The following problem is and open economy problem from chapter 5

advertisement

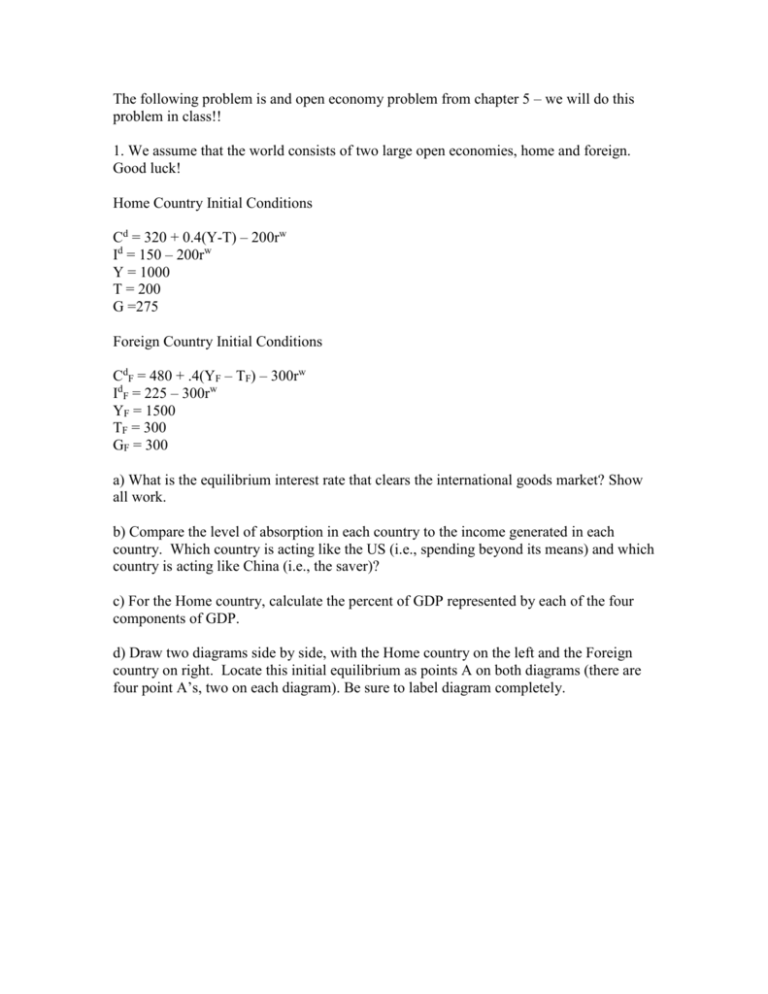

The following problem is and open economy problem from chapter 5 – we will do this problem in class!! 1. We assume that the world consists of two large open economies, home and foreign. Good luck! Home Country Initial Conditions Cd = 320 + 0.4(Y-T) – 200rw Id = 150 – 200rw Y = 1000 T = 200 G =275 Foreign Country Initial Conditions CdF = 480 + .4(YF – TF) – 300rw IdF = 225 – 300rw YF = 1500 TF = 300 GF = 300 a) What is the equilibrium interest rate that clears the international goods market? Show all work. b) Compare the level of absorption in each country to the income generated in each country. Which country is acting like the US (i.e., spending beyond its means) and which country is acting like China (i.e., the saver)? c) For the Home country, calculate the percent of GDP represented by each of the four components of GDP. d) Draw two diagrams side by side, with the Home country on the left and the Foreign country on right. Locate this initial equilibrium as points A on both diagrams (there are four point A’s, two on each diagram). Be sure to label diagram completely. e) Now the Home, let’s call it the US from now on, decides to embark on some expansionary fiscal policy. Let’s try to mimic the Obama Administration’s Stimulus package. Remember, the critics of this policy, including Robert Barro,1 argue that the plan won’t work (as in no change in Y), and will simply result in crowding out other components of GDP. In fact, we impose Barro’s assumption of a zero government spending (and tax) multiplier and thus, keep Y at its current level equal to 1000. Of course, this is a Classical school proposition consistent with output being exclusively determined by the production function. Therefore, in this problem we are making two very important assumptions: 1) We are in a Classical world and 2) These policies do not influence the production function at all, and thus, output is fixed! The Policy (similar to the one just passed in percent of GDP): An increase in G of 40 (4% of GDP) A reduction in taxes of 25 (2.5% of GDP) f) Given these expansionary fiscal policies by the US, calculate the ‘new’ world real interest rate (rw) that clears the international goods market. Please show all work. g) Compare the level of absorption in each country to the income generated in each country and comment on what has happened to each component of absorption and why. For example, did desired consumption for the US change? Why or why not? (hint, the answer begins with “on one hand….”) Same with desired investment – the G changed for obvious reasons (we don’t model G, we treat it as exogenous). Did the increase in G “crowd out” investment as many (including Barro) claim it would? Why or why not? What are the implications for the supply side and the long run in this context? What has happened to net exports? Are we still spending beyond our means? Why exactly did the world real interest rate change? h) redo part c and comment on the changes. Was Barro right? i) Add these new conditions to your graphs and label as point B. Be sure to label your graph completely. j) Are your results consistent with the “twin deficit” story?? Why or why not? 1 Barro’s article is posted on our home page. k) Re-draw two diagrams side by side as before depicting these new conditions (after the ‘stimulus’ package enacted by the US). Now the foreign country, call it China from this point forward, decides to enact a Fiscal policy of their own and it is massive. Consider the excerpt below from http://www.chinadaily.com.cn/bizchina/200901/16/content_7404155.htm “China announced a fiscal stimulus package of $586 billion (or 15 percent of China's GDP), to be implemented during 2009 and 2010.” l) So 15% of 1500 is 225 so let’s recalculate the world real interest rate that clears the international goods market, given that China (the foreign country) has increased G by 225. m) Add these new developments to your diagrams being sure to label everything. m) What has happened to the trade balance of each country and why? Please explain the intuition. n) Now consider what has happened to the level of absorption for each country, component by component? What has happened to the US’s share of net exports relative to GDP? Is the US better off or worse off due to the expansionary Fiscal policy conducted by China? Explain in terms of the short run and long run!