PO Box J Prague Oklahoma 74864 405.567.2611 Fax 405

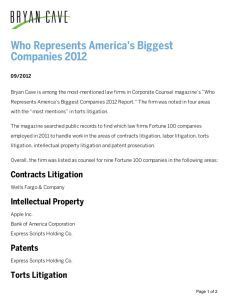

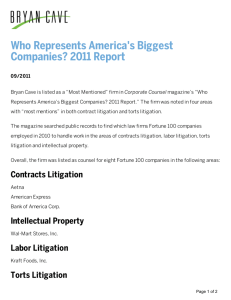

advertisement

PO Box J Prague Oklahoma 74864 405.567.2611 Fax 405. 567.3307 www.agrip.org hpumford@agrip.org 2222 W. Main (Highway 62) Inquiry on the Type and Extent of Coverage Liability Pools Provided for Claims Arising out of “Land Use Decisions”. As of December 2005 Original inquiry from Larry Bush Intergovernmental Risk Management Agency (IL) as follows: IRMA is receiving a steadily increasing number of cases based on zoning and land use decisions. We have the standard exclusions for condemnation, adverse possession and eminent domain, and relief for other than monetary damages is excluded. Years ago, the effect of these exclusions was to exclude most cases based on zoning and land use decisions. However, types of claims that previously had not included monetary damages now routinely include allegations of civil rights violations, and seek damages. Civil rights violations are covered by IRMA. Not only does IRMA become responsible for its own legal fees and any judgments or settlements, but under the fee shifting provisions of section 1983 we are also responsible for the plaintiff’s legal fees. Zoning and land use exposures are the fastest rising element of IRMA’s liability coverage cost. Because of the political nature of some local zoning decisions, our members are concerned that unlimited coverage will encourage local actions that result in litigation. On the other hand, they do not want to give up coverage of litigation resulting from zoning decisions, because litigation often arises out of the appropriate and proper exercise of zoning powers by our members. We are exploring a number of options to limit coverage, such as a sub-limit, higher deductibles for zoning and land use cases, and a quota share distribution between IRMA and the member. We are seeking information regarding the type and extent of coverage provided by other pools for zoning and land use cases. We are particularly interested in any special limitations or restrictions. We are also interested in information regarding any large ($3 million or more) verdicts that have come out of zoning and land use cases. Responses 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. Harold Pumford, AGRiP CEO, former CEO Oklahoma Municipal Assurance Group Pete Tritz, CEO, League of Minnesota Cities Insurance Trust Lester Nixon, CEO, Utah Counties Insurance Pool Chris Carey, Assistant Administrator, Virginia Association of Counties Mike Fleming CEO/Jack Blyskal Director of Claims, CSAC Excess Insurance Authority (CA) Marvin Townsend, CEO,/David Reagan, General Counsel, Texas Municipal League Intergovernmental Risk Pool Joanne Rennie, General Manager / Amanda Wright, Administrative Assistant, Public Agency Risk Sharing Authority of California Craig L. Nelson, Executive Director, Larry Pelan, Risk Manager, Nebraska Intergovernmental Risk Management Association I and II Lynnette L. McHenry, Associate General Counsel & Claims Manager, Idaho Counties Risk Management Program Steve Kopelman, Risk Manager, New Mexico County Insurance Authority Multi Line Pool Page 1 of 9 D:\106759302.doc Page 2 Page 2 Page 6 Page 7 Page 8 Page 8 Page 8 Page 8 Page 9 Page 9 1. Harold Pumford, AGRiP CEO, former CEO Oklahoma Municipal Assurance Group. The approach we took several years ago at OMAG, the pool was to provide some assistance in defense cost for actions alleging inverse condemnation, annexation/deannexation, zoning and board of adjustment matters which were otherwise excluded. The plan would reimburse a member 40% of legal expenses and costs, up to a maximum of $10,000 (annual aggregate) after the plan member had paid $5,000 for such expenses and costs, i.e. once the member has paid $5,000, OMAG would participate in 50% of the next $20,000. According to OMAG’s General Counsel, Stephen Reel, these limits are still in place and they receive about 1 case every month for liability coverage, which is denied. Mr. Reel’s recollection was that they have paid defense costs under the above in perhaps three to five cases in the course of the past 10 years. Specific OMAG language: In addition to the coverage provided in the Municipal Liability Protection Plan, OMAG agrees to reimburse any plan member for 50% of its legal expenses and costs, up to a maximum of $10,000, after the plan member has paid $5,000 for such expenses and costs, when incurred in the defense of any civil cause of action for inverse condemnation or seeking injunctive relief or a declaratory judgment with regard to annexation/deannexation, zoning or board of adjustment decision of the plan member. This coverage is not available when OMAG is providing coverage and defending any of the above causes of action under a reservation of rights. Regardless of the number of actions brought against a plan member during the plan year $10,000 is the total maximum amount OMAG will reimburse a plan member. Under this coverage program the plan member will be responsible for the selection and employment of legal counsel. OMAG’s sole obligation shall be for partial reimbursement of legal expenses and costs as provided herein. OMAG reserves the right to audit related legal bills as necessary to determine the amount of reimbursement due to the plan member. 2. Pete Tritz, CEO, League of Minnesota Cities Insurance Trust. Mr. Tritz provided the following memorandum that is available to his members. “LMCIT COVERAGE FOR LITIGATION RELATING TO LAND USE REGULATION, DEVELOPMENT, AND FRANCHISING” Litigation relating to a city’s land use regulation decisions, development and redevelopment activities, and franchising has become more and more frequent. This kind of litigation can be expensive. For a city that’s unexpectedly hit with this kind of litigation, the legal costs can be a significant financial burden. For this reason, LMCIT has developed a specialized approach to covering this type of litigation for Minnesota cities. Compared to conventional liability insurance, a key difference of the LMCIT coverage is that litigation relating to land use regulation, development or redevelopment, or franchising is covered regardless of whether the litigation includes a claim for damages. This memo will explain how this coverage works, and answer some common questions about the LMCIT coverage for land use, development, and franchising litigation. Keep in mind that this memo is only a summary of the coverage. The actual terms and conditions of the coverage are defined by the LMCIT liability coverage document, and any specific coverage issues will be determined based on the language of the coverage document. What types of litigation are covered? Page 2 of 9 D:\106759302.doc The specialized coverage for land use, development, and franchising litigation is found in “Coverage D” of the LMCIT liability coverage document. It provides coverage for three broad classes of litigation: 1. Land use regulation. Any litigation relating to the application, interpretation, or validity of a land use, zoning, subdivision, or similar ordinance or regulation. 2. Development. Any litigation relating to the city’s involvement in the financing or approval of any development of redevelopment project. 3. Franchising. Any litigation relating to the granting, refusal, interpretation, or enforcement of any franchise, ordinance, permit, license, or other mechanism through which the city authorizes or regulates the provision of cable communications, electricity, gas, heat, telephone, or other public utilities within the city. A few specific types of litigation within those three categories are excluded under Coverage. The types of litigation that are not covered are: • Physical takings. Litigation that seeks only compensation or other relief for an actual or alleged physical occupation, invasion, or use of property by the city. • Special assessments. Litigation that seeks only reduction or invalidation of a special assessment. • Negligent inspection. Litigation that seeks only compensation for damages based on the city’s actual or alleged negligent inspection or enforcement of the state building code or the state plumbing, electrical, fire, or similar codes. (These “negligent inspection” damage claims are covered under the general municipal liability coverage found in Coverage A.) • Contractual obligations. Litigation that seeks only amounts due or allegedly due under contract, including any city bonds or other obligations. • Ordinary land use enforcement. Litigation which was initiated by the city to enforce a land use regulation, and which does not involve a challenge to the validity or constitutionality of the regulation. There are a couple of important things to remember about the coverage: 1) Subject to the exceptions listed above, litigation relating to land use regulation, development, or franchising is covered whether or not it includes a claim for damages. 2) The coverage is available regardless of the whether the action is brought by or against the city. Accordingly, the coverage is available even if the city is a plaintiff seeking to enforce its land use, development, or franchise rights. If we get involved in this kind of litigation, what does the coverage pay for? The coverage applies to “litigation costs”. “Litigation costs” includes the following: • Legal fees for the counsel selected jointly by the city and LMCIT to represent the city. • Necessary legal fees for counsel to represent the city which the city incurs prior to reporting the litigation to LMCIT. (These fees are covered at 50%.) • Necessary litigation expenses other than legal fees. • Most damages the city is required to pay. • Supplementary payments, including up to $200,000 of statutory attorneys fees. “Litigation costs” are covered on a sliding scale: • 100% of the first $25,000 of litigation costs; • 85% of the next $225,000 of litigation costs; • 60% of litigation costs over $250,000. If the city incurs necessary legal fees prior to reporting the litigation to LMCIT, those costs will be reimbursed at 50%. Note also, that for litigation between LMCIT members, the coverage pays only one-half of the percentages described above, subject to a $500,000 maximum. Page 3 of 9 D:\106759302.doc What kinds of damages are not covered? Most money damages that might be awarded against the city are covered. This specifically includes two types of damages that are frequently excluded under conventional liability insurance policies: Awards of attorneys fees in federal civil rights or state human rights actions; and “Temporary taking” damages; i.e., inverse condemnation damages awarded for the claimant’s loss of use of property prior to the time that a land use regulation has been ruled by a court to be unconstitutional as a “taking” of property. The following types of monetary damages are not covered: Exemplary or punitive damages or attorneys fees awarded against a city officer or employee, unless he/she was acting within his/her duties and not guilty of malfeasance, willful neglect of duty, or bad faith. Fines or penalties. The cost of complying with an injunction or similar order. Repayment of any taxes, assessments, fees, or other charges that the city wrongfully collected, or any interest on that repayment. Amounts paid for the permanent acquisition of property or property rights, or for the right to permanently enforce a land use regulation or restriction. Amounts due under contract. How do city deductibles work in conjunction with the co-payment provision? If the city’s liability coverage is written with a deductible, the deductible is applied to the percentage of the costs that would otherwise be paid by LMCIT. The city’s co-pay amounts (i.e., the percentages of litigation costs and damages for which the city is responsible, as outlined above) do not count toward satisfying the city’s deductible. For example, if the litigation costs on a case are $75,000 and the city carries a $10,000 deductible, the city’s share of the $75,000 is determined as follows: LMCIT’s share $57,500 (100% of the first $25,000 plus 85% of the next $50,000, less the $10,000 deductible.) City’s share $17,500 (15% of the amount in excess of $25,000, plus the $10,000 deductible) What is the coverage limit? The primary LMCIT coverage provides a $1,000,000 annual aggregate limit for all “Coverage D” litigation filed during the city’s coverage year. This is the maximum amount of litigation cost and damages that LMCIT will pay regardless of the number of claims or occurrences in any given year. By purchasing LMCIT’s optional excess liability coverage, the city can increase the total available limit in $1,000,000 increments up to $6,000,000. In calculating whether the aggregate limit has been met, city co-payments are not included, but city deductible obligations are. For example, in order to exhaust the $1,000,000 aggregate limit a city would have to incur total litigation costs of $1,556,250. If that city’s coverage was subject to a $25,000 deductible, the maximum amount LMCIT would actually pay would be $975,000. Note: For litigation between LMCIT members, the coverage is subject to a limit of $500,000 for that claim. This limit is within – i.e., not in addition to – the $1,000,000 annual aggregate limit. (The coverage percentages for this type of litigation are also reduced by one-half, as described above.) Page 4 of 9 D:\106759302.doc When should the city report a land use regulation, development, or franchising dispute to LMCIT? Under Coverage D, coverage for this type of litigation is triggered when the litigation is first filed or served on the city. You should report the litigation to LMCIT immediately upon filing or being served with the summons and complaint that formally commences the litigation. You must report the litigation to LMCIT no later than one year after the litigation commences in order for the coverage to apply. If you’re involved in a land use regulation, development, or franchising dispute that you think is likely to lead to litigation, we’d strongly encourage you to report it to LMCIT right away, even before the litigation is formally commenced. While general legal advice from the city attorney is not normally considered part of the litigation costs, it is possible that the city could incur some litigation-related costs in anticipation of the litigation. Keep in mind if the city incurs litigation costs before reporting the actual or anticipated litigation to LMCIT, those costs will be reimbursed at only 50%. How is litigation counsel selected? Litigation counsel is selected by mutual agreement between the city and LMCIT. If in some unusual circumstance we were not able to agree on an attorney to defend the city, LMCIT will give the city a list of five qualified attorneys who are experienced in that type of litigation. The city then can select any of the five. Except in rare and unusual circumstances, the city’s own city attorney will not normally be appointed to represent the city in the covered litigation. We take this approach because often times the city attorney has been intimately involved in providing legal advice to the city about how to handle the particular land use situation. If the city attorney were selected to represent the city in the litigation, it is conceivable that the attorney could become involved in having to defend his or her own recommendations, and to some degree the city might lose the benefit of an independent, detached evaluation of the strengths and weakness of the case. Who manages the litigation and makes the decisions on strategy, settlement, etc.? With one exception, decisions on settlement and strategy are made by mutual agreement of the city and LMCIT, in consultation with the attorney that the city and LMCIT have agreed to retain. Neither LMCIT nor the city has the authority to agree to a settlement without the other’s consent. The one exception is litigation between LMCIT members. In cases of inter-city litigation, after selection of the counsel, LMCIT will not participate in the management of the litigation, except that settlement of any litigation involving the payment of damages must be approved by LMCIT. This collaborative decision-making process reflects the particular nature of this type of litigation. Unlike the tort claims that conventional insurance policies are designed to cover, the issues in this kind of litigation are often not just a matter of whether and how much money damages the city owes. The real issues at stake may be questions like whether or not a permit is issued, a financing package approved, a franchise granted, etc. – things which involve local policy issues and which may require legislative or other official action by the city council. At the same time, we also need to keep in mind that the funds used to pay LMCIT’s share of the costs are really the joint property of all of LMCIT’s member cities. Those other member cities are entitled to know that their funds aren’t being wasted on frivolous disputes or in pointlessly prolonging litigation in which the city has little chance of prevailing. Involving both the city and LMCIT in the decision-making process is a means of trying to balance those potentially competing interests. The cost-sharing provisions are incorporated in the coverage for much the same reason. Will claims under this coverage affect our future premium costs? Page 5 of 9 D:\106759302.doc Yes. The premiums for the city’s LMCIT liability coverage are experience-rated, so any claims the city has will affect future premiums. Claims under Coverage D are weighted more heavily in the experience-rating formula than are ordinary liability claims. The reason is that the costs for this type of litigation are to a significant extent a function of the discretionary decisions the city makes. (Liability claims relating to employment are also weighted more heavily in the experience-rating formula, for similar reasons.) And of course, these claims will also affect the city’s share of any future dividends. Under LMCIT’s dividend formula, dividends are allocated among the member cities based on the difference between the city’s total earned premiums and total incurred losses, for all the years the city has participated in LMCIT. This concludes LMCIT’s memorandum on “LMCIT COVERAGE FOR LITIGATION RELATING TO LAND USE REGULATION, DEVELOPMENT, AND FRANCHISING”. Mr. Tritz also provided these claim counts and costs, as calendar year figures, as of 6/30/05. Reported at: 6 months Current '92 '93 '94 '95 '96 '97 '98 '99 '00 '01 '02 '03 '04 '05 3. 14 18 39 23 31 30 37 25 31 54 25 37 23 24 34 54 94 70 64 75 87 58 96 102 62 85 61 Land Use Litigation Loss Costs Incurred Cost at June 30, 2005 $4,000,000 $3,000,000 $2,000,000 $1,000,000 $0 '97 '98 '99 '00 Damages '01 '02 Defense '03 '04 Total '05 Lester Nixon, CEO, Utah Counties Insurance Pool UCIP excludes claims alleging inverse condemnation, even those also claiming civil rights violations, but we do provide a $25,000 defense sublimit for those claims. To help out with land use issues, we provide a "Land Use Hotline" as a free loss prevention tool. Members may call our lead land use attorney for up to 2 hours on any land related issue. If the consultation requires more time, we may elect to provide more time free or subsidized or turn it back to the member, depending on the nature of the issues. The following is language from Endorsement No. 8 in UCIP’s policy. LIMITED COVERAGE FOR LAND USE MATTERS “This endorsement attaches to and forms part of Policy No. Form No. UCIP-05.100 Page 6 of 9 D:\106759302.doc “The effective date of this endorsement is January 1, 2004. “It is hereby agreed and understood this Agreement does not provide coverage for any liability arising out of the principles of eminent domain, condemnation proceedings or claims, inverse condemnation or claims, and regulatory taking by whatever name called, land use actions, zoning, rezoning or failure to zone, whether that liability accrues directly against the Insured or by virtue of any agreement entered into, by or on behalf of the Member. Claims alleging civil rights violations arising out of any of the listed proceedings are also excluded. “However a defense will be provided, up to a maximum of $25,000 annual aggregate per Member for claims in inverse condemnation. The sub-limited amount applies to defense costs of the Member only and cannot be applied to pay a settlement, plaintiff’s costs or legal fees. Claims for injunctive relief and Boards of Adjustment appeals to District Court are not eligible for defense costs. “Subject otherwise to all terms, clauses and conditions of this Agreement.” Mr. Nixon also provided this compilation of UCIP Claims Experience, 2000-2005. LAND USE CLAIMS YEAR # OF CLAIMS EXPENSES PAID 2000 2001 2002 2003 2004 2005 14 6 4 10 8 3 $58,813.16 $127,829.58 $190,382.77 $270.387.07 $28,625.78 $21,255.03 TOTAL 45 $697,293.39 4. Chris Carey, Assistant Administrator, Virginia Association of Counties. We provide limited defense coverage for land-use claims seeking non-monetary damages. We limit defense coverage to $100,000 but we apply a higher deductible of $25,000. We also make the member share 50/50 in the defense cost after the deductible is met. For claims seeking monetary damages, we exclude all land-use claims. If civil rights violations are alleged, we defend under a reservation of rights and will not agree to any damages. And, if the member is released from the suit on the civil rights portion, we will cease our defense altogether. 5. Mike Fleming, CEO, Jack Blyskal, Director of Claims, CSAC Excess Insurance Authority (CA). Our MOC provides Personal Injury and Errors and Omissions coverage to our Members, subject to the following exclusion (in re: land use): “To liability arising out of or in connection with the principles of eminent domain, condemnation proceedings or inverse condemnation by whatever name regardless of whether such claims are made directly against the covered party or by virtue of any agreement entered into by or on behalf of the Page 7 of 9 D:\106759302.doc covered party. “This exclusion does not apply to direct physical injury to or direct destruction of third party tangible property, caused by and occurrence, even though a legal theory upon which a claimant seeks recovery is the principle of inverse condemnation.” We interpret this to apply whether civil rights violations are alleged or not. 6. Marvin Townsend, CEO,/David Reagan, General Counsel, Texas Municipal League Intergovernmental Risk Pool. There is one exclusion in the Pool's liability coverage concerning this matter and it reads as follows: “This Agreement does not apply to or provide coverage for any claims or suits for damages, including suits for devaluation of property based upon the Member's or Covered Party's exercise of or failure to exercise its zoning or subdivision regulatory powers, except where or to the extent that such claim or suit seeks damages, unless otherwise excluded from coverage under this Agreement.” Therefore, the Texas Municipal League Intergovernmental Risk Pool provides coverage for claims based upon the exercise of or failure to exercise zoning or subdivision regulatory powers if damages are sought. If no damages are sought, the Pool does not provide coverage. The Pool began providing this type of coverage in the early 1990's. Such cases do involve civil right violations and are usually complicated. However, the Pool has not seen the number of such suits increase substantially over recent years. 7. Joanne Rennie, General Manager / Amanda Wright, Administrative Assistant, Public Agency Risk Sharing Authority of California The PARSAC Memorandum of Liability Coverage provides as follows: Limitation “P. Condemnation and Land-Use Regulation. Any claim arising out of or in connection with land-use regulation, land-use planning, the principles of eminent domain or inverse condemnation, by whatever name called, or condemnation proceedings, regardless of whether such claims are made directly against the Protected Party or by virtue of any agreement entered into by or on behalf of the Protected Party. However, this limitation shall not apply to claims arising from physical damage to tangible property. With respect to any coverage granted by this provision that is not otherwise provided by the Memorandum, the Protection Limit is $250,000 Ultimate Net Loss as the result of any one Occurrence.” 8. Craig L. Nelson, Executive Director Larry Pelan, Risk Manager, Nebraska Intergovernmental Risk Management Association I and II Personal Injury is covered under our General Liability coverage. The definition of Personal Injury under our GL coverage includes injury arising out of a violation of property rights. Property Rights are then defined as “rights granted under any ordinance or law regulating zoning, construction, use or repair of any property. This coverage does not include claims for eminent domain, condemnation and inverse condemnation or for wrongful taking pursuant to 42 U.S.C. 1983.” We can also look at potential coverage under the Public Officials Liability coverage. The definition of Public Officials Wrongful Acts includes “any actual or alleged: … 2. Violation of civil rights protected under 42USC 1981 et sequential; or 3. Violation of any state civil rights law;” … The eminent domain, condemnation and inverse condemnation exclusion applies here too. Property damage is Page 8 of 9 D:\106759302.doc excluded under this coverage and the definition of property damage includes “loss of use of tangible property that is not physically injured”. As usual, the breadth, or lack thereof, of our coverage would depend upon the specifics of the claim. I would conclude that if a claim is made against a member county alleging the county’s action prevented them from exercising their civil right to use their property as they deem appropriate, there would be coverage under the GL section of our package policy as long as they were requesting money damages. If just injunctive relief and/or a declaratory judgment was being sought, no coverage. 9. Lynnette L. McHenry, Associate General Counsel & Claims Manager, Idaho Counties Risk Management Program Ms. McHenry provided the following information on their pool’s cost for claims related to this issue. It is very difficult for me to come up with actual costs and numbers for the due process claims that come in as Property & Zoning claims, because we don't code them as such in our system. We do code "constitutional rights" violations, which would include due process violations, and "governmental decisions," which may or may not include due process violations. The number of claims for those two codes is approximately 221 over the last five years with a pay out of about $500,000 in attorney fees and costs. I can tell you that from my memory since 2001, we have not paid out on any damages resulting from due process violations in the Property & Zoning setting. However, we have paid out for defense costs, which can get quite extensive since we have to defend the entire lawsuit until the covered claim is dismissed. We have had quite a change in procedures during the last five years, so claims have been coded differently throughout our history. However, I believe that in the last three years, we have been pretty consistent with our coding. 10. Steve Kopelman, Risk Manager, New Mexico County Insurance Authority Multi Line Pool The New Mexico County Insurance Authority has a blanket exclusion for “any liability arising out of the operation of the principles of eminent domain, condemnation proceedings or claims, inverse condemnation proceedings or claims, regulatory taking by whatever name called, land use actions, zoning, rezoning or failure to zone….Claims alleging civil rights violations arising out of any of the listed proceedings are also excluded.” However, the Multiline Pool offers member counties an option for limited coverage for land use matters. Counties can opt for coverage for defense of these excluded matters up to a maximum of $20,000 per occurrence with an annual aggregate of $60,000. A supplemental premium is charged. Page 9 of 9 D:\106759302.doc