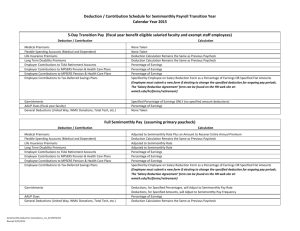

Section 3 - Updating Tax Withholding Information

advertisement