Week 6 Practice Quiz b

advertisement

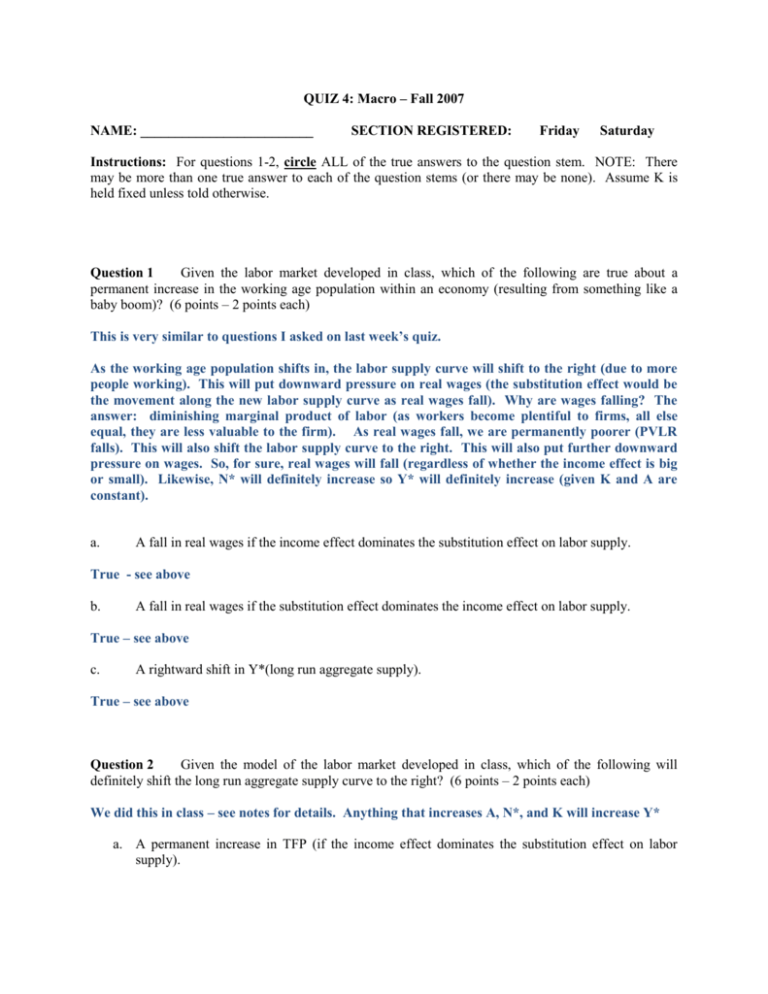

QUIZ 4: Macro – Fall 2007

NAME: _________________________

SECTION REGISTERED:

Friday

Saturday

Instructions: For questions 1-2, circle ALL of the true answers to the question stem. NOTE: There

may be more than one true answer to each of the question stems (or there may be none). Assume K is

held fixed unless told otherwise.

Question 1

Given the labor market developed in class, which of the following are true about a

permanent increase in the working age population within an economy (resulting from something like a

baby boom)? (6 points – 2 points each)

This is very similar to questions I asked on last week’s quiz.

As the working age population shifts in, the labor supply curve will shift to the right (due to more

people working). This will put downward pressure on real wages (the substitution effect would be

the movement along the new labor supply curve as real wages fall). Why are wages falling? The

answer: diminishing marginal product of labor (as workers become plentiful to firms, all else

equal, they are less valuable to the firm). As real wages fall, we are permanently poorer (PVLR

falls). This will also shift the labor supply curve to the right. This will also put further downward

pressure on wages. So, for sure, real wages will fall (regardless of whether the income effect is big

or small). Likewise, N* will definitely increase so Y* will definitely increase (given K and A are

constant).

a.

A fall in real wages if the income effect dominates the substitution effect on labor supply.

True - see above

b.

A fall in real wages if the substitution effect dominates the income effect on labor supply.

True – see above

c.

A rightward shift in Y*(long run aggregate supply).

True – see above

Question 2

Given the model of the labor market developed in class, which of the following will

definitely shift the long run aggregate supply curve to the right? (6 points – 2 points each)

We did this in class – see notes for details. Anything that increases A, N*, and K will increase Y*

a. A permanent increase in TFP (if the income effect dominates the substitution effect on labor

supply).

True, A increases and N falls. But, the increase in A is bigger than the fall in N (the only reason

that N falls is because there was a large income effect – that means income had to go up).

b. A permanent decline in labor income tax rates (if the income effect dominates the substitution

effect on labor supply).

False, N falls so Y* falls. We have done this 1 million times.

c.

A large decline in the price of consumption goods in the economy (P).

False – this is a movement along the LRAS. The LRAS is drawn in {P,Y} space.

Question 3

Note: Let’s define the marginal propensity to consume in period 1 from an unexpected income shock as

the difference between the consumption that occurs in period 1 with the shock and the hypothetical

consumption that would have occurred in period 1 without the shock all divided by the unexpected

change to income. In symbols, this is = ΔC/ΔY where ΔC is the change in consumption (as described in

the previous sentence) and ΔY is the unexpected change in income described in the scenarios below.

Problem set up: Consider a permanent income consumer (as put forth by Friedman) in the period 1 of his

10 period life. Our consumer has log utility as described in class but does not discount future utility, β =

1. Furthermore interest rates in our world are zero, r = 0, and no one is liquidity constrained. <<This is the

exact set up we discussed in class!>>

Below are four scenarios in which our consumer receives news about his income. For each scenario

calculate the consumer’s marginal propensity to consume in period 1, due to the given news. I want you

to assume that all shocks are unexpected and that the person found out about the income change

prior to period 1.

Hint: The answer should be a fraction (between 0 and 1). Essentially no math is needed for this

problem. Given that people live 10 periods, the answer to this question is completely intuitive. How

would period 1 consumption respond to these unexpected changes in income (as a fraction of the income

change)? Place your answers for the corresponding MPC in the box. Again, no work is needed for credit!

We went over these in class. As a result, my answers will be brief.

a.

An unexpected increase in income only in period 1

1/LL = 0.1 (smooth out the transitory change over periods of life)

b.

An unexpected increase in income only in period 10

1/LL = 0.1 (smooth out the transitory change over period of life).

c.

An unexpected permanent increase in income in every period (1 – 10)

1

d.

(consume the entire change in income in each period)

An unexpected permanent increase in wealth starting in period 0 (i.e., prior to period 1)

1/LL = 0.1 (smooth out the increase in wealth over periods of life).

In class, I said for realistic models 1/LL is approximately equal to zero. Some of you put zero for a,

b, AND d. Specifically, I am referring to the answer sequence of 0,0,1,0). This told me that you

read the question wrong and did not see that LL was 10. (there was only 2 of you in the class that

did that – one of you told me this after class). If that was the case you received 6/8 for this

question. However, if you put zero sometimes and 0.1 sometimes, it told me you did not know what

was going on – and as a result, you lost 2 points for every 0 answer you gave.