4% participate in Long duathlon (approx. 10k run, 70k bike, 10k run) What Other Type of Events? 69% participate in 10K 64% participate in 5K 54% participate in marathon 31% participate in off-road triathlon 16% participate in winter triathlon Age and Gender Average age: 38 59.6% Male 39.5% Female 7% are Under 25 12.8% are 25-29 15.7% are 30-34 19.9% are 35-39 17.3% are 40-44 12.1% are 45-49 7.5% are 50-54 3.5% are 55-59 1.6% are 60-64 0.6% are 65-69 0.3% are 70+ Relationships 63% are married 11% are in committed relationship 21% are single 5% are widowed, divorced or separated 44% have children living at home Occupation 49% report white-collar jobs 19% report professional jobs such as doctor, lawyer or accountant 12% are students or education workers 12% are blue or gray collar workers 6% are government or military Income Average income: $126,000 12.9% have incomes under $50K 14.5% have incomes $50-74,999 16% have incomes $75-$99,999 23.4% have incomes $100-$149,999 12.1% have incomes $150-$199,999 8.4% have incomes $200-$299,999 5.5% have incomes over $300K Spending (discretionary income) 50% of dollars spent on bikes and bike equipment 17% of dollars spent on race entry fees 8% of dollars on fitness clothing 11% of dollars on athletic shoes $2,274 spent on bikes in past 12 months $564 spent on race fees in past 12 months $524 spent on bike equipment $370 spent on training, running and athletic footwear $277 spent on nutritional supplements Race and Ethnicity 88.2% are Caucasian/White 3.2% are Hispanic 2.1% are Asian 1.5% are Multi-racial 0.5% are African-American 1.1% are other To learn more about the TribeGroup and their services, e-mail them at info@tribegroupllc.com or call (877) 716-9422.