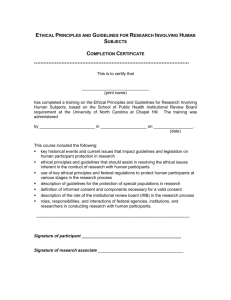

Course Overview

advertisement