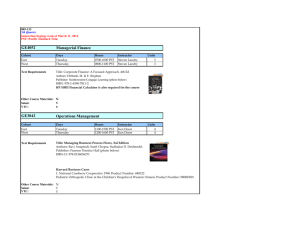

MEL3E – Mathematics for Everyday Life Unit 4 Vehicle Costs Lesson 16 MEL3E Page 1 MEL3E – Mathematics for Everyday Life Unit 4 Lesson Sixteen Concepts Calculating annual cost of a vehicle Identifying common vehicle expenses Calculating cost per km of maintaining a vehicle Calculating cost of an item including PST and GST Car Expense To operate a car there are numerous expense associated. Here is a list of just few of the main expenses individuals experience with their vehicles. Gas Oil Oil changes with oil filter Wiper fluid Tires Air filter Insurance Car payments Example 1 The following are car expenses that Jill experienced for 1 year. $41.56 oil $1664 gas $513.24 new tires $31.00 wiper fluid $17.00 air filter $917.63 insurance $3804 car payments What amount did it cost her per month? Solution Yearly expenses = 41.45 + 1664 + 513.24 + 31 + 17 + 917.63 + 3804 = $6988.43 Monthly cost = yearly cost 12 = 6988.43 12 = $582.37 MEL3E Page 2 MEL3E – Mathematics for Everyday Life Unit 4 Example 2 Suppose Jill drove 28349 km in that one year. How much did it cost her per kilometre to run her car? Solution Cost per km = yearly cost number of km per year = 6988.43 28 349 = 24.7¢/ km Support Questions 1. The following are car expenses that Kristen experienced for 1 year. $41.56 oil $175/ month gas $48.00 wiper fluid $12.00 air filter $1129.43 insurance $327.18/ monthly car payment Total km driven in one year: 21395 km a. How much did Kristen spend on her car in the 1 year? b. How much did it cost her per month to run her car? c. What is the per km cost of running her car? 2. The following are car expenses that Don experienced for 1 year. $87.81 oil changes $158.25/ month gas $827.15 new tires $1129.43 insurance $571.38/ monthly car payment Total km driven in one year: 24843 km a. How much did Don spend on his car in the 1 year? b. How much did it cost him per month to run his car? c. What is the per km cost of running his car? MEL3E Page 3 MEL3E – Mathematics for Everyday Life Unit 4 Support Questions (continued) 3. Cliff needs four new tires for his vehicle. a. How much will 4 new tires at the sale price cost him including GST and PST? b. How much are these tires per month if he keeps them for 3 years? c. How much are these tires per km if he drives 57000 km on them? 4. Lester needs a new muffler installed on his vehicle. He purchases a new exhaust system for his car that cost $487.26. a. How much is this exhaust system per month if it lasts for 10 years? b. How much is this exhaust system per km if he drives 192000 km with it? MEL3E Page 4 MEL3E – Mathematics for Everyday Life Unit 4 Key Question #16 1. The following are car expenses that Elaine experienced for 1 year. $48.92 oil $163/ month gas $28.00 wiper fluid $74.00 licence plate fee $89.24/ month insurance $407.74/ monthly car payment Total km driven in one year: 23839 km a. How much did Elaine spend on her car in the 1 year? b. How much did it cost her per month to run her car? c. What is the per km cost of running her car? 2. The following are car expenses that Noah experienced for 1 year. $110.28 oil changes $141.18/ month gas $683.27 new tires $125.72/ month insurance $368.91/ monthly car payment $74.00 licence plate fee $103.00 brake pads Total km driven in one year: 20361 km a. How much did Noah spend on his car in the 1 year? b. How much did it cost him per month to run his car? c. What is the per km cost of running his car? MEL3E Page 5 MEL3E – Mathematics for Everyday Life Unit 4 Key Question #16 (continued) 3. Alicia needs new brake pads for her car. a. How much will the brake pads cost her including GST and PST? b. How much are these brake pads per month if she keeps them for 3 years? c. How much are these brake pads per km if she drives 63000 km on them? 4. Noah gets his car’s oil changed every 3 months. After taxes the total comes to $27.94. a. How much does he spend annually on oil changes? b. How much does this cost per month? c. If Noah drives 25420 km in one year how much does the oil change cost him per km? 5. Car expenses can happen unexpectedly, list three other common auto expenses that a person could experience. 6. What is one other major factor that must be considered in the price of fixing a vehicle in addition to the cost of the part or parts? MEL3E Page 6 MEL3E – Mathematics for Everyday Life Unit 4 New and Used Vehicles Lesson 17 MEL3E Page 7 MEL3E – Mathematics for Everyday Life Unit 4 Lesson Seventeen Concepts Understanding additional costs associated with new and used vehicles Calculating depreciated value of vehicles Calculating taxes associated with vehicle purchases New Cars New cars have numerous costs in addition to the “sticker” or base price. Some such extra costs are as follows. Delivery Freight Pre-delivery expense Pre-delivery inspection Administration fee Dealer preparation There is a fuel consumption tax for all new cars. If the car also has air conditioning there is a $100 federal tax. PST and GST are also charged to the total price of the vehicle. The dealer also charges a fuel charge because they have put some gas in the tank of the purchased vehicle. The dealer also charges a licence fee because they install the plates on the new vehicle. Example 1 Noah is buying a new car. The car’s total purchase price includes $21499 base price $750 delivery charge $100 federal air conditioner tax $75 fuel consumption tax PST (8%) and GST (6%) $20 licence fee $30 fuel What is the total purchase price of this new car? Solution Price before taxes = base price + delivery charge + air tax + fuel tax = 21499 + 750 + 100 + 75 = $22424 MEL3E Page 8 MEL3E – Mathematics for Everyday Life Unit 4 Price including taxes = 22424 x 1.14 =$25563.36 Price including licence and fuel = 25 563.36 + 20 + 30 = $25 613.36 Support Questions 1. Calculate the total purchase price for the car given below: $14 999 base price $1000 delivery charge $100 federal air conditioner tax $75 fuel consumption tax PST (8%) and GST (6%) $20 licence fee $25 fuel 2. The 2005 Ford Freestyle base price is given below: $500 delivery charge $100 federal air conditioner tax $75 fuel consumption tax PST (8%) and GST (6%) $20 licence fee $40 fuel a. What is the total purchase price for the Ford Freestyle? b. How much more it the total price than the base price? MEL3E Page 9 MEL3E – Mathematics for Everyday Life Unit 4 Support Questions 3. The 2005 Ford Mustang GT Convertible base price is given below: $750 delivery charge $34500 base price $100 federal air conditioner tax $75 fuel consumption tax $90 administration fee PST (8%) and GST (6%) $20 licence fee $30 fuel a. What is the total purchase price for the Ford Mustang? b. How much more it the total price than the base price? Depreciation North American made vehicle in general depreciate about 50% in three years. Example 1 What is Noah’s car worth one year later if it depreciates 20% in the first year? Solution Value of car in one year = base value x (1 – decimal form of depreciation %) = 21 499 x (1 – 0.20) =21 499 x 0.80 =$17 199.20 Support Questions 4. Determine the depreciation value of each car. a. base price $18 250, depreciates 20% in one year b. base price $33 999, depreciates 35% in two years c. base price $12 699, depreciates 55% in four years MEL3E Page 10 MEL3E – Mathematics for Everyday Life Unit 4 Used Cars Used cars also have numerous costs in addition to asking price. Some such extra costs are as follows. Safety Standards Certificate (certified) Drive Clean emissions test (e-tested) Extended warranty PST GST (not on private sales) Example 1 Brianna, is going to buy a used vehicle from an auto dealer. The price including certification and e-testing is $9500 The licence fee is $20 and the fuel fee is $25 There is a 3 month extended warranty for 1 year or 20 000 km for $1000 plus PST and GST What is the total purchase price of the care with the warranty? Solution Price before taxes = car + warranty = 9 500 + 1000 = $10500 Price including GST and PST = 10500 x 1.14 = $11970 Total purchase price = Price with taxes + licence and fuel fees = 11970 + 20 + 25 = $12015 Example 2 Kristen buys a used car privately. The car price is $8000 and not included in this price is: Certification $100.00 emission-test $37.50 PST and GST on both Certification and emission testing PST on the price of the car What is the total purchase price? MEL3E Page 11 MEL3E – Mathematics for Everyday Life Unit 4 Solution Certification and emission test = 100 + 37.50 = $137.50 PST and GST on certification and emission test = 137.50 x 1.14 = $156.75 Price of car including PST = 8000 x 1.08 = $8640 Total price of the car = 8640 + 156.75 = $8796.75 Support Questions 5. Calculate the total purchase price for the used car sold privately: Certification $75.00 emission-test $37.50 PST and GST on both Certification and emission testing PST on the price of the car $4500 sale price 6. What is the total purchase price for the used car given in the advertisement given below? MEL3E Page 12 MEL3E – Mathematics for Everyday Life Unit 4 Key Question # 17 1. Calculate the total purchase price for the car given below: $20 149 base price $900 delivery charge $100 federal air conditioner tax $75 fuel consumption tax $125 administration fee PST (8%) and GST (6%) $20 licence fee $50 fuel 2. The 2006 Dodge Magnum price is given below: $70 fuel consumption tax PST (8%) and GST (6%) $20 licence fee $45 fuel a. What is the base price of the 2005 Dodge Magnum? b. What is the total price of the 2005 Dodge Magnum? c. How much more that the base price is the total price of the Dodge Magnum? 3. Determine the depreciation value of each car. a. base price $19 250, depreciates 25% in one year b. base price $28 950, depreciates 30% in two years c. base price $17 999, depreciates 45% in four years MEL3E Page 13 MEL3E – Mathematics for Everyday Life Unit 4 Key Question # 17 (continued) 4. Calculate the total purchase price for the used car sold privately: Certification $75.00 emission-test $37.50 PST and GST on both Certification and emission testing PST on the price of the car $4500 sale price 5. What is the total purchase price for the used car given in the advertisement given below? 6. Give 2 advantages and 2 disadvantages of buying a used car versus and new car. 7. What is one advantage and one disadvantage of buying a used car from a dealership versus privately? MEL3E Page 14 MEL3E – Mathematics for Everyday Life Unit 4 Leasing Vehicles Lesson 18 MEL3E Page 15 MEL3E – Mathematics for Everyday Life Unit 4 Lesson Eighteen Concepts Understanding additional costs associated with leasing vehicles Calculating lease payments including taxes Calculating excess kilometre surcharges Calculating cost of leasing over a fixed term Calculating total cost of purchasing after the end of a lease Leasing Cars Leasing is as simple as traditional financing but has several advantages. With traditional financing, you purchase a car or truck, make a down payment and agree to pay for the vehicle over the life of the finance contract - plus any interest on the loan. These loan agreements usually range between four and five years. With leasing, you pay only the portion of the vehicle's worth that you anticipate usingover the term of the lease - plus any lease charges. By choosing a lease, you can select a convenient 24 or 36-month lease. At the end of your lease, you have three options after you fulfill all of your lease obligations: Return the vehicle and lease a new one, or Purchase the vehicle at a predetermined price and keep it, or Return the vehicle and walk away There are various extra fees associated with leasing. Some of these are as follows: Security deposit (refundable at end of lease) Down payment Excess km usage fee PST and GST on monthly payments Example 1 Brianna is going to lease a new car. The conditions of the lease are given below: $4 000 down payment $400 refundable security deposit 36 monthly payments of $374.56 PST (8%) and GST (6%) on each monthly payment How much will she pay to use the car for the 3 years? MEL3E Page 16 MEL3E – Mathematics for Everyday Life Unit 4 Solution Lease payment including PST and GST = 1.14 x 374.56 = $427.00 Cost of lease = down payment + 36 lease payments including taxes = 4000 + (36 x 427.00) = $19 372 Assuming that Brianna gets his security deposit back, Brianna will pay $19372 to use the car for three years. Support Questions 1. Calculate the cost of leasing each of the vehicles described below. a. $3000 down payment $350 refundable security deposit 48 monthly payments of $329.99 PST (8%) and GST (6%) on each monthly payment b. $5000 down payment $500 refundable security deposit 60 monthly payments of $439.00 PST (8%) and GST (6%) on each monthly payment c. $2000 down payment $300 refundable security deposit 24 monthly payments of $297.29 PST (8%) and GST (6%) on each monthly payment d. $0 down payment $350 refundable security deposit 48 monthly payments of $479.99 PST (8%) and GST (6%) on each monthly payment MEL3E Page 17 MEL3E – Mathematics for Everyday Life Unit 4 Kilometre Usage Surcharge When leasing a vehicle, the vehicle has a maximum km usage associated. Example 1 Kristen’s 3 year lease allowed her to drive 60000 km with a $0.20 surcharge on every km over 60000. Over the 3 years she drove 68126 km. What is her surcharge for exceeding the allowable kilometres? Solution Excess km = 68126 – 60000 = 8126 km Excess surcharge = 8126 x 0.20 = $1625.20 Support Questions 2. Calculate the kilometre surcharge on each below. a. Allowable usage: 65 000 km; actual usage 71 342 km. $0.15/km surcharge b. Allowable usage: 40 000 km; actual usage 48 829 km. $0.20/km surcharge c. Allowable usage: 60 000 km; actual usage 62 133 km. $0.10/km surcharge d. Allowable usage: 80 000 km; actual usage 104 237 km. $0.08/km surcharge e. Allowable usage: 100 000 km; actual usage 129 205 km. $0.12/km surcharge 3. Calculate the cost of leasing each of the vehicles described below assuming the security deposit was not returned. a. $4500 down payment $425 refundable security deposit 36 monthly payments of $197.99 PST (8%) and GST (6%) on each monthly payment Allowable usage: 60000 km; actual usage 72492 km. $0.10/km surcharge MEL3E Page 18 MEL3E – Mathematics for Everyday Life Unit 4 Support Questions (continued) b. $1000 down payment $200 refundable security deposit 24 monthly payments of $329.00 PST (8%) and GST (6%) on each monthly payment Allowable usage: 45000 km; actual usage 47211 km. $0.16/km surcharge 4. Christopher has decided to purchase his vehicle after the lease ran out. The purchase price of the vehicle is $7250.00. His previous lease payments where $379.15 monthly for 3 years not including GST and PST. He originally gave a down payment of $3500. What is the total purchase price of the vehicle if you include the cost of leasing and that he is paying cash for the purchase of the vehicle? Key Question # 18 1. Calculate the cost of leasing each of the vehicles described below. a. $1500 down payment $300 refundable security deposit 36 monthly payments of $365.00 PST (8%) and GST (%) on each monthly payment b. $7000 down payment $600 refundable security deposit 60 monthly payments of $519.00 PST (8%) and GST (6%) on each monthly payment c. $3500 down payment $225 refundable security deposit 48 monthly payments of $179.97 PST (8%) and GST (6%) on each monthly payment MEL3E Page 19 MEL3E – Mathematics for Everyday Life Unit 4 Key Question # 18 (continued) 2. Calculate the kilometre surcharge on each below. a. Allowable usage: 45000 km; actual usage 66976 km. $0.22/km surcharge b. Allowable usage: 60000 km; actual usage 65173 km. $0.09/km surcharge c. Allowable usage: 80000 km; actual usage 86593 km. $0.07/km surcharge d. Allowable usage: 100000 km; actual usage 93237 km. $0.14/km surcharge 3. Calculate the cost of leasing each of the vehicles described below assuming the security deposit was not returned. a. $2500 down payment $400 refundable security deposit 60 monthly payments of $324.99 PST (8%) and GST (6%) on each monthly payment Allowable usage: 90000 km; actual usage 106584 km. $0.13/km surcharge b. $500 down payment $200 refundable security deposit 24 monthly payments of $156.00 PST (8%) and GST (6%) on each monthly payment Allowable usage: 40000 km; actual usage 51759 km. $0.20/km surcharge 4. Richard has decided to purchase his vehicle after the lease ran out. The purchase price of the vehicle is $11700.00. His previous lease payments where $457.25 monthly for 3 years not including GST and PST. He originally gave a down payment of $5500. What is the total purchase price of the vehicle if you include the cost of leasing and that he is paying cash for the purchase of the vehicle? MEL3E Page 20 MEL3E – Mathematics for Everyday Life Unit 4 Key Question # 18 (continued) 5. Use the table below: a. What is the term for both purchasing and leasing the 2005 Mustang? b. Why does the N/A appear under the “Buy” column when referring to the kilometres per term? c. What is the difference in the monthly payments? (Lease quote does not include taxes.) d. What is the total leasing cost for using the car for 4 years? e. Which would you choose? Buy or Lease? Explain your choice. MEL3E Page 21 MEL3E – Mathematics for Everyday Life Unit 4 Travelling Distances Lesson 19 MEL3E Page 22 MEL3E – Mathematics for Everyday Life Unit 4 Lesson Nineteen Concepts Using ratios to find an unknown Measuring in millimetres Estimating distance Using a scale on a map to help calculate distance Estimating Distances on Maps Rarely are two places on a map connected by a straight line. So estimation is used to calculate the distance between two locations. To use estimation effectively a scale must be given on the map to calculate distances. Usually, these scales are given in one of the corners of the map. Example 1 MEL3E Page 23 MEL3E – Mathematics for Everyday Life Unit 4 Solution First: use a ruler measure the distance in mm of line 1 and line 2. Line 1 = 42 mm Line 2 = 17 mm Second: add the estimated distance measured on the map Total measured distance = 42 + 17 = 59 mm Third: measure the scale given on the map. 19 mm = 5 km MEL3E Page 24 MEL3E – Mathematics for Everyday Life Unit 4 Four: use common ratios (equivalent fractions) to find the estimated distance Therefore the distance between Cannington and Sunderland is approximately 11.06 km. Support Questions 1. Find the value of “x” for each situation set of ratios given below: a. 5 x 12 48 b. 3 x 70 351 c. 8 x 6 14 2. Find the unknown distance in kilometres represented by x. a. MEL3E 6 km x 10 mm 53 mm b. 25 km x 5 mm 73 mm c. 12 km x 8 mm 42 mm Page 25 MEL3E – Mathematics for Everyday Life Unit 4 Support Questions 3. Using the map provided below find the distance between each of the towns or cities. a. Pickering and Oshawa b. Brooklin and Whitby c. Courtice and Bowmanville d. Oshawa and Hampton e. Pickering and Bowmanville MEL3E Page 26 MEL3E – Mathematics for Everyday Life Unit 4 Key Question # 19 1. Find the value of “x” for each situation set of ratios given below: a. 7 x 15 62 b. 4 x 38 200 c. 5 x 9 37 2. Find the unknown distance in kilometres represented by x. a. 5 km x 15 mm 70 mm b. 30 km x 10 mm 91 mm c. 20 km x 6 mm 72 mm 3. Using the map provided below find the distance between each of the towns or cities. a. Mississauga and Toronto b. Toronto and Markham c. Brampton and Georgetown d. Vaughan and Markham e. Toronto and Vaughan MEL3E Page 27 MEL3E – Mathematics for Everyday Life Unit 4 Key Question # 19 (continued) 4. Why is not usually a realistic distance to measure the distance between to points on a map as a straight line? Explain 5. On the map below estimate the distance between the Toronto and Montreal. Assume you were driving 90 km per hour, how long without stops would it take to get from Toronto to Montreal? 6. Explain how each of the conditions could influence travel times. a. Driving to work at 8:30 am. b. Traveling to a vacation spot on a Friday late afternoon c. Traveling to a ski resort to go skiing d. Going to a friends house at 2 pm on a Wednesday afternoon in May MEL3E Page 28 MEL3E – Mathematics for Everyday Life Unit 4 Reading Charts and Schedules Lesson 20 MEL3E Page 29 MEL3E – Mathematics for Everyday Life Unit 4 Lesson Twenty Concepts Reading schedules Recognizing taxes and levies involved with the cost of traveling Reading a 24 hour clock Calculating duration of a trip based on departure and arrival times Recognizing various factors involved in choosing a mode of travel Reading Charts and Schedules When traveling reading charts and schedules along with their associated costs of using that particular mode is essential. Example 1 Use the flight schedule/chart below to answer the following questions. a. b. c. d. e. MEL3E Based on price which flights are the best? Based on the arrival time which flight is best? Which flights arrive in the morning? Which flight is the shortest? Why are there four times associated with WS 663? Page 30 MEL3E – Mathematics for Everyday Life Unit 4 Solution c. Morning arrivals are WS 653, WS 209, and WS625 MEL3E Page 31 MEL3E – Mathematics for Everyday Life Unit 4 d. 9 – 7 = 2 hours and 35 – 30 = 5 min. Shortest trip is 2 hours and 5 minutes e. Means the plane stops at other cities along the way from Toronto to Vancouver. Support Questions 1. Use the schedule below to answer the following questions. a. What is the departure time from Oshawa and arrival time in Toronto on July 27, 2005? b. What is the departure time from Toronto and arrival time in Winnipeg on July 27, 2005? MEL3E Page 32 MEL3E – Mathematics for Everyday Life Unit 4 Support Questions (continued) 2. Use the schedule from the previous page to answer the following questions. a. How many people are traveling with this itinerary? b. What is the total cost of the trip? c. How much tax was charged on this trip? d. What class is being traveled by the people on this trip? 3. Use the schedule/chart below to answer the following questions; a. How many buses leave for Montreal from Toronto? b. Which bus schedule is the quickest? c. How much is saved if the ticket is purchased 7 days in advance instead of as a walk up (standard)? d. Why is there a “1” in the transfer column? MEL3E Page 33 MEL3E – Mathematics for Everyday Life Unit 4 Key Question # 20 1. Use the schedule below to answer the following questions; a. What time does the plane leave Toronto and what time does it arrive in Vancouver? b. What is the total of all the surcharges and taxes on the cost of a single ticket? c. Why does it appear to take a great deal longer to fly back to Toronto? d. Why do you think the return trip costs more? e. What date is the trip to Vancouver and what date is the return trip to Toronto? MEL3E Page 34 MEL3E – Mathematics for Everyday Life Unit 4 Key Question # 20 (continued) 2. Use the schedule below to answer the following questions. a. What is the departure time from Toronto and arrival time in Montreal on Sept. 26, 2005? b. How many people are traveling with this itinerary? c. What is the total cost of the trip? d. How much tax was charged on this trip? e. What class is being traveled by the people on this trip? MEL3E Page 35 MEL3E – Mathematics for Everyday Life Unit 4 Key Question # 20 (continued) 3. Use the schedule/chart below to answer the following questions. a. Based on price which flights are the best? b. Based on the arrival times which flight is earliest to and from Halifax? c. Which flights arrive in the morning? d. Which flight combination is the shortest? e. Why are there four times associated with WS 663? f. What is the maximum number of cities that could be involved in a return trip? What are these cities? 4. When booking an airline flight, name two factors other than price that might determine which flight to choose? MEL3E Page 36 MEL3E – Mathematics for Everyday Life Unit 4 Support Question Answers Lesson Sixteen 1. a. Annual cost = 41.65 + 175(12) + 48 + 12 + 1129.43 + 327.18(12) = $7257.15 b. 7257.15 12 = 604.76 / month c. 7257.15 21395 = 33.9¢ / km 2. a. Annual cost = 87.81 + 158.25(12) + 827.15 + 1129.43 + 571.38(12) = $10799.95 b. 10799.95 12 = 900.00 / month c. 10799.95 24 843 = 43.5¢ / km 3. a. 73.49 x 1.15 84.51 x 4 = $84.51 = $338.04 b. 338.04 36 = $9.39 / month c. 338.04 57000 = 0.6¢ / km 4. a. 487.26 120 = $4.04 / month b. 487.26 192000 = 0.25¢ / km Lesson Seventeen 1. Price before taxes = base price + delivery charge + air tax + fuel tax = 14999 + 1000 + 100 + 75 = $16174 Price including taxes = 16174 x 1.14 = $18438.36 Price including licence and fuel = 18438.36+ 20 + 25 = $18483.36 2. a. Price before taxes MEL3E = base price + delivery charge + air tax + fuel tax = 33295 + 500 + 100 + 75 = $33970 Page 37 MEL3E – Mathematics for Everyday Life Price including taxes 3. 4. Unit 4 = 33970 x 1.14 = $38725.80 Price including licence and fuel = 38725.80+ 20 + 40 = $38785.80 b. Difference from base price = Price including licence and fuel – base price = 38725.80 – 33295.00 = $5490.80 a. Price before taxes = base price + delivery charge + air tax + fuel tax + admin fee = 34500 + 750 + 100 + 75 + 90 = $35515 Price including taxes = 35515 x 1.14 = $40487.10 Price including licence and fuel = 40487.10+ 20 + 30 = $40537.10 b. Difference from base price = Price including licence and fuel – base price = 40537.10 – 34500 = $6037.10 a. depreciated value = base price x (1 – decimal of percent) = 18 250 x (1 –0.20) = 18 250(0.80) = $14 600 b. depreciated value = base price x (1 – decimal of percent) = 33 999 x (1 –0.35) = 33 999(0.65) = $22 099.35 c. depreciated value = base price x (1 – decimal of percent) = 12 699 x (1 –0.55) = 12 699(0.45) = $5714.55 5. Total price of car = price of car with PST + certification & emission testing with both taxes Price of car with PST MEL3E = 4500 x 1.08 = $4860 Page 38 MEL3E – Mathematics for Everyday Life Unit 4 Certification and emission testing with PST and GST = (75 + 37.50) x 1.14 = 112.50 x 1.14 = $128.25 Total price of car 6. Total price of car Price of car with PST = 4860 + 128.25 = $4988.25 = price of car with PST = 72 000 x 1.08 = $77 760 Certification and emission testing with PST and GST = included in price Total price of car = $77 760.00 Lesson Eighteen 1. a. Lease payment including PST and GST = 1.14 x 329.99 = $376.19 Cost of lease = down payment + 48 lease payments including taxes = 3000 + 48 x 376.19 = $21201.12 b. Lease payment including PST and GST = 1.14 x 439.00 = $500.46 Cost of lease = down payment + 60 lease payments including taxes = 5000 + 60 x 500.46 = $35027.6 c. Lease payment including PST and GST = 1.14 x 297.29 = $339.58 Cost of lease = down payment + 24 lease payments including taxes = 2000 + 24 x 339.58 = $10149.92 d. Lease payment including PST and GST = 1.14 x 479.99 = $547.89 Cost of lease = down payment + 48 lease payments including taxes = 0 + 48 x 547.89 = $26298.72 MEL3E Page 39 MEL3E – Mathematics for Everyday Life 2. 3. a. Excess km = 71342 – 65000 = 6342 km Excess surcharge = 6342 x 0.15 = $951.30 b. Excess km = 48829 – 40000 = 8829 km Excess surcharge = 8829 x 0.20 = $1765.80 c. Excess km = 62133 – 60000 = 2133 km Excess surcharge = 2133 x 0.10 = $213.30 d. Excess km = 104237 – 80000 = 24237 km Excess surcharge = 24237 x 0.08 = $1938.96 e. Excess km =129205 – 100000 = 29205 km Excess surcharge = 29205 x 0.12 = $3504.60 a. Lease payment including PST and GST Unit 4 = 1.14 x 197.99 = $225.71 Cost of lease without km surcharge = down payment + 36 lease payments with taxes + security deposit = 4500 + 36 x 225.71 + 425 = $13050.56 Excess km = 72492 – 60000 = 12492 km Excess surcharge = 12492 x 0.10 = $1249.20 Cost of lease with km surcharge = 13050.56 + 1249.20 = $14299.76 MEL3E Page 40 MEL3E – Mathematics for Everyday Life b. Unit 4 Lease payment including PST and GST = 1.14 x 329.00 = $375.06 Cost of lease without km surcharge = down payment + 36 lease payments with taxes + security deposit = 1000 + 24 x 375.06 + 200 = $10201.44 Excess km = 47211 – 45000 = 2211 km Excess surcharge = 2211 x 0.16 = $353.76 Cost of lease with km surcharge = 10201.44 + 353.76 = $10555.20 4. Lease payment including PST and GST = 1.14 x 379.15 = $432.23 Cost of lease = down payment + 36 lease payments with taxes = 3500 + 36 x 432.23 = $19060.28 Cost of buyout after lease Total purchase price = buy price + PST and GST = 7250 x 1.14 = $8265.00 = cost of lease + total cost of buyout = 19060.28 + 8265.00 = $27325.28 Lesson Nineteen 1. a. b. 5 x 12 48 (5)(48) (12)( x ) 240 12 x 240 12 x 12 12 240 x 12 20 x MEL3E c. 3 x 70 351 (3)(351) (70)( x ) 1053 70 x 1053 70 x 70 70 1053 x 70 15.04 x 8 x 6 14 (8)(14) (6)( x ) 112 6 x 112 6 x 6 6 112 x 6 18.67 x Page 41 MEL3E – Mathematics for Everyday Life 2. a. b. 6 x 10 53 (6)(53) (10)( x ) 318 10 x 318 10 x 10 10 318 x 10 31.8 x 3. Unit 4 c. 25 x 5 73 (25)(73) (5)( x ) 1825 5 x 1825 5 x 5 5 1825 x 5 365 x 12 x 8 42 (12)(42) (8)( x ) 504 8 x 504 8 x 8 8 504 x 8 63 x a. measured distance is 78 mm and using the scale 5 km = 20 mm 5 x 20 78 (5)(78) (20)( x ) 390 20 x 390 20 x 20 20 390 x 20 19.5 x b. measured distance is 33 mm and using the scale 5 km = 20 mm 5 x 20 33 (5)(33) (20)( x ) 165 20 x 165 20 x 20 20 165 x 20 8.25 x MEL3E Page 42 MEL3E – Mathematics for Everyday Life Unit 4 c. measured distance is 34 mm and using the scale 5 km = 20 mm 5 x 20 34 (5)(34) (20)( x ) 170 20 x 170 20 x 20 20 170 x 20 8.5 x d. measured distance is 74 mm and using the scale 5 km = 20 mm 5 x 20 74 (5)(74) (20)( x ) 370 20 x 370 20 x 20 20 370 x 20 18.5 x e. measured distance is 143 mm and using the scale 5 km = 20 mm 5 x 20 143 (5)(143) (20)( x ) 715 20 x 715 20 x 20 20 715 x 20 35.75 x MEL3E Page 43 MEL3E – Mathematics for Everyday Life Unit 4 Lesson Twenty 1. a. Depart Oshawa 16:11 and Arrival in Toronto 16:46 b. Depart Toronto 09:00 and Arrival in Winnipeg 15:45 c. 2 adults and one child d. $1927.07 e. $126.07 f. Comfort class 2. a. 7 buses b. Bus schedules 6212 and 6210 are both 7 hours and 50 min c. 85.75 – 43.90 = 41.85 in savings d. Means that passengers must get of a bus and get on another bus once during the trip. MEL3E Page 44

advertisement

Download

advertisement

Add this document to collection(s)

You can add this document to your study collection(s)

Sign in Available only to authorized usersAdd this document to saved

You can add this document to your saved list

Sign in Available only to authorized users