How Important Is Your Credit

advertisement

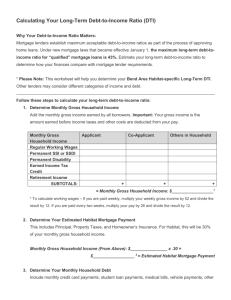

How Important Is Your Credit Your credit score can affect the type of car you may purchase, the cost of purchasing insurance, whether you will get the job of your dreams, what interest rate you may pay on a home mortgage, the rent you may pay (if you cannot afford to purchase a home), and in some situations, limit your ability to borrow to cover the cost of a college education. This is why it is so important to create and maintain the best credit possible. Since a large portion of our population lack financial literacy, it is not uncommon for people to fall into debt at some point in their lifetime, and this usually leads to the situations that cause bad credit. Teaching young adults to keep their credit spotless early is very important. However, if the parents are not financially savvy, young adults will learn about the importance of keeping a good credit score by trial and error. If this occurs, it could take years for young people to get back on the right track. When calculating a person’s credit score, underwriters are aware that a person’s credit history won’t always be perfect, and a few minor mistakes are usually not counted largely against your score as long as you are responsible in paying your obligations on time. A low credit score could not only cost you thousands of dollars a year in higher interest rates, but your score could deny you access to loans, insurance, job opportunities and even a place to live. A person’s credit score tells lenders the level of risk of lending you money and your score will also tell employers, landlords, and others about the stability of the individual. This publication is intended to outline how your residence, employment, banking accounts, loans, and credit cards affect your credit scores. How Long Have You lived At Your Current Address Having a stable address is an important factor that will help establish a good credit history. If you show a pattern of moving several times over a short period of time (every 2 years), underwriters will look at this as a red flag. It shows that you may not be a stable risk. When a person shows permanence, in relationship to where they live, it shows lenders that you have stability and the appearance of stability will greatly improve your chances in getting a loan. What about individuals that are attending college or have just received their degree? Most of the times, underwriters and lenders will normally give a bit more latitude if a student or graduate have changed several locations in the past few years. How Long Have You Been Employed With The Same Employer National statistics show, a person in our present economic society, will change jobs or careers at least once every seven years. Job stability shows underwriters and lenders that a person has the potential of upward mobility with the employer. It shows you have taken the time and energy to potentially position yourself to advance within the business. Many times, if a person changes jobs often, it may show prospective employer that stability is lacking. Changes jobs often will affect your credit score and a poor credit score could show employers you may not be able to handle your personal affairs and could show a good indication that you will not be able to handle the company’s affairs as well. Saving And Checking Accounts Normally banks and credit unions DO NOT report checking and savings to credit bureaus. However, if you apply for a loan to purchase a car or mortgage loan, the lender will ask for this information. Having a checking account will show lenders that you are stable and they can check to see if you are responsible in keeping your account balanced. Having a savings account also shows financial prudence, as well. Even if you have to keep both balances low, having both accounts will improve your overall credit rating with loan underwriters. When you apply for a loan, many lenders will require you to provide at least three months worth of checking account statements. If you are applying for a mortgage, most lenders will ask for 12 full months of checking and savings account statements. The main reason for these statements, it shows the lender your spending habits. Debt-To-Income Ratio And How Much Income Do You Earn Or Receive In our e-book, “Dangers Of Borrowing Too Much”, we talk about the importance of your debt-to-income ratios. The amount of income you earn or receive is a major factor in establishing good credit, and it is an indication of how much you can borrow. In other words, if your debt-to-income is high, you will pay higher interest rates on loans and could restrict your borrowing limits. Having a high debt-to-income ratio shows the lender that you are a high risk. This is the reason why an individual that is turned down for a loan with a bank or credit union, turns to high risk finance companies that charge 15% or higher interest rates. Loan underwriters frown on people who have high incomes and a lot of debt. They are aware that your financial situation can change at any moment. Whether your income is high, low, or moderate, most lenders will look on you favorably if you have proven that you can pay back a loan and make payments on time by keeping a healthy debt-to-income ratio. Having a reasonable debt-to-income ratio is VERY important to students when they borrow for college. If a student borrows more than what their potential future income will support after graduation, could cause the student to face financial problems for many, many years to come. Credit Cards According to the federal government, 45% of Americans are spending more than they earn. Most of the over spending is coming from credit card usage. Many individual do not know how to use credit cards appropriately. Having one or more credit cards is good for your credit rating, however that does not mean you have to max them out. Using your credit to the limits will show that you have dangerous spending habits, and this can actually lower your credit score. I am not a big believer in credit cards, however many individual feel they must have one or two. If this is the case, it is a good idea to avoid high credit card limits. Having high credit card limits could penalize you on your credit report without you ever knowing it. Showing high credit limits could be perceived as a person who likes to spend. Even a stable credit history might be frowned upon if the credit card balances are too high. If you must have a credit card, the goal should be to accumulate only those cards that you really have a true use for. Other Important Information You should be very careful to make sure that NO payments are ever over 60 days late, and mortgage or rent payments should NEVER be late. The best credit score is rated “A”, and this can be established if you have at least six solid credit sources that are at least TWO years old with NO late payments. These sources could include auto loans, personal loans, credit cards, and mortgages or rent payments. Conclusion Establishing good credit is one of the more important aspects of life. However not understanding how to use credit properly and getting yourself into debt, could cause years of physical and mental anxiety. It is important to use credit wisely and above all everyone should live within their means. Impulse buying normally is funded by credit card usage. To avoid this type of dangerous purchasing, wait at least 48 hours before making a decision to purchase the item. By purchasing this way, the emotion of impulse buying is taken out of the picture or reduced greatly. Waiting 48 hours before using your hard earned money or using a credit card, will reduce the emotional aspect of buying the item.