Use this form to register for self-employment and/or advise of low

advertisement

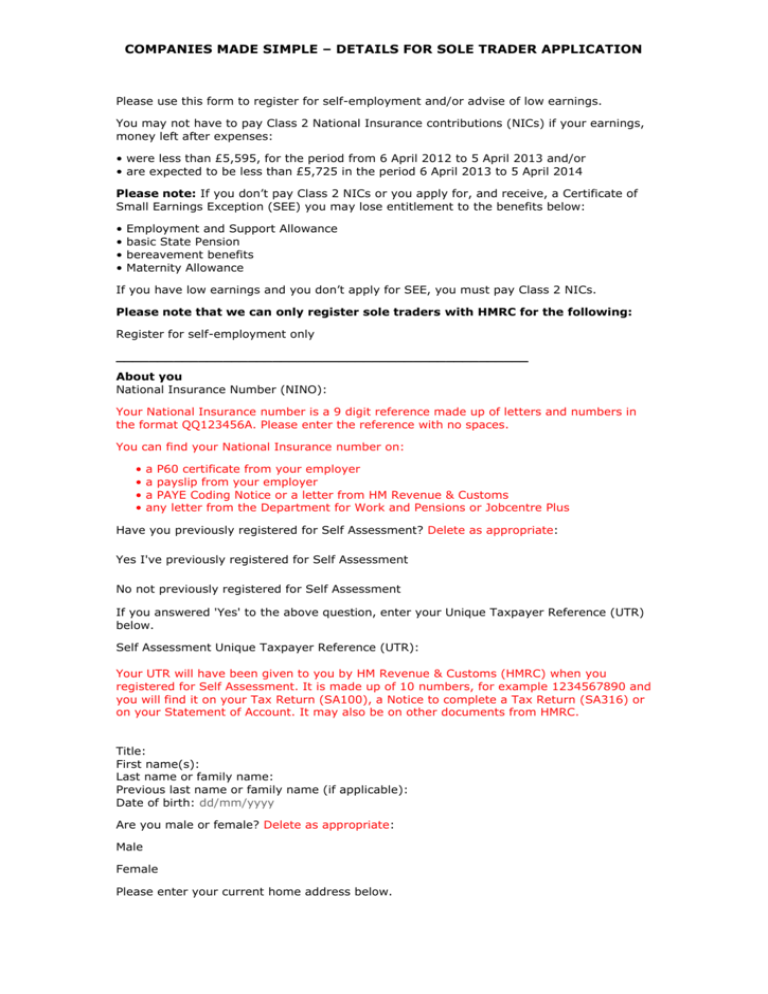

COMPANIES MADE SIMPLE – DETAILS FOR SOLE TRADER APPLICATION Please use this form to register for self-employment and/or advise of low earnings. You may not have to pay Class 2 National Insurance contributions (NICs) if your earnings, money left after expenses: • were less than £5,595, for the period from 6 April 2012 to 5 April 2013 and/or • are expected to be less than £5,725 in the period 6 April 2013 to 5 April 2014 Please note: If you don’t pay Class 2 NICs or you apply for, and receive, a Certificate of Small Earnings Exception (SEE) you may lose entitlement to the benefits below: • • • • Employment and Support Allowance basic State Pension bereavement benefits Maternity Allowance If you have low earnings and you don’t apply for SEE, you must pay Class 2 NICs. Please note that we can only register sole traders with HMRC for the following: Register for self-employment only __________________________________________________ About you National Insurance Number (NINO): Your National Insurance number is a 9 digit reference made up of letters and numbers in the format QQ123456A. Please enter the reference with no spaces. You can find your National Insurance number on: • • • • a P60 certificate from your employer a payslip from your employer a PAYE Coding Notice or a letter from HM Revenue & Customs any letter from the Department for Work and Pensions or Jobcentre Plus Have you previously registered for Self Assessment? Delete as appropriate: Yes I've previously registered for Self Assessment No not previously registered for Self Assessment If you answered 'Yes' to the above question, enter your Unique Taxpayer Reference (UTR) below. Self Assessment Unique Taxpayer Reference (UTR): Your UTR will have been given to you by HM Revenue & Customs (HMRC) when you registered for Self Assessment. It is made up of 10 numbers, for example 1234567890 and you will find it on your Tax Return (SA100), a Notice to complete a Tax Return (SA316) or on your Statement of Account. It may also be on other documents from HMRC. Title: First name(s): Last name or family name: Previous last name or family name (if applicable): Date of birth: dd/mm/yyyy Are you male or female? Delete as appropriate: Male Female Please enter your current home address below. COMPANIES MADE SIMPLE – DETAILS FOR SOLE TRADER APPLICATION Address line 1: Address line 2: Address line 3: Postcode: Daytime telephone number (including STD): Email address: If appropriate enter your previous home address below. Previous Previous Previous Previous address line 1: address line 2: address line 3: postcode: __________________________________________________ Are you a UK resident? Delete as appropriate: No, I'm not a UK resident Yes, I'm a UK resident If you answered 'No' to the question above, have you come to the UK from a non-EU country within the last 12 months? Tick the relevant box below. I've come from an EU country I've come from a non-EU country __________________________________________________ About your business Your business name must only contain letters (A-Z) or numbers (0-9). Name of business: What sort of self-employed work do you do? Date you started working for yourself: dd/mm/yyyy Are you are a subcontractor under CIS? : If your business works in the construction industry or does construction related work then it may need to register with HM Revenue & Customs as either a contractor or subcontractor under the Construction Industry Scheme (CIS). You can get further information about it by phoning the CIS Helpline on 0300 200 3210. For customers who are deaf or speech impaired phone 0300 200 3219 (textphone). You will still need to complete the rest of this form to register as self-employed. Are you are a share fisherman? : A share fisherman is someone who works in the fishing industry and is paid from a share of the boat's profits. Enter your business address below. If your business address is the same as your home address, please enter SAME in the appropriate fields below. Business address line 1: Business address line 2: Business address line 3: Postcode: COMPANIES MADE SIMPLE – DETAILS FOR SOLE TRADER APPLICATION __________________________________________________ If you are, or will be, doing all your work for 1 person or firm, enter their name and address below. Full name: Address line 1: Address line 2: Address line 3: Postcode: _________________________________________________________________ That’s it! Please email back to cosec@madesimplegroup.com with subject: Sole Trader Registration Details