Q.report 2, 2009

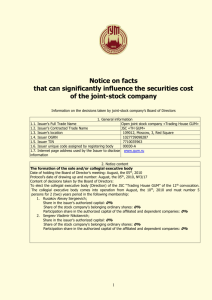

advertisement