FORM A. R. 5A PUBLIC RECORD FRIENDLY SOCIETIES ACT

advertisement

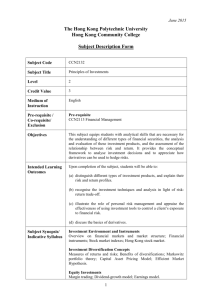

FORM A. R. 5A PUBLIC RECORD FRIENDLY SOCIETIES ACT 1974 ANNUAL RETURN for an INVESTMENT ASSOCIATION REGISTERED as a SPECIALLY AUTHORISED SOCIETY, No...................................S.A.L. Year Ended 31st December, 20….. This return is to be sent to the Registrar as soon as possible after 31st December, and, in any event, not later than 31st July. It should be accompanied by 1. 2. 3. A copy of the Auditor's Report (the space specifically provided on the back page may be used for this purpose). A copy of each Printed Account and Balance Sheet made up to a date within the period covered by the Return Name of Society (as registered) ……………………………………………………………... Registered Office ………………………………………………………………………... .................................................................................... ..…. Date of Establishment of Society ... Note: This society *has/has not made use of the wider range of investment powers conferred by the Trustee Investments Act 1961. *Delete as appropriate NAMES AND ADDRESSES OF THE TRUSTEES AND THE COMMITTEE (in block letters) AT THE DATE ………………………….…ON WHICH THE ANNUAL RETURN IS SIGNED. Name Address Trustees Committee (Chairman) RETURN OF MEMBERS *Number at the end of the year ……………………………. *In the case of a Benevolent Society insert the number subscribing during the year, including Life Members. Received 1st FOR OFFICIAL USE Ltr. A/cs. A.Rpt. Ackd. 2nd 1 Fee Entd. Ab. Ex. R.C. R.Pd. A - Depositors’ Account £ £ Due to Depositors at beginning of year ... Withdrawn - Principal ... Deposits received ... Interest ... Due on Depositors at end of year, as per Balance Sheet (E) ... Interest credited to Depositors ... Total Total B - Profit and Loss £ £ Salaries and Wages ... Bank Interest ... Audit Fees ... Interest on Investment (gross) ... Rent and Rates ... Rents ... Insurances ... Profit on realisation of Investments ... Printing, Stationary and Postage ... Other credits (to be specified):- Repairs ... Other Expenses (to be specified):- Loss on realisation on Investments ... Depreciation of Investments ... Other Debits (to be specified):- Profit on year to Account (C) ... Total Total C - Appropriation Account £ £ Interest credited to Depositors ... Balance of unappropriated profit at beginning of year ... Added to Reserve Fund ... Profit on year as per Account (B) ... Balance of unappropriated profit at end of year as per Balance Sheet (E) ... Withdrawn from Reserve Fund ... Total Total 2 D - Investments Statement* (1) - Purchases and sales £ £ Investments made during the first year, less accrued interest. (Full particulars of each investment to be stated):- Investments realised during the year, less accrued interest. (Full particulars of each investment to be stated):- Profit on realisation of investments as per Account (B) ... Loans on realisation of Investments, as per Account (B) ... Total ... Total ... Book Value of Investments at the end of the year, as per statement D (2) and Balance Sheet (E) ... Book Value of Investments at the beginning of the year ... Total Total * Where there is not sufficient space to enter all the investments, they should be entered on additional sheets to be attached to and form part of the return. 3 D - Investments Statement (continued) (2) Values as at date of balance sheet* DESCRIPTION Nominal Value Value in Balance Sheet (E) DESCRIPTION Nominal Value Value in Balance Sheet (E) Total brought forward from preceding column TOTAL as per statement D (1) and Balance Sheet (E) TOTAL carried to next column * Full particulars of each investment must be stated, but where a Society issues a list of investments to its members, a copy of that list may be affixed here instead of filling in this statement provided that the list contains all the particulars required to be given in the statement. Where there is not sufficient space to enter all the investments, they should be entered on additional sheets to be attached to and form part of the return. 4 E - Balance Sheet £ £ Investments: Due to Depositors at the end of year, as per Account (A) ... *Land and Buildings ... Freehold ... Reserve Fund ... Leasehold ... Ground Rents, Rent Charges and Feu Duties ... Unappropriated Profit carried forward, as per Account (C) ... Total... Mortgages on Land and Buildings including (in Due to Secretary ... Scotland) bonds on heritable properties Do. Treasurer ... British Government and British Government Guaranteed Securities (to be specified):- Other Liabilities (to be specified):- British Municipal and County Securities (to be specified):- Other Investments (to be specified):- Total Investments as per Investments Statement ... Interest, Dividends and Rents accrued and outstanding ... Balance at... ............................................. .Bank Cash in hand or Treasurer ... Do. Secretary ... Other Assets (to be specified):- Total Total Notes * Land and Buildings have been brought into account on the following basis ... † Investments include £ ... .. in respect of quoted securities with a market value of £ ... 5 VALUATION STATEMENT (in accordance with Section 43 (5) of the Friendly Societies Act 1974) Signature of Trustee who hereby certifies to the investments shown in Balance Sheet ………………………… Signature to the Annual Return including the Account and Balance Sheet contained within the Annual Return: Signature of member of Committee ……………………………………………………………………………… Signature of member of Committee ……………………………………………………………………………… Signature of Secretary ……………………………………………………………………………………………. AUDITOR'S REPORT (In accordance with Section 38 of the Friendly Societies Act 1974) Signature(s)………………………………………………………………………………………………………... Profession(s) or Calling(s) …………………………………………………………………………………………. Are you a Registered auditor? (for the purposes of the Companies Act 1989) Yes/No* *Delete as appropriate Address(es) ………………………………………………………………………………………………………… Address to which completed annual returns should be sent: The FCA, Mutual Returns Team, 25 The North Colonnade, Canary Wharf, London E14 5HS 6