here - YouthBuild

advertisement

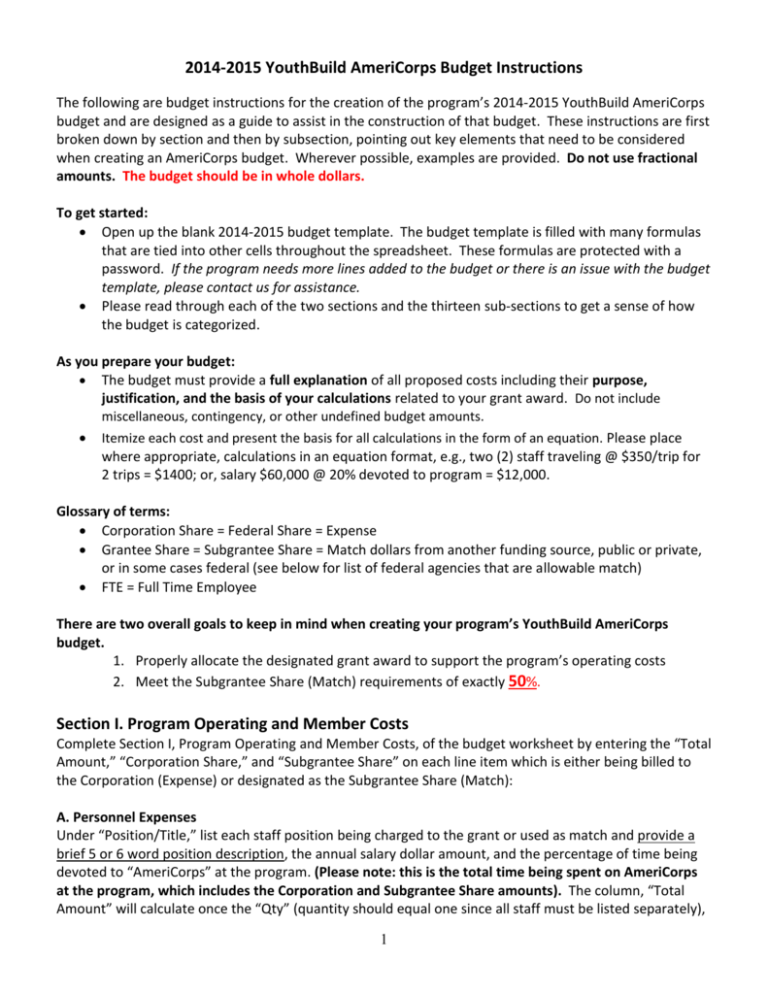

2014-2015 YouthBuild AmeriCorps Budget Instructions The following are budget instructions for the creation of the program’s 2014-2015 YouthBuild AmeriCorps budget and are designed as a guide to assist in the construction of that budget. These instructions are first broken down by section and then by subsection, pointing out key elements that need to be considered when creating an AmeriCorps budget. Wherever possible, examples are provided. Do not use fractional amounts. The budget should be in whole dollars. To get started: Open up the blank 2014-2015 budget template. The budget template is filled with many formulas that are tied into other cells throughout the spreadsheet. These formulas are protected with a password. If the program needs more lines added to the budget or there is an issue with the budget template, please contact us for assistance. Please read through each of the two sections and the thirteen sub-sections to get a sense of how the budget is categorized. As you prepare your budget: The budget must provide a full explanation of all proposed costs including their purpose, justification, and the basis of your calculations related to your grant award. Do not include miscellaneous, contingency, or other undefined budget amounts. Itemize each cost and present the basis for all calculations in the form of an equation. Please place where appropriate, calculations in an equation format, e.g., two (2) staff traveling @ $350/trip for 2 trips = $1400; or, salary $60,000 @ 20% devoted to program = $12,000. Glossary of terms: Corporation Share = Federal Share = Expense Grantee Share = Subgrantee Share = Match dollars from another funding source, public or private, or in some cases federal (see below for list of federal agencies that are allowable match) FTE = Full Time Employee There are two overall goals to keep in mind when creating your program’s YouthBuild AmeriCorps budget. 1. Properly allocate the designated grant award to support the program’s operating costs 2. Meet the Subgrantee Share (Match) requirements of exactly 50%. Section I. Program Operating and Member Costs Complete Section I, Program Operating and Member Costs, of the budget worksheet by entering the “Total Amount,” “Corporation Share,” and “Subgrantee Share” on each line item which is either being billed to the Corporation (Expense) or designated as the Subgrantee Share (Match): A. Personnel Expenses Under “Position/Title,” list each staff position being charged to the grant or used as match and provide a brief 5 or 6 word position description, the annual salary dollar amount, and the percentage of time being devoted to “AmeriCorps” at the program. (Please note: this is the total time being spent on AmeriCorps at the program, which includes the Corporation and Subgrantee Share amounts). The column, “Total Amount” will calculate once the “Qty” (quantity should equal one since all staff must be listed separately), 1 “Annual Salary” (this is the staff person’s annual gross salary), and “% of Time” have been entered. All calculations have been protected. Next, decide how much of the salary will be charged to the Corporation share of the grant. The formulas in the budget will then determine what the Subgrantee share will be. Example: A Personnel Expenses Position / Title Case Manager / Responsible for all documents involving AmeriCorps requirements along with day to day individual member assistance Qty Annual Salary 1 $44,387 Total Amount % of Time 50% Corporation Share $22,194 Subgrantee Share $15,536 $6,658 B. Personnel Fringe Benefits Under “Purpose” identify the types of fringe benefits to be covered and the costs of benefit(s) for each staff position. Allowable fringe benefits typically include FICA, Worker’s Compensation, Retirement, SUTA, Health and Life Insurance, IRA, and 401K. You may provide a calculation or rate for total benefits as a percentage of the salaries to which they apply or list each benefit as a separate item. Please justify how the program determined this rate if less than 30%. Typically, holidays, leave, and other similar vacation benefits are not included in the fringe benefit rates but rather are absorbed into the personnel expenses (salary) budget line item. Uncommon or exceptionally high-cost benefits should be itemized. If a fringe amount is 30% or over, please list the items separately like in example #2. Please keep in mind that the Corporation Share fringes should be prorated based on the salaries being charged to the Corporation. (For example, if only 20% of Hank’s salary is being charged to the Corporation, then only 20% of his fringes should be charged to the Corporation – not 21% or higher.) If the program is charging payroll taxes, they should be included as part of fringe. Example 1: A. Personnel Expenses Total Total Amount Corporation Share $ $ 43,660 Subgrantee Share 36,010 $7,650 B. Personnel Fringe Benefits Purpose Fringe Benefits (FICA, Worker's Comp, Health Ins, Retirement) Calculation Total Salary x 24% fringe rate Total Total Amount Corporation Share Subgrantee Share $ 10,478 $ 8,642 $ 1,836 $ 10,478 $ 8,642 $ 1,836 Or Example 2: A. Personnel Expenses Total $ 82,884 $ 58,019 $24,865 B. Personnel Fringe Benefits Purpose Calculation Total Amount Corporation Share Subgrantee Share FICA Total Salaries X 7.65% $6,341 $4,439 $1,902 SUI $7000 X 6.2% X 1.9 FTEs $825 $578 $247 Life Insurance Workers Compensation - Program Manager & Assistant Director Total Salaries X .5% $414 $290 $124 Total Salaries X .74% $179 $125 $54 Workers Compensation - Case Manager Total Salaries X .82% $182 $127 $55 Workers Compensation - Construction Supervisor Total Salaries X 6.35% $2,318 $1,623 $695 $696.36 per month X 12 months X 1.75 FTEs $14,624 $10,237 $4,387 Health Insurance 2 Health Insurance Pension $294.16 per month X 12 months X .15 FTE Total Salaries x 5% Total $ $529 $370 $159 $4,144 $2,901 $1,243 29,556 $ 20,690 $ 8,866 C. 1. Staff Travel Describe the purpose for which program operating staff will travel related to the grant. Provide a calculation to include costs for airfare, transportation, lodging, per diem, and other travel related expenses multiplied by the number of trips/staff. Where applicable, identify the current standard reimbursement rate(s) of the organization for mileage, daily per diem, and similar supporting information. Only domestic travel is allowable; other travel is allowable only if specifically identified and approved as a condition of the grant award. **The YBUSA Management Conference is held annually prior to the start of the grant year. Hotel rooms are a YouthBuild USA expense and not an expense of the program. However, programs can budget round trip airfare, dinners, transportation to and from the airports and any incidentals for up to three staff members: 2 program staff and 1 financial staff member, during the conference. Please note that breakfast & lunch on day 2 & 3 are already being paid by the YouthBuild USA’s Corporation funds. This means that the program would not be able to seek reimbursement for those meals from the Corporation. Example: C 1. Staff Travel Purpose **YBUSA Management Conference Calculation 3 FTE @ $200 per flight, $100 each food, $100 trans.) Total Total Amount Corporation Share Subgrantee Share $ 1,000 $ 1,000 $0 $ 1,000 $ 1,000 $0 C. 2. Member Travel Describe the purpose for which members will travel. Provide a calculation to include costs for airfare, transportation, lodging, travel allowance, and other related expenses for members to travel outside their service location or between sites. Costs associated with local travel, such as bus passes to local sites, program vans used to transport the members back and forth between the service site and program site, should be included in this budget category. Where applicable, identify the current standard reimbursement rate (s) of the organization for mileage, daily per diem, and similar supporting information. Example: C 2. Member Travel Purpose Calculation Total Amount Corporation Share Subgrantee Share $200 per month for gas x 2 vans x 10 mos Member Transportation (VANS) Conference of Young Leaders $ 2 members @ $25 baggage fees Total $ 4,000 $0 $ 4 ,000 50 $ 50 $0 $ 4,050 $ 4,050 $0 D. Equipment Equipment is defined as tangible, non-expendable personal property having a useful life of more than one year AND an acquisition cost of $5,000 or more per unit (including accessories, attachments, and modifications). Items that do not meet this definition belong in Sub-Section E. Supplies. Purchases of equipment are limited to 10% of the total Corporation funds requested. If applicable, show the unit cost and number of units you are requesting. Provide a brief justification for the purchase of the equipment under Item/Purpose. Programs are discouraged from purchasing equipment of over $5,000 due to the reporting requirements to the Corporation over the lifetime of the equipment. Please talk to us prior to 3 adding anything in this subsection of the budget. If an item cost under $5,000, then it should be listed under “Supplies” and is not considered “Equipment”. E. Supplies This subsection includes the amount of funds to purchase consumable supplies and materials, including member service gear and equipment that does not fit the definition above listed in the equipment subsection. You must individually list any single item costing $1,000 or more. Day of Service Expenses – This is a suggested budget line item for national service project days. It is not a required line item. AmeriCorps Signage: This is a suggested budget line item. It is not a required line item. Member Service Gear – NEW INFORMATION -- AmeriCorps members MUST wear an AmeriCorps logo on a daily basis-preferably clothing with the AmeriCorps logo. This line item is a required budget line item. Include the cost of the item with the AmeriCorps logo in the budget OR explain how the program will be providing the item to AmeriCorps members without using grant funds. Grantees may only charge the cost of member service gear to the Corporation share if it includes the AmeriCorps logo. There is no maximum charge per member. The service gear MUST have the AmeriCorps logo. Grantees may also add the AmeriCorps logo to their own local program uniform items using Corporation (federal) funds. Ask us for ideas of different ways the program can meet this new Corporation requirement. Member Safety Gear – A commonly budgeted item but is not required. All safety gear (hard hats gloves, boots, safety glasses, protective pants, safety vests, etc.) may be charged to the federal share, regardless of whether it includes the AmeriCorps logo. There is no maximum charge per member. Example: E. Supplies Calculation 3 service days @ $50 Total Amount Corporation Share $ 150 $ 150 $0 $ 2,625 $ 2,625 $0 $ 1,750 $ 1,750 $0 1 computer 35 members X $75 per member 35 members X $50 per member (has AmeriCorps logo) Estimated cost of 1 computer $ 800 $ 800 $0 1 printer Estimated cost of 1 printer $ 200 $ 200 $0 $ 5,525 $ 5,525 $0 Item Day of Service Expenses Member Safety Gear (Boots & Safety Glasses) Member Service Gear (T-Shirts and Sweatshirts) Total Subgrantee Share F. Contractual and Consultant Services Include costs for consultants related to the project’s operations, except evaluation consultants, who will be listed in Section H., below. There is no daily rate minimum. Indicate the daily rate for consultants you are proposing to use, their contractual services, and provide the names of the organizations when available. Indicate the daily rate, number of days, and total cost. For any pro bono work by a contractor in combination with fee-based work, affirm that the vendor’s normal fee schedule and market-based work warrant the in-kind value placed on the donated portion. Example: Section F. Contractual & Consultant Services Purpose Daily Rate Total Amount Corporation Share Finance, Accounting, & Audit $30,000 / year x 20% Calculation $127 day $ 6,000 $ 6,000 $0 Network Administrator $9,600 / year x 15% $185 day $ 1,440 $ 1,440 $0 4 Subgrantee Share Total $ 10,230 $ 10,230 $0 G. 1. Staff Training Include the costs associated with training staff on project requirements and training to enhance the skills staff need for effective project implementation, i.e., project or financial management, team building, etc. If using a consultant(s) for training, indicate the estimated daily rate. There is no daily rate minimum. Example: Section G 1. Staff Training Purpose Staff trainings and teambuilding Daily Rate Calculation 1/yr. @ $500 $500 Total Amount Corporation Share $ $ 500 Subgrantee Share 250 $250 $0 Total $ 500 $ 250 $250 G. 2. Member Training Include the costs associated with member training to support them in carrying out their service activities, for example, orientation, project-specific skills such as age-appropriate tutoring, CPR, or ecosystems and the environment. You may also use this section to request funds to support training for life after AmeriCorps. If using a consultant(s) for training, indicate the estimated daily rate. *CPR/First Aid Training is a required line item Example: Section G 2. Member Training Purpose *CPR/First Aid (required) Conference of Young Leaders Calculation Daily Rate $ 60 X 35 members 2 members x $300 registration fee Total Total Amount Corporation Share Subgrantee Share $ 2,100 $ 1,000 $1,100 $ 600 $ 500 $100 $ 2,700 $ 1,500 $2,200 H. Evaluation Include costs for project evaluation activities including additional staff time or subcontracts you did not budget under Section I A. Personnel Expenses, use of evaluation consultants, purchase of instrumentation and other costs specifically for this activity. This cost does not include the daily/weekly gathering of data to assess progress toward meeting performance measures, but is a larger assessment of the impact your project is having on the community, as well as an assessment of the overall systems and project design. Indicate daily rates of consultants, where applicable. I. Other Operating Costs Allowable costs in this budget category should include when applicable: Background checks (required) of members and grant-funded staff who have recurring access to vulnerable populations, i.e., children, the elderly, disabled, etc. Occupancy: Office space rental for projects operating without an approved indirect cost rate agreement that covers office space. For national office space, rental may be unallowable; check relevant OMB Circulars. If space is budgeted and it is shared with other projects or activities, the costs must be equitably pro-rated and allocated between the activities or projects. 5 Occupancy (Utilities), Communications (telephone, internet) and similar expenses that are specifically used for AmeriCorps members and AmeriCorps project staff, and are not part of the organizations indirect cost/admin cost allocation pool. The costs must be equitably pro-rated and allocated between the activities or projects. Recognition costs for members. List each item and provide a justification in the budget narrative. Gifts (gift cards) and/or food in an entertainment/event setting are not allowable costs. Food for members is not an allowable cost. Example: Section I. Other Program Operating Costs – In this example, 100% of this program is made up of AmeriCorps members and the program can budget 100% of its “other program operating costs” to the grant, if it chooses. If the program was not made up of 100% AmeriCorps members then these operating expenses need to be allocated across funders. Subgrantee Share Purpose Calculation Total Amount Corporation Share Rent $2,300 x 12/mo $ 27,600 $ 8,280 $19,320 Utilities $409 x 12/mo $ 4,910 $ 1,473 $3,437 Phone, Internet $300 x 12/mo $ 3,600 $ 1,080 $2,520 Background Checks $50 x 44 members / 8 staff $ 2,600 $ 2,600 $ 38,710 $ 13,433 Total $0 $25,277 J. Member Living Allowance This subsection should clearly identify the number of members you are supporting by category (i.e., fulltime, half-time, reduced-half-time, or quarter-time members). If the program plans to charge any portion of a RHT or QT member’s living allowance to the grant, then please talk to the program’s Portfolio Manager concerning the risks. All full time members must be in the budget as expense or a combination of expense and match. They MUST also receive no less than the minimum and no more than the maximum (see below’s chart) even if the program chooses not to charge the living allowance as expense or match to the grant. All program’s must provide the amount that they will be paying its full time member. Please provide the member living allowance rate, total amount, and the Corporation and subgrantee share breakdown on the designated member budget line. Please refer to the chart below that shows the minimum and maximum living allowance a Full Time Member may receive. . Table 4: 2013 AmeriCorps Maximum Federal Share of Living Allowance Term of Service Minimum Number of Hours Minimum Living Allowance Maximum Living Allowance Full Time Member 1700 Hours $12, 100 $24,200 Example: Section J. Member Living Allowance Item Full Time (1700 hours) # members 3 Rate $ # w/o Allowance 12,920 0 Half Time (900 hours) Reduced Half Time (675 hours) 25 25 Quarter Time (450 hours) Total 6 Total Amount Corporation Share $ 38,760 $ $ - $ - $0 $ - $ - $0 $ - $ $ 38,760 $ Subgrantee Share 38,760 $0 38,760 $0 $ - K. Member Support Costs Consistent with the laws of your state, you must provide members with the benefits described below. FICA. Unless exempted by the IRS with accompanying documentation (note in the narrative and provide documentation with application), all projects must pay FICA for any member receiving a living allowance, even when the Corporation does not supply the living allowance. In the first column next to FICA, indicate the number of members who will receive FICA. Calculate the FICA at 7.65% of the total amount of the living allowance. Worker’s Compensation. Some states require worker’s compensation for AmeriCorps members. You must check with your State Department of Labor or state commission to determine if you are required to pay worker’s compensation and at what level. If you are not required to pay worker’s compensation, you must obtain Occupational, Accidental, Death and Dismemberment coverage for members to cover in-service injury or incidents. Health Care. You must offer health care benefits to full-time members in accordance with AmeriCorps requirements. If the member purchases his/her health insurance through healthcare.gov or a private agency, the program must reimburse that member. Except as stated below, you may not pay health care benefits to half-time members with Corporation funds. You may choose to provide health care benefits to half-time members from other sources (i.e., nonfederal). Half-time members who are serving in a full-time capacity for a sustained period of time (such as a full-time summer project) are eligible for health care benefits. In your budget narrative, indicate the number of members who will receive health care benefits. The Corporation will not pay for dependent coverage. Unemployment Insurance and Other Member Support Costs. Include any other required member support costs here. Some states require unemployment coverage for their AmeriCorps members. You may not charge the cost of unemployment insurance taxes to the grant unless mandated by state law. Programs are responsible for determining the requirements of state law by consulting their state commission, legal counsel, or the applicable state agency. Example: Section K. Member Support Costs Purpose FICA Workers Compensation Health Care (for FT members) Total Amount Corporation Share Total Living Allowance x 7.65% $ 2,965 $ 2,965 $0 $38,760 X .0974 $ 3,775 $ 3,775 $0 Calculation Subgrantee Share $120 X 3 members X 12 months $ 4,320 $ 4,320 $0 Total $ 11,060 $ 11,060 $0 Section II. Administrative/Indirect Costs A. Definitions Administrative costs are general or centralized expenses of the overall administration of an organization that receives Corporation funds and do not include particular project costs. For organizations that have an established indirect cost rate for federal awards, administrative costs mean those costs that are included in the organization’s indirect cost rate agreement. Such costs are generally identified with the 7 organization’s overall operation and are further described in Office of Management and Budget Circulars A-21, A-87, and A-122. B. Options for Calculating Administrative/Indirect Costs (choose either 1 OR 2) Applicants can choose to use one of two methods to calculate allowable administrative costs – a Corporation fixed percentage method or a federally approved indirect cost rate method. Regardless of the option chosen, the Corporation’s share of administrative costs is limited by statute to 5.26% of the total Corporation funds actually expended under this grant. 1. Corporation Fixed Percentage Method The Corporation fixed rate allows you to charge administrative costs up to a cap without a federally approved indirect cost rate and without documentation supporting the allocation. If you choose the Corporation Fixed Percentage Method (Section IIIA in eGrants), you may charge, for administrative costs, a fixed 5% of the total of the Corporation funds expended. In order to charge this fixed 5%, the subgrantee match for administrative costs may not exceed 10% of all direct cost expenditures. This has been calculated for you already and the number is populated in the budget. 2. Federally Approved Indirect Cost Rate Method If you have a Federally Approved Indirect Cost (IDC) rate and choose to use it, the IDC rate will constitute documentation of your administrative costs including the 5% maximum payable by the Corporation. Specify the Cost Type for which your organization has current documentation on file, i.e., Provisional, Predetermined, Fixed, or Final indirect cost rate. Supply your approved IDC rate (percentage) and the base upon which this rate is calculated (direct salaries, salaries and fringe benefits, etc.). It is at your discretion whether or not to claim your entire IDC rate to calculate administrative costs. If you choose to claim a lower rate, please include this rate under the Rate Claimed field. Please send a copy of the approved rate with the budget. a. Determine the base amount of direct costs to which you will apply the IDC rate, including both the Corporation and Grantee’s shares, as prescribed by your established rate agreement (i.e., based on salaries and benefits, total direct costs, or other). Then multiply the appropriate direct costs by the rate being claimed. This will determine the total amount of indirect costs allowable under the grant. b. Multiply the sum of the Corporation funding share in Section I by 0.0526. This is the maximum amount you can claim as the Corporation share of indirect costs. c. Subtract the amount calculated in step b (the Corporation administrative share) from the amount calculated in step a (the Indirect Cost total). This is the amount the applicant can claim as grantee share for administrative costs. Example of a Federally Approved Indirect Cost Method Section I Total: Program and Member Costs $122,615 Section II: Administrative (Indirect) 8 $ 92,153 $ 30,462 Costs Cost Type(Provisional or Predetermined or Fixed or Final IDC Basis (Salaries & Benefits or Total Direct Cost or Other) Provisional Total Direct Cost Calculation Rate Claimed Total Amount Corporation Share Subgrantee Share 21.67% $ 26,569 $ 4,847 $ 21,722 Total $ 26,569 $ 4,847 $ 21,722 Total Section I +II $ 149,184 $ 97,000 Total Grant Amount $ 97,000 $52,184 Providing enough Subgrantee Share (or match) in your program’s budget: To start, the first rule you need to know is that the Subgrantee Share (match) of Sections I plus II must be at least 50%. What is the Subgrantee Share (Match)? Goods and services that have been correctly documented and are necessary to accomplish the program’s goals and activities may be used as match. Adding more of the Subgrantee Share (Match) to your budget: Once you have allocated the full grant award among the subsections of your budget, please see if the budget has met the 50% Subgrantee Share (match) requirement (this is automatically calculated on the budget template). If the total Subgrantee Share is still below the 50% Subgrantee Share requirement, please revisit your budget subsections and add line items and expenses that can be leveraged as “match” on your budget. Things to know about the Subgrantee Share (match): (1) You may provide your share of program operating costs with cash, including other Federal funds (as long as the other Federal agency permits its funds to be used as match), or third party in-kind contributions. The following federal agencies have provided written approval to use as match for AmeriCorps: DOL YouthBuild, US Department of Education, US Administration on Aging, US Department of Interior, US Department of Agriculture. If the program wants to use any other federal source as match, a written approval from the federal agency’s program officer will have to accompany the budget. If a program is using pass through federal funds from its state agency, please get written approval and forward with the budget. The program must get a new approval letter unless they can verify that the grant being used as match captures multiple grant years. (2) Contributions, including third party in-kind must: (i) Be verifiable from your records; (ii) Not be included as contributions for any other Federally assisted program; (iii) Be necessary and reasonable for the proper and efficient accomplishment of your program's objectives; and (iv) Be allowable under applicable OMB cost principles. (3) You may not include the value of direct community service performed by volunteers, but you may include the value of services contributed by volunteers to your organizations for organizational functions such as accounting, audit, and training of staff and AmeriCorps programs. 9 Once the budget meets the Subgrantee Share requirement of 50%, the program must list on the budget its “sources of match” that are being leveraged against the grant. Source of Match In the “Source of Match” fields at the end of the budget, enter a brief description of the Source of Match, the amount, the match classification (Cash, In-kind, or Not Available) and Match Source (State/Local, Federal, Private, Other or Not Available). Be sure to define any non-Corporation acronyms the first time they are used. Once you have listed the total sources of match and its dollar amounts verify that the total of match equals the total Subgrantee Share amount. Example: Sources of Match: Source(s), Type, Amount, Intended Purpose State and/or Local Private In-kind: Purpose and Source American Red Cross – First Aid Training $1000 $1000 Total In-kind Federal $0 $0 Cash: Purpose and Source Personnel Salaries & Fringes from Department of Labor-YouthBuild Full time Member Living Allowances & Member Support Costs Wasala County Justice Grant Member Service & Safety Gear from Internally Generated Real Estate Income $ $ $ 39,044 8,000 5,000 $ Total Cash Total Match Per Column $5,000 $ 6,000 $8,000 $8,000 $39,044 $39,044 Total Match: $53,044 = Must equal the total Grantee Share Creating your AmeriCorps budget can be difficult if it is your first time. If you have problems or questions, do not hesitate to call us. 10