Question 1 (from the exam) - The University of Chicago Booth

advertisement

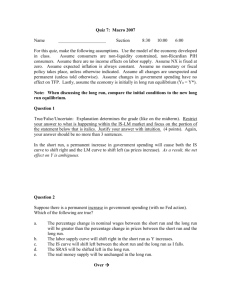

QUIZ 7: Macro – Winter 2008 Name: ______________________ Section Registered (circle one): 8:30 10:00 6:00 Quiz assumptions (READ!): Use the models developed in class and assume all curves are well behaved (i.e., IS slopes down in standard ways, LM slopes up in standard ways, etc.). Also, assume: 1) all consumers are non-liquidity constrained, non-Ricardian PIH (as developed in class), 2) NX = 0, 3) expected inflation has no effect on money demand, 4) all changes are permanent and unexpected unless told otherwise, 5) there is no income effect on labor supply (i.e., actual or expected PVLR changes do not change labor supply), 6) the economy is initially in long run equilibrium at Y*, 7) no monetary or fiscal policy takes place unless I tell you otherwise, and 8) TFP, taxes, consumer confidence, value of leisure, population, government spending, and the nominal money supply do not change unless I tell you they change NOTE: Unless I tell you otherwise, when I ask you about the LONG RUN, you should compare the initial condition in the economy with the eventual long run position of the economy (compare position 0 directly with position 2 – using our notation from class). Question 1 (circle all the true answers – 8 points total, 1 point each) Which of the following are definitely true about a permanent increase in the nominal money supply (M)? We did all of these in class – so, I am not going to go through them in detail. But, you should graph this problem out (in the short run and then, again, for the long run). The graphs will tell you almost all the answers that you will need. a. The IS curve will be shifted right in the short run. False – the increase in M shifts the LM curve to the right (as M increases). This will occur even though P increases. The IS curve will not shift (although, we will move along the IS curve). b. The IS curve will shift left between the short run and the long run. False – there will still be no movement in the IS curve (again, we will only move along the IS curve). C and G are remaining constant and the autonomous part of I is not changing (the part driven by TFP, business confidence, etc.). Investment is changing because interest rates are changing. That is a movement along the IS curve. c. The SRAS curve will be shifted left in the long run. True – this is the self correcting mechanism. As nominal wages (W) increase between the short run and the long run, the SRAS will shift left. d. The labor supply curve will be shifted right in the short run. False – there is NO change in the labor supply curve (there is no change in taxes, value of leisure, working age population, PVLR, etc.). e. Consumption will increase in the short run. False – there is no change in the consumer’s expectation of after tax PVLR. So, PIH consumers will not respond to the temporary change in income in the short run. Keynesians, however, will. But, we assumed PIH consumers in the quiz assumptions Note: Keynesians increase C when Y increases (total income)). So, even though wage income fell (in real terms) – total income (including capital income and profits) will go up. Keynesians will consume more in the short run as Y increases (temporarily). This would be an extra shift in the AD in the short run – however, in the long run, the self correcting mechanism would still kick in and Y would return to Y* (so, C for keynesians would return to its initial level). So, in the long run – C will not change regardless of whether we have PIH consumers or Keynesians. However, for the short run, there could be a difference. None of this matters for this question though – because in the quiz assumptions, we assumed non-liquidity constrained PIH consumers. f. The AD curve will be shifted right in the long run. True – M increases and the AD shifts right in the short run. Nothing shifts it back in the long run so, it is still shifted right in the long run. g. Real money supply will increase in the short run. True – M increases. We also know that P increases in the short run. What happens to M/P? Well, we know that the only reason that P increased was because Y increased (we moved up the SRAS). Why did Y increase? Y increased because I increased. How did I increase? I increased because r fell. The only way that r fell was because the LM curve shifted right. So, we know that the net effect of M increasing and P increasing is that the LM curve must have shifted right (or P would have never increased). So, M/P definitely goes up in the short run (again – the only reason that P is increasing is that r fell (causing I and Y to increase)). h. Actual government budget deficits will fall in the short run. True – Y increases in the short run – so, tax revenues increase in the short run. Given fixed government spending (G), government deficits will fall. OVER Question 2 (circle all the true answers – 6 points total, 1 point each) Consider a permanent increase in consumer confidence (subject to the assumptions on the front of the quiz). Assume that the Fed is trying to stabilize prices such that P remains close to P0. For simplicity, assume the Fed action takes place between the short run and the long run. Which of the following are definitely true? Again, we did this in class – you should be able to graph this situation yourself. a. The IS curve will be shifted right in the long run. True. As consumer confidence increases, IS shifts right in the short run. Nothing shifts it back in the long run. b. The AD curve will be shifted right in the long run. False. As consumer confidence increases, AD shifts right in the short run. However, as M falls (to prevent the inflation), the AD shifts left between the short run in the long run. In the long run, it is right back where it started from (keeping P at P0). This is the monetary policy. (NOTE: In the IS-LM market – this is the LM curve shifting – not the IS curve). c. Investment will fall in the short run. True – as the IS shifts right in the short run (see (a) and the LM shifts in the short run (as M/P falls because P is increasing), r will definitely increase in the short run. The increase in r will cause I to fall (move up along the new IS curve). d. Between the short run and the long run, the percentage change in nominal wages will exceed the percentage change in prices. True – W is fixed in the short run and P is increasing in the short run, so W/P falls in the short run. We know that W/P is too low in the short run. We know that between the short run and the long run, W/P will have to return to its initial level (because W/P will not change in the long run). So, W/P will have to increase between the short run and the long run. This can only happen if the %ΔW > %ΔP. The answer is unambiguously true. Notice – this question is true regardless of whether or not the Fed takes us back to Y* or the self correcting mechanism takes back to Y*. In the self correcting mechanism, W increases by more than P increases (in percentage terms) between the short run and the long run. With the Fed action, W does not change but P falls (as the Fed reduces the inflationary pressures – the Fed takes us from P1 back to P0). e. The money demand curve will be shifted left in the long run. False – Money demand curve is only a function of Y (given the quiz assumptions). Y has not changed in the long run, so money demand will not change in the long run. f. Consumption will be increased in the long run. True - Consumer confidence increased permanently – C increases in the long run (Y is unchanged because I declines by the same amount in the long run – this is the crowding out that we talked about last week with an increase in G – it is the same mechanism). Question 3 (short answer – 6 points total). Consider an economy where Y* is fixed over time (A, K and N* are held constant). Furthermore, consider the version of the Quantity Theory of Money as envisioned by Friedman (with velocity constant). Discuss whether the following statement (in italics) is true, false or uncertain. As always, your explanation determines your grade. Assume that all assumptions at the beginning of the quiz still hold. The change in the price level (P) that results from a z% increase in the nominal money supply (M) will be identical under both Friedman’s Quantity Theory of Money (as described above) and the model of the economy that we built from household and firm optimization (AD, AS, labor market, money market, etc.). When providing your answer, explain what the increase in P would be under both models. Furthermore, for the model of the economy that we built, explain why the increase in P would be what you say it would be. Your answer should not be more than 4 sentences. True – in both models (the quantity theory and our micro founded model), a one time increase in M of z% will increase P by z%. This is by definition in the quantity theory (given that v and Y are fixed by assumption). In our model, we know that Y* is fixed in the long run (changing M has no effect on Y*). So, there can be no change in C+I+G in the long run. C and G are fixed according to our models. So, that means I must be fixed. I is set by interest rates. So, this implies r must be fixed in the long run. Given that money demand will be constant in the long run (given that Y will not change in the long run), we know that real money supply must be constant in the long run (or interest rates will change). That means M/P will be fixed in the long run. If M increases by z%, P will therefore increase by z%. The quantity theory and our model give the same prediction about the role of money in creating inflation. The difference is that our model allows for the role of money when other shocks hit the economy (like a permanent increase in G or a fall in consumer confidence). None of these options are embedded in the quantity theory. That is why our model is more flexible than the quantity theory. Friedman knew this as well – he just didn’t believe that we can effectively use money as a stabilization tool (as we talked about in class this week – because of the “long and variable lags”).