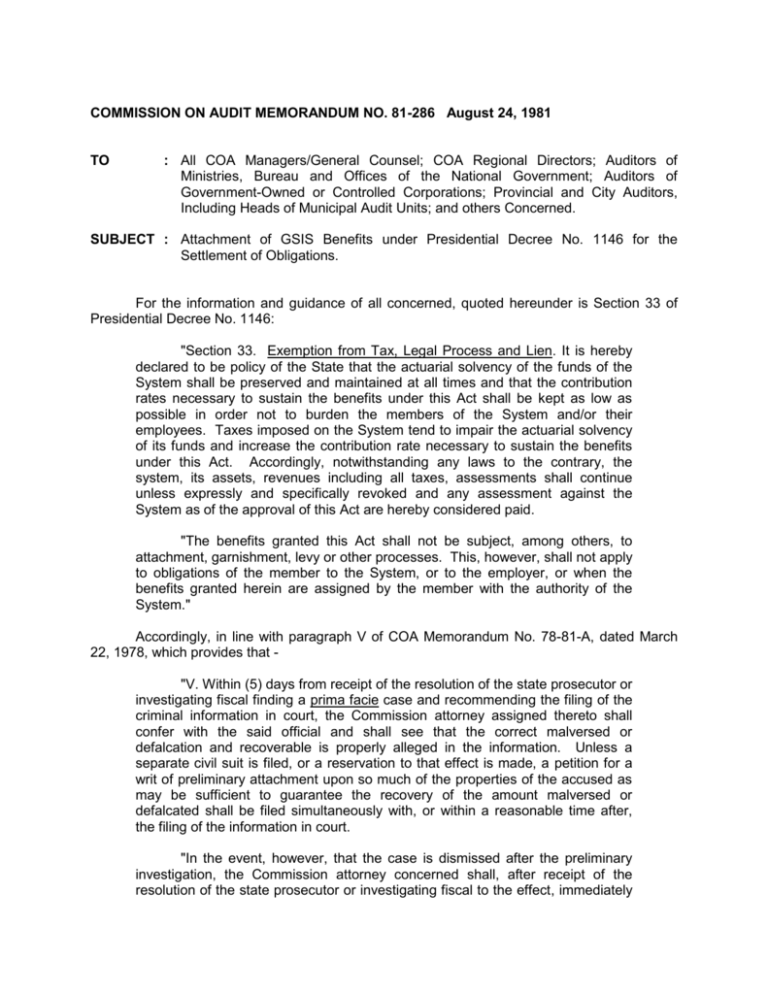

COMMISSION ON AUDIT MEMORANDUM NO. 81-286

advertisement

COMMISSION ON AUDIT MEMORANDUM NO. 81-286 August 24, 1981 TO : All COA Managers/General Counsel; COA Regional Directors; Auditors of Ministries, Bureau and Offices of the National Government; Auditors of Government-Owned or Controlled Corporations; Provincial and City Auditors, Including Heads of Municipal Audit Units; and others Concerned. SUBJECT : Attachment of GSIS Benefits under Presidential Decree No. 1146 for the Settlement of Obligations. For the information and guidance of all concerned, quoted hereunder is Section 33 of Presidential Decree No. 1146: "Section 33. Exemption from Tax, Legal Process and Lien. It is hereby declared to be policy of the State that the actuarial solvency of the funds of the System shall be preserved and maintained at all times and that the contribution rates necessary to sustain the benefits under this Act shall be kept as low as possible in order not to burden the members of the System and/or their employees. Taxes imposed on the System tend to impair the actuarial solvency of its funds and increase the contribution rate necessary to sustain the benefits under this Act. Accordingly, notwithstanding any laws to the contrary, the system, its assets, revenues including all taxes, assessments shall continue unless expressly and specifically revoked and any assessment against the System as of the approval of this Act are hereby considered paid. "The benefits granted this Act shall not be subject, among others, to attachment, garnishment, levy or other processes. This, however, shall not apply to obligations of the member to the System, or to the employer, or when the benefits granted herein are assigned by the member with the authority of the System." Accordingly, in line with paragraph V of COA Memorandum No. 78-81-A, dated March 22, 1978, which provides that "V. Within (5) days from receipt of the resolution of the state prosecutor or investigating fiscal finding a prima facie case and recommending the filing of the criminal information in court, the Commission attorney assigned thereto shall confer with the said official and shall see that the correct malversed or defalcation and recoverable is properly alleged in the information. Unless a separate civil suit is filed, or a reservation to that effect is made, a petition for a writ of preliminary attachment upon so much of the properties of the accused as may be sufficient to guarantee the recovery of the amount malversed or defalcated shall be filed simultaneously with, or within a reasonable time after, the filing of the information in court. "In the event, however, that the case is dismissed after the preliminary investigation, the Commission attorney concerned shall, after receipt of the resolution of the state prosecutor or investigating fiscal to the effect, immediately confer or communicate with the Manager, Legal Office and/or the COA Chairman for the purpose of determining the advisability of appealing the dismissal order to the Secretary of Justice, furnishing them with a copy of the said resolution." whenever an information for malversation of public funds or property is filed in court against a prospective government retiree, it shall be the responsibility of the auditor concerned to make strong representations with the state prosecutor or fiscal assigned to the case towards obtaining the desired writ of preliminary attachment upon so much of the benefits payable by the Government Service Insurance System (GSIS) to the prospective retiree. The COA Manager or COA Regional Director concerned shall immediately cause the transmittal order for the latter's information and guidance. The foregoing procedure shall be observed irrespective of whether or not the government retiree has been cleared previously from accountability for funds and/or property. Strict compliance herewith is enjoined. (SGD.) FRANCISCO S. TANTUICO, JR. Acting Chairman