3Q 2012 - Agora SA

AGORA GROUP

Report for

3Q 2012

November 9, 2012

[ w w w . a g o r a . p l ] Page 1

Management Discussion and Analysis for the third quarter of 2012

TABLE OF CONTENTS translation only

MANAGEMENT DISCUSSION AND ANALYSIS (MD&A) OF THE GROUP’S RESULTS FOR THE THIRD QUARTER OF 2012. 4

[ w w w . a g o r a . p l ] Page 2

Management Discussion and Analysis for the third quarter of 2012 translation only

[ w w w . a g o r a . p l ] Page 3

Management Discussion and Analysis for the third quarter of 2012 translation only

AGORA GROUP

MANAGEMENT DISCUSSION AND ANALYSIS

(MD&A) OF THE GROUP’S RESULTS

FOR THE THIRD QUARTER OF 2012

REVENUE PLN 829.0 MILLION

NET LOSS PLN 8.7 MILLION

OPERATING EBITDA PLN 61.6 MILLION

OPERATING CASH FLOW PLN 59.4 MILLION

Unless indicated otherwise, all data presented herein represent the period of January - September 2012, while comparisons refer to the same period of 2011. All data sources are presented in part IV of this MD&A.

I. IMPORTANT EVENTS AND FACTORS WHICH INFLUENCE THE FINANCIALS OF THE

GROUP

According to the Agora Group (‘the Group’) estimates, in the period from January to September of 2012, advertising spending for all media in Poland amounted to ca PLN 5.3 billion and decreased by over 4.5% yoy. At that time, advertisers increased their advertising expenditure in Internet (up by almost 10% yoy), and in cinemas

(up by 11.5% yoy). Advertisers decreased their spending in television by 5.5% yoy. Advertising expenditure in outdoor decreased by over 6% yoy. Advertising budgets in press decreased by almost 14.5% yoy. Advertisers spent almost 19.5% less yoy in dailies and 10.5% less yoy in magazines. The value of advertising market in

Poland in the discussed period of time and especially in the second quarter of 2012 was significantly influenced by European Football Championship taking place in Poland and in Ukraine, which resulted in limited scale of advertising campaigns on outdoor panels and in radio stations. Moreover, in the third quarter of 2012, the value of advertising expenditure in Poland decreased by over 6.5% yoy.

The Group’s revenues, from January to September of 2012, decreased by 7.8% yoy and amounted to PLN 829.0 million. The Group’s ticket sales amounted to PLN 95.7 million and decreased by 8.2% yoy largely due to a 23.5% yoy drop in ticket sales revenues in the second quarter of 2012, as a result of lower number of tickets sold at that time due to European Footbal Championship taking place in Poland at that time. The Group’s advertising revenues, during the first three quarters of 2012, decreased by 9.2% yoy to PLN 467.1 million. The revenues from copy sales stood at PLN 115.7 million (down by 18.9% yoy), mainly as a result of lower copy sales of Gazeta

Wyborcza and books published by Special Projects division. The revenues from other sales increased by 9.7% yoy to PLN 150.5 million, mainly as a result of higher sales of printing services for external clients.

In the period from January to September of 2012, Gazeta’s advertising sales reached PLN 153.5 million (down by

19.0% yoy). Gazeta’s copy sales revenues decreased by 17.0% yoy to PLN 80.8 million. After nine months of

2012, Gazeta sold 258.8 thousand copies on average and its share in the advertising expenditure in dailies amounted to over 37%. In the third quarter of 2012, it amounted to over 36% and remained flat yoy [4].

In the period from January to September of 2012, the advertising sales in the Free Press division amounted to

PLN 20.1 million and decreased by 8.2% yoy, mainly as a result of 21.6% yoy decrease in the third quarter of

2012. The share of Agora’s free newspaper in dailies ad spend after the first three quarters of 2012 increased by over 0.5 pp and reached almost 5% [3]. During the discussed period of time, the division achieved a positive result (EBIT) of PLN 1.8 million, which was lower than in the same period of 2011 [1]. This is a consequence of good results achieved by the division in the first quarter of 2012 and cost savings measures implemented in the second quarter of 2012.

In the first three quarters of 2012, revenues of the Internet segment amounted to PLN 82.7 million and increased by 1.6% yoy, mainly due to their growth by 8.5% yoy in the second quarter of 2012. In the period

[ w w w . a g o r a . p l ] Page 4

Management Discussion and Analysis for the third quarter of 2012 translation only from January to September of 2012, due to the revenue growth and cost saving measures, segment improved its operating result EBIT to PLN 4.3 million [1], despite the cost related to group lay-offs which burdened the segment’s results in the third quarter of 2012 with the amount of PLN 1.2 million. If the effect of lay-off cost was excluded, the operating result of the segment would be even better and it would amount to PLN 5.5 million [1].

In September 2012, the reach of online services from Gazeta.pl group amounted to 58.7% and made it the third most popular Internet portal. The number of its users reached 11.4 million people [6].

In the period from January to September of 2012, the revenues of the cinema segment decreased by 0.4% yoy and amounted to PLN 143.1 million. In the discussed period of time, the segment’s results were negatively affected by European Football Championship due to which lower number of tickets to the cinemas were sold in the second quarter of 2012. The number of tickets sold in Helios cinemas after the first three quarters of 2012 decreased by nearly 8.1% yoy to 5.4 million tickets, which resulted in lower revenues from ticket sales and from food and beverages sales in bars operated in cinemas. Segment noted an operating result EBIT of PLN 1.2 million which was lower yoy. In the third quarter of 2012, due to the dynamic growth of revenues, the segment improved its operating results EBIT to PLN 3.6 million and operating EBITDA to PLN 8.7 million.

After nine months of 2012, revenues of the AMS group decreased by 8.4% yoy to PLN 115.4 million, mainly as a result of 20.2% yoy decrease noted in the second quarter of 2012 due to the European Football Championship organized in Poland and in Ukraine. The segment noted an operating loss on the EBIT level of PLN 0.2 million. In the period of January-September 2012, AMS group’s share in outdoor advertising market decreased slightly

(down by 0.5pp) to almost 29.0% and it reached over 31.5% in the third quarter of 2012 [8]. In the period of

January – September 2012, the value of outdoor advertising market in Poland decreased by over 6% yoy [8].

In the period from January to September of 2012, the Radio segment revenues grew by 2.4% yoy to PLN 63.5 million. The segment’s operating cost increased by 6.7% yoy, mainly due to higher outlays for air time purchase in the third party radio stations. The segment noted an operating loss (EBIT) of PLN 0.3 million, mainly as a result of the operating loss in the amount of PLN 0.9 million in the third quarter of 2012 [1].

In the first three quarters of 2012, revenues of the magazine business reached PLN 50.1 million and dropped by

11.2% yoy. The segment achieved a positive result at the level of EBIT and operating EBITDA of PLN 2.7 million and PLN 2.9 million [1].

After the first three quarters of 2012, total net operating cost of the Group decreased by 1.8% yoy and reached

PLN 839.0 million, despite the cost of group lay-offs in Agora S.A., which burdened the Group’s results with the amount of PLN 9.2 million. This cost decline results mainly from 26.8% yoy drop in marketing and promotion expenditure and lower yoy non-cash expense relating to share-based payments. Cost reductions were also observed in the cost of raw materials, energy and consumables as well as in the cost of amortization and depreciation, mainly due to the drops in these cost categories in the second quarter of 2012.

In the period from January to September of 2012, operating EBITDA of the Group decreased yoy to PLN 61.6 million. As a result of operating loss booked in the third quarter of 2012, in the amount of PLN 10.1 million, the

Group noted an operating loss (EBIT) of PLN 10.0 and net loss of PLN 8.7 million after the first three quarters of

2012. At that time, the operating loss attributable to the equity holders of the parent amounted to PLN 8.9 million. In the third quarter of 2012, the net loss of the Group amounted to PLN 8.3 million and the Group’s net profit attributable to the equity holders of the parent amounted to PLN 8.7 million. These results were also affected by, inter alia, cost related to group lay-offs in Agora S.A. in the amount of PLN 9.2 million, which burdened the Group’s results in the third quarter of 2012.

Excluding the cost of the group lay-offs, which burdened the Group’s result in the third quarter of 2012 with the amount of PLN 9.2 million, operating EBITDA of the Group, after the first three quarters of 2012, would amount to PLN 70.8 million and the operating loss (EBIT) would be at the level of PLN 0.8 million. The Group would note a net loss of PLN 1.2 million after the first three quarters of 2012 and of PLN 0.8 million in the third quarter of

2012.

At the end of September 2012, the Group’s cash and short-term monetary assets amounted to PLN 219.1 million, out of which PLN 96.6 million in cash and cash equivalents and PLN 122.5 million in short-term securities.

At the end of September 2012, the Group’s debt amounted to PLN 194.6 million (including: bank credits, loans and finance lease liabilities in Helios group amounting to PLN 107.7 million).

[ w w w . a g o r a . p l ] Page 5

Management Discussion and Analysis for the third quarter of 2012 translation only

II. EXTERNAL AND INTERNAL FACTORS IMPORTANT FOR THE DEVELOPMENT

OF THE GROUP

1. EXTERNAL FACTORS

1.1 Advertising market [3]

According to the Agora’s estimates, based on public data sources, in the third quarter of 2012, total advertising spending in Poland amounted to ca PLN 1.55 billion and decreased by over 6.5% yoy.

At that time advertisers limited their expenditure in all media except for Internet and cinema.

The largest drops of advertising expenditure were visible in dailies (down by over 21.5% yoy), whereas in magazines these drops were on the level of almost 14% yoy.

Advertisers limited their advertising budgets in outdoor by over 17.5% yoy in the third quarter of 2012. It has been the largest reduction of advertising budgets observed in this medium this year.

In radio, advertisers limited their expenditure by over 10% yoy and it has been also the worst quarter for radio advertising expenditure this year.

Moreover, advertisers cut their advertising expenditure in TV by over 6% yoy.

Advertising expenditure in Internet grew by almost 11% yoy, mainly as a result of growing expenditure in search engines. In the third quarter of 2012, advertisers increased their expenditure in cinemas by over 6% yoy.

As a result of limited advertising expenditure in all three quarters of 2012, the value of total advertising expenditure in Poland in the period from January to September 2012 decreased by over 4.5% yoy.

The only segments that noted a growth of advertising expenditure in the first three quarters of 2012 in Poland were

Internet and cinema. Advertising expenditure in cinema grew by 11.5% yoy and in Internet by almost 10% yoy. The third quarter of 2012 brought about further cuts in advertising outlays in press and in TV. Due to these trends, in the period of January – September 2012, the value of advertising budgets in dailies decreased by almost 19.5% yoy, in magazines by 10.5% yoy and in TV by nearly 5.5% yoy.

A consecutive quarter of limited advertising expenditure in outdoor advertising resulted in over 6% yoy drop in the value of outdoor advertising in Poland after the first three quarters of 2012.

As a result of deepening reductions of advertising expenditure in radio stations the value of total radio advertising expenditure decreased in the first three quarters of 2012 by over 5.5% yoy.

The Company would like to stress that one should bear in mind that these advertising market estimations may represent some margin of error due to significant discount pressure on the market and lack of reliable data on average market discount rates. Once the Company has a more reliable market data in consecutive quarters, it may correct the ad spending estimations in particular media in subsequent reports.

2. INTERNAL FACTORS

2.1. Revenue

In the third quarter of 2012, the Group recorded a 6.7% yoy decrease of sales revenues to PLN 264.6 million. Cinema segment was the only one to record revenue growth.

At that time, the Group’s advertising sales decreased by 12.6% yoy and amounted to PLN 142.0 million. This drop results mainly from lower, by PLN 11.9 million, yoy advertising revenues in Gazeta Wyborcza. Lower advertising revenues were also observed in Radio, Magazine and Outdoor segments.

In the third quarter of 2012, the segments that noted a growth in advertising revenue included Internet and Cinema.

Advertising revenues in Internet segment grew by 7.8% yoy. In the Cinema segment the value of advertising sales increased to PLN 3.7 million.

[ w w w . a g o r a . p l ] Page 6

Management Discussion and Analysis for the third quarter of 2012 translation only

In the third quarter of 2012, the Group’s total revenues from the copy sales amounted to PLN 34.7 million and went down by 18.0% yoy. The main reason for this decrease are lower revenues from the copy sales of Gazeta Wyborcza

(down by 20.3% yoy) resulting from the lower number of newspaper copies sold and lower sales of more expensive editions (so-called dual pricing offer). In the Magazine segment, the revenues from the copies sold decreased by

6.8% yoy to PLN 6.9 million as a result of lower number of copies sold and cover price decrease in selected magazines.

In the third quarter of 2012, the revenues from tickets sold in the cinemas composing the Helios network increased by 5.2% yoy and amounted to PLN 36.6 million. In the discussed period of time, people bought nearly 2.1 million cinema tickets in the Helios network, i.e. 12.5% more than in the third quarter of 2011.

Other revenues amounted to PLN 51.3 million and increased by 16.3% yoy. The main contributor were higher by

21.1% yoy revenues from the sales of printing services to external clients and higher sales of food and beverages in the cinemas from Helios network.

After the first three quarters of 2012, the Group’s total revenues decreased by 7.8% yoy to PLN 829.0 million, mainly as a result of 11.3% yoy drop noted in the second quarter of 2012.

In the period of January – September 2012, advertising sales of the Group decreased by 9.2% yoy and amounted to

PLN 467.1 million with the largest drops observed in Newspapers and Outdoor segments.

At the same time, advertising revenue grew in Internet segment by 12.0% yoy to PLN 64.3 million, in Radio segment by 1.5% yoy to PLN 61.9 million, mainly due to higher revenues from brokerage services in the third party radio stations and in Cinema segment due to the cooperation with other business segments in the Group.

In the period of January – September 2012, the Group’s total revenues from the copy sales decreased by 18.9% yoy to PLN 115.7 million. The main reasons for this decrease include lower copy sales of press titles, smaller number of more expensive editions (dual pricing offer), lower number of book collections published by Special Projects division and price decrease of selected press titles. In the discussed period of time, the revenues from the copy sales in

Gazeta Wyborcza decreased by 17.0% yoy and in the Magazine segment by 10.7% yoy.

In the period of January - September 2012, the revenues from tickets sold in the cinemas composing the Helios network amounted to PLN 95.7 million and decreased by 8.2% yoy. In the discussed period of time people bought

5.4 million cinema tickets in the Helios network, i.e. 8.1% yoy less than at the same time of 2011.

In the first three quarters of 2012, other revenues increased by 9.7% yoy to PLN 150.5 million, mainly as a result of growth observed in the first and third quarter of 2012 related to the increase in the sales of printing services to external clients. Revenues from the sales of book collections published by Special Projects division and from the sales of food and beverages in the cinemas from Helios network were lower yoy.

2.2. Operating cost

Total net operating cost of the Group, in the first three quarters of 2012, reached PLN 839.0 million and decreased by 1.8% yoy, despite the cost related to group lay-offs, which burdened the Group’s results in the third quarter of

2012 with the amount of PLN 9.2 million. This was possible due to its methodical decrease in each of previously reported quarters of 2012. In the third quarter of 2012, after excluding the cost related to group lay-offs, the

Group’s net operating cost would decrease by 3.7% yoy and would amount to PLN 265.5 million.

The Group’s staff cost (excluding non-cash cost of share-based payments and cost related to group lay-offs in Agora

S.A. which burdened the Group’s results in the third quarter of 2012 with the amount of PLN 9.2 million) increased by 0.6% yoy in the first three quarters of 2012. In the third quarter of 2012, the staff cost decreased by 2.1% yoy.

The largest drop of staff cost was observed in the Newspapers segment.

The Group’s headcount, at the end of September 2012, was 3,347 employees and was lower by 145 FTEs than at the end of September 2011.

Total non – cash expense relating to share - based payments (described in note 5A to the condensed interim consolidated financial statements of the Agora Group) charged to the Group’s profit and loss account after the first three quarters of 2012 amounted to PLN 1.8 million.

The Group offers its employees other incentive plans (for example: cash motivation plans, incentive plans in sales departments etc.), which cost is charged to the Group’s staff cost. Since the fourth quarter of 2010, the Group’s operating result is burdened quarterly by the cost of Three-Year-Long Incentive Plan for the Management Board

[ w w w . a g o r a . p l ] Page 7

Management Discussion and Analysis for the third quarter of 2012 translation only members and higher managerial personnel (described in note 5B to the condensed interim consolidated financial statements of the Agora Group). In the period January - September of 2012, this cost amounted to PLN 0.7 million and in the third quarter of 2012 to PLN 0.2 million.

The cost of external services in the first three quarters of 2012 increased by 1.5% yoy and amounted to PLN 260.1 million. This growth results, inter alia, from the higher cost of purchased aerial time in the third party radio stations and higher cost of sales of brokerage services. Higher cost of space rental for outdoor panels and cinema space rentals also contributed to the growth of this cost position. In the third quarter of 2012, this cost position increased by 1.8% yoy mainly due to higher rental cost for outdoor panels and cost of film copies purchase. In the period

January - September 2012, the cost of film copies purchase was lower due to smaller number of film premiers in the cinemas, mainly in the second quarter of 2012, due to the European Football Championship in Poland.

In the first three quarters of 2012, cost of raw materials, energy and consumables decreased by 2.5% yoy to PLN

179.5 million, as a result of 8.2% yoy decrease in the second quarter and 4.0% yoy decrease in the third quarter of

2012. The drop in this cost position in the second and in the third quarter of 2012 stems mainly from the decrease in the cost of consumables due to lower production cost of book series in Special Projects division as a result of lower number of projects yoy.

In the first three quarters of 2012, promotion and marketing expense was PLN 59.8 million and decreased by 26.8% yoy. In the third quarter of 2012, the Group’s advertising expenditure decreased by 35.4% yoy to PLN 17.3 million.

The largest decrease in promotion and marketing expense took place in Newspapers’ segment in each of - so far - reported quarters of 2012. In the period of January – September 2012, the increase of promotion and marketing expenditure was observed in Cinema, Magazines and Outdoor segments.

3. PROSPECTS

3.1. Advertising market

Taking into account deteriorating conditions in macroeconomic and advertising environments, the Company decided to verify again its estimates of the advertising market in Poland in 2012. Having conducted a thourough analysis of the Polish advertising market after the first three quarters of 2012 and till the date of publication of this report, the

Company estimates that the value of the Polish advertising market may decrease by 3-6% yoy in 2012.

One of the reasons to decrease the estimates of advertising expenditure in Poland in 2012 was, inter alia, a large decrease, by over 17.5% yoy, in outdoor advertising in the third quarter of 2012. This also forced the Company to review its estimates for total outdoor advertising expenditure in 2012. Currently, the Company estimates that the value of outdoor advertising in Poland in 2012 shall decrease by 4-7% yoy.

Other medium that noted, larger than estimated by the Company, drop of advertising expenditure was radio. Due to over 10% yoy decrease in radio advertising expenditure in the third quarter of 2012, the Company verified its estimates of advertising expenditure in this medium in 2012. Currently, the Company is of the opinion that the value of radio advertising shall decrease by 5-8% yoy.

Moreover, based on the available data, the Company decided to verify its estimates of TV advertising. According to the Company’s opinion the value of TV advertising shall decrease by ca. 5-8% yoy.

Cinema advertising performed better than expected. After the first three quarters of 2012, the value of cinema advertising grew by almost 11.5% yoy. As a result, the Company increased its estimates of cinema advertising expenditure in 2012 and right now according to the Company’s estimates, advertisers will spend 3-6% yoy more on the cinema advertising.

According to the Company’s estimates advertisers shall further reduce their advertising expenditure in Press. The value of advertising expenditure in dailies shall decrease by ca 17-20% yoy. In magazines, the reduction of advertising budgets may be deeper than previously estimated and reach ca 9-12% yoy.

In case of Internet, the Company decided to preserve its estimates of advertising expenditure growth in 2012 at the level of 8-11%.

The Company would like to stress that one should bear in mind that these advertising market estimations may represent some margin of error due to significant discount pressure on the market, lack of reliable data on the

[ w w w . a g o r a . p l ] Page 8

Management Discussion and Analysis for the third quarter of 2012 translation only average market discount rate and ongoing change in the way of media consumption and short span of time in planning advertising campaigns.

3.2. Operating cost

In the last quarter of 2012, the Group plans to further decrease its operating cost base, inter alia, through group layoffs executed in Agora S.A. and strict cost control policy. Due to the worsening situation on the advertising market, the Group manages its operating cost base in a flexible manner in order to be able to meet the market conditions in its business segments.

3.2.1 Cost of external services

The cost of external services shall be dependent on the cost of film copies for the cinema business, EUR/PLN exchange rate and cost of brokerage services. Additionally, this cost position may increase due to the planned openings of new cinemas in the fourth quarter of 2012.

3.2.2 Staff cost

Taking into account weakening condition of the advertising market and dynamic changes in media environment, the

Group adapts its scale of operation to market conditions in particular business segments. Since September 10th,

2012, Agora S.A. has been in the process of group lay-offs, which will affect up to 250 people and will last till January

31st, 2013. Due to this process, the cost of PLN 9.2 million was charged to the Company’s and the Group’s profit and loss account in the third quarter of 2012.

It should be also remembered that the staff cost can be influenced by the execution of development projects within the Group (including openings of new cinemas) and provisions for motivation plans (described in note 5 to the condensed interim consolidated financial statements of the Agora Group).

3.2.3 Non – cash expense relating to share - based payments

Estimated total cost related to share – based incentive plans to be charged to the Group’s 2012 profit and loss account shall amount to PLN 2.6 million. It should be noted, however, that this amount includes estimated cost of execution of incentive plan but the Company does not in fact know the number of certificates to be purchased by employees pursuant to the future plan, or the stock price of Agora’s shares at that accounting period. Hence, for purposes of providing an estimate, the Company assumed that these values will be equivalent to those on which the fourth quarter 2011 calculations were based. The cost of incentive plans are reflected in the Group’s P&L according to the accounting rules referred to in note 5A to the condensed interim consolidated financial statements in this report. Pursuant to these rules, share‐based compensation cost will be charged unevenly throughout the year. In the first half of 2012, the Group’s P&L was affected by PLN 1.8 million of outstanding non‐cash incentive compensation.

The cost of new incentive plan of PLN 0.8 million will be reflected in the Group’s P&L in the fourth quarter of 2012.

3.2.4 Promotion and marketing cost

Due to the market situation and limited number of promotional campaigns within the Agora Group’s segments, the promotion and marketing cost decreased from January to September of 2012 by 26.8% yoy and in the third quarter of 2012 by 35.4% yoy. The Group does not intend to intensify its promotional and marketing activities in the last quarter of 2012. However, it should be remembered that the level of promotion and marketing expense depends on the dynamics of particular media development, as well as the number of projects (including book series) and the market activities and projects of the Group’s competitors.

3.2.5 Cost of raw materials and energy

In the first three quarters of 2012, the cost of materials and energy increased, mainly as a result of growth noted in the first quarter of 2012. This cost category was influenced, inter alia, by the increased volume of production for external clients and growing prices of energy. In the third quarter of 2012 this cost decreased. The level of this cost in the fourth quarter of 2012 will be dependent mainly on the price of newsprint, the volume of production and

EUR/PLN exchange rate.

[ w w w . a g o r a . p l ] Page 9

Management Discussion and Analysis for the third quarter of 2012

3.3. The Group’s main objectives in 2012

translation only

Due to the worsening condition of the advertising market, in the fourth quarter of 2012, the Group shall concentrate its efforts on decreasing the operating cost base in order to adapt the Group’s mode of operation and structure to the market situation and changes taking place in media.

Additionally, the Group activities shall focus on continuation of its main objectives for 2012 including, inter alia:

(i) intensification of actions strengthening the synergies among different segments from the Group’s portfolio as well as actions taking advantage of the Internet to develop new forms and scope of activities in the so – called traditional media segments;

(ii) intense growth of both Internet segment and widely understood Internet in the Agora Group;

(iii) developing in the cinema business by opening new cinemas;

(iv) increasing the scale of the Group’s operations, also, through further acquisitions strengthening the Group’s position and/or diversifying the sources of the Group’s revenues.

[ w w w . a g o r a . p l ] Page 10

Management Discussion and Analysis for the third quarter of 2012

III. FINANCIAL RESULTS

translation only

1. THE AGORA GROUP

The consolidated financial statements of the Agora Group for the third quarter of 2012 include: Agora S.A., Agora

Poligrafia Sp. z o.o., AMS S.A. group (“AMS group”), Agora TC Sp. z o.o., Trader.com (Polska) Sp. z o.o., AdTaily Sp. z o.o., Sport4People Sp. z o.o., 4 subsidiaries of the radio business, Helios S.A. and Next Film Sp. z o.o. operating in the cinema business, the Ukrainian company LLC Agora Ukraine, jointly controlled entity Business Ad Network Sp. z o.o. as well as two associated companies A2 Multimedia (till January 31, 2012) and GoldenLine Sp. z o.o.

A detailed list of companies of the Agora Group is presented in the note 12 and selected financial data together with translation into EURO are presented in notes 18 and 20 to the financial statements in this report.

2. PROFIT AND LOSS ACCOUNT OF THE AGORA GROUP

Tab. 1 in PLN million 3Q 2012 3Q 2011

% change yoy

1-3Q

2012

1-3Q

2011

% change yoy

Total sales (1)

Advertising revenue

Copy sales

Ticket sales

Other

Operating cost net, including:

Raw materials, energy and consumables

D&A

External services

Staff cost (2)

Non-cash expense relating to share-based payments

264.6

142.0

34.7

36.6

(55.2)

(23.1)

(86.0)

(75.0)

-

283.6

(57.5)

-

(6.7%)

162.4 (12.6%)

42.3

34.8

51.3 44.1

(274.7) (275.7)

(22.4)

(84.5)

(76.6)

(18.0%)

5.2%

16.3%

(0.4%)

(4.0%)

829.0

467.1

115.7

95.7

150.5

(839.0)

(179.5)

3.1% (69.8)

1.8% (260.1)

(2.1%) (234.2)

- (1.8)

Promotion and marketing

Cost of group lay-offs

Operating result - EBIT

Finance cost, net, incl.:

Revenue from short-term investment

Interest on bank loans, borrowings, finance lease and similar items

Foreign exchange (losses) / gains

Share of results of equity accounted investees

Profit/(loss) before income tax

Income tax

Net profit/(loss) for the period

Attributable to:

Equity holders of the parent

Non - controlling interest

(17.3)

(9.2)

(10.1)

0.5

3.3

(3.2)

0.5

(0.1)

(9.7)

1.4

(8.3)

(8.7)

0.3

(26.8) (35.4%)

- -

7.9

(0.3)

3.2

-

-

3.1%

(3.9) (17.9%)

- -

(0.1) -

7.5 -

(2.0)

5.5

-

-

-

5.4

0.1 200.0%

(59.8)

(9.2)

(10.0)

1.3

9.7

(9.8)

0.7

(0.2)

(8.9)

0.2

(8.7)

(8.9)

0.2

898.7

514.5

(7.8%)

(9.2%)

142.7 (18.9%)

104.3 (8.2%)

137.2

(854.2)

9.7%

(1.8%)

(184.1)

(70.3)

(256.2)

(232.7)

(2.5%)

(0.7%)

1.5%

0.6%

(8.8)

(81.7)

-

(79.5%)

(26.8%)

-

44.5

(0.5)

10.8 (10.2%)

-

-

(11.6) (15.5%)

(0.3) -

(0.1) 100.0%

43.9 -

(9.8)

34.1

33.2

0.9 (77.8%)

-

-

-

[ w w w . a g o r a . p l ] Page 11

Management Discussion and Analysis for the third quarter of 2012 translation only in PLN million 3Q 2012 3Q 2011

% change yoy

1-3Q

2012

1-3Q

2011

% change yoy

EBIT margin (EBIT/Sales)

EBITDA

EBITDA margin (EBITDA/Sales)

Operating EBITDA (3)

Operating EBITDA margin (Operating

EBITDA/Sales)

EBIT excluding cost of group lay-offs

EBIT margin excluding group lay-offs

EBITDA excluding group lay-offs

(3.8%)

13.0

4.9%

13.0

4.9%

(0.9)

(0.3%)

22.2

2.8% (6.6pp) (1.21%)

30.3 (57.1%) 59.8

10.7% (5.8pp)

30.3 (57.1%)

7.2%

61.6

10.7% (5.8pp) 7.4%

7.9

2.8% (3.1pp)

-

30.3 (26.7%)

(0.8)

(0.1%)

69.0

5.0% (6.2pp)

114.8 (47.9%)

12.8% (5.6pp)

123.6 (50.2%)

13.8% (6.4pp)

44.5

5.0% (5.1pp)

114.8

-

(39.9%)

EBITDA margin excluding group lay-offs 8.4% 10.7% (2.3pp) 8.3% 12.8% (4.5pp)

Operating EBITDA (3) excluding group layoffs

Operating EBITDA margin (3) excluding group lay-offs

22.2

8.4%

30.3 (26.7%)

10.7% (2.3pp)

70.8

8.5%

123.6 (42.7%)

13.8% (5.3pp)

Net profit / (loss) for the period excluding group lay-offs (0.8) 5.5 - (1.2) 34.1

(1) particular sales positions include sales of Special Projects (with book collections), described in details in point IV.A in this report;

(2) excluding non-cash cost of share-based payments and cost related to group lay-offs in Agora S.A.;

(3) excluding non-cash cost of share-based payments.

-

[ w w w . a g o r a . p l ] Page 12

Management Discussion and Analysis for the third quarter of 2012 translation only

2.1. Financial results presented according to major segments of the Agora Group for the first three quarters of 2012

Major products and services, as well as operating revenue and cost of the Agora Group are presented in detail in part IV of this MD&A (“Operating review – major segments of the Agora Group”).

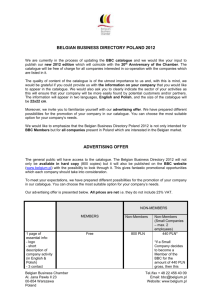

Tab. 2 in PLN million

News- papers

Internet Cinema Outdoor Radio Magazines

Matching positions

(3)

Total

(consoli- dated)

1-3Q 2012

Total sales (4)

% share

Operating cost net

(4)

EBIT

Finance cost, net

Share of results of equity accounted investees

Income tax

Net loss

Attributable to:

Equity holders of the parent

Non-controlling interest

EBITDA

Operating EBITDA (1)

388.7

46.9%

(342.9)

45.8

82.7

10.0%

(78.4)

4.3

144.0

17.4%

(142.2)

1.8

115.4

13.9%

(115.6)

(0.2)

63.5

7.7%

(63.8)

(0.3)

50.1

6.0%

(47.4)

2.7

(15.4)

(1.9%)

(48.7)

(64.1)

829.0

100.0%

(839.0)

(10.0)

1.3

(0.2)

0.2

(8.7)

(8.9)

66.7

67.5

8.5

8.6

16.2

16.2

13.4

13.5

1.7

1.8

2.8

2.9

(49.5)

(48.9)

0.2

59.8

61.6

CAPEX (2) (14.1) (5.0) (40.4) (7.3) (3.2) (0.2) (3.3) (73.5)

(1) excluding non-cash cost of share-based payments;

(2) based on invoices booked in the period; in the Cinema segment includes also PLN 11.9 million of non-current assets in lease;

(3) matching positions show data not included in particular segments, inter alia: other revenues and costs of Agora’s support divisions and the Management Board of Agora S.A., Agora TC Sp. z o.o., intercompany eliminations and other matching adjustments which reconcile the data presented in the management reports to the consolidated financials of the Agora Group;

(4) the amounts do not include revenues and total cost of cross-promotion of Agora’s different media if such promotion is executed without prior reservation between segments of the Agora Group; the direct variable cost of campaigns carried out on advertising panels is the only cost that is included above; it is allocated from the Outdoor segment to other segments.

[ w w w . a g o r a . p l ] Page 13

Management Discussion and Analysis for the third quarter of 2012

2.2. Finance cost, net

translation only

Net financial activities of the Group in the first three quarters of 2012 were affected mainly by income from investing short-term monetary assets, foreign exchange gains and losses as well as bank commissions and interest on the bank loans and lease liabilities.

3. BALANCE SHEET OF THE AGORA GROUP

Tab. 3 in PLN million 30-09-2012 30-06-2012

% change to

30-06-2012

31-12-2011 30-09-2011

Non-current assets share in balance sheet total

Current assets share in balance sheet total

TOTAL ASSETS

Equity holders of the parent share in balance sheet total

Non-controlling interest share in balance sheet total

Non-current liabilities and provisions share in balance sheet total

Current liabilities and provisions share in balance sheet total

TOTAL LIABILITIES AND EQUITY

3.1. Non-current assets

1,215.3

71.8%

476.9

28.2%

1,692.2

1,187.7

70.1%

17.0

1.0%

183.7

10.9%

303.8

18.0%

1,692.2

1,206.2 0.8%

68.5% 3.3pp

554.8 (14.0%)

31.5% (3.3pp)

1,761.0 (3.9%)

1,196.6 (0.74%)

68.0% 2.1pp

16.6 2.4%

0.9% 0.1pp

193.7 (5.2%)

11.0% (0.1pp)

354.1 (14.2%)

20.1% (2.1pp)

1,761.0 (3.9%)

1,203.3

66.7%

600.4

33.3%

1,803.7

1,246.1

69.1%

17.3

1.0%

221.3

12.3%

319.0

17.6%

1,803.7

The increase in non-current assets versus 30 June 2012 stems mainly from investments in property, plant and equipment and intangibles (mainly new cinemas in Helios network).

3.2. Current assets

The decrease in current assets versus 30 June 2012 results mainly from the decrease in short-term securities, cash and cash equivalents.

3.3. Non-current liabilities and provisions

The decrease of non-current liabilities and provisions versus 30 June 2012 stems mainly from the decrease of bank and other borrowings, including financial lease liabilities, by PLN 5.4 million (where PLN 8.7 million stems from the decrease in borrowings of Agora S.A.).

3.4. Current liabilities and provisions

The decrease in current liabilities and provisions versus 30 June 2012 was caused mainly by the decrease of dividend liability (PLN 50.9 million).

1,193.1

67.2%

581.2

32.8%

1,774.3

1,237.7

69.8%

16.0

0.9%

226.0

12.7%

294.6

16.6%

1,774.3

[ w w w . a g o r a . p l ] Page 14

Management Discussion and Analysis for the third quarter of 2012

4. CASH FLOW STATEMENT OF THE AGORA GROUP

translation only in PLN million 3Q 2012 3Q 2011

% change yoy

1-3Q

2012

1-3Q

2011

Tab. 4

% change yoy

Net cash from operating activities 21.3 50.0 (57.4%) 59.4 106.0 (44.0%)

Net cash from investment activities 29.4 (21.4) - 12.9 (89.3) -

Net cash from financing activities (59.8) (43.9) 36.2% (101.2) (82.1) 23.3%

Total movement of cash and cash equivalents

Cash and cash equivalents at the end of period

(9.1)

96.6

(15.3)

117.0

(40.5%)

(17.4%)

(28.9)

96.6

(65.4)

117.0

(55.8%)

(17.4%)

As at 30 September 2012, the Agora Group had PLN 219.1 million in cash and in short-term monetary assets, of which PLN 96.6 million was in cash and cash equivalents (cash, bank accounts and bank deposits) and PLN 122.5 million in short-term securities.

Agora S.A. has not been in the first three quarters of 2012 engaged in any currency option instruments or other derivatives (used for hedging or speculative ones).

On May 25, 2012, the Company executed annex no. 13 (the “Annex 13”) to the loan agreement with the Bank Pekao

S.A. On the basis of the Annex 13 signed, the Company has the credit line in the amount of PLN 150 million, which may be used by May 31, 2012. In the first three quarters of 2012, Agora S.A. repaid three installments of the credit line used in previous years.

As at the date of this consolidated quarterly report, considering the cash position and available credit facility, the

Agora Group does not anticipate any liquidity problems with regards to its further investment plans (including capital investments).

4.1. Operating activities

In the first three quarters of 2012, the net cash inflows from operating activities were lower yoy mainly due to operating loss noted in the described period in the amount of PLN 10.0 million.

4.2. Investment activities

Net inflow from investing activities in the first three quarters of 2012 results mainly from the sale of short-term securities.

4.3. Financing activities

In the first three quarters of 2012, the net cash from financing activities included mainly repayments and drawings of bank loans by Helios S.A., financial lease payments and repayments of the credit line by Agora S.A. Additionallly,

Agora S.A. paid a dividend to its shareholders in the amount of PLN 50.9 million.

[ w w w . a g o r a . p l ] Page 15

Management Discussion and Analysis for the third quarter of 2012

5. SELECTED FINANCIAL RATIOS [5]

translation only

3Q 2012 3Q 2011

% change yoy

1-3Q

2012

Tab. 5

1-3Q

2011

% change yoy

Profitability ratios

Net profit margin

Gross profit margin

Return on equity

Efficiency ratios

Inventory turnover

Debtors days

Creditors days

Liquidity ratio

Current ratio

(3.3%)

26.8%

(2.9%)

1.9% (5.2pp) (1.10%)

11 days 12 days

70 days 66 days

41 days 44 days

1.6

34.0% (7.2pp)

1.8% (4.7pp)

29.2%

(1.00%)

3.7% (4.8pp)

35.6% (6.4pp)

3.6% (4.6pp)

(8.3%) 12 days 12 days

6.1% 66 days 61 days

(6.8%)

2.0 (20.0%)

43 days

1.6

Financing ratios

Gearing ratio (1)

Interest cover

-

(3.3)

-

2.3

-

-

-

(1.1)

Free cash flow interest cover (0.8) 7.5 -

(1) as at 30 September 2012 and 30 September 2011 the Group had net cash position.

(2.0)

46 days

2.0

-

4.2

5.2

-

8.2%

(6.5%)

(20.0%)

-

-

-

Definitions of financial ratios [5] are presented at the end of part IV of this MD&A ("Operating review – major segments of the Agora Group").

[ w w w . a g o r a . p l ] Page 16

Management Discussion and Analysis for the third quarter of 2012 translation only

IV. OPERATING REVIEW - MAJOR SEGMENTS OF THE AGORA GROUP

IV.A. NEWSPAPERS [1]

The Newspapers segment includes the pro-forma consolidated financials of Gazeta Wyborcza, Metro, Special

Projects, Agora’s Printing Department and Agora Poligrafia Sp. z o.o.

Tab. 6 in PLN million 3Q 2012 3Q 2011

% change yoy

1-3Q

2012

1-3Q

2011

% change yoy

Total sales

Copy sales (1) incl. Gazeta Wyborcza

Advertising revenue (1), (2)

incl. Gazeta Wyborcza (3) incl. Metro (4)

Special Projects (including book collections)

Other revenue

Total operating cost, including

Raw materials, energy, consumables and printing services

Staff cost (5)

Non-cash expense relating to share-based payments

D&A

Promotion and marketing (2) (6)

Cost of group lay-offs

EBIT

EBIT margin

EBITDA

EBITDA margin

Operating EBITDA (7)

Operating EBITDA margin

EBIT excluding cost of group lay-offs

EBIT margin excluding group lay-offs

EBITDA excluding group lay-offs

EBITDA margin excluding group lay-offs

Operating EBITDA (7) excluding group layoffs

Operating EBITDA margin excluding group lay-offs

116.7

26.2

25.2

53.8

45.4

5.8

5.6

31.1

(109.5)

(43.2)

(31.4)

-

(6.6)

(9.6)

(6.0)

7.2

6.2%

13.8

11.8%

13.8

11.8%

13.2

11.3%

19.8

17.0%

19.8

17.0%

132.9

32.3

31.6

67.8

57.3

7.4

6.1

26.7

(113.7)

(46.0)

(33.1)

-

(12.2%)

(18.9%)

(20.3%)

(20.6%)

(20.8%)

(21.6%)

(8.2%)

16.5%

(3.7%)

(6.1%)

(5.1%)

-

(6.6) -

(14.9) (35.6%)

- -

19.2 (62.5%)

14.4% (8.2pp)

25.8 (46.5%)

19.4% (7.6pp)

25.8 (46.5%)

19.4% (7.6pp)

19.2 (31.3%)

14.4% (3.1pp)

25.8 (23.3%)

19.4% (2.4pp)

25.8 (23.3%)

19.4% (2.4pp)

388.7

84.1

80.8

183.8

153.5

20.1

21.9

98.9

(342.9)

(147.1)

(98.1)

(0.8)

(20.9)

(32.6)

(6.0)

45.8

11.8%

66.7

17.2%

67.5

17.4%

51.8

13.3%

72.7

18.7%

73.5

18.9%

436.8 (11.0%)

100.5 (16.3%)

97.3 (17.0%)

220.0 (16.5%)

189.5

21.9

38.2

78.1

(366.4)

(150.5)

(100.1)

(3.9)

(22.5)

-

70.4

(19.0%)

(8.2%)

(42.7%)

26.6%

(6.4%)

(2.3%)

(2.0%)

(79.5%)

(7.1%)

(48.2) (32.4%)

-

(34.9%)

16.1% (4.3pp)

92.9 (28.2%)

21.3% (4.1pp)

96.8 (30.3%)

22.2% (4.8pp)

70.4 (26.4%)

16.1% (2.8pp)

92.9 (21.7%)

21.3% (2.6pp)

96.8 (24.1%)

22.2% (3.3pp)

(1) excluding revenues from Special Projects;

(2) the amounts do not include revenues and total cost of cross-promotion of different media between the Agora

Group segments (only direct variable cost of campaigns carried out on advertising panels) if such promotion is executed without prior reservation;

[ w w w . a g o r a . p l ] Page 17

Management Discussion and Analysis for the third quarter of 2012 translation only

(3) the amounts refer to only a portion of total revenues from dual media offers (published both in Gazeta Wyborcza, as well as on GazetaPraca.pl, GazetaDom.pl, Domiporta.pl, Komunikaty.pl verticals and Nekrologi.Wyborcza.pl website), which is allocated to the print edition of Gazeta;

(4) the amounts refer to total revenues of the Free Press Department, including revenues from Metro’s display advertising, classifieds and inserts as well as from mTarget services and Metro’s special activities;

(5) excluding non-cash cost of share-based payments and cost related to group lay-offs in Agora S.A.;

(6) the amounts include inter alia the start-up cost of new book collections (i.e. initial promotional cost in the media) and the production and promotional cost of gadgets offered with Gazeta;

(7) excluding non-cash cost of share-based payments.

In the third quarter of 2012, as a result of the diminishing expenditure in newspaper advertising and a decrease in copy sales, the operating EBITDA of the segment decreased yoy to PLN 13.8 million. The operating EBITDA margin reached 11.8% [1]. Additionally, costs related to group lay-offs in Agora S.A. burdened the segment’s results by PLN

6.0 million. Excluding these costs, the segment achieved an operating EBITDA of PLN 19.8 million and operating

EBITDA margin of 17.0% .

1. GAZETA WYBORCZA

1.1. Revenue

1.1.1. Copy sales [4]

In the third quarter of 2012, Gazeta Wyborcza maintained its leading position among the opinion-making newspapers.

In the third quarter of 2012, Gazeta sold 247 thousand copies on average (down by 16.8% yoy). In the discussed period of time, Gazeta’s revenues from copy sales decreased by 20.3% yoy.

In the third quarter of 2012, total average paid circulation of Dziennik Gazeta Prawna amounted to 73.1 thousand copies (down by 15.0% yoy). In the discussed period, total average paid circulation of Rzeczpospolita amounted to

103 thousand copies (down by 16.9% yoy), that of Fakt to 365 thousand copies (down by 8.0% yoy) and that of Super

Express to 157 thousand copies (down by 7.6% yoy).

In the third quarter of 2012, all titles of Polskapresse under Polska brand were distributed in 204 thousand copies on average (down by 13.0% yoy) [4].

1.1.2. Readership [4]

In the third quarter of 2012, the weekly readership of Gazeta Wyborcza stood at 11.4% (3.4 million readers; CCS, weekly readership index). The readership of the tabloid Fakt stood at 10.9% (3.3 million readers). Both titles held, ex aequo, the first position among nationwide dailies. During this period, Metro was read by 1.4 million people (CCS, weekly readership 4.8%) and Super Express reached on average 4.8% (1.4 million readers). This means, that as far as readership is concerned Metro and Super Express were preceded only by Gazeta Wyborcza and Fakt among national dailies. In the third quarter of 2012, the readership rate of Rzeczpospolita stood at 2.8% (nearly 0.9 million readers) and of Dziennik Gazeta Prawna at 1.8% (0.6 million readers).

1.1.3. Advertising sales [3]

In the third quarter of 2012, Gazeta’s net advertising revenue (including display advertising, classifieds and inserts) amounted to PLN 45.4 million (down by 20.8% yoy). The above figures include a portion of revenues from dualmedia advertising offers (published both in print as well as on GazetaPraca.pl, GazetaDom.pl, Domiporta.pl,

Komunikaty.pl verticals and Nekrologi.Wyborcza.pl website), which is allocated to the print edition of Gazeta

Wyborcza.

In the third quarter of 2012, the ad spend in dailies in Poland decreased by over 21.5% yoy. In the discussed period of time, Gazeta’s revenues from display advertising decreased by 22% yoy, and its estimated share in display ad spend in dailies stood at over 36% (flat yoy). In the third quarter of 2012, the share of Agora’s dailies (Gazeta and

Metro) in display ad spend in dailies remained at the same level yoy.

[ w w w . a g o r a . p l ] Page 18

Management Discussion and Analysis for the third quarter of 2012 translation only

In the third quarter of 2012, the estimated share of Dziennik Gazeta Prawna in dailies ad expenditure stood at over

3.5% (flat yoy) and that of Rzeczpospolita stood at almost 7% (down by nearly 1pp yoy). In the discussed period of time, the estimated share of Fakt in display ad spend in dailies stood at over 9.5% (up by 1pp yoy) and that of Super

Express at ca 3.5% (flat yoy).

In the third quarter of 2012, Gazeta’s share in the national newspaper ad spend amounted to over 42% (up by nearly

0.5pp yoy). During this period of time, Gazeta maintained its share in Warsaw ad spend in newspapers while the joint share of Gazeta and Metro was up by nearly 3pp yoy. At the same time, Gazeta’s share in local dailies

(excluding Warsaw) decreased by almost 0.5pp yoy, while the joint share of Gazeta and Metro remained at the same level yoy.

One should bear in mind that these advertising market estimations may represent some margin of error due to significant discount pressure on the market. Once the Company has more reliable market data, it may correct the ad spending estimations in the consecutive reporting periods.

In the third quarter of 2012, the share of ad pages in Gazeta’s total pagecount amounted to ca 30.3% (down by ca.3.7pp yoy), while the average number of paid-for ad pages published daily in all local and national editions reached ca 122 (down by ca 14% yoy).

1.1.4. Other revenues

In the third quarter of 2012, the Company’s revenues from the sales of printing services to external clients rose by

21.1% yoy, mainly due to an increase in the volume of orders.

In the first three quarters of 2012, the Company’s revenues from the sales of printing services to external clients rose by 32.6% yoy, mainly due to an increase in the volume of orders.

1.2. Cost

1.2.1 Printing cost of Gazeta Wyborcza

Tab. 7 in PLN million 3Q 2012 3Q 2011

% change yoy

1-3Q

2012

1-3Q

2011

% change yoy

Fixed cost 7.2 9.1 (20.9%) 24.7 28.5 (13.3%) incl. D&A

Variable cost, incl.

2.3

14.2

3.0 (23.3%)

19.9 (28.6%)

7.8

50.1

9.5 (17.9%)

61.4 (18.4%)

newsprint 11.5 17.1 (32.7%) 41.3 52.4 (21.2%)

TOTAL fixed and variable cost 21.4 29.0 (26.2%) 74.8 89.9 (16.8%)

In the third quarter of 2012, fixed cost attributed to Gazeta Wyborcza was lower by 20.9% yoy as a result of a decrease in the number of copies and pagecount printed as well as the decrease in Gazeta’s share in the entire volume of print. The 28.6% yoy decrease in Gazeta’s variable cost as well as the 32.7% yoy decrease in newsprint cost were due to the lower number of copies and pagecount printed.

In the first three quarters of 2012, fixed cost attributed to Gazeta Wyborcza was 13.3% yoy lower as a result of a decrease in the number of copies and pagecount printed as well as the decrease in Gazeta’s share in the entire volume of print. In the period of January-September 2012, the 18.4% yoy decrease in Gazeta’s variable cost

(including the 21.2% yoy decrease in newsprint cost) was due to the lower number of copies and pagecount printed.

1.2.2. Promotion and marketing cost

In the third quarter of 2012, promotion and marketing cost of the Newspapers segment was down by 35.6% yoy.

This decrease results mainly from the reduced scope of Gazeta Wyborcza’s promotional activities.

[ w w w . a g o r a . p l ] Page 19

Management Discussion and Analysis for the third quarter of 2012

2. FREE PRESS [3], [4]

translation only

In the third quarter of 2012, 4,8% of Poles read Metro throughout the week (1.4 million readers; CCS, weekly readership index). As a result, Metro had nearly 0.9 million more readers than Dziennik Gazeta Prawna and almost

0.6 million readers more than Rzeczpospolita. Similar readership results noted Super Express, which had 1.4 million readers and a readership rate of 4.8%. This means, that as far as readership is concerned Metro and Super Express were preceded only by Gazeta Wyborcza and Fakt among national dailies. Metro, together with Gazeta Wyborcza, was the most popular daily in Warsaw (Metro: weekly readership 30.3%, 0.4 million readers).

In the third quarter of 2012, Metro’s total ad revenues decreased by 21.6% yoy, including a 22.6% yoy decrease in display advertising. In this period of time, the total display ad spend in all daily newspapers decreased by over 21.5% yoy. As a result, Metro maintained its share in advertising spending in dailies at the level of ca. 4.5%. In the discussed period of time, Metro’s share in national dailies decreased by 1pp yoy to 3.5%. In Warsaw dailies, Metro’s share increased by ca. 3pp yoy to over 18.5% and in local dailies by 0.5pp yoy to 3.5%.

In the third quarter of 2012, the operating EBITDA of the Free Press division decreased yoy to PLN 0.5 million [1].

3. SPECIAL PROJECTS

Tab. 8 in PLN million 1Q 2011 2Q 2011 3Q 2011 4Q 2011 1Q 2012 2Q 2012 3Q 2012

Revenue from Special Projects

(including collections)

16.0 16.1 6.1 11.2 8.2 8.1

In the third quarter of 2012, Agora decreased the number of publishing projects. During this period, Agora continued only 1 collection: Miasta marzen 2 and no new collections were launched.

In the third quarter of 2012, Agora ran 8 publishing projects and 1 music album. As a result, during this period of time, Special Projects division sold 0.2

million books and books with CDs and DVDs.

In the third quarter of 2012, Special Projects were expanding the online bookstore Publio.pl, which also influenced the operating results of the division.

As a results, in the third quarter of 2012, Special Projects recorded a negative EBIT of PLN 0.5 million [1].

5.6

[ w w w . a g o r a . p l ] Page 20

Management Discussion and Analysis for the third quarter of 2012

IV.B INTERNET [1] [6]

translation only

The Internet segment includes the pro-forma consolidated financials of Agora’s Internet Department, LLC Agora

Ukraine, Trader.com (Polska) Sp. z o.o., AdTaily Sp. z o.o. and Sport4People Sp. z o.o. (since November 30, 2011).

Tab. 9 in PLN million

Total sales , including

Display ad sales (1)

3Q 2012 3Q 2011

24.9

19.4

26.0

18.0

% change yoy

(4.2%)

7.8%

1-3Q

2012

82.7

64.3

1-3Q

2011

81.4

57.4

% change yoy

1.6%

12.0%

Ad sales in verticals (2) 4.2 6.0 (30.0%) 13.6 18.6 (26.9%)

Total operating cost, including

IT and network maintenance

Staff cost (3)

Non-cash expense relating to sharebased payments

D&A

Promotion and marketing (1)

Cost of group lay-offs

EBIT

EBIT margin

EBITDA

EBITDA margin

Operating EBITDA (4)

Operating EBITDA margin

EBIT excluding cost of group lay-offs

EBIT margin excluding group lay-offs

EBITDA excluding group lay-offs

(25.0)

(0.8)

(11.9)

-

(1.4)

(2.5)

(1.2)

(0.1)

(0.4%)

1.3

5.2%

1.3

5.2%

(24.6)

(0.7)

(12.5)

-

1.6%

14.3%

(4.8%)

-

(1.4) -

(3.2) (21.9%)

- -

1.4 -

5.4% (5.8pp)

2.8 (53.6%)

10.8% (5.6pp)

2.8 (53.6%)

10.8% (5.6pp)

1.4 (21.4%)

5.4% (1.0pp)

2.8 (10.7%)

(78.4)

(2.3)

(36.9)

(0.1)

(4.2)

(10.3)

(1.2)

4.3

5.2%

8.5

10.3%

8.6

10.4%

(78.5)

(2.2)

(36.2)

(0.6)

(0.1%)

4.5%

1.9%

(83.3%)

(4.6) (8.7%)

(13.3) (22.6%)

- -

2.9 48.3%

3.6% 1.6pp

7.5 13.3%

9.2% 1.1pp

8.1 6.2%

10.0% 0.4pp

2.9 89.7%

3.6% 3.1pp

7.5 29.3%

1.1

4.4%

2.5

5.5

6.7%

9.7

EBITDA margin excluding group lay-offs

Operating EBITDA (4) excluding group layoffs

10.0%

2.5

10.8% (0.8pp)

2.8 (10.7%)

11.7%

9.8

9.2% 2.5pp

8.1 21.0%

Operating EBITDA margin excluding group lay-offs

10.0% 10.8% (0.8pp) 11.9% 10.0% 1.9pp

(1) the amounts do not include total revenues and cost of cross-promotion of Agora’s different media (only direct variable cost of campaigns carried out on advertising panels) if such promotion is executed without prior reservation, as well as inter-company sales between Agora’s Internet Department, LLC Agora Ukraine, Trader.com (Polska)

Sp. z o.o. and AdTaily Sp. z o.o., and Sport4People Sp. z o.o.;

(2) including, among others, allocated revenues from the dual media offer (i.e. published both in Gazeta Wyborcza, as well as on GazetaPraca.pl, GazetaDom.pl, Domiporta.pl, Komunikaty.pl verticals and Nekrologi.Wyborcza.pl website);

(3) excluding non-cash cost of share-based payments and cost related to group lay-offs in Agora S.A.;

(4) excluding non-cash cost of share-based payments.

[ w w w . a g o r a . p l ] Page 21

Management Discussion and Analysis for the third quarter of 2012 translation only

In the third quarter of 2012, the operating result (EBIT) of the Internet segment was lower yoy, mainly due to the costs of group lay-offs and the decrease of the ad sales in verticals. In the first three quarters of 2012, the operating result (EBIT) of the Internet segment increased by nearly a half as compared to the the same period in 2011.

1. REVENUE

In the third quarter of 2012, the total sales of the Internet segment decreased by 4.2% yoy to the level of PLN 24.9 million, mainly due to the 30.0% yoy drop in ad sales in verticals.

In the third quarter of 2012, the display advertising sales maintained growth and increased by 7.8% yoy to the level of PLN 19.4 million, while in the same period, the total expenditure for Internet display advertising and e-mail marketing in Poland grew by ca 5% yoy.

In the third quarter of 2012, the ad sales in verticals decreased by 30.0% yoy, mainly as a result of a lower allocation from the dual media offer in print edition of Gazeta Wyborcza and Internet as well as lower ad sales in verticals dedicated to recruitment and real estate.

In the third quarter of 2012, total revenue of Trader.com (Polska) Sp. z o.o. amounted to PLN 4.4 million (down by

13.7% yoy). Revenues from the company’s Internet activities amounted to PLN 3.9 million and from its press activities to PLN 0.5 million (down by 28.6% yoy). In the third quarter of 2012, the company reported positive operating result (EBIT) of PLN 0.8 million.

2. COST

In the third quarter of 2012, the operating costs of the Internet segment increased by 1.6% yoy, mainly due to the costs of group lay-offs which amounted to PLN 1.2 million.

The staff cost (excluding non-cash cost of share-based payments and cost of group lay-offs) went down by 4.8% yoy in the third quarter of 2012 as a result of the reduction of number of FTEs in Agora’s Internet Department and in

Trader.com (Polska) Sp. z o.o.

In the third quarter of 2012, the promotion and marketing costs decreased by 21.9% yoy, mainly due to the reduction of promotion and marketing cost of Gazeta.pl portal.

3. IMPORTANT INFORMATION ON INTERNET ACTIVITIES

In September 2012, the reach of Gazeta.pl group services among Polish Internet users stood at 58.7%, which made

Gazeta.pl group the third player among Internet portals, after Onet.pl and Wirtualna Polska - Orange groups. The number of users reached 11.4 million (down by 1.9% yoy). In the same month, the total number of page views from

Polish users reached 1,073 million (up by 2.3% yoy), with an average viewing time of 2 hours and 2 minutes per user

(1 minute less than in September 2011).

In September 2012, the number of page views generated by mobile devices on the websites of Gazeta.pl group reached 80 million (up by 187% yoy), which made Gazeta.pl group the second player according to Megapanel

PBI/Gemius data. The share of mobile page views on the websites of Gazeta.pl group stood at 7.5% and was the highest among Polish horizontal portals.

The websites of Gazeta.pl group are ranked among top thematic market players. According to Megapanel

PBI/Gemius data from September 2012, Gazeta.pl is the leader in the Forums & Discussion Groups category (inter alia Forum.Gazeta.pl). Gazeta.pl group is ranked second in the Building & real estate category and Gazeta.pl’s parenting sites (i.a. eDziecko.pl) are ranked second in Children, Family category and Gazeta.pl’s community sites are ranked second in Blogs category. The third places are held by: Gazeta.pl’s sport sites (i.a. Sport.pl) in Sport category,

Gazeta.pl’s information sites in the Information & journalism category, Gazeta.pl’s education sites (i.a.

Edukacja.Gazeta.pl) in Education category and Gazeta.pl’s youth sites (i.a. Kotek.pl) in Student & Youth category.

[ w w w . a g o r a . p l ] Page 22

Management Discussion and Analysis for the third quarter of 2012

IV.C. CINEMA

translation only

The Cinema segment includes the pro-forma consolidated data of Helios S.A. (on August 31, 2011 Helios S.A. merged with Kinoplex Sp. z o.o.) and Next Film Sp. z o.o. (since September 14, 2012), which form the Helios group.

Tab. 10 in PLN million

Total sales, including :

Tickets sales

Sales from foods & beverages

Advertising revenues (2)

Other sales

Total cost, including:

External services

3Q 2012 3Q 2011

55.0

36.6

11.9

3.7

2.8

(51.4)

(29.4)

% change yoy

1-3Q

2012

48.9

34.8

10.3

3.2

12.5%

5.2%

15.5%

15.6%

0.6 366.7%

(45.9)

143.1

95.7

28.7

12.9

5.8

12.0% (141.9)

(26.2) 12.2% (79.0)

1-3Q

2011

% change yoy

143.7

104.3

30.5

7.7

(0.4%)

(8.2%)

(5.9%)

67.5%

1.2 383.3%

(133.5) 6.3%

(75.5) 4.6%

Raw materials, energy and consumables (6.4) (6.3) 1.6% (18.0) (18.3) (1.6%)

Staff cost

D&A

Promotion and marketing (2)

Other net operating cost

EBIT

EBIT margin

EBITDA

EBITDA margin

Operating EBITDA (1)

Operating EBITDA margin (1)

(6.2)

(5.1)

(2.0)

(2.3)

3.6

6.5%

8.7

15.8%

8.7

15.8%

(6.0)

(4.5)

(1.2)

(1.7)

3.0

6.1% 0.4pp

7.5

15.3% 0.5pp

7.5

3.3%

13.3%

66.7%

35.3%

20.0%

16.0%

16.0%

15.3% 0.5pp

(19.1)

(14.4)

(6.1)

(5.3)

1.2

0.8%

15.6

10.9%

15.6

10.9%

(18.1)

(13.3)

(2.7)

(5.6)

10.2

5.5%

8.3%

125.9%

(5.4%)

(88.2%)

7.1% (6.3pp)

23.5 (33.6%)

16.4% (5.5pp)

23.5 (33.6%)

16.4% (5.5pp)

(1) as far as the Helios group is concerned EBITDA and operating EBITDA ratios are equal as in the period referred to in the table there was not any non-cash cost of share-based payments incurred;

(2) the amounts do not include revenues and total cost of cross-promotion of Agora’s different media (only the direct variable cost of campaigns carried out on advertising panels) if such a promotion was executed without prior reservation.

In the third quarter of 2012, due to a significant increase in the revenues, the operating result (EBIT) of the Helios group increased yoy to PLN 3.6 million. EBITDA and operating EBITDA of the segment increased as well, while the

EBITDA margin reached 15.8% (up by 0.5 pp yoy).

1. REVENUE [3]

In the third quarter of 2012, total revenue of the Cinema segment amounted to PLN 55.0 million (up by 12.5% yoy).

The increase resulted from higher revenues from ticket sales (up by 5.2% yoy) and higher revenues from food and beverages (up by 15.5% yoy). The number of visitors in Helios cinemas reached nearly 2.1 million [11] and increased by 12.5% yoy.

In the third quarter of 2012, the growth of Helios’ advertising revenues resulted mainly from the cooperation with other segments from the Agora Group.

In the third quarter of 2012, out of the total number of tickets sold, nearly 56% constituted tickets for 3D films

(down by over 3pp yoy).

[ w w w . a g o r a . p l ] Page 23

Management Discussion and Analysis for the third quarter of 2012

2. COST

translation only

In the third quarter of 2012, the operating cost of the segment reached PLN 51.4 million (up by 12.0% yoy). Higher marketing and promotion cost reflects the increased scope of cooperation with other segments from the Agora

Group. It should be remembered that this cost is compensated by higher advertising revenues.

In the third quarter of 2012, staff cost and D&A cost increased yoy, mainly due to the opening of a new cinemas by

Helios in 2012.

3. OTHER EVENTS

In September 2012, Helios opened a successive multiplex - a four-screen cinema in Kedzierzyn-Kozle, which is the the only multiplex in this city. This is the third multiplex opened this year, after the cinemas in Grudziadz and Tczew launched by Helios in 2012.

On July 19, 2012, Next Film Sp. z o.o., a wholly-owned subsidiary of Helios was founded, which core activity is film distribution in cinemas. On September 14, 2012 the company was registered by the National Court Register in Lodz.

The digitalization process of Helios cinemas is completed – all Helios cinemas are fully digitalized.

[ w w w . a g o r a . p l ] Page 24

Management Discussion and Analysis for the third quarter of 2012

IV.D. OUTDOOR (AMS GROUP)

translation only

The Outdoor segment consists of the pro-forma consolidated data of companies constituting the AMS group

(AMS S.A., Adpol Sp. z o.o.).

Tab. 11 in PLN million

Total sales, including:

Advertising revenue (1)

Total operating cost, including:

Execution of campaigns

Maintenance cost

Staff cost (2)

3Q 2012 3Q 2011

38.8

37.9

(38.8)

(6.3)

(18.7)

(4.9)

40.1

39.3

(39.1)

(6.0)

(18.1)

(5.0)

% change yoy

(3.2%)

(3.6%)

(0.8%)

5.0%

3.3%

(2.0%)

1-3Q

2012

115.4

113.0

(115.6)

(18.7)

(55.8)

(14.5)

1-3Q

2011

126.0

123.2

(117.0)

(19.7)

(55.0)

(15.0)

% change yoy

(8.4%)

(8.3%)

(1.2%)

(5.1%)

1.5%

(3.3%)

Non-cash expense relating to share-based payments

- - - (0.1) (0.7) (85.7%)

Promotion and marketing

D&A

EBIT

EBIT margin

EBITDA (4)

EBITDA margin

Operating EBITDA (2) (4)

Operating EBITDA margin

Number of advertising spaces (3)

(1.5)

(4.5)

0.0

0.0%

4.4

(1.1)

(4.5)

1.0

36.4%

-

-

2.5% (2.5pp)

5.5 (20.0%)

(4.2)

(13.7)

(0.2)

(0.2%)

13.4

(3.4)

(13.7)

9.0

23.5%

-

-

7.1% (7.3pp)

22.7 (41.0%)

11.3%

4.4

13.7% (2.4pp)

5.5 (20.0%)

11.6%

13.5

18.0% (6.4pp)

23.4 (42.3%)

11.3% 13.7% (2.4pp)

24,397 23,831 2.4%

11.7%

24,397

18.6% (6.9pp)

23,831 2.4%

(1) the amounts do not include revenues, direct and variable cost of cross-promotion of Agora’s other media on AMS panels if such promotion was executed without prior reservation;

(2) excluding non-cash cost of share-based payments;

(3) excluding advertising panels of AMS group installed on petrol stations, small panels on bus shelters and in the

Warsaw subway, as well as advertising panels on buses and trams;

(4) the amounts include a reclassification adjustment of D&A, resulting from financing sources of fixed assets owned by AMS group.

In the third quarter of 2012, the operating EBITDA of the Outdoor segment was lower yoy and amounted to PLN 4.4 million. The operating EBITDA margin reached 11.3% and was lower yoy.

1. REVENUE [8]

In the third quarter of 2012, the total amount of outdoor market expenditure, according to IGRZ estimates, decreased by over 17.5% yoy. In the third quarter of 2012, the drop in advertising sales recorded by the AMS group was significantly lower compared to the market and amounted 3.6%. As a result, the estimated share of AMS in outdoor ad spending increased by over 4.5pp and amounted to over 31.5%.

[ w w w . a g o r a . p l ] Page 25

Management Discussion and Analysis for the third quarter of 2012

2. COST

translation only

In the third quarter of 2012, the AMS group reduced its operating cost by 0.8% yoy to the level of 38.8 million, mainly by the decrease of general fixed cost in AMS group.

The cost of campaign execution increased by 5.0% yoy, due to a higher rental cost of advertising space on buses and higher cost of non-standard campaigns execution on advertising panels. This growth results from higher number of advertising campaigns on buses and non-standard campaigns on outdoor panels.

The increase in maintenance cost (up by 3.3% yoy) was related to the higher number of advertising panels, such as

18 sqm billboards and citylights.

In the third quarter of 2012, the decrease in staff cost (down by 2.0% yoy) reflected lower variable remuneration components resulting from lower advertising sales of the segment.

Higher promotion and marketing cost (up by 36.4% yoy) results from a higher yoy total cost of social campaigns.

3. OTHER EVENTS

In the third quarter of 2012, AMS won the concession procedure for placing 34 shelters in new locations in Cracow.

Further investment in urban furniture reflects a consistent development strategy of the AMS group.

[ w w w . a g o r a . p l ] Page 26

Management Discussion and Analysis for the third quarter of 2012

IV.E. RADIO

translation only

The Radio segment includes the pro-forma consolidated financials of Agora’s Radio Department, all local radio stations and a super-regional radio TOK FM, being parts of the Agora Group. This includes: 20 Golden Hits (Złote

Przeboje) local radio stations, 7 local radio stations (Radio Roxy FM), one AC format (Adult Contemporary) local station and a super-regional news radio TOK FM broadcasting in nine largest metropolitan areas.

Tab. 12 in PLN million 3Q 2012 3Q 2011

% change yoy

1-3Q

2012

1-3Q

2011

% change yoy

Total sales, including :

Advertising revenue (1) (3)

Total operating cost, including: (3)

Staff cost (2)

18.2

17.6

(19.1)

(6.3)

21.4 (15.0%)

21.1 (16.6%)

(21.7) (12.0%)

(6.1) 3.3%

63.5

61.9

(63.8)

(19.4)

62.0

61.0

(59.8)

(18.7)

2.4%

1.5%

6.7%

3.7%

Non-cash expense relating to share-based payments

- - - (0.1) (0.5) (80.0%)

Licenses, rental and telecommunication costs

D&A

Promotion and marketing (3)

EBIT

EBIT margin

EBITDA

EBITDA margin

(1.9)

(0.7)

(2.8)

(0.9)

(4.9%)

(0.2)

(1.1%)

(2.0)

(0.6)

(5.9)

(0.3)

(5.0%)

16.7%

(52.5%)

(200.0%)

(1.4%) (3.5pp)

0.3 -

1.4% (2.5pp)

(6.2)

(2.0)

(10.0)

(0.3)

(0.5%)

1.7

2.7%

(6.2)

(1.9)

(12.7)

2.2

-

5.3%

(21.3%)

-

3.5% (4.0pp)

4.1 (58.5%)

6.6% (3.9pp)

Operating EBITDA (2)

Operating EBITDA margin

(0.2)

(1.1%)

0.3 -

1.4% (2.5pp)

1.8

2.8%

4.6 (60.9%)

7.4% (4.6pp)

(1) advertising revenues include revenues from brokerage services of proprietary and third-party air time;

(2) excluding non-cash cost of share-based payments;

(3) the amounts do not include revenues and total cost of cross-promotion of Agora’s different media (only the direct variable cost of campaigns carried out on advertising panels) if such a promotion was executed without prior reservation.

In the third quarter of 2012, mainly as a result of drop in revenues the operating EBITDA of Agora’s Radio segment decreased yoy and was negative at the level of PLN 0.2 million.

1. REVENUE [3]

In the third quarter of 2012, the sales revenue of the Radio segment amounted to PLN 18.2 million (down by 15.0% yoy) and were affected by the decrease of the total radio advertising expenditure by more than 10% yoy.

Additionally, in the third quarter of 2011, segment revenues included a barter transaction related to the ARTPOP

Festival Zlote Przeboje Bydgoszcz 2011. Excluding this transaction, the dynamics of the revenue decrease of the

Radio segment in the third quarter of 2012 would be lower than that of the entire radio advertising market.

2. COST

In the third quarter of 2012, the operating cost of the Radio segment decreased by 12.0% yoy, mainly as a result of lower promotion and marketing cost. This cost was lower due to a barter transaction related to the ARTPOP Festival

Zlote Przeboje Bydgoszcz 2011 which was held in the third quarter of 2012. Excluding this transaction, promotion and marketing costs would be at the similar level as in the third quarter of 2011..

[ w w w . a g o r a . p l ] Page 27

Management Discussion and Analysis for the third quarter of 2012

3. AUDIENCE SHARES [9]

translation only

In the third quarter of 2012, the audience share of Agora’s music radio stations reached a five-year record.

In the third quarter of 2012, the audience share of Agora’s music radio stations increased by 1.6pp yoy and reached

8.6%. In the same period of time, the audience share of TOK FM in all the cities of broadcasting reached 4.0% (in the third quarter of 2011: 4.2%). In the third quarter of 2012, the audience share of TOK FM in Warsaw reached 6.2%

(up by 0.4pp yoy).

In the first three quarters of 2012, the audience share of Agora’s music local radio stations increased by 1.2pp yoy and reached 8.2%. In the same period of time, the audience share of TOK FM in all the cities of broadcasting amounted to 4.5% (in the first three quarters of 2011: 4.8%). In the first three quarters of 2012, the audience share of TOK FM in Warsaw amounted to 7.3% share (up by 0.5pp yoy).

4. OTHER EVENTS

In July 2012, Agora Radio group launched Tuba.FM for computers and tablets with Windows 8. The application offers the same functionalities that are available on the website, but with a very modern, attractive layout and userfriendly form. The application quickly gained the status of the best music application available on the Windows 8 platform.

In August 2012, Agora Radio group launched Tuba.FM for television decoders of the operator Netia. As a result, users of Netia decoders can benefit from a wide range of Tuba FM music offer, including FM stations as well as thousands of Internet radio stations.

Radiowe Doradztwo Reklamowe Sp. z o.o. signed a cooperation agreement expanding its advertising portfolio by the