Law of partnership

advertisement

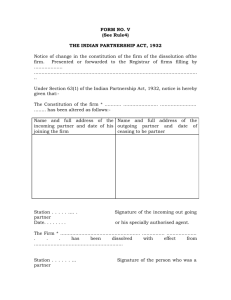

Law of partnership Indian Partnership Act 1932 which deals with law of partnership came in to force on 1st October 1932. The most important change brought about by the Act is the provision for registration of firms. 1. Define partnership? What are its essentials? What is the stipulation with regard to the minimum and maximum number of partners? Sec 4. Partnership is the relation between persons who have agreed to share the profits of a business carried on by all or any one of them acting for all. Persons who have entered into partnership with one another are called individually ‘partners’ and collectively a ’firm’. The name under which the business is carried on is called ‘firm name’ Essentials 1. Association:-There should be an association of at least two or more competent persons to constitute a partnership. The person used in section 4 is a legal person. A firm is not a separate legal entity and as such two partnership firms cannot enter into partnership. Competency of parties is determined in accordance with section 11 of Indian contract 1872. 2. Agreement: - Section 5 of the Indian partnership Act 1932 says that the relation of partnership arises from contract and not from status. There should be an agreement and this may either be express or implied to form a partnership. 3. Business:-There should be a business as one of the essential elements in partnership. This is reflected in section 4 of the Act. Business includes every trade, occupation and profession. Needless to say, business must be legal. 4. Sharing of profits: Section 4 of the Act mentions sharing of profits. Sharing of profit includes sharing of loss and this will be in the agreed ratio among the partners. 5. Mutual agency: Section 4 mentions carrying of business by all or any of them acting for all. From this it can be inferred that mutual agency is one of the essentials of partnership. A partner is both an agent and principal. He can bind the other partners by his acts and he is bound by the acts of other partners. Number of partners Indian Partnership Act is silent with regard to the number of partners. It can be inferred from section 4 that minimum number required to form a partnership is two. Companies Act 1956 vide section 11 stipulates that number of members carrying on banking business should not exceed ten and in any other business twenty .So if the number exceeds these limits then same will be in violation of the companies Act. 2. What is the mode of determining existence of partnership? Section 6 of the Act says that in determining whether a group of persons is or is not a firm or whether a person is or is not a partner in a firm real regard shall be had to the real intention between the parties. If there is agreement to share the profits of a business and the business is carried on all or any of them acting for all, then it can be deemed that there exists partnership. Mere receipt of share of profits cannot by itself constitute partnership though it is a prima-facie evidence of partnership. Whether a genuine partnership exists or not is a mixed question of law and fact. The real relation between the partners is to be determined from all the facts and surrounding circumstances. The following persons are not partners(S 5) a) The members of Hindu undivided family, carrying on family business b) Burmese Buddhist husband and wife carrying on business 3. Distinguish between partnership and Joint Hindu family? Partnership 1 Creation: Result of an agreement 2 Interest in business: It is a result of an agreement and interest in business is acquired as a consequence there to 3 New members: A new partner can be admitted only with the consent of all partners or in accordance with partnership deed 4 Minor: Cannot be a partner but with the consent of all other partners he can be admitted to the benefits of a partnership Joint Hindu family Arises from status Male members acquire interest by birth Male becomes member by birth A male minor can become its member merely by his birth 5 Gender: There is no gender discrimination and as such a female can become a partner 6 Member ship limits: Section 11 of the companies Act stipulates that number of members should not exceed 10 in the case of banking business and 20 in the case of any other business 7 Authority: Each partner has implied authority to bind the firm in the ordinary course the business of the firm. There is a mutual agency 8 Registration: Indirectly law has made the registration compulsory A female does not becomes its member by birth There is no such limit Only the Karta has the implied authority to contract debts and pledge the credit and the property of the family for the ordinary purpose of family business. There is no mutual agency No registration is required 4. Distinguish between partnership and Co ownership? 1 2 3 4 5 Partnership Creation: Result of an agreement Can exist only when there is business Transfer of Interest: Cannot transfer to a stranger with out the consent of the other partners Number of members: Cannot exceed the statutory limit Authority: A partner is the agent of his copartners 6 A partnership has a lien on the partnership property for expenses incurred by him on such property 7 Partition of property: A partner can sue for division of the partnership property. His remedy lies in suing his copartners for the dissolution of firm and accounts Co ownership May arise by any other way No business is necessary A co owner can There is no limit Co owner is not the agent of other co owners A co owner has no such lien A co owner can sue for the division of property 5. Distinguish between partnership and Company? 1 2 3 4 Partnership Not a separate legal entity No limited liability Joint and several liability A partner is agent of other partners 5 Transfer of share only with the consent of other partners 6 Death of partner dissolves the partnership 7 Registration is not compulsory Company A separate legal entity Un limited liability No joint and several liability A share holder is not an agent of other share holders No consent is necessary for transfer of shares Death of share holder does not dissolve the company Registration is compulsory 6. Explain partnership at will and particular partnership? Partnership at will:-Section 7 of the Act is about partnership at will. Section 7 reads thus “Where no provision is made by contract between the partners for the duration of their partnership, or for the determination of their partnership, the partnership is partnership at will”. Partnership at will can be dissolved by any partner by giving a notice in writing to all other partners of his intention to dissolve the firm. Notice once given cannot be withdrawn unless all the parties agree to it. Partnership entered into for a fixed period will not come under this head. Partnership entered into for a fixed period comes to an end when the said fixed period is over. Partners even after the expiry of fixed term are free to continue the business of firm and if the said is with out any stipulation with regard to duration or determination, then partnership becomes partnership at will. Particular partnership:-Section 8 – When a person becomes a partner with another person or persons in a particular adventure or undertaking, such a partnership is known as particular partnership. Particular partnership comes to an end as soon as that adventure is completed. If it is continued after the completion of that adventure with out any stipulation with regard to duration or determination, then partnership becomes partnership at will. 7. What are the partner’s rights and duties? The relation of partners to one another is governed by their own agreement, whether express or implied. If the agreement is silent on this, the relation of partners regarding their rights and duties are governed by provision of the Partnership Act. The following are the rights of partners i. Right to take part in the business of firm: Partnership business is the common business of all. Section 12(a) says that every partner has the right to take part in the conduct of business. Partners may determine by their agreement the mode of conduct of business and if any mode is stipulated then conduct of business shall be in accordance there with. ii. Right to share the profits: Section 13(b) says that partners are entitled to share equally in the profits earned. Partners may determine by their agreement the proportion of share in profits. iii. Right to be consulted: Every partner has the right to be consulted and heard in all matters concerning the business of firm. Section 12© says that any difference arising as to ordinary matters connected with the business may be decided by a majority of the partners, and every partner shall have the right to express his opinion, before the matter is decided, but no change may be made in the nature of business with out the consent of all the partners. iv. Free access to books, inspect and to copy: Section 12(d) says that every partner has a right to have access to and inspect and copy any of the books of the firm. According to section 30(2), a minor may have access to and inspect and copy any of the accounts of the firm. v. Right to be indemnified: Section 13(e) states that the firm shall indemnify a partner in respect of payments made and liabilities incurred by him in the ordinary and proper conduct of the business and in doing such act, in an emergency, for the purpose of protecting the firm from loss as would be done by a person of ordinary prudence in his own case under similar circumstances. vi. Joint ownership: Every partner is a joint owner of the partnership property and property of the firm shall be held and used by the partners as stipulated in Section 15 vii. Right to retire: A partner can retire a) With the consent of all partners b) In accordance with express agreement between the partners. c) Where partnership is at will by giving notice in writing to all the other partners of his/her intention to retire. viii. Right not to be expelled:-According to section 33, a partner may not be expelled from a firm by any majority of the partners, save in exercise of good faith of powers conferred by contract between the partners ix. Right of outgoing partner in certain cases to share subsequent profits:Section 37 says that where any member of a firm had died or otherwise eased to be a partner and the surviving or continuing partners carry on the business of the firm with the property of the firm with out any final settlement of accounts as between them and out going partner or his estate. In such a case legal representative of the deceased partner or the out going partner in the absence of contract to the contrary is entitled at his option, to a) such share of the profits as is proportionate to his share in the property of the firm b) interest at the rate of 6 percent per annum on the amount of the share in the property of the firm Duties of partners i. To carry on business to the greatest common advantage: This is reflected in section 9 of the Act. ii. To be just and faithful: It is the bounden duty of the partner to be just and faithful and utmost good faith towards every other partner of the firm. iii. To render true accounts and information: Every partner must render true ,proper and correct accounts of all things affecting the firm and allow other partners to inspect and copy them iv. To indemnify for fraud: Section 10 stipulates that every partner shall indemnify the firm for any loss caused to it by his fraud in the conduct of the business of the firm. v. To attend diligently: Section 12 (b) says that every partner is bound to attend diligently to his duties in the conduct of business. This is subject to the contract between the partners vi. To share losses: Every partner must share losses equally in the absence of an agreement to the contrary(S 13(b)) vii. Use of partnership property: Property of the firm shall be held and used by the partners exclusively for the purpose of the business. (S15) viii. To indemnify for willful neglect: Section 13(f) says that a partner shall indemnify the firm for any loss caused to it by his willful neglect in the conduct of the business of the firm. ix. To act with in authority: Every partner must act with in his actual authority and where he exceeds his powers, he must compensate the other partners for the loss arising out of exercise of excessive powers. x. To be liable jointly and severally: According to section 25 every partner is liable, jointly with all the other partners and also severally for all acts of the firm done while he is a partner xi. Not to assign his rights: Partner should not assign his share in the firm to a stranger with out the consent of all partners. Similarly he cannot assign his rights and interest in the firm to an outsider so as to make him the partner of the firm. 8. Explain good will? Good will is a commercial term and it is the value of the reputation and connections established by the firm due to its integrity, efficiency in service, quality of the products etc is called the good will of the firm. It is an intangible asset of firm and depends upon the nature and character of the business. It is gained by the continuous years of honest work and prestige earned through it. 9. What is the position of a minor in partnership? A minor is legally incompetent to enter into a contract and there fore a minor’s contract is void. But according to section 30 of the Act a minor may be admitted to the benefits of partnership with the consent of all the partners. This is based on the rule that a minor cannot be a promisor but he can be a promise or a beneficiary. Position of minor before attaining majority (S 30) He has a right to such share of property and of the profits of the firm as may be agreed upon He may have access to and inspect and copy any of the accounts of the firm Minor’s share is liable for the cats of firm; bur the minor is not personally liable for any such act If minor does not get his due share of profit, he can file a suit for his share of the property .This can be done only when he wants to serve his connection with the firm Position of minor on attaining majority (S 30) At any time with in six months of attaining his majority or of his obtaining knowledge that he had been admitted to the benefits of a partnership, which ever date is earlier, such person may give public notice that he has elected to become or that he has elected not to become a partner in the firm and such notice shall determine his position as regards the firm. If minor fails to give notice, he shall become a partner in the firm on the expiry of the said six months When minor elects to become a partner i. He is personally liable to third parties for all the cats of firm since he was admitted to the benefits of partnership ii. His share in the property and profits is the share to which he was entitled as a minor partner When minor elects not to become partner i. His rights and liabilities continue o be those of the minor till the date of public notice ii. His share is not liable for the acts of the firm done after the date of public notice iii. He is entitled to sue the partners for his share of the property and profits in the firm 10. When a partnership firm is said to be reconstituted? A partnership firm is said to be reconstituted when any of the following change occurs and the firm continues. 1) Introduction of a partner 2) Retirement of a partner 3) Expulsion of a partner 4) Insolvency of a partner 5) Death of a partner Introduction of a new partner Subject to section 30 a person may be admitted as new partner either a. With the consent of all partners b. In accordance with contract already entered in to between the existing partners for the admission of anew partner An incoming partner does not become liable for any act of the firm prior to his admission as a partner S 31(2). Retirement of partner (Sec 32) A partner may retire from a firm a. With the consent of all the other partners b. In accordance with an express agreement by the partners c. Where partner ship is at will, by giving notice in writing to all the other partners of his intention to retire Expulsion of partner (Sec 33) a. A partner may be expelled from partnership subject to the following condition b. The power of expulsion of partner should be conferred by the contract between the partners c. The power should be exercised in good faith as follows i. That it must be in the interest of partnership ii. The power to be expelled should be served with notice iii. The partner to be expelled should be given an opportunity of being heard Insolvency of partner (Sec 34) Effects a. When a partner is adjudicated insolvent, he ceases to be a partner on the date on which the order of adjudication is made b. The firm is dissolved on the date of the order of adjudication but the partners may specifically provide that on such a contingency the firm shall not be dissolved c. The estate of insolvent partner is not liable for the acts of the firm done after the date of order of adjudication. A public notice to the effect that a partner has been adjudicated insolvent is not required d. The firm is also not liable for the acts of the insolvent partner after insolvency Death of a partner (Sec 42©) A firm is dissolved by the death of partner subject to the contract between them. If by the contract between the partners, the contract is not dissolved by the death of a partner, the estate of deceased partner is not liable for the act of a firm. Public notice of the death of partner is not necessary 11. Discuss the rights and liabilities of retired partner? Liabilities Acts before retirement A retired partner continues to be liable for all the acts of firm done before his retirement or acts pending at the time of his retirement unless he is discharged from his liability. He may be discharged from his liability to any third party for the acts of firm done before his retirement if i. There is an agreement made by him with such third party and the partners of reconstituted firm and such agreement may be implied by a course of dealing between such third party and the reconstituted firm after he had knowledge of retirement. (S 32(2)) Acts after retirement After retirement, retired partner continues to be liable as partner to third parties for any acts done by any of them until public notice is given of the retirement. A sleeping partner need not give a public notice.(S 32(3)) Rights a. He may carry on business competing with that of firm and he may advertise business, but he should not use the firm name, nor represent himself as carrying on the business of the firm, or solicit the custom of persons who were dealing with the firm before he ceased to be a partner. b. When a partner ceases to be a partner and settlement of accounts is not finalized, the legal representatives are entitled to share the profit earned after the retirement of partner and they may claim interest at the rate of 6 % per annum on the amount of his share in the property 12. What is dissolution of firm? What are the different methods in which a partnership firm can be dissolved? Dissolution of firm Section 39.The dissolution of partnership between all the partners of the firm is called the ‘dissolution of the firm’. Dissolution of partnership only involves a change in the relation of partners, where as dissolution of firm means complete break down of the relation of partnership between all the partners Methods of dissolution of firm Broadly, there are two types of dissolution of firm They are Dissolution with out the order of court Dissolution by court Dissolution with out the order of court Mutual agreement: Sec 40 A firm may be dissolved with the consent of all partners or in accordance with a contract between partners Compulsory dissolution (Sec 41) By adjudication of all the partners or all but one as insolvent By happening of any event which makes it unlawful for the business of the firm to be carried on for the partners to carry it on in partnership Happening of certain contingency (Sec 42) By the expiry of term By completion of adventures for which firm is constituted By death By adjudication of a partner as an insolvent By Notice (Sec 43) When the partnership is at will, the firm may be dissolved by any partner giving notice in writing to all the other partners of his intention to dissolve the firm Dissolution by the court (Sec 44) a. That a partner has become of unsound mind, in which suit may be brought as well as by next friend of the partner who has become of unsound mind b. When any partner has become permanently incapable to do his duties as partner c. When any partner is guilty of misconduct which is likely to affect prejudicially the carrying of the business d. That a partner willfully or persistently commits breach of agreement relating to the management of the affairs of the firm or the conduct of the business of firm e. That a partner has transferred the whole of his interest in firm to any third party or has allowed his share to be charged or has allowed to be sold in the recovery of arrears of land revenue f. That the business of firm cannot be carried on save at a loss g. For any just and equitable grounds Imp: If no public notice of dissolution is given, every partner is liable to third parties for any act done by any of them after dissolution 13. Explain the provision of the partnership Act relating to the registration of firm and also the effects of non registration? The Act does not provide for the compulsory registration of the firm. But section 69 of the Act deals with certain disabilities as consequence of non registration. Procedure for registration The registration of a firm may be effected at any time by sending by post or delivering to the Registrar of area in which any place of the business of firm is situated or proposed to be situated, a statement in the prescribed form and accompanied by the prescribed fee stating. a. b. c. d. e. f. Firm name The place or principal place of business of the firm The names of any other places where the firm carries on business The date when each partner joined the firm The names in full and permanent address of the partners The duration of firm The statement shall be signed by all the partners or by their agents specially authorized in this behalf and each person signing the statement shall also verify in the manner prescribed.(S 58) When the registrar appointed under S 57 is satisfied that provisions under section 58 have been duly complied, he shall record an entry of statement in a register called the register of firms and shall file the statement Effect of non registration S 69 1) Suits between partners of firm: A person suing as partner of an unregistered firm cannot sue the firm or any partners of the firm to enforce a right arising from a contract or conferred by the Partnership Act. 2) Suits between firms and third parties: An unregistered firm cannot sue a third party to enforce a right against arising from a contract. 3) The firm cannot sue the partners 4) The firm cannot claim setoff in suits filed by third parties But non registration does not affect 1) The right of a firm or partners of firm having no place of business in India 2) The right to any suit or claim of setoff not exceeding 100 in value 3) The right of partner to sue for the dissolution of firm or for accounts of the dissolved firm 4) The right of a third party to proceed against unregistered firm 5) The right of an unregistered firm to enforce a right arising other wise than out of a contract