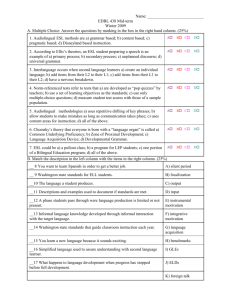

Budget Guidelines

advertisement

FY 2016 Title II NGO - Budget Guidelines Lead agencies and all partners must develop their budgets using the Budget Detail/Budget Worksheets which will then serve to generate the costs in the Budget Summary and Budget Narrative. Costs contained in these documents must correctly reflect one another. In order to assure equitable distribution of funds across the State, individual awards must provide adult basic skills instruction or services to adults within their county/multicounty area, and will be based upon the following per-client amounts for ABE/ASE and ESL and IELCE: *For Adult Basic Skills, the per-client amount is up to $1,000 for all Levels served. *For IELCE, the per-client amount is up to $1,000 for all Levels of ESL served. It should be noted that with this increased dollar amount per client, the LWD expects that ALL consortiums will propose course delivery with increased instructional hours and rigor in order to achieve benchmark outcomes. The total of the Program and Admin columns under the ABS/ESL Level I and II on the Budget Summary must equal the cost of the number of ABS/ESL Level I and II clients identified on the Consortium Partner page and the Funding Levels by Source, plus any amounts to be used from the lead agency coordination fee and professional development award. The Program and Admin columns under the ABS/ESL Level III must equal the cost of the number of ABS/ESL Level III clients identified on the Consortium Partner page and Funding Levels by Source, plus any amounts to be used from your lead agency coordination fee and professional development awards. The lead agency must reflect the use of the lead agency coordination fee and professional development award funds on the Schedule B Non Personnel Costs under the Admin column of the ABS/ESL Level I and II or Level III column. The total of the Program and Admin Columns under the IELCE Level I and II on the Budget Summary must equal the cost of the number of IELCE Level I and II clients identified on the Consortium Partner page and the Funding Levels by Source, plus any amounts to be used from the lead agency coordination fee and professional development award. The Program and Admin Columns under the IELCE Level III must equal the cost of the number of IELCE Level III clients identified on the Consortium Partner page and the Funding Levels by Source, plus any amounts to be used from the lead agency coordination fee and professional development award. The combined totals of these columns do not include the lead agency coordination fee amounts. The lead agency must reflect the use of the lead agency coordination fee and professional development award funds on the Schedule B Non Personnel Costs under the Admin column of the IELCE Level I and II or Level III column. Lead Agency Coordination Fee: The lead agency coordination fee amount must be identified on the Non-Personnel Services budget page, under an Admin column of the ABS/ESL or IELCE, Level I and II or Level III. The lead agency coordination fee is in addition to the ABS/ESL or IELCE award amount. 1 Professional Development Award: The professional development award amount must be identified on the Non-Personnel Services budget page, under an Admin column of the ABS/ESL or IELCE, Level I and II or Level III. The professional development award amount identified for the county/multicounty area is in addition to the ABS/ESL and IELCE award amounts and separate from the five percent administrative cap for the specific cost related to the provision of the professional development activities that are provided for in the grant application and which meet the outcome of the professional development plan. These funds can be used to cover stipends, travel, meals, registration costs and costs of substitute staff who deliver instruction for those clients in the professional development activity. The Budget Summary must be completed with the assistance of the CFO of the individual partner and lead agency. Match is calculated at 25 percent of the total program expenditures (federal and non-federal), not including the lead agency coordination fee and professional development award. For Example: 3 to 1 ratio $150,000 (Federal) 50,000 (non-Federal) 25 percent $200,000 Total Program Projects must allocate at least 95 percent of their total grant for carrying out adult basic skills education, including alternative methods of instructional delivery (e.g., online distance learning). Examples of these costs include salaries and fringe benefits for persons with direct instructional, recruitment, referral, advisement or counseling responsibilities; support services; and materials or equipment directly related to instruction of adult clients. Grant funds must be used to supplement, not supplant, existing federal, state and local funds. In addition, not more than five percent of the total grant funds may be used for planning, administration, professional development and interagency coordination. Professional development (staff training/workshops and associated costs) costs are administrative and must be included in the 5 percent administrative cap. Amounts requested on the Budget Summary must be fully supported by information provided on the Budget Justification. Applicants are strongly encouraged to verify all figures for accuracy; ensure grant funds and match funds are shown on the correct budget line and the amounts and assignments are consistent with those reflected on the corresponding budget summary and justification. Amounts requested on the Consortium Partner and Budget Summary must be fully supported by information provided on the corresponding budget justification. SAGE will only allow for entries to be in whole dollars. The budget justification is designed to link program activities to requested costs, and provide the cost basis for each estimated cost with itemization or detail as necessary. Itemization and/or detail are required to ensure the cost is eligible under the NGO and is being budgeted in the appropriate line. The LWD reviewers will be considering whether the costs for which funds are requested are allowable, allocable, necessary and reasonable: 2 Allowable costs are those costs which are not ineligible for funding through the grant program. Costs may be determined to be ineligible generally under Federal cost principles or specifically for the individual grant program by the funding source or by the LWD. Allocable costs are those costs which are directly related to and provide a specific benefit for the grant project for which funds are being requested. In addition to reviewing whether the requested costs are allocable, the LWD reviewer will be considering whether costs have been allocated to the correct category line. Necessary costs are for the successful implementation of the program. Reasonable costs represent the fair market value of an item or service. Complete all columns on each of the Schedules. When appropriate, enter “0” to complete the column. Entering a zero or in the appropriate column tells the LWD reviewer it is applicant’s intention to enter no costs in that column. Group together all items within the same area and record them sequentially when completing the budget pages. For example, all full-time salaries should be grouped together and all part-time salaries should be grouped together. Identify the position for each salary, both full-time and part-time. NOTE: Level I and II costs must be separated from Level III costs, and ABS/ESL costs must be separated from IELCE costs. Cost Basis: The budget estimate must have a demonstrated cost basis demonstrating how the applicant arrived at the estimate. In most cases, the cost basis includes a calculation (e.g., 50 notebooks @ $1.00 = $50) of hard and soft costs. An estimate may also be based upon past experience. If any cost is unusual, provide documentation or an explanation to support the estimate. The cost basis is presented through the itemized lists required on the budget detail/worksheet forms. Itemized Lists: Where the budget justification calls for an itemized list, provide the following information for each item: Item name and/or description. Unit cost: This is the cost of the item itself. If using a unit cost, such as a per client cost, applicants must present an itemized list of the costs which constitute the per client estimate. Quantity of the item to be purchased. Total Cost (unit cost x quantity). Matching or other funds to be applied to the purchase of this item. Grant request for this item. The amount entered in the Total Funds Needed column should equal the amount in the Matching Funds column plus the amount in the Grant Request column. Be certain to complete the Matching Funds column of each Schedule. This column may also be used to show applicant contributions to support the grant project. This is often important when costs that are necessary for the successful implementation of the grant project are not 3 included in the applicant’s grant request. In such circumstances, the LWD reviewers may question whether the applicant has made provision for meeting the costs. Rounding: Show all entries in whole dollars only. All amounts exceeding one whole dollar must be rounded to the nearest whole dollar amount. Since the budget is an estimate, where feasible, applicants should round to the nearest whole dollar before entering a unit cost. Applicants may not estimate salaries, which are actual numbers, or fringe benefits, which are calculations based upon salaries. If a fringe benefit is not a whole number, round it up before entering it (e.g., $15,500 x 7.65 percent for FICA= $1,185.75. Enter the FICA fringe benefit for this staff person as $1,186.) Schedule A Personnel Costs This budget category is broken down into three budget titles: Schedule A Full-time Personnel Costs – This will include all personnel who are working full time on this grant program. It is necessary to include the percentage of salary for each fringe benefit and to have that percentage within the proper funding stream and level. Schedule A Part-time Personnel Costs – This will include all personnel who are working part-time on this grant program. It is necessary to include the percentage of salary for each fringe benefit and to have that percentage within the proper funding stream and level. Schedule A Personnel Costs – No Fringe – This will include all personnel who are working on this grant program but do not have a fringe benefit. Schedule B Non-Personnel Costs This budget category includes all professional development, the professional development award and the lead agency coordination fee. It also includes all supplies and costs that are considered administrative costs. Schedule C Direct Student Services Costs This budget category includes all supplies and costs that are considered direct program costs. 4