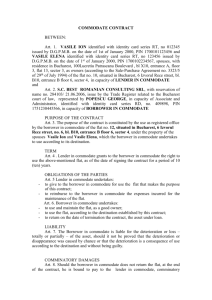

US Department of Housing - Standard Solutions, Inc.

advertisement