6 International context of e-waste management

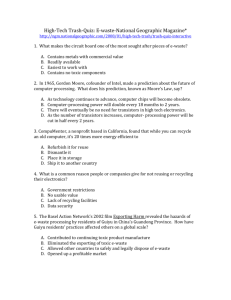

advertisement