壹 - 國立彰化師範大學圖書館

advertisement

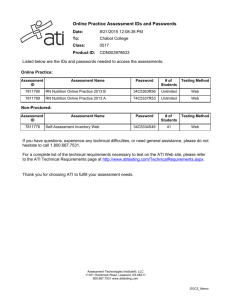

國立彰化師範大學九十四學年度碩士班招生考試試題 系所:會計學系 科目: 管理會計(含成本會計學) ☆☆請在答案紙上作答☆☆ 共 6 頁,第 1 頁 Problem (100%) ※Attention: you cannot get any point without computation. 1. The Angela Company is considering two new colors for glove products: pink and blue. Either can be produced using present facilities. Each product requires an increase in annual fixed costs of $300,000. The products have the same $10 selling price and the same $7 variable cost per unit. Management, after analyzing past experience with similar products, has prepared the following probability distribution: Units Demanded 50,000 100,000 200,000 300,000 400,000 500,000 Pink Glove 0.0 x 2x 0.4 0.2 0.1 Probability for Blue Glove 0.3 0.1 0.1 y 0.4 0.1 Required: (1) What is the breakeven point in units for Blue Glove? (4%) (2) Compute margin of safety in dollars for Pink Glove? (4%) (3) Which product should be chosen, assuming the objective of the Angela is to maximize expected operating income? (4%) 2. Jolin, the financial manager at the Miracle hotel, is examining if there is any relationship between newspaper advertising and sales revenues at the hotel. She obtains the following data: Month March April May June July August September October November December Revenues $ 50,000 70,000 55,000 65,000 50,000 65,000 45,000 60,000 55,000 80,000 Advertising Costs $ 2,000 3,000 1,500 3,500 1,000 2,000 1,500 2,500 2,500 4,000 Required: (1) Use the high-low method to compute the cost function. (5%) (2) What is the increase in revenues for each $2,000 spent on advertising within the relevant range when Jolin decides to adopt regression analysis method? (6%) -1- 國立彰化師範大學九十四學年度碩士班招生考試試題 系所:會計學系 科目: 管理會計(含成本會計學) ☆☆請在答案紙上作答☆☆ 共 6 頁,第 2 頁 3. ATi Company produces component parts. One product, Rz, has annual sales of 50,000 units and sells for $40.6 per unit. ATi incurs no marketing, distribution, or customer-service costs. ATi includes all R&D and design costs in engineering costs. ATi’s direct costs including long-run fixed cost of machine capacity dedicated to Rz are: Direct material costs (DMC; variable) $850,000 Direct manufacturing labor costs (DMLC; variable) 300,000 Direct machining costs (fixed, 50,000hours) 150,000 ATi adopts activity-based costing, and has the following data: Activity Setup Testing Engineering Cost driver Setup-hours Testing-hours Complexity of product and process Cost per unit of cost driver $25 $2 Costs assigned to products by special study Over a long-run horizon, management views indirect costs as variable with respect to their chosen cost drivers. Additional data for Rz are: Production batch size Setup time per batch Testing and inspection time per unit of product produced Engineering costs 500 units 12 hours 2.5hours $170,000 Due to competitive pressures, ATi decides to reduce the price of Rz to $34.8. The new price will not affect its current unit sales. If ATi does not reduce price, it will lose sales. Obviously, the challenge for ATi is to cut the cost of Rz. Engineers have proposed product design and process improvements for the “New Rz” to replace Rz. The expected effects of the new design relative to Rz are: A. DMC for New Rz are expected to decrease by $3 per unit. B. DMLC for New Rz are expected to decrease by $0.75 per unit. C. New Rz will take 6 setup-hours for each setup. D. Time required for testing each unit of New Rz is expected to reduce by 0.5 hour. E. Engineering costs will be unchanged. Assume that the batch sizes are the same for New Rz as for Rz. Assume further that the cost per unit of each cost driver for New Rz is the same as for Rz. If ATi requires additional resources to implement the new design, it can acquire these resources in the quantities needed. Required: (1) Compute the full cost per unit for Rz adopting activity-based costing. (5%) (2) What is the markup percentage on the full cost per unit for Rz? (5%) (3) What is ATi’s target cost per unit for New Rz if it is to maintain the same markup percentage on the full cost per unit as for Rz? (5%) (4) What price will ATi charge for New Rz if it uses the same markup percentage on the full cost per unit for New Rz as for Rz? (5%) -2- 國立彰化師範大學九十四學年度碩士班招生考試試題 系所:會計學系 科目: 管理會計(含成本會計學) ☆☆請在答案紙上作答☆☆ 共 6 頁,第 3 頁 4. Winchester Company sells women’s clothing. Winchester’s strategy is to offer a wide choice of clothes and excellent customer service and to charge a premium price. Winchester provides the data for 2003 and 2004. To simplify, assume that each customer buys one piece of clothing. 1. Pieces of clothing purchased and sold 2. Average selling price 3. Average cost per piece of clothing 4. Selling and customer-service capacity 5. Selling and customer-service costs 6. Purchasing and administrative capacity 7. Purchasing and administrative costs 8. Purchasing and administrative capacity cost per distinct design 2003 40,000 $60 $40 51,000 customers $357,000 980 $245,000 $250 2004 40,000 $59 $41 43,000 customers $296,700 850 $204,000 $240 Total selling and customer-service costs depend on the number of customers that Winchester has created capacity to support, not the actual number of customers that Winchester serves. Total purchasing and administrative costs depend on purchasing and administrative capacity that Winchester has created (defined in terms of the number of distinct clothing designs that Winchester can purchase and administer). Purchasing and administrative costs do not depend on the actual number of distinct clothing designs purchased. Winchester respectively purchased 930 and 820 distinct designs in 2003 and 2004. Required: (1) Is Winchester’s strategy one of cost leadership or product differentiation? Explain. (3%) (2) Please compute the growth, price-recovery and productivity components of changes in operating income between 2003 and 2004. (12%) 5. Berkshire Corporation produces gears using turning machines. In 2004, Berkshire’s turning machines operated for 80,000 hours. The company employed four workers in its repair and maintenance area to repair machines that broke down. In 2004, each worker was paid a fixed annual salary of $30,000 for 250 days of work at 8 hours per day. During 2004, the workers spent 6,500 hours doing repairs and maintenance. Required: (1) Compute the cost of unused repair and maintenance capacity in 2004 if we assume that the costs are engineered costs. (6%) -3- 國立彰化師範大學九十四學年度碩士班招生考試試題 系所:會計學系 科目: 管理會計(含成本會計學) ☆☆請在答案紙上作答☆☆ 共 6 頁,第 4 頁 6. Sasa Chemicals has a Mixing Department and a Refining Department. Its process-costing system in the Mixing Department has two direct materials cost categories (Chemical T and Chemical R) and one conversion costs pool. The following data pertain to the Mixing Department for July 2004: Units Work in process, July 1 Units started Completed and transferred to Refining Department 0 50,000 35,000 Costs Chemical T Chemical R Conversion costs $250,000 70,000 135,000 Chemical T is introduced at the start of operations in the Mixing Department, and chemical R is added when the product is three-fourths completed in the Mixing Department. Conversion costs are added evenly during the process. The ending work in process in the Mixing Department is two-thirds complete. Required: (1) Compute the equivalent units in the Mixing Department for July 2004 for each cost category. (6%) 7. The Media Group has three divisions: (1) Newspapers which owns leading newspapers on four continents, (2) Television which owns major television networks on three continents, and (3) Film studios which owns one of the five largest film studios in the world. The following table provides summary financial data (in millions) for each division in 2002 and 2003. Operating Income Revenues 2002 2003 2002 2003 2002 2003 $900 $1,100 $4,500 $4,600 $4,400 $4,900 Television 130 160 6,000 6,400 2,700 3,000 Film studios 220 210 1,600 1,650 2,500 2,600 Newspapers Total Assets Division managers have an annual bonus plan based on their own divisional ROI (defined as operating income divided by total assets). Senior executives from divisions reporting increases in ROI from the prior year are automatically eligible for a bonus. However, if they report a decline in the division ROI, they need to provide persuasive explanations for the decline to be eligible for a limited bonus. John, manager of the Newspapers Division, is considering a project to invest $260 million in fast-speed printing presses with color-print options. He expects that the operating income in 2004 -4- 國立彰化師範大學九十四學年度碩士班招生考試試題 系所:會計學系 科目: 管理會計(含成本會計學) ☆☆請在答案紙上作答☆☆ 共 6 頁,第 5 頁 would increase about $30 million. The Media Group has a 12% required rate of return for investments in all divisions. Required: (1) Please explain differences among the divisions in their ROIs for 2003 by adopting the DuPont method of profitability analysis. Use total assets in 2003 as the investment base. (5%) (2) Compute the residual income (RI) of the Film studios Division in 2003. (5%) (3) Would adoption of a RI measure reduce John’s reluctance to employ the investment project? (5%) 8. The Hope Company adopts a flexible budget and standard costs to help planning and control of its machining manufacturing operations. Its normal-costing system for manufacturing has two direct-cost categories (direct materials and direct manufacturing labor- both costs are variable) and two indirect-cost categories (variable manufacturing overhead and fixed manufacturing overhead, both allocated using direct manufacturing labor-hours). At the 40,000 budgeted direct manufacturing labor-hour level for April, budgeted direct manufacturing labor costs are $800,000, budgeted variable manufacturing overhead is $480,000, and budgeted fixed manufacturing overhead is $640,000. The following actual results are for April: Direct materials price variance (based on purchases) Direct materials efficiency variance Direct manufacturing labor costs incurred Variable manufacturing overhead flexible-budget variance Variable manufacturing overhead efficiency variance Fixed manufacturing overhead incurred Fixed manufacturing overhead spending variance $176,000F 69,000U 522,750 10,350U 18,000U 597,460 42,540F The standard cost per pound of direct materials is $11.50. The standard allowance is three pounds of direct materials for each unit of product. During April 30,000 units of product were produced. There was no beginning inventory of direct materials. There was no beginning or ending work in process. In April, the direct materials price variance was $1.10 per pound. In March, labor unrest caused a major slowdown in the pace of production, resulting in an unfavorable direct manufacturing labor efficiency variance of $45,000. There was no direct manufacturing labor price variance. Labor unrest persisted into April. Some workers quit. Their replacements had to be hired at higher rates, which had to be extended to all workers. The actual average wage rate in April exceeded the standard average wage rate by $0.5 per hour. -5- 國立彰化師範大學九十四學年度碩士班招生考試試題 系所:會計學系 科目: 管理會計(含成本會計學) ☆☆請在答案紙上作答☆☆ 共 6 頁,第 6 頁 Required: (1) Compute total number of pounds of excess direct materials used for April. (5%) (2) Compute production volume variance for April. (5%) (3) Compute total number of actual direct manufacturing labor-hours used for April. (5%) -6-