A Gateway's Strategy to Reinvent Itself

advertisement

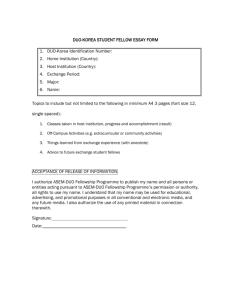

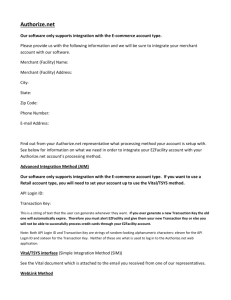

A Gateway’s Strategy to Reinvent Itself As transaction processors jockey to add volume in a hyper-competitive business, the role of the transaction gateway—the entity that links merchants with processors’ data centers—is becoming increasingly uncomfortable. Now that the processors themselves are adding value, gateways are under pressure as never before to serve as more than an intermediary. This fact of life has not been lost on Authorize.net Inc., American Fork, Utah, one of the major gateways serving Internet merchants. Its strategy is two-pronged: beef up value-added services and expand quickly into the physical point of sale, which is more competitive than e-commerce but offers high-growth potential in high-throughput markets like fast food, which seek the lightning-like payment speeds of the Internet. This strategy got a big boost this spring when Lightbridge Inc., a Burlington, Mass.-based provider of billing and fraud-management systems, acquired Authorize.net for $82 million. Lightbridge’s expertise lies in providing merchants, particularly those in the telecommunications industry, with fraud prevention, credit qualification, and identity- verification solutions. The company also offers enhanced voice and data solutions intended to help merchants improve customer service. With Authorize.net, Lightbridge gets entrée into transaction processing, while the gateway wins the backing it needs to pursue its value-added play. The plan, according to Roy Bank, vice president and general manager for Authorize.net, is to leverage Lightbridge’s fraud detection and other solutions to transform Authorize.net into a value-added gateway. This comes at a time when some observers are beginning to doubt the value of the gateway concept itself. Authorize.net itself has seen its market share shrink to about one-third from over half just four years ago, according to Celent Communications. “All processors have the infrastructure to accept [Internet Protocol]based transactions,” says Michael Mulcahy, chief operating officer and executive vice president of sales for Exadigm Inc., a Tustin, Calif.-based maker of wireless and landline payment terminals. “If merchants are not getting added value from their gateway provider, then gateways become an extra layer of expense.” Certainly, Lightbridge is in a position to provide the resources Authorize.net needs to make the transition. Lightbridge posted revenues of $36.7 million during the second quarter of 2004, up 17.2% from the same period a year earlier, with $8.1 million of that gain coming from Authorize.net. Industry experts believe the company will budget the money for research and development to broaden Authorize.net’s menu of services. “We expect Lightbridge to put more research and development and marketing money behind Authorize.net,” says Jill Gapper, director of product integration for Atlanta-based Global Payments, a reseller of Authorize.net’s gateway services. Beefing up its resources is key to Authorize.net’s long-term survival. Global Payments, a leading transaction processor, plans to launch a gateway application that will connect merchants to network service providers, such as Sprint, MCI, and AT&T. The application will route transactions originated from IPbased point-of-sale terminals over these telecom networks to Global Payments. The gateway is targeted at merchants without in-house information technology staffs or that prefer to outsource the technical issues associated with IP-based POS solutions. “For merchants, using our service will be a choice similar to outsourcing a data center,” adds Gapper. “We aren’t looking to compete in the gateway space, but going forward we do expect merchants to take a harder look at what they want from a gateway provider.” Global Payments intends to continue its partnership with Authorize.net to support merchants that want value-added gateway services. By adding real-time fraud prevention and related security applications to Authorize.net’s core services, Lightbridge figures there is an opportunity to expand Authorize.net’s reach deeper into the brick-andmortar merchant community. Authorize.net already provides gateway services to about 200 physical merchants, including several quick-service restaurants, which have embraced IP-based POS solutions for their speed and architectural flexibility. During the second quarter of 2004, Authorize.net added 5,900 Web merchants, raising its total merchant portfolio to more than 100,000. The portfolio is made up of primarily small and mid-size and Web-based merchants. Expansion opportunities into the card-present market include merchants that want to deploy wirelessbased IP solutions to create temporary checkout lanes or want to connect their point-of-sale system to their in-house database or inventory-management systems via the Internet. Wireless IP-based POS systems deliver increased flexibility to sales staff for checking inventory or connecting to customer-loyalty applications via wireless terminals anywhere in the store. This market segment is expected to grow significantly as terminal makers move away from dial-up technology to IP-based wireless units, according to Mulcahy. “Cable companies are pushing broadband into stores to deliver information to their host system wirelessly,” he adds. “Terminal makers are going to piggyback on what’s happening in the telecom world.” Authorize.net is betting this trend will prompt brick-and-mortar merchants to aggressively embrace IPbased solutions because of lower operating costs and faster transaction speeds. Because wireless terminals are networked to a host system, merchants can hang multiple terminals off a single server, as opposed to connecting a land line to each terminal. Merchants can save as much as $30 a month by eliminating a single land line. As for transaction speed, IP-based wireless terminals can authorize a payment in about four seconds, compared to 15 to 45 seconds for a dial-up terminal. The difference in speed can make a huge difference for merchants when it comes to moving customers through the checkout lane during peak periods. “There is a natural trend among merchants toward IP enablement of the POS device,” says Authorize.net’s Bank. “Providing this service is not a departure from our core competency as an IP-based transaction platform provider.” Industry experts see the combination of value-added services, cost reduction, and faster authorization as key selling points in Authorize.net’s strategy to expand its reach in the physical merchant world where competition for clients is stiffer than in e-commerce. “For merchants the question is whether gateways provide added value,” says Exadigm’s Mulcahy. “If they don’t, why add the service?” One potential bump in the road: the departure in August of Pamela D.A. Reeve, who had been chief executive of Lightbridge for almost 15 years. Board member Robert Donahue, who has held executive positions with Manufacturers Services Ltd. and Stratus Computer Inc., has been named Reeve’s interim successor. Western Union Scrambles to Stay on Top When it comes to money transfers, Western Union Financial Services Inc. is king. But now, with competition for the lucrative foreign-remittance market heating up, some industry watchers wonder whether the venerable company’s crown is in jeopardy. Armed with a household name and more than 195,000 agent locations worldwide, Western Union handles about one quarter of total person-to person and person-to-business remittances, by far the largest of any money-transfer company or bank. A large chunk of the business comes from payments sent to Mexico. During the second quarter alone, remittances to Mexico grew 16%. Though the company refuses to say how much of its total business the payments to Mexico account for, the country is clearly one of Western Union’s top destination markets. The market looks increasingly inviting. In 2003, money-transfer companies and banks facilitated $13.3 billion in remittances to Mexico, up from $10.5 billion in 2002, according to the Inter-American Development Bank. Overall, remittances sent to Latin America, Mexico, and the Caribbean totaled $38 billion in 2003, up from $32 billion from 2002. About $30 billion of remittances sent to Latin America in 2003 were originated in the U.S. More than one-third of the 10 million Latin American immigrants living in the U.S. are Mexican, according to the IDB. Outside Mexico, Western Union is aggressively growing its business in India and China, where 9,000 and 3,000 new agent locations were added during 2003. The additions raised combined agent locations in those countries to more than 25,000. Revenues from Western Union’s money-transfer business account for more than 80% of revenues for the Payment Services division of Greenwood Village, Colo.-based parent First Data Corp. During the second quarter, Payment Services revenues totaled $1 billion for the first time on a quarterly basis. But little of this has escaped the attention of competitors—both existing and potential. “Western Union has been delivering significant revenue and profits to First Data for years,” says Beth Robertson, a senior analyst for Needham, Mass. TowerGroup. “It is for that reason competitors are ramping up their marketing efforts.” The bulk of the competition is coming from banks launching prepaid remittance cards. In the past year, such heavyweights as Citibank, London-based HSBC and Minneapolis-based U.S. Bank, have launched prepaid remittance cards. U.S. Bank is partnering with Minneapolis-based MoneyGram Payments Inc., a direct competitor of Western Union and a global brand in the money transfer business. HSBC is teaming with Yahoo Finance to offer PayDirect. In 2002, Charlotte, N.C.-based Bank of America introduced its SafeSend remittance card. With remittances to Latin America projected to exceed $100 billion annually by 2010, payments to Mexico are currently the hottest market. “Banks are aggressively trying to compete with Western Union, especially for this business,” says Gwenn Bezard, a senior analyst for Boston-based Celent Communications. “Western Union charges the most of any provider and banks see an opportunity to compete on price.” On average, Western Union customers pay about $14 to conduct a money transfer. In comparison, U.S Bank charges about $10 to transfer up to $1,000 and BofA has reportedly dropped its prices below those of Western Union. Since 2000, the average cost of sending a $200 remittance to Latin America has fallen from 15% of the transaction amount to about 8%, according to the IDB. While pressure on transaction costs is expected to continue, the higher prices charged by Western Union has led to profit margins of more than 30% for the company, compared to 12% for commercial banks, according to Bezard. But trimming transaction fees is not a surefire recipe for banks to pull business away from Western Union. Industry experts argue that success is more dependent on the size of each player’s remittance network and brand recognition. To bolster its market presence, U.S. Bank has affiliated with MoneyGram, which in July was spun off by parent Viad Corp. and is now a subsidiary of MoneyGram International Inc. MoneyGram has 68,000 outlets in about 160 countries. More than 6,000 of MoneyGram’s outlets are in Mexico. HSBC has linked its money transfer/gift card to the Cirrus ATM network, which has more than 900,000 ATMs in 120 countries. HSBC is also a MoneyGram affiliate. BofA’s SafeSend card can be used at more than 855,000 Plus ATMs in 149 countries, 20,000 of which are in Mexico. Citi’s Tricolor Card can be cashed at any Banamex branch or ATM in Mexico or used to make a purchase at more than 120,000 affiliated Mexican merchants. Still, Western Union isn’t standing still. The company was out in front in the remittance card market, launching a MasterCard-branded card in 2001. The card, which is accepted at 4,600 ATMs in the U.S., usually in or near agent locations, has proven modestly successful. “ATMs will play a role in the future of remittance, but they are not a panacea,” says the Western Union spokesperson. “Anecdotal evidence indicates customers feel more comfortable with agents that speak their language.” Then there are questions about ATM fees and whether customers originating a money transfer or receiving one will eventually be required to open a bank account, something that is currently not a requirement for most competitors. “ATM and account fees raise the cost to the customer,” says Bezard. More recently, Western Union has introduced a service to allow consumers to purchase a ticket on Continental Airlines in cash. After ordering a ticket online or over the phone, customers receive a confirmation number, which must be taken to a Western Union agent, along with payment, within 24 hours. Travelers can pick up their boarding pass at a Continental e-Service kiosk the day of departure or by checking in through Continental’s Web site up to 30 hours prior to flight time. Western Union loyalty card holders can earn points toward reduced transaction fees or redeem points for merchandise. In addition, cardholders earn up to 20 minutes of local calling time or five minutes of international calling time for each transaction. Many cardholders use the minutes to phone relatives and tell them they have initiated a money transfer. Nor is Western Union turning a blind eye to the competition U.S. banks pose. To counter this threat, Western Union in August signed Minneapolis-based TCF Bank as an agent. TCF brings more than 400 locations to Western Union’s network. For now, it appears competition is doing more to cement Western Union’s position than to weaken it. M-Commerce Report Preparing for Its Early ‘05 Launch, Simpay Lines up Testing Vendors Following the April announcement appointing Encorus as its central service provider, Simpay has announced that Tata Infotech and Integri will form the cornerstones of its testing strategy for the payment system it is due to launch commercially in early 2005. Global systems integrator Tata Infotech, part of India’s best-known industrial conglomerate, will support Simpay in testing the central processing systems and the readiness of Simpay’s members for launch. Tata Infotech was chosen for its ability to meet Simpay’s requirement to conduct extensive and intensive testing cost effectively, using a combination of onshore and offshore resources, and having undertaken similar projects with other customers in the areas of software development, IT-enabled services, and IT infrastructure management. “Tata Infotech is proud to partner with Simpay, which is the appropriate vehicle to take m-commerce to the masses,” says Charles Antony, chief operating officer at Tata Infotech. Integri has been selected to build a suite of simulators of Simpay’s systems to enable standalone testing by mobile operators of their own components of the program before full integration, and to support the acceptance testing of the central platform. The Simpay Scheme Simulator will be built around Integri’s INQ Test Tool. Integri’s worldwide customer base includes financial institutions, telecom operators, and system integrators in both e- and m-commerce. Simpay’s offering will allow consumers to make low-price purchases using their mobile phones. The cost of the goods or services, including MP3 music files, games, or sports results, is debited from the mobile user’s account by his or her mobile operator. Simpay is also suited to next-generation mobile services such as real-time video. Verizon And Sprint Report Stepped-up M-Commerce Traffic Verizon Wireless and Sprint are each on pace to earn about $1 billion this year from customers who download games and ring tones, use wireless broadband connections, and send and receive instant messages. While that’s a significant improvement over 2003, this year’s pace is below what people expected when such services debuted. The carriers say it’s encouraging that Verizon Wireless is seeing an average of 20 billion instant messages a month so far this year and Sprint has seen data revenue rise 33%. Industry executives assert that the inexpensive net services now gaining popularity are “gateways” to wireless broadband and other more lucrative offerings. “Wireless data represents a bigger and bigger percentage of our revenue,” says Lawrence Babbio, Verizon president. “We see growth in that area.” Most popular among the new services are games, says Sprint, which claims to lead all other US carriers in this area. Between January and April, Sprint customers bought 3.5 million games, priced between $3 and $15 each, compared with the 5 million sold in all of 2003. The 2-year-old “Get It Now” service has never seen higher traffic, Verizon Wireless reported in July. Get It Now uses Qualcomm’s BREW technology to sell ring tones, games, and business applications. Verizon is the only U.S. carrier selling BREW-based games. Between January and May, 34 million purchases were made through Get It Now, nearly matching last year’s overall tally. The articles in this section are published by arrangement with Mobile Payments World, an online-only newsletter published 22 times a year in the UK by European Card Review, Europe’s leading payments card magazine. More details: www.mobilepaymentsworld.com.