7. news snippets

NEWS

LOSS-MAKING CO-OPERATIVE BANKS:

As per the

RBI

‟ s Deputy Governor K.C. Chakrabarty, Reserve Bank of India will shortly cancel licences of 26 loss-making co-operative banks, including 16 in Uttar Pradesh. A capital of Rs.2,000 crore is required for running 16 co-operatives banks in the state and RBI may not cancel the licenses of these banks if the state government supports. The Dy Governor emphasised that it is better to close down such banks if there is no capital. Such cooperatives banks are not required anymore if 90 per cent of depositors' money has been lost.

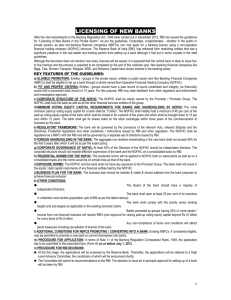

NEW BANKING LICENCES:

The Parliamentary Standing

Committee on Finance almost in one voice wants the Reserve

Bank of India to drop the move to issue new banking licences.

Questioning what they called the “subjective nature” of the RBI ‟ s final guidelines, many members reportedly told the RBI Governor that the guidelines could open an avenue for corruption. Though some MPs supported the RBI

‟ s plan, they argued that the final guidelines will not encourage any one to start a bank. RBI

Governor D. Subbarao briefed the panel on the final guidelines to allow corporate houses and public sector entities with “sound credentials and a minimum track record of 10 years” to start banks.

MAJOR CONCERNS:

Global situation demands more caution from RBI to issue new banking licences.

Countries such as India have not allowed corporate players to enter the banking sector.

RBI must ensure that allowing more private players in the country does not pave way for creating more black money.

SBI RAISES $1 BILLION:

India's largest commercial bank has a board mandate to raise $ 10 billion from abroad over the next few years. Of this target, headroom available is around

$6 billion. The five-year unsecured Notes - denominated in US dollars will be issued by the London branch of SBI and carry a coupon of 3.25 per cent (US Treasury plus 255 basis points).

The initial guidance for the coupon was treasury plus 275 basis points, but the final price was tighter at treasury plus 255 basis points. The latest SBI bond offering was subscribed 4.3 times.

NBFCS KEY DEMANDS:

In the customary pre-policy consultative meeting with the RBI, the NBFCs articulated the problems faced by them and what help they would need from the regulator.

KEY DEMANDS

:

NBFCs have requested the RBI to restore the priority sector lending tag for banks lending to NBFCs. This would help

NBFCs access funds at cheaper rates from banks.

NBFCs also requested the RBI to further liberalise the external commercial borrowing norms to access cheaper funds from overseas markets.

To put on hold the Usha Thorat committee recommendations on issues and concerns in the NBFC sector, till the economy recovers. The draft guidelines of the

Committee suggested that NBFCs be brought on par with banks by reducing the period for classifying loans as nonperforming from 180 days to 90 days. The committee also suggested that NBFCs maintain a tier-I capital ratio of 10 per cent against the existing 7.5 per cent to equip them better from future financial shocks.

1

NBFCs have argued that like banks they are not allowed to recover loans using the Securitisation and Reconstruction of

Financial Assets and Enforcement of Security Interest

(SARFAESI) Act, 2002 or the Debt Recovery Tribunals.

LTV GOLD LOAN RATIO:

State Bank of India will review its loan-to-value (LTV) ratio for gold loans on the back of a sharp fall in the price of the gold. Currently, SBI

‟ s LTV for gold loans is

70 per cent. The Reserve Bank of India (RBI) had asked gold loan non-banking finance companies to have an LTV ratio of 60 per cent but has not mandated any such ratio for banks. In

London, gold has declined around 16 per cent since the beginning of this year and 33 per cent from the peak of $1,920 an oz to trade currently at $1,388 an oz. Global advisory firm

UBS has forecast gold price to decline further to $1,250 an oz.

IMPORT TARIFF VALUE OF GOLD RAISED:

The tariff value of gold has been raised to $472 per 10 grams on account of a volatile price trend in global markets. Tariff value is the base price on which the customs duty is determined to prevent underinvoicing.

It was only 10 days back that tariff value of gold was changed bringing it down to $449 per 10 grams due to weak global prices. However, the import tariff value of silver has been kept unchanged at $762 per kg. The notification in this regard has been issued by the Central Board of Excise and Customs

(CBEC).

INDIAN GOVT MAY SHIFT CASH HOLDINGS TO

BANKS:

The Indian Government has hefty cash holdings, presently parked at the Reserve Bank of India. At the end of the last month, the Govt. had one trillion rupees ($18.5 billion) held at the RBI, outside of circulation, and roughly twice the amount normally held there as it cuts back spending in order to contain its fiscal deficit. There is a proposal to deposit the same with commercial banks - a move that would add liquidity to the banking system and make monetary policy more effective by making it easier for banks to cut lending rates. The government also stands to get better returns.

SCANNER ON BANKS SELLING GOLD PRODUCTS:

RBI is looking into the sale of gold coins and gold-related investment products by about 30 banks to find out whether their employees are mis-selling such products to customers. The move follows complaints of customers being induced by bank employees and others within bank premises to purchase gold coins, gold-related investment products and other wealth management schemes. The central bank is studying the business practices of 30 banks to ascertain any mis-selling of these products and to find whether such products are being sold as a pre-condition for offering the regular banking services. As per RBI, it has undertaken a thematic study in respect of banks that are active in selling gold coins, wealth management products to examine whether there are systemic issues and to plug deficiencies and legal loopholes. An RBI Working Group has already proposed a slew of measures like mandatory quoting of PAN numbers for high-value gold purchases, restriction on gold loans and check on NBFC branches dealing with gold loans.

RBI EXTENDS INVESTIGATION TO 34 BANKS:

Online portal Cobrapost

‟ s sting operations, which alleged three private sector banks were violating KYC & anti money-laundering norms, are turning out to be a tip of the proverbial iceberg. The

RBI, which is investigating the allegations, has found the root cause is the perverse incentive schemes that banks offer to

2

employees, which lure them to sell insurance and mutual fund products. As a result, the probe, which started with three banks, has now been extended to 34 major banks in India which sell such products. The investigations also revealed that insurance and mutual fund agents were found sitting in bank branches to sell such products, giving the wrong impression to customers that the agents are the bank

‟ s staff. This also exposes banks to reputational risk.

MAY 2013

RS 1,400 CR PROJECT OF INDIA POST:

IT major Tata

Consultancy Services has bagged the Rs.1,400-crore project of

India Post for computerising counter operations. The project is divided into two parts - two years for implementation and five years of maintenance. The Government has approved Rs 4,909 crore for phase II of modernisation of post offices under which the department is gearing up for providing real time core banking services as well. TCS had also bagged the mission mode egovernance project and Passport Seva Project from the Ministry of External Affairs.

INDIA MORTGAGE GUARANTEE CORPORATION

(IMGC):

As per National Housing Bank (NHB) its subsidiary

India Mortgage Guarantee Corporation has got registered with the RBI to function as the first such company in the country.

IMGC will offer guarantees against borrower defaults on housing loans, which will help expand access to housing in the country.

HIGHLIGHTS:

NHB holds 38% of IMGC, while Genworth has 36 per cent stake, and ADB and IFC - member of the World Bank Group have a 13 per cent stake each in the joint venture company.

To begin with, the company will have paid-up capital of Rs 135 crore so to meet the RBI regulations, with authorised share capital being Rs.750 crore.

The corporation

‟ s primary clients will be housing finance companies (HFCs) and banks that are responsible for the majority of mortgage lending.

IMGC will provide credit guarantees to banks and HFCs on behalf of the borrowers. The lending institutions, having taken guarantee cover from a mortgage guarantee company, can benefit from capital relief against such guaranteed loans through lower risk weights.

The company will leverage the learning from its technical partner

Genworth to bring best practices to the market and from the rich experience of NHB.

Mortgage guarantee will spur expansion in the housing finance sector and provide it stability as it involves commercial and supervisory oversight by the company, as well as its regulator.

Mortgage guarantee operations will improve opportunities for home ownership in the country by making home loans more accessible to a larger segment of the population. The increased access will result from lower down payment requirements for borrowers due to additional security provided by the mortgage guarantee.

CAD MAY EASE TO ABOUT 3% OF GDP IN 2013-

14:

Current Account Deficit (CAD) could ease to around 3% in the current fiscal year from prior estimates of about 4% due to sharp drop in global commodity prices. Gold, considered as a safe-haven asset, posted its biggest ever daily fall and has been languishing over worries that indebted eurozone countries might follow Cyprus to sell bullion reserves and the uncertainty surrounding the U.S. Federal Reserve's stimulus programme.

3

As per the Barclays for Indian economy, the immediate and most visible impact would be on the current account balance, which could improve by nearly 1% of GDP in FY 2013-14. The reduction in the current account deficit should provide the RBI with greater headroom for policy easing. India's current account gap hit a worse-than-expected 6.7% of GDP in the December quarter, driven by heavy oil and gold imports and muted exports.

During April-December, the gap was 5.4% of GDP. Most analysts expect the current account deficit for 2012-13 to be at

5.1% of GDP. The Brent crude had dropped to a level of $98 a barrel, the lowest since July 2012, on uncertainties over global economic recovery. The resultant reduction in oil underrecoveries would also reduce the necessity for domestic fuel price hikes, which contribute over 25% to current inflation.

PROPERTIES WORTH OVER RS 20K CR ON THE

BLOCK TO RECOVER DUES:

To recover dues, banks have put properties worth Rs.20,000 crore on the block in the past 18 months. The properties include residential apartments, commercial offices, industrial lands & factories. NPAsource.com, a portal dedicated to the resolution of NPA of banks and financial institutions, has registered 21,470 properties across Indian cities.

As of Feb-end, the value of these properties was estimated at Rs

20,333 crore. As per Bankers, selling mortgaged properties was one of the ways through which lenders recovered loans and improved credit quality. To name and shame wilful defaulters, many banks, including SBI, have decided to publish their photographs and details in newspapers.

‘FACTORY ASIA’:

As per Chief Economic Advisor

Raghuram Rajan, India aims to enter the coveted „Factory Asia ‟ league, Factory Asia refers to the model of regional production networks connecting different Asian economies, producing parts and components that are then assembled, with the final product shipped largely to advanced economies. This phenomenon began with economic liberalisation in China in the late 1980s, aided by rapid development of production networks. The group comprises, among others, China, Japan, South Korea and

Indonesia. India has shown impressive gains in manufacturing, which has focused more on serving its relatively large domestic market. India has moved up in country ranking by „manufacturing nominal gross value-added

‟

. From 14th place in 1980, it moved up to 10 th in 2011. Four major issues that will take India to

Factory Asia: First, development of the Delhi-Mumbai Industrial

Corridor. Along this 1,483-km corridor will have six-lane highways, nine industrial townships, three ports and six airports.

The project will cost $90 billion and is being developed with assistance from Japan. 2 nd is about making India investorfriendly.

3 rd is skill development; 4 th is reforming the labour laws.

ADB GDP PROJECTION FOR INDIA:

As per Asian

Development Bank (ADB) projections, the Indian economy will grow at six per cent this fiscal. The Indian economy could even return to 8-9% growth levels if the country were to get its investment story right. The ADB growth forecast of six per cent is better than the RBI latest growth projection of 5.7% for the current fiscal. Painting an optimistic picture about India

‟ s growth prospects, India

‟ s growth story will be driven by investments.

However, there is need for structural reforms on the investment side. If legislations are passed on direct taxes and GST, then

India can get to 8-9% growth level. The recent softening in global commodity prices will have a positive impact on India and may lead to some improvement in the current account deficit (CAD)

4

situation. ADB sees India

‟ s inflation moderating to 7.2% in 2013-

14 and 6.8% in 2014-15. As regards CAD, ADB sees it coming down to 4.4% of GDP in 2013-14 from a level of about five per cent last year. ADB sees India

‟ s CAD coming down to four per cent in 2014-15. However, ADB

‟ s concern was more about the quality of economic growth rather than the quantity.

‘CULTURE AND HERITAGE’ IN CSR LIST:

Taking note of the poor flow of funds into the field of culture, a Parliamentary panel has strongly recommended inclusion of “heritage and culture” as a CSR activity in the Indian Companies Bill. In its

192nd report on demand for grants, the Standing Committee on

Transport Tourism and Culture, has stated that Culture Ministry has sought for inclusion of „culture and heritage ‟

in the Bill, piloted by the Corporate Affairs Ministry. As of now, there are 18 ongoing projects under corporate funding of about Rs 45 crore, mainly by public sector undertakings. This year, the

Archaeological Survey of India (ASI) has approved six more projects, which would require Rs 56 crore.

MAY 2013

SNIPPETS

ISLAMIC EQUITY INDEX: The Bombay Stock Exchange (BSE) has launched an Islamic equity index based on the wide-measure S&P BSE

500 index. It will provide a new benchmark for Islamic investors in one of the world's largest stock exchanges.

‘AN ARDENT PATRIOT’:

T he Vice President of India has released a book titled

An Ardent Patriot – Dinesh Goswami , compiled and edited by Kumar Deepak Das, Member of Parliament. The book is compilation of Parliamentary Speeches of veteran parliamentarian from

Assam- Dinesh Goswami.

FLAT ROAMING RATES FOR AFRICAN

CUSTOMERS: Bharti Airtel has introduced Flat Roaming Rates for its

African Customers in order to strengthen its

One Airtel

, service. With the

Introduction of Flat roaming rates the customers can now access data and

SMS at a flat rate in addition to receiving free incoming calls while roaming across Africa and South Asia.

DADASAHEB PHALKE ACADEMY AWARD 2013: Yash

Chopra, Rajesh Khanna and Asha Bhosale are to be honoured with the

Dadasaheb Phalke Academy Awards 2013

FARMER’S CLUB SCHEME IN KARGIL: NABARD has started its Farmer’s Club Scheme in Kargil region of Jammu and Kashmir.

The Club will play a major role in uplifting the Sheep and Goat Rearing

Sector and Pashmina Rearing.

PRESIDENT ASIAN DEVELOPMENT BANK BOARD:

Takehiko Nakao has been appointed as the President of the Asian

Development Bank.

WOMEN’S POLITICAL EMPOWERMENT DAY: 20th

Women’s Political Empowerment Day has been celebrated on 22 April.

WORLD BOOK AND COPYRIGHT DAY: World Book and

Copyright Day has been celebrated on 23 April.

HEAT ACTION PLAN: In 2013, the Indian city of Ahmedabad launched a first-of-its-kind Heat Action Plan. With this it became the first city in South Asia to launch a Heat Action Plan (HAP).

CHEAPEST HANDSET: Nokia has launched the most affordable mobile Nokia 105 at the price of Rs.1,249 Rupees in order to rope in low income group customers and also the first-time buyers.

DA HIKED: Union Cabinet of India has hiked the DA hiked to 80

5

percent for Employees of Central Government.

WOMEN DG OF CRPF: Aruna Bahuguna, Senior IPS Officer has been appointed as the new Special Director General of CRPF, India’s largest paramilitary force.

TWITTER LAUNCHED NEW MUSIC SERVICE

:

Twitter launched a New Music Service called #Music.

WORLD HERITAGE DAY: World Heritage Day has been observed on 18 April.

WORLD HEMOPHILIA DAY: World Hemophilia Day has been observed on 17 April.

SHER-I-KASHMIR AWARD: Navjot Singh became the youngest

Athlete to be conferred with the Sher-i-Kashmir Award.

PULITZER PRIZE FOR FICTION: Adam Johnson’s novel The

Orphan Master’s son won the Pulitzer Prize for fiction in 2013.

ASIAN FORUM OF PARLIAMENTARIANS: PJ Kurien has been elected Chairman of Asian forum of Parliamentarians.

NATIONAL SAFE MOTHERHOOD DAY: National Safe

Motherhood day has been observed across India on 11 April to create awareness on proper healthcare and maternity facilities to pregnant and lactating women.

TIMES OF INDIA FILM AWARDS: The 2013 Times of India

Film Awards (TOIFA) ceremony took place in BC Place, Vancouver. The top winner of the awards was Barfi which bagged the best film, best director, best actor and best actress trophies.

M&M LAUNCHES NEW CAR: Mahindra & Mahindra has launched e20 car in Delhi Priced at 5.96 Lakh Rupees.

TVS MOTOR AND BMW MOTORRAD TIED-UP: The

TVS Motor Co. Ltd. and BMW Motorrad announced a deal to jointly develop

Made in India Bikes in below 500 CC segment.

FAMILY CIRCLE CUP 2013: Serena Williams won the Family

Circle Cup 2013 by defeating Jelena Jankovic

ROJGAR MANTRA.COM: Vocational education, services and egovernance network, AISECT has launched a job portal called

RojgarMantra.com to cater mainly to people in rural and semi urban India.

SBI DISCONTINUE FREE ACCIDENT INSURANCE

COVER: India's largest bank SBI will discontinue a free accident insurance cover given to its home and car loan customers from July 2013.

DBT SCHEME EXPANDED: DBT Scheme to be expanded to 78 more Districts from July 2013.

OLIVE CROWN AWARDS 2013: Grey Worldwide Won Agency of the Year Award.

NEW PRESIDENT OF CII:

S Gopalakrishnan has been elected as new President of Confederation of Indian Industry (CII).

JP MORGAN CHASE PENALISED: JP Morgan Chase, N.A.,

Mumbai, has been penalised Rs 5 lakh by the RBI for contravention of various directions and instructions issued by it in respect of risk management and inter-bank dealings and compliance functions. The RBI, in a statement, said these contraventions took place during 2011-12.

NAME AND SHAME: The Income Tax department has decided to name and shame "chronic" tax defaulters / habitual tax dodgers and subsequently upload their names. As per the Central Board of Direct Taxes

(CBDT), its public campaign asking taxpayers to pay their dues has bore fruit. There are select cases of "chronic" and "persistent" default which needs to be put in public domain to obtain vital leads in these case.

PAKISTANI RUPEE HITS THE 100-LEVEL VS US

DOLLAR: The Pakistani rupee has hit the 100-mark against the US dollar in open market deals today on concerns over rising exports and an

6

uncertain political scenario. This is the second instance in two months that the rupee has hit the 100-mark versus dollar. The International Monetary

Fund (IMF) has asked Pakistan to begin taking necessary actions to stabilise the economy and lay the groundwork for future growth.

RAMNIT WORM

:

Ramnit - a new virus has been found to be

"spreading widely" in the Indian cyberspace which cleverly steals bank account details and passwords of the user once it is clicked. The cyber security sleuths have alerted Internet users in the country about the new and suspected variant of malware family called 'Win32/Ramnit'. This worm spreads by infecting or modifying files existing on target systems such as

(EXE, dll or html) and creating a new section so as to modify the entry point to that section," an advisory issued by country's premier cyber security agency – Computer Emergency Response Team. The virus is such lethal in its operations that it "infects the removable media by copying itself to its recycle bin and creates an autorun.inf file.

BANKING SECRECY: Swiss President has stated that he saw no need to change strategy after fellow financial centre Luxembourg eased its bank secrecy practices. Banking secrecy is comparable to medical confidentiality and the state must absolutely respect the private sphere.

Luxembourg, home to a prized financial centre, changed tack in the face of growing international pressure over tax evasion, agreeing to the automatic exchange of bank account information with its EU partners from 2015.

DIGITAL KRISHI CARD FOR FARMERS: Goa Government has launched a digital Krishi Card which is supposed to help farmers in making use of benefits such as subsidies & loans given by the State Govt.

ASIAN FOOTBALL CONFEDERATION: Sheikh Salman has been elected as the New President of Asian Football Confederation.

FAMILY CIRCLE CUP 2013: Serena Williams Won the Family CIRCLE CUP 2013

7