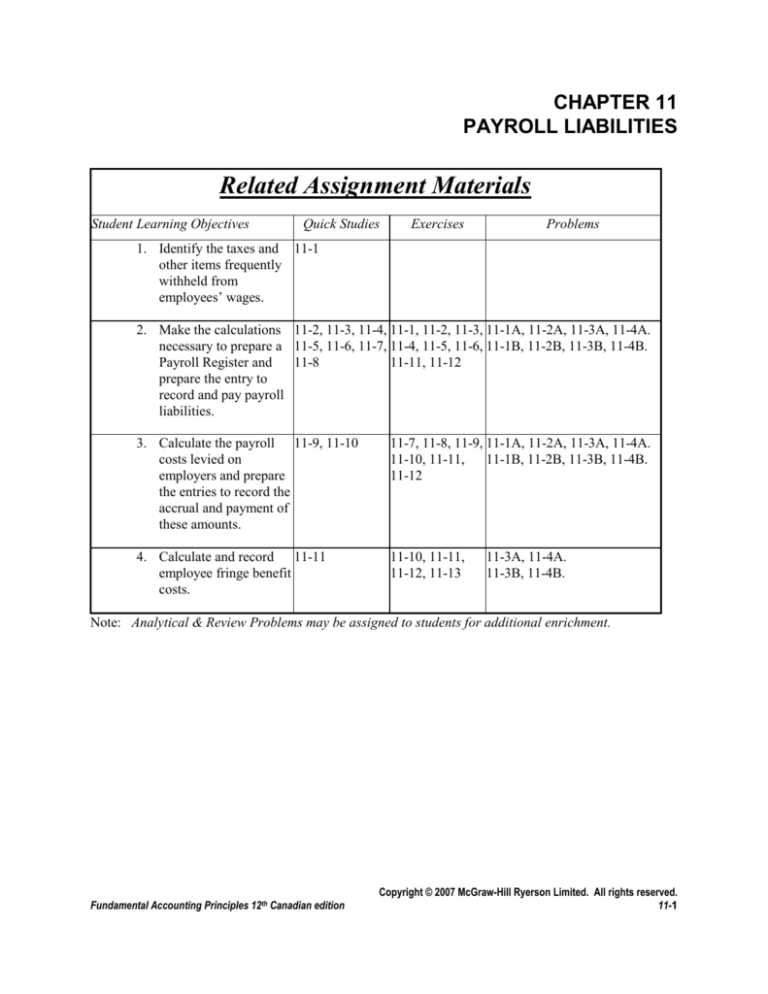

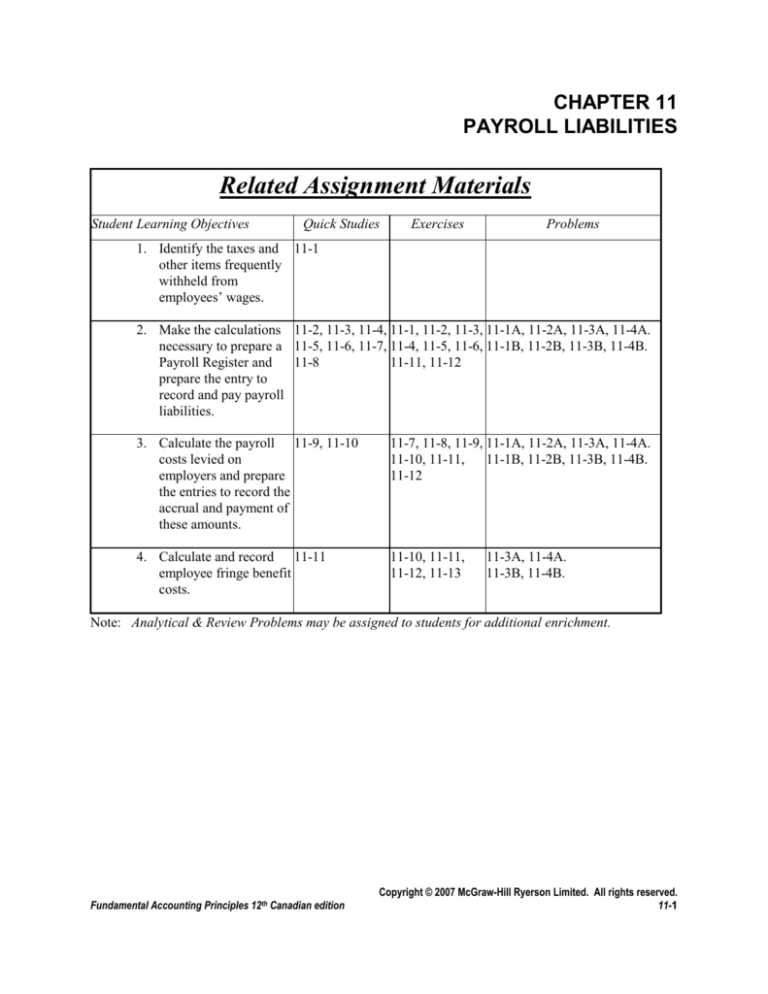

CHAPTER 11

PAYROLL LIABILITIES

Related Assignment Materials

Student Learning Objectives

Quick Studies

Exercises

Problems

1. Identify the taxes and 11-1

other items frequently

withheld from

employees’ wages.

2. Make the calculations 11-2, 11-3, 11-4, 11-1, 11-2, 11-3, 11-1A, 11-2A, 11-3A, 11-4A.

necessary to prepare a 11-5, 11-6, 11-7, 11-4, 11-5, 11-6, 11-1B, 11-2B, 11-3B, 11-4B.

Payroll Register and

11-8

11-11, 11-12

prepare the entry to

record and pay payroll

liabilities.

3. Calculate the payroll 11-9, 11-10

costs levied on

employers and prepare

the entries to record the

accrual and payment of

these amounts.

11-7, 11-8, 11-9, 11-1A, 11-2A, 11-3A, 11-4A.

11-10, 11-11,

11-1B, 11-2B, 11-3B, 11-4B.

11-12

4. Calculate and record 11-11

employee fringe benefit

costs.

11-10, 11-11,

11-12, 11-13

11-3A, 11-4A.

11-3B, 11-4B.

Note: Analytical & Review Problems may be assigned to students for additional enrichment.

Fundamental Accounting Principles 12th Canadian edition

Copyright © 2007 McGraw-Hill Ryerson Limited. All rights reserved.

11-1

Instructor’s Notes

Chapter Outline

For most business labour cost represents a significant proportion of total

expenses and consequently materially affects net income. Payroll accounting:

Records cash payments to employees

Provides valuable information regarding labour costs.

Accounts for amounts withheld from employees’ pay.

Accounts for employee (fringe) benefits and payroll costs paid by the

employer.

Provides the means to comply with government regulations on

employee compensation.

I.

Items Withheld from Employees Wages

A. Employee Income Taxes

1. The first federal income tax law became effective in 1917

applying to only a few individuals. During World War II

income taxes were levied on substantially all wage earners.

The income tax system continues to evolve and is affected

yearly by government budgets.

2. Employers are required to withhold a portion of their

employees' gross earnings for payment to the Receiver

General of Canada. The amount withheld should

approximately equal the employees' tax liability at year-end.

3. Each employee must file an Employee Tax Deduction

Return (TD1) indicating the amount of exemptions claimed.

Employers withhold taxes on the bases of information

provided on this TD1 form.

4. CRA provides tax withholding tables to determine the

exact amount to withhold based on completed TD1 forms.

5. With the exemption of Quebec, taxes withheld include

provincial taxes. Tax withholding tables will differ among

provinces to reflect different provincial rates.

B. Canada Pension Plan

1. Applies to all employees and self-employed individuals

between the ages of 18 and 70. (few exceptions)

2. Employers must withhold the employee contributions and

remit these deductions to the Receiver General of Canada.

Quebec, however, administers its own similar pension plan.

Copyright © 2007 McGraw-Hill Ryerson Limited. All rights reserved.

11-2

Fundamental Accounting Principles 12th Canadian edition

Instructor’s Notes

Chapter Outline

3. Employers must match the employee contribution and

remit an equal amount to the Receiver General of Canada.

4. Self-employed individuals must pay the combined rate for

employees and employers of 9.9% of annual earnings between

$3,500 and $42,100.

C. Employment Insurance Program (EI)

The objectives of the EI program are: To alleviate financial

hardships caused by interruptions in employment earnings.

EI is financed jointly by employees and their employers.

Employers are required to deduct 1.87% from employees'

gross wages (the definition of insurable earnings for use in

this text). The employer must then contribute 1.4 times the

employee contribution. Both the premium rate and the

insurable earnings may change yearly at government

discretion.

The Employment Insurance Act requires an employer to

complete a “Record of Employment” because of termination

of employment, illness, injury or pregnancy and keep a record

for each employee showing wages subject to employment

insurance and taxes withheld.

Use of Withholding Tables--Tables are available in paper and

electronic form which determine how much CPP, EI and taxes

should be deducted from employees. Employers are required to

prepare T4 forms for employees and forward them on or before

the last day of February each year.

Wages, Hours and Union Contracts—All provinces have laws

which specify minimum pay rates and establish maximum hours

of work. Businesses must pay an overtime premium for hours in

excess of 40 per week, i.e., time and a half (1 1/2 times regular

rate). Union contracts that promise better benefits take precedence

over provincial legislation, i.e., double time or double time and a

half for holidays.

D. Other Payroll Deductions

Individual employees may authorize additional deduction of

specific amounts.

Examples Include:

1. purchase of Canada Savings Bonds

2. insurance premium (health, accident, life, hospital)

3. loan repayments (loan from employer or employee’s

credit union)

4. deductions to pay for merchandise purchased from the

company

5. charitable donations (United Way, Red Cross)

Fundamental Accounting Principles 12th Canadian edition

Copyright © 2007 McGraw-Hill Ryerson Limited. All rights reserved.

11-3

Instructor’s Notes

Chapter Outline

II.

Payroll Register

The total hours worked by each employee are summarized in a Payroll

Register. Gross pay, which includes regular hours plus any overtime

premium is calculated first. Deductions, such as CPP, EI, income

taxes and net pay are summarized by pay period in payroll register.

Columns are provided for employee name, hours worked, (regular and

overtime hours), earnings, each deduction, payment amount, cheque

number, salary expense, account debited. See text illustration 11-2. The

design of a payroll register is dependent on the needs of management and

the requirements of various payroll-related laws.

Recording the Payroll

The data in the payroll register is used for general journal entry.

Sales Salaries Expenses

XXX

Office Salaries Expense

XXX

Employment Insurance Payable

XXX

Employees' Income Taxes Payable

XXX

Employees' Hospital Insurance Payable

XXX

Canada Pension Plan Payable

XXX

Payroll Payable

XXX

XXX

XXX

XXX

XXX

To record the Payroll for the week ending (date).

The salaries and wages expense accounts are charged for the

gross wages since that is the cost to the employer. The fact

that the gross pay will be paid to the employee, the Receiver

General, insurance companies, etc. affects the current liability

accounts.

The Payroll Payable is the net amount due employees. The

payroll entry is usually made at the end of a payroll period. A

time lag exists between the end of a payroll period and the

payday.

The payroll register, instead of the general journal, could

serve as a journal and the payroll data could be posted to the

ledger accounts from the payroll register.

Paying the Employees

Almost every business pays employees by cheque or through

electronic funds transfer. Employees are given an earnings

statement each payday.

Copyright © 2007 McGraw-Hill Ryerson Limited. All rights reserved.

11-4

Fundamental Accounting Principles 12th Canadian edition

Instructor’s Notes

Chapter Outline

Employee's Individual Earnings Record

An individual record for each employee (see illustration 11-5)

accumulates information that:

a. serves as a basis for employer payroll tax returns.

b. indicates when an employee's cumulative gross earnings

have reached ceilings for CPP and EI deductions

c. supplies data for Form T-4, which must be given to each

employee at year-end. (see exhibit 11-1.)

III.

Payroll Deductions Required of the Employer

The employer is required to pay an amount equal to the sum of

employees’ CPP and 140% of employees EI to CCRA on behalf of

employees.

The general journal entry to record the employer's amounts is

EI Expense (1.4X employees’ amt.) XX

CPP Expense (same as employees’)

EI Payable

CPP Payable

XX

XX

XX

These amounts along with employees’ deductions are remitted to the

Receiver General. This payment is usually done by the 15th of the

next month.

Fundamental Accounting Principles 12th Canadian edition

Copyright © 2007 McGraw-Hill Ryerson Limited. All rights reserved.

11-5

Instructor’s Notes

Chapter Outline

IV.

Employee Benefit Costs

Fringe benefits include insurance and retirement plans.

1. Workers compensation and vacation pay are required to be paid by

employers according to legislation in each province.

2. Employers that pay for part or all of these benefits incur payrollrelated expenses.

a. Benefits Expense

XXX

b. Employees' Hospital Insurance Payable.

XXX

c. Employees' Retirement Program Payable

XXX

XXX

XX

Note: Students should be made aware of the business reality that the cost

of employing an individual is far greater than the annual salary. Payroll

taxes and fringe benefits can add well over 25 percent to the salaries.

3. Vacation Pay

The effect of a two-week vacation is to increase the employer's

payroll expense by 4% (2 weeks/50 weeks). The fact that some

employees do not accrue vacation time until they have worked for

a certain period of time reduces this percentage.

Benefits Expense

XXX

Estimated Vacation Pay Liability XXX

As employees take their vacation, the estimated vacation pay

liability is reduced. All deductions are applicable to vacation pay.

Copyright © 2007 McGraw-Hill Ryerson Limited. All rights reserved.

11-6

Fundamental Accounting Principles 12th Canadian edition