Microsoft Word 97

Accounting 20

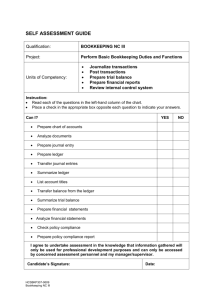

Module 1

Lesson 4

Accounting 20 1 Lesson 4

Accounting 20 2 Lesson 4

Lesson 4 - Introducing the Accounts Receivable

Application

Read pages 296 to 340 in the text.

•

•

•

•

•

•

•

•

•

Topics:

•

•

•

•

•

•

•

•

•

•

•

•

Introduction

Originating and Analyzing Dental Charges

Journalizing and Posting Dental Charges

Controlling Cash Receipts

Journalizing and Posting Cash Receipts

Explaining Month-End Procedures and Introducing the One-Write System

Remember These Important Points

Do You Understand?

Conclusion

Self Test

Answers for Self Test

Assignment 4

After studying lesson 4, the student should be able to prepare a patient ledger card for a new patient. prepare the stub and dental fee bill portions on a dental charge. analyze correctly in General Journal form the information shown on a completed dental fee bill. record given dental "charge" transactions in the Fees Earned Journal. post transactions from a completed Fees Earned Journal to individual patient accounts in the Accounts Receivable Ledger. total and rule the Fees Earned Journal. post the total of the Fees Earned Journal to appropriate General Ledger accounts. list and explain the measures used by a business to control cash receipts. complete a problem involving a set of transactions for a dental firm in the General

Journal, Fees Earned Journal, and Cash Receipts Journal; post the data to the

General Ledger and Accounts Receivable Ledger; and prepare the trial balances of the General Ledger and Accounts Receivable Ledger.

Accounting 20 3 Lesson 4

Introduction

As a bookkeeper for a small dental practice operating under the name John H. Johnson,

D.D.S., you are responsible for completing all steps of the accounting cycle.

At the end of the first year of operation, the Chart of Accounts for the General Ledger is found on page 296 of the text.

Note that the Chart of Accounts is becoming quite large due to the individual listing of accounts receivable and accounts payable. As the business prospers, the Chart of

Accounts will grow. To solve this problem you will learn how to keep track of all the customer accounts in a separate book known as the accounts receivable application--all accounting dealing with customer accounts.

Originating and Analyzing Dental Charges

Preparing a Patient Ledger Card

The textbook on page 297 illustrates a patient ledger card for the Garcia family. This card is prepared by a dental clerk before services can be rendered and it is simply a record of the dental fees charged to the family, and the cash payments received by the family.

The balance is calculated after each charge or payment, and it shows the amount owing to

Dr. Johnson from this family of patients.

Accounting 20 4 Lesson 4

Preparing a Dental Fee Bill

A source document showing charges to and payments from dental patients is used by the majority of dental practices to record services performed by the dentist.

Pages 298 and 299 of the text illustrates how two transactions would be shown on the dental bill and in the general journal.

Answering Important Questions on GAAPs

Students will study this section on page 300 of the text.

Journalizing and Posting Dental Charges

If the transactions on pages 303 and 304 were recorded in a General Journal, Accounts

Receivable/Name of Patient would be debited, and Professional Fees credited 23 times.

These 23 transactions would use at least 69 - 92 writing lines. A typical dental practice would probably have 15 to 20 similar transactions per day. In addition to this, other business transactions would also be recorded in the General Journal. Consequently, you would have to search through many pages of the journal to find the total fees earned for a given day or month. To overcome these difficulties, you will use a special journal to record revenue earned called the Fees Earned Journal.

Illustrating the Fees Earned Journal

The Fees Earned Journal is a special journal recording all fees earned in chronological order.

Page 306 of the text shows how the 23 transactions discussed above will be shown in the special Fees Earned Journal.

Read pages 305 to 307 carefully.

Note that the name of the Accounts Receivable/Customer's name goes in the Account

Debit column. The credit to Professional Fees Earned is understood as having been recorded each time the debit entry is made. The total of credits for each month is posted at the end of the month.

Accounting 20 5 Lesson 4

The main advantage of a special journal is that the information is recorded on one line.

Looking at the Need for an Accounts Receivable Ledger

Up to this point, all transactions involving accounts receivable were posted to a few individual customer accounts that were filed together with other asset accounts in the same general ledger.

Most professional firms have a large number of accounts receivable. To overcome the problems discussed on pages 307 and 308 of the text, individual customer or patient accounts are filed in a separate ledger called the Accounts Receivable Ledger.

Organizing a Separate Accounts Receivable Ledger

Study pages 308 and 309 carefully.

Note these important definitions:

General Ledger - the main ledger from which financial statements are prepared.

Subsidiary Ledger - a secondary ledger which stores the details of all the accounts of only one class of account.

Accounts Receivable Ledger - the file of all the individual customer accounts.

Accounts Receivable Control - the general ledger account which contains the total of all individual customer account balances.

Posting Individual Customer Accounts

Study carefully pages 309 and 310 of the text. The posting to the accounts receivable subsidiary ledger is done on a daily basis so that the balance owing can be known at any time.

Accounting 20 6 Lesson 4

Posting to the General Ledger

At the end of the month, the Fees Earned Journal is totalled to determine the amount to be posted to the General Ledger. This is shown on page 311 of the text. The total must be in the form of a complete double entry:

• A debit must be acknowledged and then posted to the Accounts Receivable controlling account.

• A credit must be shown to the revenue account called Professional Fees Earned.

Note also how the Post. Ref. column of the Fees Earned Journal is divided with a diagonal

(slash) line so that the two account numbers for the General Ledger accounts can be distinguished. Of course, these numbers would be inserted only after the information has been posted to the General Ledger.

Finally, observe how the Fees Earned Journal is ruled to show completeness of the month's journalizing of Professional Fees Earned. The double line rules the journal so that the next month's transactions may begin below.

Advantages of the Special Journal

Note the four advantages listed on page 312 of the text.

Controlling Cash Receipts

Study pages 315 to 320.

Accounting 20 7 Lesson 4

Journalizing and Posting Cash Receipts

Study pages 324 to 327 carefully.

Since transactions involving cash received every day are common and numerous, many firms will use a special journal known as the Cash Receipts Journal to ensure a better control of recording all cash receipts.

In the Account Credit column remember to record each account credited in each cash receipts transaction.

For each line except the final total line, it is helpful to think of each transaction in general journal form so that the correct credit entry may be recorded. For example, in the first transaction on page 327, the entry in general journal form would be analyzed as: Cash

(Debit) and Accts. Rec. /Ms. Mary Brown (Credit). Of course, Cash (Debit) is understood and will be shown at the end of the month when the Amount column is totalled.

At the end of the month, the Amount column is totalled and journalized. That is, this total is recorded in debit and credit form. Of course, Cash must be debited and Accounts

Receivable must be credited for the total.

When a special journal like the Cash Receipts Journal is used together with the General

Ledger and Accounts Receivable Ledger, it is helpful to think of the transfer procedure as being divided into two stages:

• one stage consists of daily posting to the credit side of individual customer (patient) accounts filed in the Account Receivable Ledger.

• a second stage which consists of transferring the total of the Amount column to the debit side of the Cash account and the credit side of the Accounts Receivable

(controlling) account in the General Ledger. This total would be transferred at the end of the month.

Accounting 20 8 Lesson 4

Explaining Month-End Procedures and Introducing the

One-Write System

Preparing Monthly Trial Balances

When a General Ledger and an Accounts Receivable Ledger are used in the accounting system, it is important to prepare a trial balance at the end of the month for each ledger.

General Ledger Trial Balance

Remember that a trial balance is a summary of General Ledger account balances. Read

(page 332 of the text).

Preparing the Accounts Receivable Trial Balance

Study pages 333 and 334 carefully.

The Schedule of Accounts Receivable is a list of individual customer account balances at the end of the month.

Remember that the total of the Schedule of Accounts Receivable must agree with the balance of Accounts Receivable (Control) in the General Ledger.

Preparing the Aged Trial Balance

Study pages 334 to 336 in the text.

The example of an Aged Trial Balance is on page 336.

Preparing the Statement of Account

Study pages 336 to 338 in the text.

A statement of account is a statement mailed monthly to a customer showing the balance the customer owes.

Accounting 20 9 Lesson 4

Note that the copy of Mr. D. Garcia's ledger card appears on page 338.

Using the One-Write System for the Accounts Receivable Application

A one-write system is a system of preparing more than one accounting document and record in a single step.

Study pages 338 to 340 in the text.

Remember These Important Points

• The majority of dental practices use a source document called the dental fee bill to account for dental services carried out.

• Since a patient may pay part or all of the dental fee, the fee bill also acts as a receipt in cases where money is paid by the patient.

• The total fee charged on the fee bill is accounted for by debiting the asset Accts.

Rec./patient's name, and crediting the revenue account Professional Fees Earned.

• In dental practice, it is customary to use a separate accounts receivable ledger card for each family rather than for each member of the family.

• Special journals record only transactions that are similar and highly repetitive in nature. Therefore, all fees charged by the dental office would be recorded in the

Fees Earned Journal.

• Every time you record an amount in the Amount column of the Fees Earned

Journal, in accounting theory you must think of this amount being credited to the revenue account--Professional Fees Earned.

• One of the advantages of using a special journal like the Fees Earned Journal is that you can record a complete transaction on one line. In a General Journal, at least three lines are required.

Accounting 20 10 Lesson 4

•

•

•

•

•

•

•

•

•

•

A common practice is to show only one account for Accounts Receivable in the

General Ledger. This account becomes the controlling account because it controls by total the individual customer (patient) accounts filed in a separate ledger.

A controlling account is a general ledger account, the balance of which represents the total of the balances of the related accounts in a subsidiary ledger. We studied the controlling account--Accounts Receivable.

When a controlling account is used in the General Ledger, the individually related accounts are filed in a separate ledger. Individual customer (patient) accounts would be filed in a separate Accounts Receivable Ledger.

The Accounts Receivable Ledger is said to be a subsidiary ledger because it may be thought of as a secondary branch of the general ledger.

When a special journal like the Fees Earned Journal is used, posting to individual patient accounts is done on a daily basis. This is important because management and/or the customer may want to know what is owing on account on any given day.

When a special journal like the Fees Earned Journal is used, posting to the General

Ledger is done only at the end of the month. This posting is done by totalling the

Amount column (with a double ruled line) and identifying this total in the form of a double entry: debit Accounts Receivable (controlling account); and credit

Professional Fees Earned (revenue account).

A check mark is used after posting individual amounts to the customer's account in the Accounts Receivable Ledger. This check mark is placed in the Post. Ref. column of the Fees Earned Journal only after you post the information to the individual customer's account.

After posting the total to the General Ledger, you show the account numbers of the accounts posted in the Post. Ref. column of the Fees Earned Journal.

At the end of the each month, a trial balance is taken of both the General Ledger and Accounts Receivable Ledger to make sure that the balance of the General

Ledger controlling account agrees with the total of the balances of the related accounts in the subsidiary ledger.

The trial balance (schedule) of the Accounts Receivable Ledger is the listing of all customer (patient) accounts, in alphabetic order, and their individual month-end balances.

Accounting 20 11 Lesson 4

•

•

•

•

•

•

•

•

•

•

The total of the Schedule of Accounts Receivable is the total of Accounts Receivable.

This total must agree with the balance of the Accounts Receivable controlling account in the General Ledger.

The majority of businesses set up separate systems to account for cash coming in and cash going out of the business. Divide the responsibility to ensure that the person handling the cash is separated from the person recording the cash transaction in the accounting records.

The Cash Receipts Journal is a special journal in which cash received from dental patients is recorded.

The name of the patient's account will always appear in the Account Credit column because Accounts Receivable /name of patient must be credited for the cash received from a customer.

Every time you record an amount in the Amount column of the Cash Receipts

Journal, in accounting theory you must think of this amount being debited to the asset account--Cash.

When the Cash Receipts Journal is used, posting to individual customer (patient) accounts is done on a daily basis.

A check mark is used after posting individual amounts to the customer's account in the Accounts Receivable Ledger. This check mark is placed in the Post. Ref. column of the Cash Receipts Journal only after you post the information to the individual customer's account.

After posting the total to the General Ledger, you show the account numbers of the accounts posted in the Post. Ref. column of the Cash Receipts Journal.

The Cash Receipts Journal is ruled by double lines at the end of the month.

In general, a special journal for Cash Receipts is often used as part of an accounting system because cash receipts occur very often during the month. Because the double entry Cash debit and Accounts Receivable credit occurs many times during a month, that entry is better recorded in the Cash Receipts Journal.

Accounting 20 12 Lesson 4

Do You Understand?

Accounts Receivable Application - all accounting dealing with customer accounts.

Dental Fee Bill - a source document showing charges to and payments from dental patients.

Fees Earned Journal - a special journal recording all fees earned in chronological order.

Accounts Receivable Ledger - the file of all individual customer or patient accounts.

Accounts Receivable - a current asset account in the General Ledger.

Accounts Receivable Control - the General Ledger account which contains the total of all individual customer account balances.

Subsidiary Ledger - a secondary ledger which stores the details of all the accounts of only one type.

Internal Control System - activities organized within a business for the purpose of (1) protecting its assets against waste, fraud, and theft and (2) ensuring the accuracy and reliability of the data in accounting reports.

Change Fund - a small amount of currency used to make change.

Current account - a business bank account used to account for a business's cash receipts and cash payments.

Cash Receipts Journal - a special journal in which only cash receipts are recorded.

Schedule of Accounts Receivable - a list of individual customer account balances.

Trial Balance - a summary of General Ledger account balances.

Aged Trial Balance - a list of customer account balances according to their "age" (current,

31 - 60 days, 61 - 90 days, or over 90 days).

Statement of Account - a statement mailed monthly to a customer showing the balance the customer owes.

Traditional Bookkeeping Method - journalizing and posting data in separate steps.

One-Write System - a system of preparing more than one accounting document and record in a single step.

Accounting 20 13 Lesson 4

Conclusion

•

•

•

•

•

•

•

•

You have learned how to:

• originate and analyze dental charges, prepare a patient ledger card, and a dental fee bill. journalize a special journal called a Fees Earned Journal. post from a Fees Earned Journal into the Accounts Receivable Ledger and the

General Ledger. control cash receipts. journalize and post another special journal called the Cash Receipts Journal. prepare a general ledger Trial Balance. prepare a Schedule of Accounts Receivable. prepare an Aged Trial Balance. understand the One-Write System for the Accounts Receivable Application.

Accounting 20 14 Lesson 4

Self Test

1. Problem 8-1, page 300 in the text

2. Problem 8-3, page 312 in the text

3. Problem 8-5, page 314 in the text

4. Problem 8-9, page 322 in the text

5. Problem 8-10, page 328 in the text

Accounting 20 15 Lesson 4

P 8-1a Insert Dental Patient Card for Lien Chang as illustrated on page 297 of text.

8-1b, c, d Insert Dental Fee Bill as illustrated on page 298 of text.

Ge n e ra l J o u rn a l P a g e

D a t e

20__ Ac c o u n t Ti t le a n d E x p la n a t i o n

P o s t

R e f.

D e b i t Cre d i t

Accounting 20 16 Lesson 4

P 8-3a, b

D a t e

20__

Ge n e ra l J o u rn a l

Ac c o u n t Ti t le a n d E x p la n a t i o n

P o s t

R e f.

D e b i t

P a g e

Cre d i t

Accounting 20 17 Lesson 4

P 8-3a, b (continued)

D a t e

20__

Ge n e ra l J o u rn a l

Ac c o u n t Ti t le a n d E x p la n a t i o n

P o s t

R e f.

D e b i t

P a g e

Cre d i t

Accounting 20 18 Lesson 4

P 8-3c

R e c e i p t D a te

N u m b e r 20__

F e e s E a rn e d J o u rn a l

Ac c o u n t D e b i te d D e s c ri p ti o n

P o s t

R e f.

P a g e

Am o u n t

1

Accounting 20 19 Lesson 4

P 8-5a, b Insert 6 Dental Patient Ledger Card for L. M. Munro as illustrated on page

297 of text.

P 8-5a, b (continued)

Accounting 20 20 Lesson 4

P 8-5a, b (continued)

Accounting 20 21 Lesson 4

P 8-5a, b (continued)

Accounting 20 22 Lesson 4

P 8-5a, b (continued)

Accounting 20 23 Lesson 4

P 8-5a, B (continued)

Accounting 20 24 Lesson 4

P 8-5c

R e c e i p t D a te

N u m b e r 20__

F e e s E a rn e d J o u rn a l

Ac c o u n t D e b i te d D e s c ri p ti o n

P o s t

R e f.

P a g e

Am o u n t

1

Accou n ts R eceivable

D a t e

20__ E x p la n a t i o n

Profession al Fees E arn ed

D a t e

20__ E x p la n a t i o n

General Ledger

P o s t

R e f.

D e b i t

P o s t

R e f.

D e b i t

Cre d i t

Ac c o u n t N o . 103

B a la n c e

Cre d i t

Ac c o u n t N o . 4 01

B a la n c e

Accounting 20 25 Lesson 4

P 8-9a

Cash Proof

Date ________________________________________

Cash Register No. ________________________________________

Cash Sales

Received on Account

Total Cash Received

Less: Cash Paid Out

Net Cash Received

Cash in Drawer

Less: Change Fund

Net Cash Handled

Cash Short or Over

P 8-9b

Clerk ________________________________________

Supervisor ________________________________________

Key Figure to Check: net cash received is $2 158.65.

Accounting 20 26 Lesson 4

P 8-10a, c, d

R e c e i p t D a te

N u m b e r 20__

Ca s h R e c e i p t s J o u rn a l

Ac c o u n t Cre d i te d D e s c ri p ti o n

P o s t

R e f.

P a g e

Am o u n t

General Ledger

P o s t

R e f.

D e b i t

P 8-10b

P 8-10d

Cash

D a t e

20__

Return to Problem 8-5 and use the accounts receivable patient cards to complete the posting to the Accounts Receivable Ledger.

E x p la n a t i o n Cre d i t

Ac c o u n t N o . 1 01

B a la n c e

Accou n ts R eceivable

D a t e

20__

Accounting 20

E x p la n a t i o n

P o s t

R e f.

27

D e b i t Cre d i t

Ac c o u n t N o . 1 03

B a la n c e

Lesson 4

Answers For Self Test

Insert the answer for the Dental Patient Card Lien Chang.

Accounting 20 28 Lesson 4

P 8-1b, c Insert the form with the answer for Dental Fees Bill

P 8-1d

Ge n e ra l J o u rn a l

D a t e

20__ Ac c o u n t Ti t le a n d E x p la n a t i o n

P o s t

R e f.

D e b i t

Dec.

1 0 3 2 Accts. R ec./H . Van d en berk

Profession al Fees E arn ed

T o record fee bill N o. 0001.

00

P a g e

Cre d i t

1 0 3 00

Accounting 20 29 Lesson 4

P 8-3a, b

D a t e

20__

J an

Ge n e ra l J o u rn a l

Ac c o u n t Ti t le a n d E x p la n a t i o n

26 Cash

Govern m en t of Can ad a B on d s

Den tal E qu ipm en t

Office E qu ipm en t

B an k L oan Payable

Accts. Pay./B ell E qu ip. L td .

Accts. Pay./R iversid e S ystem s L td .

L .M . M u n ro, Capital

T o record th e open in g en try of Dr. L .M . M u n ro.

P o s t

R e f.

D e b i t

5 0 0 0

3 0 0 0 0

4 0 0 0 0

1 0 0 0 0

00

00

00

00

P a g e 1

Cre d i t

5 0 0 0

1 0 0 0 0

2 0 0 0

6 8 0 0 0

00

00

00

00

26 Accts. R ec./M s. M . M iscin sk i

Profession al Fees E arn ed

Fee bill N o. 001; E Cl.

27 Accts. R ec./L . M cGraw

Profession al Fees E arn ed

Fee bill N o. 002; E 2B W CL (S u san )

28 Accts. R ec./L . M cGraw

Profession al Fees E arn ed

Fee bill N o. 003; CR

28 Accts. R ec./S . K atz

Profession al Fees E arn ed

Fee bill N o. 004; lab fee

29 Accts. R ec./S . K etch eson

Profession al Fees E arn ed

Fee bill N o. 005; (R ich ard : E CL )(R on ald : E XR 2WF)

30 Accts. R ec./ J . L ain g

Profession al Fees E arn ed

Fee bill N o. 006; E B W CL

31 Accts. R ec./I R yd er

Profession al Fees E arn ed

Fee bill N o. 007; E CL

Accounting 20 30

1 0 3 00

9 3 00

3 7 0 00

1 7 5 00

1 2 4 00

1 0 6 00

1 0 3 00

1 0 3 00

9 3 00

3 7 0 00

1 7 5 00

1 2 4 00

1 0 6 00

1 0 3 00

Lesson 4

P 8-3c

F e e s E a rn e d J o u rn a l

R e c e i p t D a te

N u m b e r 20__ Ac c o u n t D e b i te d

0001 Jan.

26 M. Micsinski

0002 27 L. McGraw

0003

0004

28 L. McGraw

28 S. Katz

0005 29 S. Ketecheson

0006

0007

30 J. Laing

31 I. Ryder

31 Accts. Rec. Dr./

Prof. Fees Earned Cr.

D e s c ri p ti o n

E CL

E 2BW CL (Susan)

CR

Lab fee

Richard (E CL $65)

Ronald (E XR 2WF - $59)

E BW CL

E CL

P o s t

R e f.

103/104

P 8-5a, b Insert 6 Patient Dental Cards with answers.

P 8-5c

F e e s E a rn e d J o u rn a l

R e c e i p t D a te

N u m b e r 20__ Ac c o u n t D e b i te d D e s c ri p ti o n

0001 Jan.

26 M. Micsinski

0002 27 L. McGraw

0003

0004

28 L. McGraw

28 S. Katz

0005 29 S. Ketecheson

0006

0007

30 J. Laing

31 I. Ryder

31 Accts. Rec. Dr./

Prof. Fees Earned Cr.

E CL

E 2BW CL (Susan)

CR

Lab fee

Richard (E CL $65)

Ronald (E XR 2WF - $59)

E BW CL

E CL

P o s t

R e f.

3

3

3

3

3

3

3

103/104

General Ledger

P a g e 1

Am o u n t

1 0 3 00

9 3 00

3 7 0 00

1 7 5 00

1 2 4 00

1 0 6 00

1 0 3 00

1 0 7 4 00

P a g e 1

Am o u n t

1 0 3 00

9 3 00

3 7 0 00

1 7 5 00

1 2 4 00

1 0 6 00

1 0 3 00

1 0 7 4 00

Accounting 20 31 Lesson 4

Accou n ts R eceivable

D a t e

20__

J an .

31

E x p la n a t i o n

Profession al Fees E arn ed

D a t e

20__ E x p la n a t i o n

J an .

31

FE J

P o s t

R e f.

1

FE J

P o s t

R e f.

1

D e b i t

1 0 7 4 00

D e b i t

Cre d i t

Ac c o u n t N o . 1 03

B a la n c e

1 0 7 4 00

Cre d i t

1 0 7 4 00

Ac c o u n t N o . 401

B a la n c e

1 0 7 4 00

Accounting 20 32 Lesson 4

P 8-9a

Cash Proof

Date _____________________________________________

Cash Sales

Received on Account

Total Cash Received

Less: Cash Paid Out

Net Cash Received

1 318.30

845.00

2 163.30

4.65

2 158.65

Cash in Drawer

Less: Change Fund

Net Cash Handled

Cash Short or Over

2 217.95

50.00

2 167.95

9.30

Clerk ________________________________________

Supervisor ___________________________________

P 8-9b

You would discuss the overage with the cashier involved. This time the account was over, so the customers have been short changed and money has been put in the register without the revenue being recorded. You would probably keep track of each employee’s over and shorts to see if one particular employee is performing poorly.

Accounting 20 33 Lesson 4

P 8-10a, c, d

Ca s h R e c e i p t s J o u rn a l

R e c e i p t D a te

N u m b e r 20__ Ac c o u n t Cre d i te d

0001 Jan.

26 Ms. M. Micsinski

0003 28 L. McGraw

0008

0009

30 Ms. J. Laing

31 I. Ryder

0010

0011

0012

31 L. McGraw

31 S. Katz

31 S. Ketcheson

D e s c ri p ti o n

Full Settlement

ROA

Full settlement

Full settlement

Full settlement

ROA

ROA

31 Cash Dr./Accts. Rec. Cr.

P. 8-10d

Cash

D a t e

20__

J an .

E x p la n a t i o n

31 B alan ce Forw ard

31 CR J

Accou n ts R eceivable

D a t e

20__

J an .

E x p la n a t i o n

31 B alan ce Forw ard

31 CR J

General Ledger

P o s t

R e f.

3

1

P o s t

R e f.

3

1

D e b i t

D e b i t

P o s t

R e f.

3

3

3

3

3

3

3

101/103

P a g e 1

Am o u n t

1 0 3 00

1 0 0 00

1 0 6 00

1 0 3 00

3 6 3 00

5 0 00

1 0 0 00

9 2 5 00

Cre d i t

9 2 5 00

Ac c o u n t N o . 101

B a la n c e

5 0 0 0

5 9 2 5

00 (Dr )

00

Cre d i t

9 2 5 00

Ac c o u n t N o . 103

B a la n c e

1 5 9 3 00 (Dr )

6 6 8 00

Accounting 20 34 Lesson 4

P 8-10b Insert 6 Dental Patient Cards with answers.

Accounting 20 35 Lesson 4