Accounting II - Pleasant Valley School District

advertisement

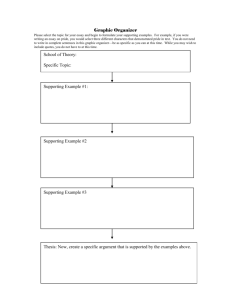

PLEASANT VALLEY SCHOOL DISTRICT PLANNED COURSE CURRICULUM GUIDE ACCOUNTING II GRADES 11, 12 I. COURSE DESCRIPTION AND INTENT: This advanced course expands upon the concepts of Accounting I and is designed to better prepare students to enter the work force after graduation or attend college to major in any area of business. The material is more detailed than Accounting I and is concerned with the "why" rather than just the "how" of accounting. Major areas of concentration are accounting control systems, departmentalized and automated accounting. Corporate accounting will be introduced in this course. Students will use database and spreadsheet computer programs to complete accounting problems and projects. II. INSTRUCTIONAL TIME: Class Periods: Daily Length of Class Periods (minutes): 57 Length of Course: 3 Quarters Unit of Credit: .75 Updated: 6/16/14 SC (New format - 1-2012) COURSE: ACCOUNTING II STRAND: GRADE(S): 10-12 TIME FRAME: 3 quarters PA ACADEMIC STANDARDS 15.1.12.Q 15.1.12.R 15.1.12.S 15.1.12.T 15.1.12.U 15.1.12.V ASSESSMENT ANCHORS RESOURCES Century 21 Accounting 9E, Gilbertson and Lehmen Aplia Access Card for online Learning Classified Advertisements Computer generated application problems Accounting Career Databases Internet search engines Library resources OBJECTIVES The learner will examine all elements of the "Accounting Framework" and explain their application of financial information in business management. The learner will identify major fields of specialization in the accounting profession and explain the career opportunities in each. ESSENTIAL CONTENT Identify terminology related to the "accounting framework". Identify terminology related to specialized fields of accounting. Cite examples of management uses of financial information. Cite examples of career opportunities in the accounting profession. Describe the relationship between accounting and management. Identify elements of specialized fields of accounting. Explain the role of ethics in business decision making. INSTRUCTIONAL STRATEGIES Cooperative group research using text to create oral presentations of key unit concepts. Oral presentations of key concepts. Discussion and note taking. Paired problem solving applying concepts. Completion of graphic organizer/topic outline. ASSESSMENTS Diagnostic: Pretest of students prior knowledge Responses to introductory questions Review of Accounting I performance Formative: Participation in group research activities Oral presentation content and delivery Completion of graphic organizer/topic outline Solutions to chapter questions and vocabulary Solutions to chapter application problems Summative: Objective format quiz Subjective format quiz Portfolio entry CORRECTIVES/EXTENSIONS Correctives: "Think-pair-share" concept sheet. Extensions: Class presentation reporting on interview with someone in specialized field. COURSE: ACCOUNTING II STRAND: GRADE(S): 10-12 TIME FRAME: 3 quarters PA ACADEMIC STANDARDS 15.1.12.Q 15.1.12.R 15.1.12.S 15.1.12.T 15.1.12.U 15.1.12.V ASSESSMENT ANCHORS RESOURCES OBJECTIVES The learner will identify accounting terminology related to a departmentalized merchandising business organized as a corporation; explain accounting concepts and practices related to a departmentalized merchandising business organized as a corporation; demonstrate accounting procedures for a departmentalized merchandizing business organized as a corporation. ESSENTIAL CONTENT Identify accounting terminology related to departmentalized merchandising business organized as a corporation. Explain accounting concepts and practices related to a departmentalized merchandising business organized as a corporation. Apply accounting procedures for a departmentalized merchandising business organized as a corporation. INSTRUCTIONAL STRATEGIES Cooperative group research using text to create oral presentations of key unit concepts. Oral presentations of key concepts. Discussion and note taking. Paired problem solving applying concepts. Completion of graphic organizer/topic outline. Journalizing transactions for a departmental merchandising corporation. Completion of end-of-period work for a departmental merchandising corporation. ASSESSMENTS Diagnostic: Pretest of students prior knowledge Responses to introductory questions Review of Accounting I performance Formative: Participation in group research activities Oral presentation content and delivery Completion of graphic organizer/topic outline Solutions to chapter questions and vocabulary Solutions to chapter application problems Summative: Objective format quiz Subjective format quiz Portfolio entry CORRECTIVES/EXTENSIONS Correctives: Paired concept sheet completion, additional skill building problems. Extensions: Class report on interview with personnel from merchandising corporation. COURSE: ACCOUNTING II STRAND: GRADE(S): 10-12 TIME FRAME: 3 quarters PA ACADEMIC STANDARDS 15.1.12.Q 15.1.12.R 15.1.12.S 15.1.12.T 15.1.12.U 15.1.12.V ASSESSMENT ANCHORS RESOURCES Century 21 Accounting 9E, Gilbertson and Lehmen Aplia Access Card for online Learning Computer generated application problems Accounting Career Databases Internet search engines Library resources OBJECTIVES The learner will identify accounting terminology related to accounting control systems; explain accounting concepts and practices related to accounting control systems; demonstrate accounting procedures for accounting control systems; use a voucher system to control cash payments; apply various inventory control and costing procedures. ESSENTIAL CONTENT Identify accounting terminology related to selected accounting control systems. Explain accounting concepts and practices related to selected accounting control systems. Apply accounting procedures for selected accounting control systems. INSTRUCTIONAL STRATEGIES Cooperative group research using text to create oral presentations of key unit concepts. Oral presentations of key concepts. Discussion and note taking. Paired problem solving applying concepts. Completion of graphic organizer/topic outline. Determine the cost of merchandise sold using selected costing methods. Estimate the cost of merchandise sold using selected estimating methods. Calculate merchandise inventory turnover ratio and average number of day's sales in merchandise inventory. Use a manual voucher system to control cash payments transactions. ASSESSMENTS Diagnostic: Pretest of students prior knowledge Responses to introductory questions Review of Accounting I performance Formative: Participation in group research activities Oral presentation content and delivery Completion of graphic organizer/topic outline Solutions to chapter questions and vocabulary Solutions to chapter application problems Summative: Objective format quiz Subjective format quiz Portfolio entry CORRECTIVES/EXTENSIONS Correctives: Paired concept sheet completion, additional skill building problems. Extensions: Class report on interview with personnel from merchandising corporation. COURSE: ACCOUNTING II STRAND: GRADE(S): 10-12 TIME FRAME: 3 quarters PA ACADEMIC STANDARDS 15.1.12.Q 15.1.12.R 15.1.12.S 15.1.12.T 15.1.12.U 15.1.12.V ASSESSMENT ANCHORS RESOURCES Century 21 Accounting 9E, Gilbertson and Lehmen Aplia Access Card for online Learning Community Resource Persons; CPA and business office personnel Classified Advertisements Computer generated application problems Accounting Career Databases Internet search engines Library resources OBJECTIVES The learner will identify accounting terminology related to general accounting adjustments; explain accounting concepts and practices related to general accounting adjustments; demonstrate accounting procedures for general accounting systems; record both daily transactions and end-of-period adjustments for uncollectible accounts, plant assets and notes. ESSENTIAL CONTENT Identify accounting terminology related to general accounting adjustments. Explain accounting concepts and practices related to general accounting adjustments. Apply accounting procedures for general accounting adjustments. INSTRUCTIONAL STRATEGIES Cooperative group research using text to create oral presentations of key unit concepts. Oral presentations of key concepts. Discussion and note taking. Paired problem solving applying concepts. Completion of graphic organizer/topic outline. Record transactions for the acquisition and disposition of plant assets. Calculate depreciation of plant assets using selected methods. Record adjusting entry for depreciation for the period. Record transactions for the issuance of notes payable. Calculate accrued interest on notes payable. Record adjusting entry for accrued interest expense. Record transactions for the acceptance of notes receivable. Calculate the accrued interest income on notes receivable. Record adjusting entry for accrued interest receivable. ASSESSMENTS Diagnostic: Pretest of students prior knowledge Responses to introductory questions Review of Accounting I performance Formative: Participation in group research activities Oral presentation content and delivery Completion of graphic organizer/topic outline Solutions to chapter questions and vocabulary Solutions to chapter application problems Summative: Objective format quiz Subjective format quiz Portfolio entry CORRECTIVES/EXTENSIONS Correctives: Paired concept sheet completion, additional skill building problems. Extensions: Class report on interview with personnel from merchandising corporation. COURSE: ACCOUNTING II STRAND: GRADE(S): 11, 12 TIME FRAME: One (1) Semester PA ACADEMIC STANDARDS 15.1.12.Q 15.1.12.R 15.1.12.S 15.1.12.T 15.1.12.U 15.1.12.V ASSESSMENT ANCHORS RESOURCES Century 21 Accounting 9E, Gilbertson and Lehmen Aplia Access Card for online Learning Computer generated application problems Accounting Career Databases Internet search engines Library resources OBJECTIVES The learner will identify accounting terminology related to a corporation; explain accounting concepts and practices related to a corporation; demonstrate accounting procedures unique to a corporation. ESSENTIAL CONTENT Identify accounting terminology related to selected corporate financial records. Explain accounting concepts and practices related to corporate financial records. Apply accounting procedures in creating and using corporate financial records. INSTRUCTIONAL STRATEGIES Cooperative group research using text to create oral presentations of key unit concepts. Oral presentations of key concepts. Discussion and note taking. Paired problem solving applying concepts. Completion of graphic organizer/topic outline. Record transactions for corporate organization. Record transactions for buying and selling stocks and bonds. Prepare financial statements for a corporation. Analyze financial statements for a corporation. ASSESSMENTS Diagnostic: Pretest of students prior knowledge Responses to introductory questions Review of Accounting I performance Formative: Participation in group research activities Oral presentation content and delivery Completion of graphic organizer/topic outline Solutions to chapter questions and vocabulary Solutions to chapter application problems Summative: Objective format quiz Subjective format quiz Portfolio entry CORRECTIVES/EXTENSIONS Correctives: Paired concept sheet completion, additional skill building problems. Extensions: Class report on financial statement analysis of actual corporate statements.