Time for Anti

advertisement

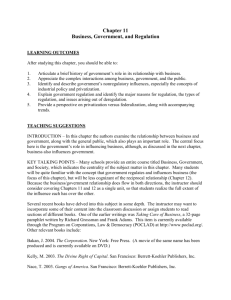

“MAPping the Future” Column in INQUIRER – 1 August 2011 Time for Anti-Trust? by Ronald U. Mendoza Lee Kwan Yew once quipped that in the Philippines, 99 percent of the population waited for a phone line, while the remaining 1 percent waited for a dial tone. While this jab was directed at our telecoms sector, Lee could have just as easily poked at the rest of our monopolized and highly regulated industries then. Sweeping market-oriented reforms in the mid-1990s were designed to change this. Deregulation and privatization would get the inefficient and costly government out of key sectors it had no business being in, and instead draw-in competitive, innovative and much more efficient private sector actors who would in turn compete for market share by providing better services at lower prices. Deregulation would enhance competition, in turn promoting the necessary investments to boost innovation and competitiveness. This would ultimately lead to increasing consumer welfare and taxpayers’ benefits, by lowering the number of loss-making and inefficient government owned and controlled corporations. Are consumers (and taxpayers) really any better off today, well over a decade after this deregulation wave? Did competition and competitiveness really increase? Telecommunications, petroleum, and air travel are three industries that are particularly illustrative of the range of outcomes. There are some gains, but also evidence of emerging challenges to promote competition and safeguard consumer welfare. Table 1. Summary of Selected Industry Information Year of Deregulation Companies before Deregulation Petroleum Airlines 1995 1998 1995 PLDT Deregulation Companies after Telecommunications PLDT (Smart; Talk N’Text-Piltel; Red Mobile-Cure and Sun-Digitel) and Globeb Shell, Petron and Caltex Philippine Airlines (PAL) Shell, Petron, Caltex, SeaOil, Flying V, Total, PAL, Cebu Pacific, SEAir, Air Jetti, City Oil and Philippines, and ZestAir UniOil Mobile Telephony: Herfindahl-Hirschman 10000 (1994) Competition Indicatora 4020 (prior to PLDTDigitel merger)b (Higher values reflect more market concentration; Date or event in parentheses) Domestic: 3427 (1996)d 2846 (2010) 10000 (1994) 3680 (2010) d 5800 (after PLDT-Digitel merger)c Landlines: International: 2548 (2010)e 10000 (1994) 3253 (prior to PLDTDigitel merger)b 4479 (after PLDT-Digitel merger)c Notes: a Herfindahl-Hirschman Index prior to and after deregulation, with year in parenthesis. The HHI it is the sum of the squared market shares of the each company in the industry. The index approximates the value zero when the industry has more firms with similar size. A higher value therefore signals potentially weaker competition and more concentration in the industry. For illustration, the US Department of Justice, Federal Trade Commission characterizes an HHI of 1500 and below as “unconcentrated”, 1500-2500 as “moderately concentrated” and 2500 and above as “highly concentrated”. b Shares prior to PLDT-Digitel merger. c Assuming PLDT-Digitel merger. d Data from the Department of Energy. e Data from the Center for Asia Pacific Aviation (2010); and based on passenger capacity, including international flights. Telecommunications The telecommunications industry was deregulated in the early 1990s, but PLDT remained a dominant player due to its control over most landlines. This was further reinforced in 1998, when First Pacific (owner of Smart) bought control of PLDT (also owner of Piltel), and these companies accounted for a combined share of 68 percent of the cellular telephone subscribers and 43 percent of the installed lines. Competition between PLDT-Smart and Globe kept pricing steady for text messaging, so in real terms (i.e. accounting for inflation), the price of text messaging declined over time, even as it was kept at PhP1 per text message. In 2003, Sun Cellular of Digital Telecommunications Philippines Inc. (Digitel) entered the mobile telecommunications market offering product innovations like “unli” (unlimited) calls and text messaging. While initially challenged by the industry incumbents through the National Telecommunications Commission (NTC), the NTC upheld Sun Cellular’s entry and it eventually provoked similar product innovations among the incumbents. Intense competition among these companies generated a wider array of product options for consumers, with ever more competitive pricing schemes fitting different consumer preferences. Well over 80 percent of the population now has access to mobile telephony—a far cry from the times when it took over a decade to get a landline from PLDT. However, the recent acquisition of Digitel by PLDT raises questions about the state of market concentration in the industry, and in turn, what this might mean for continued product innovation, competitiveness and consumer welfare. A virtual duopoly will emerge from this deal, with PLDT and its affiliates accounting for about 70 percent of the mobile phone market, and Globe serving the remaining 30 percent. Despite deregulation, barriers to enter the industry, including separate franchise requirements for each telecommunications sector and limits to foreign participation (40 percent cap), prevent further enhanced competition. Petroleum Deregulated in 1998, the downstream oil industry was initially comprised of three players: Caltex Philippines (now the marketing and distributing company under Chevron), Pilpinas Shell, and Petron (then jointly owned by the state-owned Philippine National Oil Company and Saudi Aramco). Today there are several more gasoline suppliers, including the original three plus SeaOil, Flying V, Total, Jetti, City Oil and UniOil. Unleaded gasoline was about PhP12 per liter while diesel gasoline was about PhP8 per liter during the deregulation—these recently reached peaks of about PhP60 and PhP45, respectively. Are these dramatic price increases due to deregulation? Recent analysis by the UAP and SGV suggests that, in fact, local pump prices have not gone up as fast as international indicators for crude oil and its refined products. Further, the stock prices of oil companies such as Petron and Shell do not appear to show any marked improvements during the period of study from 2005-2008, when prices at the pump were on an upward trend. Our own empirical analysis at AIM also shows that much of the change in gas prices at the pump since the deregulation was accounted for by international price movements. In fact, after correcting for the influence of international prices and a measure of industry competition, gas prices on the margin before and after deregulation are not statistically different. This suggests that while deregulation is not to blame for the dramatic rise in gas prices, it did not seem to change industry pricing either. Indeed, even as they are now also competing in retail, food and shopping options, the three main industry players still dominate—their combined market share still stands at about 77 percent. Airlines The civil aviation industry in the Philippines was dominated by PAL until the government finally opened this sector in 1995. Following the entry of new airlines like Cebu Pacific, Air Philippines and Asian Spirit (now ZestAir), PAL’s market share was cut in half, declining from 96 percent in 1995 to about 49 percent in 1999. PAL nevertheless remains a dominant player in the market with about 50 percent market share in recent years, but Cebu Pacific has captured significant ground, accounting for about 30 percent market share. Deregulation brought about a surge in domestic air travel in the country, thanks to more flights and more competitive pricing. The Manila-Iloilo route alone experienced an 83 percent increase in the number of travelers just two years after deregulation. Passengers from Manila to Davao and from Manila to Cebu also shot up by 45 percent and 34 percent, respectively, during this period. More attractive pricing clearly played a role in successfully contesting market share from PAL. There is also evidence that PAL restricted output—and this was quickly undone by the entry of more players. A recent empirical study suggests that average airfares are about 10 percent lower after liberalization, and that up to 90 percent of domestic airline passengers benefited from lower fares. The industry is not without challenges, however. Competition did improve for the most profitable routes, but the less profitable routes (or so-called missionary routes) could be left behind. PAL used to serve these routes through a cross-subsidy between the more profitable and less profitable destinations. However, with the break-up of its monopoly, and the apparent focus of the new entrants on the more profitable routes, up to 11 markets formerly served by PAL have lost airline service. Airport infrastructure is also still inadequate. In addition, even as new domestic firms have shown their competitiveness relative to the once monopoly incumbent, there are some concerns that these same firms may be hard-pressed to compete at the international level, notably once the country opens up to ASEAN competitors as part of the country’s “open skies” policy. Industry experts already forecast the Philippines could be a key battleground for low cost carriers in the region, including AirAsia (Malaysia) and Tiger Airways (Singapore) once Philippine skies have been opened up. Promoting Competition and Competitiveness The preceding examples provide some evidence of consumer gains from deregulation. However, they also flag critical issues, including the possible need to maintain healthy competition levels, and also competitiveness, across Philippine industries. Indeed the indicator of competition used widely by international regulators—the Herfindahl-Hirschman index (HHI) —suggests that the potential for abuse of market power is still present in all three industries examined here (see table 1). Since the HHI for these industries are well above 2500, according to the guidelines of the US Department of Justice and the Federal Trade Commission, they would all be described as “highly concentrated.” Some market consolidation has also already begun to take place. Indeed, if we were to draw from guidelines on competition policy presently applied in the United States or in the EU, the PLDT-Digitel merger would automatically raise a red flag and trigger closer scrutiny by regulatory authorities, as the worsening of industry concentration indicators could indicate a rise in market power and possibly open the door to anti-competitive behavior. In addition, pricing behavior and product/service strategies remain largely unexamined. Further market liberalization will also introduce challenges to some industries. Regulatory authorities will need to catch up with these developments, utilizing international good practices, including more robust analytical frameworks and technical analyses to strengthen regulatory oversight over these evolving industries. Deregulation does not mean that the government should be absent—only that its role be re-focused. Markets can also malfunction, and industries could end up consolidating in ways that undermine competition, innovation and ultimately also competitiveness. It is up to regulatory authorities to facilitate healthy competition and improved competitiveness, in order to safeguard consumer welfare. That in turn requires professional and technically equipped regulatory institutions with true independence and real capacity to exercise their mandate. Given the growing importance of anti-trust issues both nationally and internationally, more effective and coherent competition law and policy will be necessary. (The article reflects the personal opinion of the author and does not reflect the official stand of the Management Association of the Philippines. The author is Associate Professor of Economics at the Asian Institute of Management, and Executive Director of the AIM Policy Center. Prior to joining AIM, he was a senior economist with the United Nations in New York. Feedback at map@globelines.com.ph. For previous articles, please visit <map.org.ph>). G:\mapping\ mapping - rmendoza - 1August2011 - Time for Anti-Trust.doc:mel