sampple of legal unit main assignment - bctcwagga

advertisement

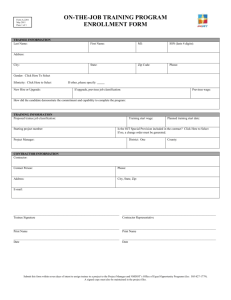

Specific areas of research; 1. Laws relating to builder licensing or registration. Your research findings; 1.1. List and summarise licensing or registration legislation relevant to NSW. You must have a contractor licence before you contract, subcontract or advertise to do: residential building work where the reasonable market cost of the labour and materials is more than $1,000 (including GST) all electrical wiring work all plumbing, draining and gasfitting work all air conditioning and refrigeration work (except plug-in appliances). http://www.fairtrading.nsw.gov.au/ftw/Tradespeople/Home_b uilding_licensing/Applying_for_a_licence_or_certificate.page 1.2. List and summarise the classifications for builders, supervisors and managers. If only one qualified supervisor is nominated, they must also hold a current endorsed individual contractor licence or qualified supervisor certificate that includes all classes of work that the company or partnership wishes to contract for. It may be necessary for the company or partnership to nominate more than one supervisor to cover all classes of work that the company or partnership proposes to carry out. Contractor Licence authorises that holder to contract and advertise to carry out the work described on their licence card. Individuals may have their contractor licence endorsed with a Q and this indicates that the licence is also equivalent to a Qualified Supervisor Certificate. As an endorsed contractor licence holder is qualified they do not require a nominated supervisor. Qualified Supervisor Certificate allows the holder to supervise and carry out the work as described on their certificate. Nominated Supervisor is an individual who holds an endorsed contractor licence or a qualified supervisor certificate, and who is registered against a contractor licence as the person supervising the residential building work or specialist work. All companies and partnerships and unqualified individuals holding a contractor licence must nominate a supervisor. http://www.fairtrading.nsw.gov.au/ftw/Tradespeople/Home _building_licensing/Licence_classes_and_qualifications.pa ge http://www.fairtrading.nsw.gov.au/ftw/About_us/Our_servi ces/Forms/Builder_and_tradespeople_forms.page Tradesperson Certificate is only issued in the classes of plumbing, draining and gasfitting and allows a person to undertake work with minimum supervision. Any work undertaken by the holder of a tradesperson certificate cannot sign off on work and work must be signed off by the holder of a contractor licence or qualified supervisor certificate. Tradesperson certificates used to be known as a ‘journeyman’. 2. WHS 2.1. List ten provisions legislation and provisions on site. of WHS legislation and regulations and any local legislative requirements relevant to onsite. Workcover NSW codes of practice: Workcover Guide to truss erection Managing falls Construction work 2.2. List five regulations and codes of practice applicable to onsite construction. What is the BCA? The Building Code of Australia (BCA) is Volumes One and Two of the National Construction Code (NCC). The BCA is produced and maintained by the Australian Building Codes Board (ABCB) on behalf of the Australian Government and 2.3. Discuss the requirements of site safety signs. State and Territory Governments. The BCA has been given the status of building regulation by all States and Territories. The BCA Goal The goal of the BCA is to enable the achievement of nationally consistent, minimum necessary standards of relevant safety (including structural safety and safety from fire), health, amenity and sustainability objectives efficiently. This goal is applied so— •there is a rigorously tested rationale for the regulation; •the regulation generates benefits to society greater than the costs (that is, net benefits); •the competitive effects of the regulation have been considered and the regulation is no more restrictive than necessary in the public interest; and •there is no regulatory or non-regulatory alternative that would generate higher net benefits. Proposals to change the BCA are subjected, as applicable, to a Regulatory Impact Assessment process. Australian Standards; Timber framing code AS1684 Residential slabs and footings AS2870 3. Codes, Acts, regulations and standards relevant to 3.1. List and Codes: summarise the NCC or BCA is the main regulatory document for Building: current codes, Acts, The Building Code of Australia (BCA) is Volumes One and Two of the National Construction Code (NCC). The BCA is produced and regulations and maintained by the Australian Building Codes Board (ABCB) on standards, behalf of the Australian Government and State and Territory construction . insurance, sustainability, environmental matters and appropriate by-laws applicable to the building type being studied. Governments. The BCA has been given the status of building regulation by all States and Territories. The goal of the BCA is: to enable the achievement of nationally consistent, minimum necessary standards of relevant safety (including structural safety and safety from fire), health, amenity and sustainability objectives efficiently. This goal is applied so— •there is a rigorously tested rationale for the regulation; •the regulation generates benefits to society greater than the costs (that is, net benefits); •the competitive effects of the regulation have been considered and the regulation is no more restrictive than necessary in the public interest; and •there is no regulatory or non-regulatory alternative that would generate higher net benefits. Proposals to change the BCA are subjected, as applicable, to a Regulatory Impact Assessment process. Codes: Codes of practice for safety will be dealt with in WHS section Acts: NSW Home Building Act 1989 is the current Regulation but there is a discussion paper being prepared by Government with possible effects due mid 2014. More information on fairtrading website. You can even subscribe to the newsletter. Regulations: NSW is undergoing a lot of changes in the planning process and more information can be found on the Government sites related to the Housing code and planning. About the NSW housing code: As part of its ongoing planning reforms, the NSW Government released the first stage of the NSW Housing Code which commenced 27 February 2009. An amendment which will commence on the 7 September 2009 introduces new exempt development types, expands complying development, clarifies existing development standards under the General Housing Code and introduces a new code covering complying development for housing internal alterations. The NSW Housing Code outlines how owners of lots of 450m2 and greater can undertake residential developments such as: · detached single and double storey dwelling houses; · home extensions and renovations; and · other ancillary development, such as swimming pools as complying development with council or accredited certifier sign-off. It also outlines how 49 types of low-impact development types (known as “exempt development”) can be undertaken without the need for planning or construction approval. The exempt development code does not stipulate any limits on lot size; however, other legislative requirements for approvals, licences, permits and authorities still apply. Summary of Regulations. Regulations include specifications, acceptable and prohibited practices, approval mechanisms and general detail relating to the execution of an Act. They provide protection to individuals. Standards: Australian Standards set out the safety requirements and provide guidance for persons working in specific areas or dealing with particular equipment. These standards do not become legally binding until they are incorporated into legislation. Examples of standards relevant to housing construction could be: AS 1684 Timber Framing Code deals with timber in housing work, bracing and tying down the building. AS 1562 Design and installation of sheet roof and wall cladding deals with sheet cladding and roofing. AS 3786 Smoke alarms … AS 2870 Residential Slabs and Footings deals with the reinforcing and sizing of slabs and footings in residential buildings. AS 2904 Damp proof courses and flashings … AS 3660 Termite management – New building work … Insurance: See next point for Home Owners Warranty insurance Sustainability: As part of its ongoing planning reforms, the NSW Government has released the first stage of the NSW The NSW Housing Code will enable the NSW Government to implement some important sustainability initiatives. These include: · limiting the maximum floor area and site coverage of homes, thereby limiting energy consumption; · requiring minimum landscaped areas, which contribute to biodiversity, housing amenity andsoil permeability, which reduces stormwater runoff within the urban environment; and · ensuring new homes comply with the NSW Government’s world-first BASIX initiative, as a means of minimising energy and water usage. BASIX continues to apply to complying development. Source: Planning.nsw.gov Environment: 4. Insurance and regulatory requirement s for housing construction . 4.1. List and describe Home warranty insurance. Home warranty insurance needs to be provided by: the insurance A builder or tradesperson before taking any money (including a required to be able deposit) from a home owner (including an owner-builder) to operate your under a residential building contract and before starting any work under that contract. business in A ‘spec’ builder before starting any residential building work on a accordance with property owned by the builder. legal requirements. A developer before entering into a contract for the sale of a property on which a builder is doing or has done residential building work for the developer. An owner-builder (ie. a home owner who did owner-builder work under an owner-builder permit) before entering into a contract for sale of the property on which residential building was done within the previous 6 years. From 1 February 2012, home warranty insurance policies must provide cover of at least $340,000. Between 28 February 2007 and 31 January 2012, the minimum cover that had to be provided was $300,000. Home warranty insurance provides a set period of cover for loss caused by defective or incomplete work in the event of the death, disappearance or insolvency of the contractor. Home warranty insurance policies issued from 19 May 2009 also enable home owners to claim on the policy where the licence of the builder or tradesperson responsible for the work is suspended or cancelled for failing to comply with a money (compensation) order made by the Consumer, Trader and Tenancy Tribunal or a Court. Cover for loss arising from defective work is provided for a period of: •6 years from the date of completion of the work or the end of the contract for the work (whichever is the later) for loss arising from a structural defect, and •2 years for loss arising otherwise than from a structural defect. An additional 6 months cover applies in cases where the loss becomes apparent in the final 6 months of the period of insurance. The 6-month period starts from the date of the loss becoming apparent. Cover is also provided for loss arising from non-completion of work for a period of 12 months after the failure to commence, or cessation of, the work. For policies issued prior to 1 February 2012, builders and consumers are encouraged to check their insurance documents for information about coverage and time periods. Public liability. Public liability insurance protects you and your business against the financial risk of being found liable to a third party for death or injury, loss or damage of property or economic loss resulting from your negligence. Work cover. The NSW Workers Compensation Scheme provides protection to workers and their employers in the event of a work-related injury or disease. The aim of the scheme is to maintain a financially viable workers compensation system that is fair and affordable for employers and improves outcomes for injured workers. 4.2. Describe how relevant contract laws are applied in Fairtrading handles obligations for builders in NSW accordance with Contract essentials common law By law, your chosen builder or tradesperson must give you a principles, relevant written contract if state or territory the contract price is over $1,000 (including GST), or the contract price is not known, is for the provision of laws and labour and materials by the contractor the reasonable market cost regulations, and fair of which is more than $1,000 (including GST). trading legislation. Jobs worth between $1,001 and $5,000 require a written 'small job' contract with minimum basic information, while building jobs worth more than $5,000 must be covered by more extensive written contracts. Apprenticeship contracts Page 117 and on 5. Legislation for financial transactions . 5.1. Describe how to setup and administer payroll systems to comply with current legislative requirements. 5.1 Employers You may have tax and superannuation obligations if you employ or contract workers into your business, either full-time or part-time. This includes your family members and you, if you are a director. Your obligations may include: o pay as you go (PAYG) withholding o superannuation guarantee o fringe benefits tax (FBT). You have responsibilities from the day your employee (or contractor) starts working for you to the day they stop. You also have some responsibilities if you stop being an employer altogether. Preparing to engage workers One thing you must do is make sure your workers are legal – that is, they must be Australian citizens, permanent residents or non-citizens with Australian visas that allow them to work. Employee or contractor Pay as you go (PAYG) withholding You will need to withhold tax from: o employees o contractors who have a voluntary agreement with you o contractors who do not provide you with an ABN Super Fringe benefits tax (FBT) http://www.ato.gov.au/Business/Employers/ Paying workers For each worker payment period, you will need to: o act on information provided by employees in their Tax file number declaration (NAT 3092), Withholding declaration and Withholding variations o withhold at the appropriate rates from contractors under a voluntary agreement and contractors who have not quoted an ABN o determine the required amount to withhold o keep the necessary PAYG withholding records. Guide to pay as you go (PAYG) withholding 5.2. Describe how GST systems are set up and administered in Employers You may have tax and superannuation obligations if you employ or contract workers into your business, either full-time compliance with current legislation. or part-time. This includes your family members and you, if you are a director. Your obligations may include: pay as you go (PAYG) withholding superannuation guarantee fringe benefits tax (FBT). You have responsibilities from the day your employee (or contractor) starts working for you to the day they stop. You also have some responsibilities if you stop being an employer altogether. http://www.ato.gov.au/Business/Employers/ 5.2 Who must register? If you carry on a business, you must register for GST if your GST turnover is at, or above the GST turnover threshold, that is, it is $75,000 or more . You can register by: visiting business.gov.au phoning 13 28 66 to obtain the appropriate form ABN registration for individuals (sole traders) (NAT 2938) ABN registration for companies, partnerships, trusts and other organisations (NAT 2939) asking your tax agent or BAS agent. What does being registered for GST mean? If you are registered or required to be registered for GST, you include GST in the price of most goods and services you sell. See The types of sales you make and Issuing and obtaining tax invoices for when you do and do not have to include GST. You must complete an activity statement every month or quarter, or an annual GST return to: report and pay the GST on your sales claim credits for any GST included in the price of your business purchases (provided you have a tax invoice and you are entitled to claim a GST credit). Register for Goods & Services Tax (GST) | Registrations & licences GST applies to most businesses across Australia and it’s highly likely that your business will be affected by the tax. Registering for GST is necessary if: your business has a GST turnover of $75,000 or more ($150,000 or more for non profit organisations) you provide taxi travel as part of your business, regardless of your GST turnover. To register, you’ll need to complete an application form. If you want to apply for an Australian Business Number (ABN) at the same time you can use the same form. You need an ABN to register for GST, as the ABN is part of the GST system. Your ABN will also be your GST registration number. http://www.business.gov.au/BusinessTopics/Regi strationand licences/Registerfortaxation/Pages/RegisterforGo odsandServicesTax(GST).aspx 6. Building contract obligations. 6.1. Describe how you 6.1 Small jobs contracts Residential building work worth between $1,001 and $5,000 must could select the be covered by a 'small jobs' contract which includes the following minimum information: correct form of contract for a the date of the contract names and signatures of both parties project. the contractor's licence number To what price is a brief description of the work, and the price (if known). a contract required Contracts for large jobs Residential building work worth more than $5,000 requires a more 6.2. How would a extensive home building contract and it must contain: builder carry out contracted work in accordance with the contractual obligations applicable to both parties and what are the obligations. 6.3. Describe how to meet the ‘conditions of a contract’, how to gain approvals, and how financial contract matters are met. the date that it was signed by both you and your contractor your name and the exact name on your contractor’s licence card and the licence number (go to our Home building online licence check to make sure the details are correct before you sign a contract) a sufficient description of the work to be carried out plans and specifications attached relevant warranties required by the Home Building Act 1989 the contract price, which must be prominently displayed on the first page and a warning with an explanation if the contract price is subject to change or if the price is not known a clear statement setting out the cooling-off period of five clear business days after being given a copy of the contract where it is valued over $20,000 a checklist of 12 items a caution about signing the contract if you cannot answer yes to all items in the check list a note about your entitlement to a copy of the signed contract within five days of signing a note that the contractor must give you a home warranty insurance certificate if the contract is valued over $20,000 (or $12,000 if the contract was entered into before 1 February 2012) a statement of acknowledgment by you that you have: i) read and understood the Consumer building guide ii) completed the check list and answered yes to all items on it a clause that states that all plans and specifications to be done under the contract (including variations) are taken to form part of the contract a clause that states that any agreement to vary the contract or any plans and specifications must be in writing and signed by you and your contractor a clause that states that the work will comply with: i) the Building Code of Australia, to the extent required under the Environmental Planning and Assessment Act 1979 ii) all other relevant codes, standards and specifications that the work is required to comply with under any law iii) the conditions of any relevant development consent or complying development certificate a clause that states that the contract may limit the liability of the contractor for failure to comply with the above work compliance clause if the failure relates solely to: i) a design or specification prepared by or on your behalf of the owner or a design or specification required by the owner if the contractor has advised the owner in writing that it contravenes the clause referred to immediately above. Caution. Contact the insurance company shown on the home warranty certificate to check that the certificate is valid. Important. The builder or tradesperson must give you a copy of the contract within five business days after you sign it (the weekend, NSW public holidays and 27-31 December [inclusive] do not count). 7. Industrial relations policies and obligations 7.1. List and summarise any relevant industrial relations policies 7.1 Training 7.6 training.nsw.gov.au http://www.industrialrelations.nsw.gov.au/biz_re s/oirwww/pdfs/Home_building_brochure.pdf relevant to housing construction . and obligations and briefly describe how http://www.industrialrelations.nsw.gov.au/oirww to apply them. w/Industries_and_Awards/Home_building_online _guide/How_does_the_national_system_affect_ my_business.page? Employment may be under this award: MA000020 - Building and Construction General Onsite Award 2010 7.2. What is the difference between a contractor and a 7.2 Workcover handles this; sub-contractor. A standard employment relationship consists of workers and employers. A worker, for workers compensation purposes, is defined as: ‘a person who has entered into or works under a contract of service or a training contract with an employer (whether by way of manual labour, clerical work or otherwise, and whether the contract is expressed or implied, and whether the contract is oral or in writing)'. A contractor is more likely to: be engaged to carry out a particular task using his or her own skill and judgement employ others, delegate or sub-let work to another be paid on the basis of a quotation for the job supply his or her own tools and materials carry on an independent business in his or her own name or under a business or firm name be affected by PAYG tax arrangements. Please note that an ABN by itself is not a definite indicator of a person(s) status. A worker is more likely to: be subject to direction from the employer as to the work to be performed and the time and manner in which it is performed be required to actually carry out the work be paid on a time basis have tools and materials supplied by the employer work exclusively for a single employer. NOTE: A person may have been hired as a contractor and be a contractor for other purposes such as tax, but still be a worker for the purpose of workers compensation. It should be noted that the status of a person for tax purposes bears no direct relationship to that person's status as a worker for workers compensation purposes. 7.3. List and summarise the relevant awards that are applied to contracts. 7.4. How are workplace agreements arrived at and administered. 7.5. Discuss how your company may ensure that discrimination and harassment are not practised in the workplace. Look through textbook for this and summarise in your words 7.4 Workplace agreements are through fairwork australia 7.5 Information on this should be available in the builders office for all employees. It may be information leaflets or directions to the workcover site. Firstly find out if what discrimination and harassment is Bullying at work is repeated, unreasonable behaviour directed towards a worker, or a group of workers, that creates a risk to their health and safety. More information on bullying The topics below have answers to common questions or call 13 10 50 for more information. • What is workplace bullying? • What is not considered workplace bullying? • Who has duties in relation to workplace bullying? • What are the benefits of preventing workplace bullying? • What can I do if I am being bullied at work? • I have reported bullying at work but it is still happening. What can I do? • What can WorkCover do about bullying in my workplace? • How do I make a complaint to WorkCover about workplace bullying? • What information is available on workplace bullying? 7.6. Discuss the process and current 7.6 NSW training is regulated by Education and regulation for Communities NSW training 2. Checklist for employers agreements. This checklist covers the important steps that occur during the apprenticeship or traineeship. • The employer and prospective apprentice or trainee complete and sign the Training Contract with the assistance of their Australian Apprenticeships Centre (AAC). • A training plan proposal must be prepared for all apprenticeships and traineeships except school-based apprenticeships and traineeships. The employer’s nominated registered training organisation (RTO) must endorse the training plan proposal. • For school-based apprenticeships and traineeships, a full Training Plan must be prepared by the RTO in consultation with the employer, apprentice/trainee, parent/caregiver and school representative and lodged with State Training Services. • The RTO will charge an enrolment fee that is payable by the apprentice/trainee or the employer. Some categories of apprentices and trainees may be entitled to a fee exemption - check with the RTO for details. • The RTO may also charge an employer contribution fee for training delivery. • The AAC checks the training contract and training plan proposal and then submits them to State Training Services for approval. • For some applications where specific industry requirements or pre-requisites apply, additional information must be provided to support the training contact application – for example: undertaking child-related employment training to obtain credit for a reduced term permanent residency or specific visa categories AACs can advise employers about State Training Services’ requirements for any additional information • Apprentices/trainees enrol with the selected RTO • The employer and apprentice/trainee receive an approval letter from State Training Services • The date the Training Contract becomes binding is specified in the approval letter • The Registered Training Organisation will develop a full Training Plan in consultation with the employer and apprentice/trainee and provide them with a copy – this must be developed within 12 weeks of the approval of the training contract. • Employers should check with their AACs regarding eligibility for incentive payments from the Australian Government • Apprentices/trainees should also check with the AAC regarding their eligibility for travel and/or accommodation allowances to attend off-the-job training and other financial incentives Application and Approval After Approval A guide to apprenticeships and traineeships in NSW 8 • Employers should check regularly with their RTO to make sure that the apprentice/trainee is attending off-the-job training (where appropriate) and is making satisfactory progress towards achieving their qualification. The Training Plan should be reviewed with the RTO every six months. • Employers and their apprentice/trainee must notify State Training Services directly or through their AAC if they wish to make changes to the training arrangements (e.g. cancellation, transfer or suspension) or vary the training contract or training plan (e.g. change of completion date, change of RTO, change of qualification or change in mode of training delivery). When the apprenticeship/traineeship is nearing completion: • Once the apprentice/trainee has been notified that they have completed their formal training, State Training Services will send a letter to all parties. The parties then have the option of applying for Competency Based Completion and should contact State Training Services to advise a mutually agreed completion date of the apprenticeship/traineeship. • If however, the apprentice/trainee has not successfully completed the formal training, the employer must notify State Training Services prior to the expected completion date of the training arrangement. If more time is needed to complete the apprenticeship/traineeship the employer must contact State Training Services immediately to arrange an extension (prior to the expected completion date). • The employer and apprentice/trainee may jointly apply for Competency Based Completion of the apprenticeship/traineeship before the nominal term indicated in the Vocational Training Order (VTO) providing that the apprentice/trainee has been issued with their qualification by the RTO and the employer considers that they are competent to industry standard. Employers must: • Advise their apprentice to apply for a licence if required by the industry in which they work. More information regarding licensing is available in Section 11.4 • Check with their AAC to see if they are eligible to receive any incentive payments that may be available after completion of the apprenticeship/traineeship. 7.7. Describe how your company’s reference material for access to industrial relations or legal information could be made available to employees. 7.7 Setup a filing system in the Office that is made available to employees so they can access the relevant information they need. The complexity of this would depend on the size of the enterprise. 8. Dispute resolution processes. 8.1. Describe how your 8.1 In workbook: Pg 97 to 114 organisation will Resolving building disputes apply its dispute Things do not always go to plan when you are building or renovating, but there are steps you can take to help resolve resolution and disputes between you and your home building contractor. It is important to develop and maintain positive communication customer with your builder or tradesperson. If people in a home building complaints policy dispute do not speak to each other about the problem, it becomes very difficult for the issue to be resolved. processes. (For NOTE: The term 'residential building work' is widely used in this section and broadly means any work involved in, or in example, refer coordinating or supervising, the construction, alteration or people to your additions, or repair, renovation, decoration or protective treatment of a dwelling. policy). Don’t list Fair Trading also deals with complaints about specialist work (ie. electrical wiring, plumbing, gas-fitting or airthe whole policy conditioning/refrigeration) in non-residential buildings. here. Step 1: Talk about it Step 2: Write a letter Step 3: Contact Fair Trading Step 4: Notify your insurer Step 5: Building inspections Home Building Advocacy Service Claim on home warranty insurance http://www.fairtrading.nsw.gov.au/ftw/Tenants_ and_home_owners/Home_building_and_renovati ng/Resolving_building_disputes.page 8.3. Describe how your 8.2 File them in the office and follow any regulations for record keeping. (research company will regulations and summarise here) document and record outcomes of disputes, and how those records will be maintained.