12-1

advertisement

CHAPTER 12 Intangible Assets ANSWERS TO QUESTIONS 1. The three main characteristics of intangibles are (a) they lack physical substance (b) they are not a financial instrument (c) they are long-term in nature and subject to amortization 2. Similarities—Accounting for an intangible asset involves many of the same kinds of problems as accounting for plant assets, namely, determining an initial carrying amount, accounting for that amount after acquisition under normal business conditions (amortization) and accounting for that amount if the value declines substantially and permanently. Generally in historical cost-based accounting, plant and intangible assets are measured initially by their acquisition price (historical cost). Typically, a firm gains possession of an asset by making expenditures that are expected to increase revenue or reduce costs to be incurred in future periods. If the future benefit or the period to be benefited is questionable, the expenditure usually is treated as a current expense and not as a deferred cost. Associating costs with the revenue or the period to which they are expected to relate is a basic problem in historical costbased accounting, both in measuring periodic income and in accounting for assets. The basic accounting treatment does not depend upon whether the asset is a building, a piece of equipment, an element of inventory, a prepaid insurance premium or whether it is tangible or intangible. The cost of goodwill and similar intangible assets is therefore essentially the same as the cost of land, buildings, or equipment under historical-cost based accounting. Conceptually, all historical costs are measures of future service potential. Differences—The problems in accounting for intangibles and plant assets differ and are complicated by the characteristics of an intangible asset. Its lack of physical qualities makes evidence of its existence elusive; its value is often difficult to estimate and its useful life may be indeterminable. Accounting for the cost of a plant asset after acquisition normally depends upon its estimated life. The cost of assets with perpetual existence, such as land, is carried forward as an asset without amortization, and the cost of assets with limited lives is amortized by systematic charges to expense. Goodwill and similar intangible assets do not clearly fit either classification since their lives are neither infinite nor specifically limited, but are indeterminate. 3. There is less sentiment for employment of some other basis of valuation such as the use of current replacement cost or appraisal value for intangibles because the basic attributes of intangibles, their uncertainty as to future benefits, and their uniqueness do not lend themselves to valuation in excess of cost. Many plant assets, for example, have a market place where some idea of the basic value of these service values can be obtained, and this is generally not true in the case of intangibles. However, as indicated in the text, because of the magnitude of intangible assets, support is increasing for finding ways to value intangible assets on a market value basis. 12-1 4. Various intangible assets differ in their characteristics, their useful lives, their relations to operations, and their later dispositions. Intangible assets may be classified on several different bases: 12-2 Questions Chapter 12 (Continued) Identifiability—in this classification a distinction is made between an expenditure made to acquire an intangible, such as a patent which is specifically identified, versus an expenditure made for advertising, which might enhance the good name of the enterprise but for which it is difficult to identify to any given intangible asset other than goodwill. Manner of acquisition—in this approach an attempt is made to differentiate between intangible assets acquired singly, in groups, in business combinations, or developed internally. For example, goodwill might be classified as either coming from a business combination or being created internally. A patent, for instance, might be classified as either purchased singly or in combination versus being developed internally. Expected period of benefits—a third possible alternative is to differentiate intangible assets on the expected period of benefit, such as limited versus unlimited life. Some intangibles’ lives are limited by law or contract (patents, copyrights) and by human or economic conditions (ultimately all intangibles); and finally, some intangibles have an indefinite or indeterminate duration (possibly, goodwill, franchises, organization costs, trademarks, trade names, secret processes and formulas). Separability from an entire enterprise—this final basis suggests that intangibles might be classified by whether they can be separated from the business and sold independently versus having to be sold with the business. The obvious classification here is between non-goodwill type intangibles, such as patents and copyrights, and goodwill type intangibles. 5. Examples of internally created intangibles might be patents, research and development costs, trademarks and trade names, secret processes, and goodwill. When “goodwill type” intangibles are created internally, it is often so difficult to determine the validity of any future service potential that APB Opinion No. 17 takes the position that these costs should be expensed as incurred. To permit deferral of these types of costs would lead to a great deal of subjectivity because management could argue that almost any expense could be capitalized on the basis that it will increase the goodwill of the company. FASB Statement No. 2 requires that research and development costs be expensed as incurred unless they have alternative future uses. 6. Companies cannot capitalize self-developed, self-maintained, or self-created goodwill. 7. The cost of intangible assets should be amortized in the income statement over the period benefited, which is not necessarily the maximum or legal life of the assets. Even though there is no existing evidence that an intangible asset has suffered a loss in value or has become limited in life (such as goodwill), an intangible must be fully amortized within 40 years. If there is reasonable evidence that an intangible asset has become worthless, its cost may be written off immediately. Such a writeoff should be reported in the income statement. 8. The write-off of an intangible asset immediately after acquisition is not conceptually sound. Such writeoff arbitrarily removes an asset from the accounts and violates the fundamental accounting objective of maintaining as accurate a record of costs and the expiration of costs as possible. Moreover, there is disregard of the basic assumption that all expenditures result initially in the acquisition of short or long-term benefits. Furthermore, removal of the asset distorts the financial statements and any analysis, such as computation of the rate of return, based thereon. 12-3 Questions Chapter 12 (Continued) 9. The $190,000 should be expensed as research and development expense in 2001. The $91,000 is expensed as selling and promotion expense in 2001. The $45,000 of costs to legally obtain the patent should be capitalized and amortized over the useful or legal life of the patent, whichever is shorter. 10. (a) Unless the R & D costs have alternative use, FASB Statement No. 2 requires that the costs be expensed upon incurrence. (b) Over some reasonable basis, subject to the 40-year rule. (c) Over some reasonable basis, subject to the 40-year rule. (d) If limited, over the life of the franchise. If unlimited, over some reasonable basis, subject to the 40-year rule. (e) Legal life (20 years) or useful life, whichever is shorter. (f) Life of the lease or useful life of the improvements, whichever is shorter. (Note: Leases should not be considered under the 40-year rule.) (g) Legal life or useful life, whichever is shorter (useful life is normally quite short), subject to the 40-year rule. 11. If the rent for the period of a long-term lease is paid in advance or if a lump sum payment is made in advance in addition to the periodic rental payments, this item is referred to as a lease prepayment and should be shown as prepaid rent expense. When the lease agreement appears to transfer substantially all of the benefits and risk incident to ownership of the property, it is in substance an installment purchase of the property, and the lessee should capitalize the lease payments as an asset and show the asset in the long-term intangible asset section. The lease should be capitalized at an amount equal to the present value of the future minimum lease payments if the lease meets one or more of the following four criteria: (1) The lease transfers ownership of the property to the lessee. (2) The lease contains a bargain purchase option. (3) The lease term (including any bargain renewal options) is equal to 75% or more of the economic life of the leased property. (4) The present value of the lease payments (excluding executory costs) equals or exceeds 90% of the fair value of the leased property. A leasehold improvement represents improvements made by the lessee to existing property; the existing property is currently owned by another party but presently being leased. A leasehold improvement should be considered part of the long-term asset section. The authors believe that none of these items should be classified as an intangible asset. The lease prepayments are better classified as prepaid expenses in the current asset section or placed in the Other Assets section if more long-term in nature. Leases that are in effect installment purchases of the property should be shown in the plant asset section. Leasehold improvements should also probably be shown in plant assets. 12. The maximum amortization period for an intangible is 40 years. Therefore, the company may amortize this asset for only 35 more years. 12-4 Questions Chapter 12 (Continued) 13. Since the option contract is not a difficult one to fulfill, the proper life appears to be 35 years. If some uncertainty existed about the granting of the option, the building should be written off over the original term of the lease (25 years). 14. These costs are referred to as start-up costs, or more specifically organizational costs in this case. The accounting for start up costs is straightforward—expense these costs as incurred. The profession recognizes that these costs are incurred with the expectation that future revenues will occur or increased efficiencies will result. However, to determine the amount and timing of future benefits is so difficult that a conservative approach—expensing these costs as incurred - - is required. 15. Varying approaches are used to define goodwill. They are (a) Goodwill should be measured initially as the excess of the fair value of the acquisition cost over the fair value of the net assets acquired. This definition is a measurement definition but does not conceptually define goodwill. (b) In the proposed SFAS on intangible assets goodwill is defined as one or more unidentified intangible assets and identifiable intangible assets that are not reliably measurable. Examples of elements of goodwill include new channels of distribution, synergies of combining sales forces, and a superior management team. (c) Goodwill may also be defined as the intrinsic value that a business has acquired beyond the mere value of its net assets whether due to the personality of those conducting it, the nature of its location, its reputation for skill, or any other circumstance incidental to the business and tending to make it permanent. Another definition is the capitalized value of the excess of estimated future profits of a business over the rate of return on capital considered normal in the industry. (d) Negative goodwill develops when the fair value of the assets purchased is higher than the cost. This situation may develop when a company fails to produce sufficient earnings to sustain a value on the business as a whole equal to the value of its separable resources and property rights or when investors are pessimistic about a company’s prospects for earning revenues in the future. 16. Goodwill is recorded only when it is acquired by purchase. Goodwill falls within the definition of Intangible Assets and is subject to the usual amortization procedures for such assets. When there is evidence of limited duration, the cost of goodwill should be amortized by systematic charges in the income statement over the period benefited. If it becomes evident that the period benefited will be longer or shorter than originally estimated, the rate of amortization may be decreased or increased proportionately. When there is no evidence to indicate limited life, goodwill still is subject to the 40-year rule. 17. Many analysts believe that the value of goodwill is so subjective that it should not be given the same status as other types of assets such as cash, receivables, inventory, etc. The analysts are simply stating that they believe that presentation of goodwill on the balance sheet does not provide any useful information to the users of financial statements. Whether this is true or not is a difficult point to prove, but it should be noted that it appears contradictory to pay for the goodwill and then immediately write it off, denying that it has any value. 18. Research and development costs are incurred to develop new products or processes, to improve present products, or to discover new knowledge. R & D expenditures present problems of (1) identifying the costs associated with particular activities, projects, or achievements, and (2) 12-5 Questions Chapter 12 (Continued) determining the magnitude of the future benefits and the length of time over which such benefits may be realized. R & D activities may incur costs classified as follows: (a) materials, equipment, and facilities, (b) personnel, (c) purchased intangibles, (d) contract services, and (e) indirect costs. Costs having characteristics similar to R & D costs are (1) start up costs, (2) operating losses, (3) advertising costs, and (4) computer software costs. 19. (a) Personnel (labor) type costs incurred in R & D activities should be expensed as incurred. (b) Materials and equipment costs should be expensed immediately unless the items have alternative future uses. If the items have alternative future uses, the materials should be recorded as inventories and allocated as consumed and the equipment should be capitalized and depreciated as used. (c) Indirect costs of R & D activities should be reasonably allocated to R & D (except for general and administrative costs, which must be clearly related to be included) and expensed. 20. (a). 21. Each of these items should be charged to current operations. Advertising costs have some minor exceptions to this general rule, the specific accounting however is beyond the scope of this textbook. 22. $605,000. ($420,000 + $60,000 + $125,000) 23. The total life, per revised facts, is 45 years (10 + 35). The maximum period to be used for amortization of any intangible asset is 40 years. Therefore, there are 30 (40 – 10) remaining years for $450,000 amortization purposes. Original amortization: = $15,000 per year; $15,000 X 10 years 30 expired = $150,000 accumulated amortization. $450,000 –150,000 $300,000 original cost accumulated amortization remaining cost to amortize $300,000 ÷ 30 years = $10,000 amortization for 2001 and years thereafter *24. The profession’s position is that costs incurred internally is creating a computer software product to be sold should be charged to expense when incurred as research and development until technological feasibility has been established for the product. Technological feasibility is established upon completion of a detailed program design or, in its absence, completion of a working model. Thereafter, all software costs should be capitalized and subsequently reported at the lower of unamortized cost or net realizable value. Capitalized costs are amortized based on current and future revenue for each product with an annual minimum equal to straight-line amortization over the remaining estimated economic life of the product. 12-6 Questions Chapter 12 (Continued) *25. Under the percent of revenue approach, $800,000 $4,000,000 X $2,000,000 $8,000,000 $2,000,000 would be reported; under the straight-line approach, $1,000,000 would be reported. Because the straight-line approach is higher, $1,000,000 should be reported as R & D expense for this product. *26. Expensing the development cost in the current year is appropriate when the costs are classified as research and development costs and the computer software is to be sold, leased, or marketed to third parties. Capitalizing the development cost of the software package over its estimated useful life is appropriate if the costs are subsequent to achieving technological feasibility and future benefits are reasonably certain. Damage to stakeholders occurs whenever expenses and revenues are mismatched. Inappropriate recognition of development costs can harm all parties involved due to any understatement and overstatement of income. *27 Excess earnings are the excess of actual earnings over what might be called “normal” earnings, where normal earnings are determined by applying a “normal earnings rate” factor to the fair value of the net assets of an enterprise. Average excess earnings are determined by dividing the sum of excess earnings for a period of years by the number of years in the period. The main justification for this method lies in the objective results it achieves. That is, it produces a situation in which the average actual earnings represent a normal rate of return on the net assets including goodwill. This can be seen from the fact that the formula for computing goodwill by this method is a variation of that for determining “return” in rate-of-return computations. The return (interest) on an investment is equal to the earnings rate times the principal times the time, or I = R X P X T. If the goodwill is assumed to have an indefinite existence T is dropped from the formula, and a simple algebraic transposition yields the goodwill formula P = I ÷ R. That is, the goodwill (principal) equals the excess earnings (I) divided by the earnings rate factor (R). Note that this method of computing goodwill assumes an indefinite life for the excess earnings. Where this assumption is not applicable, the excess may be divided into parts, to be capitalized at different rates expressing the expected period of continuation, or other appropriate methods of estimating the value of the goodwill may be used. The value of goodwill determined by the use of the capitalization method clearly depends upon the rate selected as “normal”—a highly subjective factor about which there may be considerable difference of opinion. Also the interest rate, the period of time over which applied and the determination of the asset base are matters for concern. *28. (1) Capitalization of average excess earnings. Divide the average excess earnings by an estimated discount factor. (2) If a limited number of years is assumed, goodwill may be estimated by calculating the present value of an annuity equal to the average excess earnings for the specific period. (3) A rough approximation of the value of goodwill may be made by multiplying the average excess earnings by a number of years, for example, three to five. 12-7 SOLUTIONS TO BRIEF EXERCISES BRIEF EXERCISE 12-1 Patents ............................................................................. 64,000 Cash ........................................................................ 64,000 Patent Amortization Expense ......................................... 6,400 Patents ($64,000 X 1/10 = $6,400) .......................... 6,400 BRIEF EXERCISE 12-2 Patents ............................................................................. 24,000 Cash ........................................................................ 24,000 Patent Amortization Expense ......................................... 9,400 Patents [($51,200 + $24,000) X 1/8 = $9,400] ......... 9,400 BRIEF EXERCISE 12-3 Trade Names .................................................................... 60,000 Cash ........................................................................ 60,000 Trade Name Amortization Expense ................................ 7,500 Trade Names ($60,000 X 1/8 = $7,500) .................. 7,500 BRIEF EXERCISE 12-4 Organization Cost Expense ............................................ 70,000 Cash ........................................................................ 12-8 70,000 BRIEF EXERCISE 12-5 Leasehold Improvements ............................................... 89,120 Cash ........................................................................ Leasehold Improvements Amortization Expense ......... 5,570 Leasehold Improvements ...................................... ($89,120 X 1/8 X 6/12 = $5,570) 89,120 5,570 BRIEF EXERCISE 12-6 Franchise .........................................................................100,000 Cash ........................................................................ 100,000 Franchise Amortization Expense ................................... 9,375 Franchise ($100,000 X 1/8 X 9/12 = $9,375) ........... 9,375 BRIEF EXERCISE 12-7 (a) (b) Purchase price Fair value of assets Fair value of liabilities Fair value of net assets Value assigned to goodwill $750,000 $800,000 200,000 600,000 $150,000 Goodwill Amortization Expense 5,000 Goodwill .................................................................. ($150,000 X 1/10 X 4/12 = $5,000) 5,000 BRIEF EXERCISE 12-8 Loss on Impairment ........................................................220,000 Patents ($330,000 – $110,000 = $220,000)............. 220,000 Note: An impairment has occurred because expected net future cash flows ($190,000) are less than carrying amount ($330,000). The loss is measured as the difference between the carrying amount and fair value ($110,000). 12-9 BRIEF EXERCISE 12-9 Loss on Impairment ........................................................275,000 Goodwill ($800,000 – $525,000 = $275,000) .......... 275,000 Note: An impairment has occurred because expected net future cash flows from the division ($700,000) are less than its carrying amount ($800,000). The loss is measured as the difference between the carrying amount and fair value ($525,000). BRIEF EXERCISE 12-10 Research and Development Expense ............................450,000 Cash ........................................................................ 450,000 BRIEF EXERCISE 12-11 (a) (b) (c) (d) Capitalize Expense Expense Expense BRIEF EXERCISE 12-12 Patent (1/1/02) Legal cost (12/1/02) Carrying Amount $240,000 85,000 $325,000 Life in Months 96 85 Carrying amount Less: Amortization Patent (12 X $2,500) Legal costs (1 X 1,000) Carrying amount 12/31/02 12-10 Amortization Per Month $2,500 $1,000 $325,000 (30,000) (1,000) $294,000 Months Amortization 12 1 BRIEF EXERCISE 12-13 Copyright No. 1 for $9,900 should be expensed. Copyright No. 2 for $19,200 should be capitalized and amortized over 40 years. It would be reflected on the December 31, 2002 balance sheet at its book value $19,160. This represents cost minus accumulated amortization 19,200 $19,200 . 480 *BRIEF EXERCISE 12-14 Percent of revenue approach $700,000 X $420,000 = $210,000 $1,400,000 Straight-line approach $700,000 X 1/4 = $175,000 Amortization is $210,000 *BRIEF EXERCISE 12-15 Average earnings [($600,000 – $80,000) X 1/5] Normal earnings ($560,000 X 15%) Excess earnings Capitalization rate Estimated goodwill 12-11 $104,000 (84,000) 20,000 20% $100,000 12-12

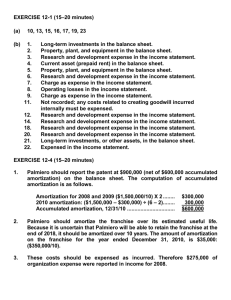

![Quiz chpt 12 13 Fall 2009[1].doc](http://s3.studylib.net/store/data/008065145_1-9341d7c32393454ecadd4d67922dfd05-300x300.png)