AP American Government & Politics

advertisement

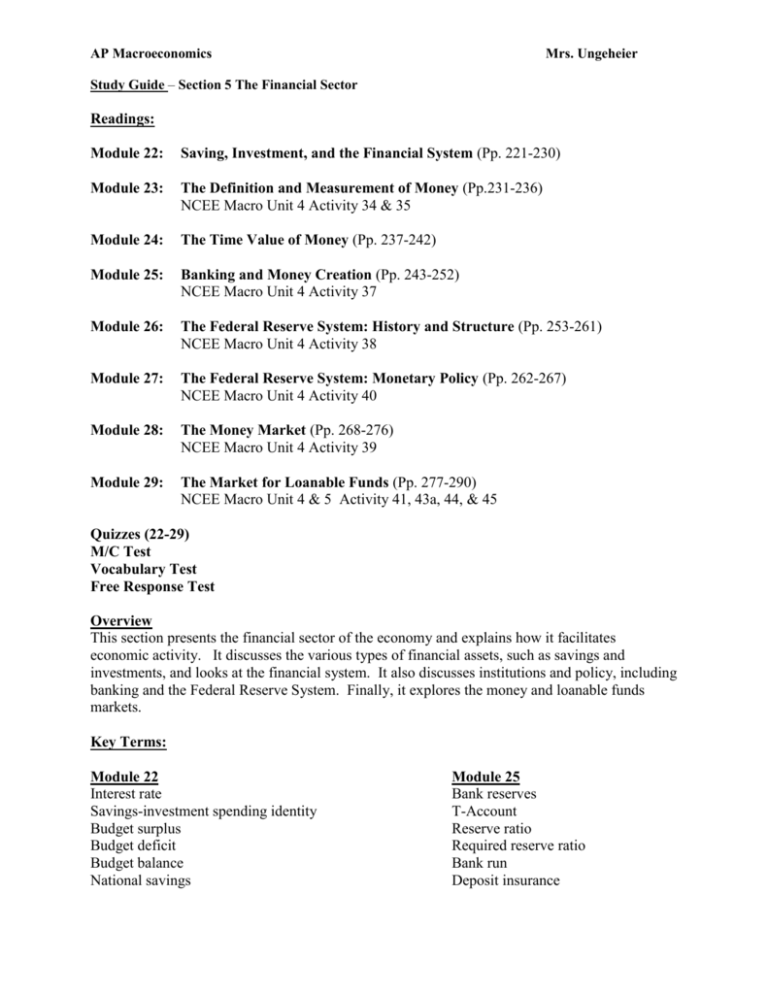

AP Macroeconomics Mrs. Ungeheier Study Guide – Section 5 The Financial Sector Readings: Module 22: Saving, Investment, and the Financial System (Pp. 221-230) Module 23: The Definition and Measurement of Money (Pp.231-236) NCEE Macro Unit 4 Activity 34 & 35 Module 24: The Time Value of Money (Pp. 237-242) Module 25: Banking and Money Creation (Pp. 243-252) NCEE Macro Unit 4 Activity 37 Module 26: The Federal Reserve System: History and Structure (Pp. 253-261) NCEE Macro Unit 4 Activity 38 Module 27: The Federal Reserve System: Monetary Policy (Pp. 262-267) NCEE Macro Unit 4 Activity 40 Module 28: The Money Market (Pp. 268-276) NCEE Macro Unit 4 Activity 39 Module 29: The Market for Loanable Funds (Pp. 277-290) NCEE Macro Unit 4 & 5 Activity 41, 43a, 44, & 45 Quizzes (22-29) M/C Test Vocabulary Test Free Response Test Overview This section presents the financial sector of the economy and explains how it facilitates economic activity. It discusses the various types of financial assets, such as savings and investments, and looks at the financial system. It also discusses institutions and policy, including banking and the Federal Reserve System. Finally, it explores the money and loanable funds markets. Key Terms: Module 22 Interest rate Savings-investment spending identity Budget surplus Budget deficit Budget balance National savings Module 25 Bank reserves T-Account Reserve ratio Required reserve ratio Bank run Deposit insurance Capital inflow Wealth Financial asset Physical asset Liability Transaction costs Financial risk Diversification Liquid illiquid loan default loan-backed securities Financial intermediary Mutual fund Pension fund Life insurance company Bank deposit Bank Module 23 Money Currency in circulation Checkable bank deposit Money supply Medium of exchange Store of value Unit of account Commodity money Commodity-backed money Fiat money Monetary aggregate Near-monies Reserve requirements Discount window Excess reserves Monetary base Money multiplier Module 27 Federal funds market Federal funds rate Discount rate Open-market operations Module 28 Short-term interest rates Long-term interest rates Money demand curve Liquidity preference model of the interest rate Money supply curve Module 29 Loanable funds market Rate of return Crowding out Fisher effect Module 24 Present value Net present value Key Topics To Remember: The Meaning of Investment When macroeconomists use the term investment spending, they almost always mean “spending on new physical capital.” This can be confusing because in ordinary life we often say that someone who buys stocks or purchases an existing building is “investment.” The important point to keep in mind is that only spending that adds to the economy’s stock of physical capital is “investment spending,” In contrast, the act of purchasing an asset such as a share of stock, a bond, or existing real estate is “making an investment.” It’s important to understand clearly the three different kinds of capital” physical capital, human capital, and financial capital. 2 o Physical capital consists of manufactured resources such as buildings and machines. o Human capital is the improvement in the labor force generated by education and knowledge. o Financial capital is funds from savings that are available for investment spending. So a country that has a positive capital inflow is experiencing a flow of funds from abroad that can be used for investment spending. It is important to understand that savings and investment spending are always equal whether the economy is open or closed. This is an accounting fact and is referred to as the savings-investment spending identity. It is good to have a basic idea of the definition of and differences between the types of financial assets. However, don’t spend lots of time memorizing specific definitions and detailed distinctions. Strive to understand the categories of assets in the context of the macroeconomic models we are developing. What’s Not in the Money Supply? Are financial assets like stocks and bonds part of the money supply? No, not under any definition, because they’re not liquid enough. o M1 consists, roughly speaking, of assets you can use to buy groceries: currency, traveler’s checks, and checkable deposits. o M2 is broader: it includes things like savings accounts, which can easily and quickly be converted into M1. o Normally, for example, you can switch funds between your savings and checking accounts with a click of a mouse or a call to an automated phone service. By contrast, converting a stock or a bond into each requires selling the stock or bond—something that usually takes some time and also involves paying a broker’s fee. That makes these assets much less liquid than bank deposits. So stocks and bonds, unlike bank deposits, aren’t considered money. It is important to understand the distinction between assets and liabilities. Make sure you clearly understand what an asset and a liability are, and then recognize that any financial instrument represents both an asset and a liability. For example, a mortgage represents a liability for the borrower and an asset for the lender; a checking account deposit represents a liability for the bank providing the check service and an asset to the individual depositing the funds. Present Value Understanding present value requires grasping two important points. o First, a dollar today is worth more than a dollar in the future. If you receive a dollar today, you can either spend the dollar immediately (and enjoy the benefits of what you buy with it) or you can save the dollar (and earn interest on it until you decide to spend it in the future). In either case, spending now or saving for later, you gain more from having the dollar right away. o Second, the interest rate determines the trade-off between receiving a dollar today and receiving it tomorrow. The interest rate is what borrowers are willing to pay to have a dollar to spend immediately and what lenders must receive in order to give up their dollar until a future date. Approach present value with this in mind and you will be better able to apply the concept to decision making when costs and/or benefits come in the future than if you try to memorize a formula without understanding its underlying principles. 3 Creating Money The idea that banks can “create” money can be difficult to understand unless you understand the definition of money and how it is measured. When we say that banks create money, we don’t mean that they create is in the same way they did before the Civil War—by printing certificates that could be redeemed for silver coins on demand. We mean that banks are able to expand the money supply through lending. Today, dollar bills are printed by the Treasury Department and issued into the economy by regional Federal Reserve banks, Banks no longer create currency. But recall that the supply of money in the economy consists of more than currency. The M1 definition of money includes currency in circulation, traveler’s checks, and checkable bank deposits. It is through loans, which change the amount of checkable deposits, that banks create money. Because we have a fractional reserve banking system (banks are required to keep only a fraction of their deposits as cash in their vaults or on deposit at the Fed), which banks receive a new deposit, they can increase their loans. When they make a loan, they increase the amount of checkable deposits, therefore increasing the money supply. It is important to understand the definition and the distinction between the monetary base, the money supply, and reserves. The money supply is the value of financial assets in the economy that are considered money: this would include cash in the hands of the public, checkable bank deposits, and traveler’s checks. Bank reserves are composed of the currency banks hold in their vaults plus their deposits at the Federal Reserve. The monetary base is the sum of currency in circulation and bank reserves. The monetary base is smaller than the money supply. When Is a Central Bank Not a Central Bank? When It’s 12 Banks (a Board of Governors, and an FOMC). The central bank of the United States is more than a single bank—it is a multi-part system. When the fed was created in 1913, its creation was influenced by the politics and geography of the country at that time (for example, look at the locations of the 12 regional Federal Reserve Banks). The Federal Reserve System has both public and private elements, as well as regional banks spread across the country. The important parts of the Federal Reserve System are summarized below. The Board of Governors is a government agency located in Washington, DC. It oversees the Federal Reserve System. The board has 7 members, appointed by the President and approved by the Senate for a 14-year term. Because governors can be appointed to complete the terms of a governor who did not complete his or her 14-year term (and then serve their own 14-year term), some governors serve more than 14 years. The Chairman of the Board of Governors is appointed every 4 years. The Federal Open Market Committee (COMC) makes decisions about monetary policy. The FOMC has 12 voting members at any given time. It is made up of the 7 members of the Board of Governors, the president of the New York Federal Reserve Bank, and the other 11 regional Federal Reserve Bank presidents. Only 4 of the other 11 regional Federal Reserve Bank presidents vote at any given time. Voting seats are rotated among the 11 other regional Federal Reserve Bank presidents. Open-Market Operations: Buying and Selling Treasury Bills, Notes, and Bonds The term “open-market operations” refers to buying and selling United States Treasury securities (Treasury bills, notes, and bonds). Treasury securities are bought and sold through auctions held by the Federal Reserve Bank of New York—that is, they are sold on the “open-market.” o Treasury securities are sold both to finance the federal government debt and to implement monetary policy. 4 o The U.S. Treasury Department must regularly borrow to finance the federal government’s debt. Approximately one-half of the national debt is held in Treasury securities. o The Treasury Department sells many of these securities through auctions held at the Federal Reserve Bank of New York. Most Treasury securities sold through Federal Reserve auctions are bought by primary dealers. Primary dealers are financial institutions that buy and sell large quantities of government securities and have established business relationships with the New York Federal Reserve bank. Currently, there are approximately 19 primary dealers. Others can purchase Treasury bills, notes and bonds from banks or brokers in the secondary market. In addition to selling securities to finance the federal debt, the New York Fed’s Open Market Desk buys and sells Treasury bills, notes, and bonds to carry out the monetary policy designated by the FOMC. The Open Market Desk adds reserves to the banking system when it buys Treasury securities; it drains reserves when it sells Treasury securities. Remember that when the Fed purchases Treasury bills, it injects reserves into the banking system, increasing the money supply, and that when the Fed sells Treasury bills, it removes reserves from the banking system, decreasing the money supply. Which Interest Rate? There are many different interest rates in the economy. For example, there are mortgage interest rates, automobile loan interest rates, credit card interest rates, and the prime interest rate. The different interest rates tend to move in the same general direction, moving together like a “web” of interest rates. It is important that you are able to distinguish between two important interest rates in our macroeconomic models, the federal funds rate and the discount rate. o The federal funds rate is the interest rate banks charge each other for overnight loans. It is set in the federal funds market, but is targeted by the Fed. Other interest rates tend to follow the federal funds rate, rising when it rises and falling when it falls. The other interest rate in our macroeconomic models is the discount rate. o The discount rate is the interest rate the Fed charges banks to borrow. The discount rate is set directly by the Fed. You will sometimes hear people say that interest rates do not reflect the supply and demand for money since the Fed sets the interest rate. In fact, the federal funds rate is determined by the supply and demand for money in the money market. The only difference is that the Fed adjusts the supply of money to achieve its target interest rate. Which Model? To discuss monetary policy and interest rates, we have used both the liquidity preference model (the money market) and the loanable funds model. In this module, we have shown how these two models are related. So how do you know which model to use if you are asked to explain how monetary policy will affect the macroeconomy? You must understand both models and be prepared to discuss either one. Pay particular attention to the labels on the axes and curves, and the slope of the supply curve in each graph. Since the Federal Reserve determines the supply of money in the economy, the equilibrium quantity of money is not affected by the interest rate—therefore the money supply curve is vertical in the money market. As the interest rate rises, the quantity of loanable funds supplied increases—the incentive to save is higher when interest rates are higher. Therefore, the 5 supply curve for loanable funds has a positive slope. You may be asked specifically to use one or the other of these models to explain your answer to questions dealing with monetary policy. When you are not asked specifically to use one model or the other, remember that the money market determines the interest rate in the short-run and the loanable funds market determined the interest rate in the long-run. o Use the money market to discuss short-run changes and the loanable funds market to discuss changes in the long run. However, in some cases it is possible to explain a situation using either model. In these cases, just be certain that you explanation is consistent and correct for the model you choose. 6