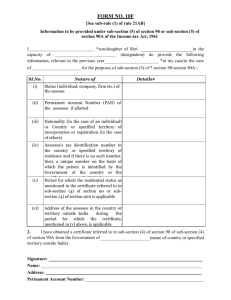

The Wealth-Tax Act, 1957

advertisement