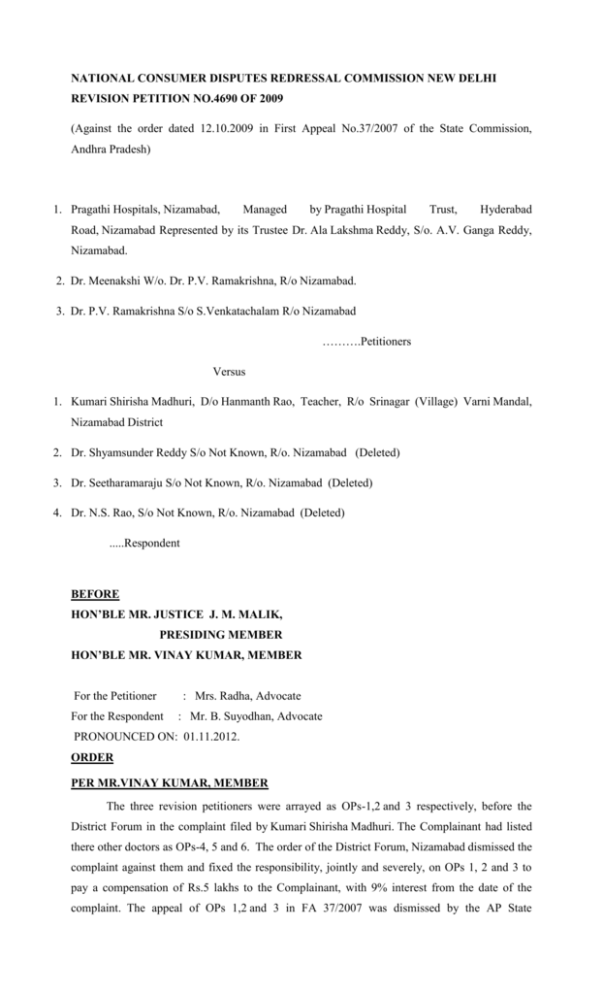

NATIONAL CONSUMER DISPUTES REDRESSAL COMMISSION NEW DELHI

REVISION PETITION NO.4690 OF 2009

(Against the order dated 12.10.2009 in First Appeal No.37/2007 of the State Commission,

Andhra Pradesh)

1. Pragathi Hospitals, Nizamabad,

Managed

by Pragathi Hospital

Trust,

Hyderabad

Road, Nizamabad Represented by its Trustee Dr. Ala Lakshma Reddy, S/o. A.V. Ganga Reddy,

Nizamabad.

2. Dr. Meenakshi W/o. Dr. P.V. Ramakrishna, R/o Nizamabad.

3. Dr. P.V. Ramakrishna S/o S.Venkatachalam R/o Nizamabad

……….Petitioners

Versus

1. Kumari Shirisha Madhuri, D/o Hanmanth Rao, Teacher, R/o Srinagar (Village) Varni Mandal,

Nizamabad District

2. Dr. Shyamsunder Reddy S/o Not Known, R/o. Nizamabad (Deleted)

3. Dr. Seetharamaraju S/o Not Known, R/o. Nizamabad (Deleted)

4. Dr. N.S. Rao, S/o Not Known, R/o. Nizamabad (Deleted)

.....Respondent

BEFORE

HON’BLE MR. JUSTICE J. M. MALIK,

PRESIDING MEMBER

HON’BLE MR. VINAY KUMAR, MEMBER

For the Petitioner

For the Respondent

: Mrs. Radha, Advocate

: Mr. B. Suyodhan, Advocate

PRONOUNCED ON: 01.11.2012.

ORDER

PER MR.VINAY KUMAR, MEMBER

The three revision petitioners were arrayed as OPs-1,2 and 3 respectively, before the

District Forum in the complaint filed by Kumari Shirisha Madhuri. The Complainant had listed

there other doctors as OPs-4, 5 and 6. The order of the District Forum, Nizamabad dismissed the

complaint against them and fixed the responsibility, jointly and severely, on OPs 1, 2 and 3 to

pay a compensation of Rs.5 lakhs to the Complainant, with 9% interest from the date of the

complaint. The appeal of OPs 1,2 and 3 in FA 37/2007 was dismissed by the AP State

Consumer Disputes Redressal Commission with cost. The order of the State Commission is now

challenged in the present proceedings by OPs 1,2 and 3.

2.

Before the District Forum, the case of the Complainant was that her mother,

Smt. Parvata Vardini was operated for hysterectomy in the OP-1 hospital on 28.4.1994. Her

condition worsened when she developed abdominal swelling and respiratory problem. Allegedly,

it was informed that a puncture wound was found in her intestine and leakage from it had to be

removed. On 4.5.1994, another surgery was performed on her by OPs 3 to 6 but the patient died

on the next day i.e. 5.5.1994.

3.

On the other hand, the contention of the OPs was that on 2.5.1994 the patient complained

of breathlessness. Her blood urea and serum creatinine were slightly above normal. On 3.5.1994

distension of abdomen was noticed and 4.5.1994 she was running temperature. Here, as per the

written response of the OPs:“Then X-ray of abdomen was taken which showed large gas shadow under the

left side Diaphragm with multiple fluids levels. As Dr.Lakshma Reddy was not

at Nizamabad on that day, the respondent no.5 was called to see the case. He

advised Giproteam as the cause for above condition of the patient is not know. As per

his advice, respondent no.6 who is a senior anesthologist was called and the respondent

no.5 performed surgery at 6.30 p.m. which went uneventfully. It is false to allege that

five litres of fluids was found in the abdomen. Patient recovered from anaesthology was

8.30 p.m. and was shifted to post operative ward. On 5.5.94 at 3.30 a.m. the patient

developed Hypertension and was treated for the same. Patient died at 11.15 a.m. Death

certificate was issued. The patient died of Cardoi-Respiratory failure due to septic and

shock with some underlying renal problem.”

4.

The District Forum and the State Commission both have relied heavily on the case sheet of

the patient (Ext. A-7 before the District Forum) as evidence of the complication which developed

after the surgery of 28.4.1994 and which eventually led to the second surgery of 5.5.1994.

5.

Significantly, the Complainant along with OPs 4,5 and 6 have been arrayed as the

respondents in the appeal before the State Commission as well as in the present revision petition.

But, the proceeding before this Commission of 16.9.2010 shows that the counsel for the revision

petitioners sought deletion of the names of respondents No.2 to 4 (OPs 4 to 6) on the ground that

they were not a necessary parties to the present proceedings. This was contested by counsel for

respondent No.1 (the Complainant) stating that respondent No.3 was the doctor who, during the

second surgical operation, had noticed the puncture in the jejunum and therefore his appearance

was necessary. The Commission after hearing the two counsels ordered deletion of respondents

No.2 to 4 from the array of the parties. Again, on 9.5.2012, counsel for the respondents

submitted that the presence of respondent No.3, already ordered to be deleted from the list of

parties, was necessary. This argument was kept open for consideration on the next date of

hearing, but has not been pressed by the respondents. The revision petition was finally heard on

23.8.2012 and reserved for orders.

6.

We have perused the records and heard the counsels for the two sides. It needs to be noted

that the revision petition assails the impugned order stating that:“The State Commission erred in holding that, the non-examination of

respondents 3 and 4 herein (Opposite Parties 5 & 6) who conducted the subsequent

operation, gives rise to the conclusion that the perforation occurred during the first

operation and the petitioners herein are negligent. The reasoning of the appellant

authority that the Opposite Parties 5 and 6 failed to file affidavit evidence and explain

the circumstances under which the perforation to jenjunum was occurred, obviously

they did not like to depose in favour of the petitioners as the perforation was caused

when the opposite parties 2 and 3 performed the operation is perverse and

unsustainable in law.”

7.

This contention needs to be viewed in the light of the evidence placed before

the fora below. No evidence was adduced that an abdominal ulcer, perforated or otherwise,

existed before the first surgery on 28.4.1994. On the contrary, the GYNAECOLOGICAL CASE

SHEET shows that the first evidence of it came in the morning of 4.5.1994. It reads—

“X Ray plain abdomen in erect posture

Large gas shadow before Lt diaphragm

With multiple fluid levels

? Volvlus

Posted for Laprotomy at 6 pm”

8.

The State Commission has observed that—

“Though Opposite Parties 1 to 3 in their affidavit evidence stated that they had

operated her for hysterectomy on 28.4.1994 they did not observe any puncture to

jejunum. Opposite parties 5 and 6 had performed an operation on 5.5.1994 when they

found puncture in the jejunum. Opposite Parties 1 to 3 could not explain why such a

puncture was caused.”

Due to this, the State Commission has noted that OPs 5 and 6 should have been the best

witnesses to answer questions on the of puncture in the jejunum but OPs 1,2 and 3 chose not to

examine them.

9.

In our view, the record in the GYNAECOLOGICAL CASE SHEET and the Written

Response of the OPs, noted above, clearly support the view taken by the State Commission. We

therefore, find no substance in the above contention of the Revision Petitioner.

10. The other ground raised in the revision petition, as well as argued by their counsel is that,

as per medical literature cited before the fora below, perforation of jejunum is an uncommon

disorder which can be caused due to many reasons and is rarely diagnosed preoperatively. But,

the counsel for petitioner could not explain how does this support their claim that perforation of

the jejunum was not caused during the surgery for hysterectomy. Learned counsel for the

respondents pointed out the petitioners should in that case, have examined the doctors who

performed the second surgery. We find ourselves in agreement with the latter. No evidence has

been led, before the fora below, by the petitioners/OPs 1,2 and 3 to show that it was not a

surgical perforation which occurred in the course of the first surgery and which necessitated the

second one.

11. We therefore, conclude that the revision petitioners have completely failed to make out any

case against the decision of the A P State Consumer Disputes Redressal Commission in

FA/37/2007 which could justify our intervention under Section 21(b) of the Consumer Protection

Act 1986. The revision petition is therefore dismissed for want of merit.

.……………Sd/-……………

(J. M. MALIK, J.)

PRESIDING MEMBER

……………Sd/-…………….

(VINAY KUMAR)

MEMBER

S./-

NATIONAL CONSUMER DISPUTES REDRESSAL COMMISSION NEW DELHI

FIRST APPEAL NO.482 of 2007

(From the Order dated 29.05.2007 in Complaint Case No.47/1999 of the State Consumer

Disputes Redressal Commission, Delhi)

St. Anthony’s Senior Secondary School

C-6, S.D.A Hauz Khas,

New Delhi-110016 Through its Principal

.. Appellant

Vs.

Richa Gupta (Minor) Through her father

and Natural Guardian Mr. Ashok K. Gupta,

F-49, Green Park, New Delhi

…..Respondent

BEFORE: HON’BLE MR. JUSTICE ASHOK BHAN, PRESIDENT

HON’BLE MRS. VINEETA RAI, MEMBER

For the Appellant

For the Respondent

PRONOUNCED ON:

: Mr. Jagdeep Bedi, Advocate

: Mr. Rajesh Aggarwal, Advocate

01 .11.2012

ORDER

ASHOK BHAN, J., PRESIDENT

Appellant which was Opposite Party before the State Commission has filed this Appeal

against the judgment and order dated 29.05.07 passed by the State Consumer Disputes Redressal

Commission, Delhi (in short, ‘the State Commission’) in Complaint Case No. C-47/1999

wherein the State Commission allowing the complaint filed by the Respondent has directed the

Appellant to pay a sum of Rs.25,000/- as compensation to the Respondent .

FACTS:-

Briefly stated the facts of the case are that the Complainant/Respondent was admitted in

the Appellant School vide registration No.5252 in KG Class on 22.02.1988. She continued her

studies without hindrance upto VIIIth Class for the session 1997-98. She was promoted to IX

class after verifying the entries of examinations by the Appellant. The classes for the session

1998-99 started from 01.04.98. However, the Respondent was not permitted to attend IX class

without giving any reason. As per averments made in the complaint, the principal of the

Appellant School told the father of the Respondent that she would not be allowed to attend the

school unless Rs.50,000/- were paid as donation to the School. The father of the Respondent

sought to leave the school. The transfer certificate was issued to him on 28.04.98 but the mark

sheet of VIII Class of the Respondent was not supplied. Respondent remained at home for a long

period without education till she was admitted to VIII Class in another School on 15.07.98.

Complainant, being aggrieved, filed the complaint before the State Commission alleging that she

lost one precious academic year due to illegal act of the Appellant.

Appellant, on being served, entered appearance and filed its written statement resisting

the complaint, inter-alia, on the grounds; that though the Respondent had failed in Class VIII

examination, yet she was provisionally promoted to Class IX only on trial basis as her overall

percentage of marks in Class VIII examinations was above 40%; that the Respondent herself did

not attend the classes w.e.f. 1.04.98 and the fees for the first quarter was not remitted; that no

donation was demanded by the Appellant; that the transfer certificate was issued to the

Respondent’s father on 28.04.98 and the mark sheet/progress report was also handed over to the

Respondent on 30.03.98.

State Commission after scanning the material available on record and going through the

evidence led by the parties partly allowed the complaint and directed the Appellant School to pay

a sum of Rs.25,000/- to the Respondent as compensation by observing thus:“10. Be that as it may, we find the O.P. guilty for deficiency in service in not

handing over the mark sheet issued to the complainant so as to facilitate her to get the

admission somewhere else even though her father had asked for transfer

certificate. Merely because the O.P. had provisionally promoted the complainant to

higher class on the basis of overall percentage of 40% in spite of her having

successfully cleared 5 subjects, nothing prevented the O.P. from issuing duplicate mark

sheet. Even if we accept that the O.P. did not permit the complainant to attend Class

IX after having been provisionally promoted as the father had asked for transfer

certificate still the allegation of having no handed over the mark sheet cannot be wiped

out.

11.

Mark sheet is important for a student to get admission in any other

school. Mere transfer certificate is not guarantee for admission. It appears that the

O.P. was shying away from issuing the mark sheet because of their own acts of

omission and commission in, may be showing generosity by, promoting the

complainant from one class to another in spite of her having failed in most of the

subjects but her over all percentage having been more than 40%. By this act of O.P,

the complainant wasted one year of her study and for this limited deficiency, we deem

that a compensation of Rs.25,000/- shall meet the ends of justice. Payment be made

within 15 days from the date of receipts of this order. The complaint is disposed of in

above terms. “

Appellant, being aggrieved, has filed the present appeal.

We have heard the ld. Counsel for the parties at length.

Ld. Counsel appearing for the Appellant contends that the State Commission has

committed an error in holding that the mark sheet was not supplied to the Respondent; that the

same was handed over to her on 30.03.98 in the class itself when her result was declared. That it

is a matter of common knowledge when the school results are declared, the mark sheets are

handed over to the students in the class room itself without taking any acknowledgement. That

the Respondent had failed in five subjects, i.e., English, Mathematics, General Science, Social

Studies and Computer Science and she as a matter of right could not demand a ‘pass’ certificate.

That the father of the Respondent did not make any request for issuing a duplicate mark sheet as

he was not interested in a duplicate mark sheet which could always be issued by the Appellant

but her farther wanted a Mark Sheet which declared the Respondent as pass in all failed

subjects. As against this, Ld. Counsel for the Respondent supports the order passed by the State

Commission.

We find substance in the contention raised by the Ld. Counsel for the Appellant. As per

general practice the mark sheets are supplied to the students in the class room at the time of

declaration of results without taking any acknowledgement. In the present case also the mark

sheet must have been supplied to the Respondent in the class room at the time of declaration of

result. Moreover, when the Appellant had given the school leaving certificate to the Respondent

it cannot by any stretch of imagination be presumed that the Appellant would not issue the mark

sheet too. There is no evidence on record to show that the mark sheet was not supplied to the

Respondent. In case Respondent had applied for issuance of duplicate mark sheet, the Appellant

as stated in their written statement would have issued the duplicate mark sheet. The finding

recorded by the State Commission that the Appellant did not give the mark sheet is not based on

any reliable evidence. State Commission has erred in awarding the compensation of Rs.25,000/to the Respondent. Accordingly, the direction given by the State Commission to the Appellant to

pay compensation of Rs.25,000/- to the Respondent is set aside. Appeal is allowed.

Appellant had deposited 50% of the awarded amount with the State Commission. State

Commission is directed to release the deposited amount in favour of the Appellant along with

accrued interest.

…………….. . . . . .

(ASHOK BHAN J.)

PRESIDENT

................

(VINEETA RAI)

MEMBER

Yd

NATIONAL CONSUMER DISPUTES REDRESSAL COMMISSION NEW DELHI

REVISION PETITION NO. 1602 OF 2012

(Against the order dated 03.02.2012 in First Appeal No. FA/12/24 of the Chhattisgarh State

Consumer Disputes Redressal Commission, Raipur)

1. Amal Sai S/o Late Birjhu

2. Smt. Pancho W/o Late Birjhu Both R/o Village Basen, Post Jigdi, P.S.& Tehsil Rajpur

Distt. Balrampur (C.G.)

... Petitioner

Versus

1. United India Insurance Co. Ltd. Through Branch Manager, United India Insurance Company

Ltd. Branch Brahma Road, Ambikapur, Distt. Surguja, C.G.

2. Surguja Kshetriya Gramin Bank Through Branch Manager, Surguja Kshetriya Gramin Bank,

Through Branch Manager, Branch Pasta, PS. & Tehsil Rajpur, Dist. Balrampur (C.G.)

... Respondents

BEFORE:

HON'BLE MR. JUSTICE J.M. MALIK, PRESIDING MEMBER

HON’BLE MR. VINAY KUMAR, MEMBER

For the Petitioner

: Ms. Sara Sundaram, Advocate

Pronounced on : 2nd November, 2012

ORDER

JUSTICE J. M. MALIK, PRESIDING MEMBER

1.

Shri Amal Sai and Smt. Pancho are the owners of a tractor with trolly attached. They had

taken loan from Sarguja Kshetriya Gramin Bank, opposite party No. 2. The above said tractor

was insured by United India Insurance Company Limited, opposite party No. 1. The said tractor

met with an accident on 26.3.2009 and it was damaged considerably. The complainants claimed

damages from the opposite party No. 1 but the opposite party No. 1 refused to pay the claim on

the ground of violation of terms and conditions of the insurance policy issued by opposite party

No. 1.

2.

The complainants filed a complaint alleging deficiency in service by respondents. The

complaint was dismissed. The complainants filed an appeal through registered post to the State

Commission, Raipur. They were under the impression that the learned State Commission would

send a notice for hearing in their favour. However, no such notice was received.

3.

Through this revision petition, they have challenged the order passed by the State

Commission dated 3.2.2012.

4.

None appears on behalf of the petitioners. However, the Commission received a letter on

behalf of the petitioners stating that they were not in a position to appear before this Commission

and prayed for engagement of an advocate on their behalf. Consequently, Ms. Sara Sundaram,

Advocate was appointed as amicus curiae. Learned Amicus Curiae submitted that she has sent a

letter to the petitioners but she did not receive any response. She argued that she is not assisted

by her client. She stated that she even does not have the policy.

5.

We have gone through the record. It is apparent that at the time of the accident, its driver

did not have the effective and valid driving licence. He was having driving licence to drive the

light motor vehicle only. Consequently, the claim filed by the complainants found

no favour even with the District Forum or with the State Commission. The order of the State

Commission clearly goes to reveal that it had sent the SPC for the date of hearing but none

appeared on behalf of the petitioners.

The State Commission did not find any substance in

the appeal and dismissed the same.

6.

The District Forum in its paras 18 and 19 as per English version mentioned as follows.

“18. In the documents exh. A-7, A-8 and A-9 filed on behalf of complainant, it has been

mentioned that at the time of accident, vehicle Tractor No. CG 15 A/4137 and Trolley No. CG 15

A/4138 was not being driven by Rajesh Dass, it was being driven by Ramdass. Rajesh was

sitting in the trolley of vehicle, however in the document exh. D-5 (1) filed on behalf of

respondent No. 1, Rajesh Panka was driving the vehicle on 26.3.2009 at the time of accident,

who expired in this accident. Complainants did not make any objection immediately after the

accident that Rajesh Panika was not driving the vehicle at the time of accident and after a long

period, in an after-thought manner, to get the benefit of insurance, it has been shown that the

vehicle in question was being driven by Ram Dass and sent the Exh. A-7, A-8 to Inspector

General of Police, Sarguja Range on 5.10.2009 to Superintendent of Police, Ambikapur on

12.5.2009. In these circumstances, it is not found reliable that at the time of accident, the vehicle

in question was being driven by Ram Dass. Complainants has not produced the driving license

of Rajesh Panika, vehicle driver, who was driving the vehicle at the time of accident as

mentioned in the Exh. D-5.

(1) In these situations, it is found established that condition of Insurance policy were violated.

19.

Even if it is presumed for the sake of arguments that Ram Dass was driving the vehicle in

question at the time of accident, then in these situations, it is to mention that the photocopy of

driving license of Ram Dass relates to the driving license of light vehicle. In these situations, he

was not authorized to drive the above-said tractor at the time of accident. In this manner, on the

basis of above, it is found established that conditions of Insurance policy were violated.”

7.

No evidence was produced to rebut these findings.

8.

The revision petition is sans merits and therefore we dismiss the same.

…………Sd/-…………….

(J. M. MALIK, J.)

PRESIDING MEMBER

…………Sd/-……………

(VINAY KUMAR)

MEMBER

Naresh/reserved

NATIONAL CONSUMER DISPUTES REDRESSAL COMMISSION NEW DELHI

REVISION PETITION NO. 2359 OF 2012

(Against the order dated 11.5.2012 in Appeal No. 30 of 2010 of the Goa State Consumer

Disputes Redressal Commission, Panaji )

1. M/s Milroc Development Co.

A partnership Firm duly constituted

Under the Indian Partnership Act

Having its office at 501,

Milroc Lar Menzes,

Swami Vivekanand Road,

Panaji, Goa

2. Mr. Kantipudi Kulasekhar

S/o Mr. K. Chandramohan

Partner of M/s Milroc Development Company

R/o Kasturi, Plot No. E-11,

La Citadel, Dona Paula, Goa

3. Mr. Kamlesh Shantilal Jhaveri

S/o S.G. Jhaveri,

Partner of M/s Milroc Development Company

Having its office at 501,

Milroc Lar Menzes,

Swami Vivekanand Road,

Panaji, Goa.

4. Mrs. Shobha Kamlesh Jhaveri

W/o Kamlesh Shantilal Jhaveri

Partner of M/s Milroc Development Company

Having its office at 501,

Milroc Lar Menzes,

Swami Vivekanand Road,

Panaji, Goa.

5. Mr. Allaparthi Durga Prasad

S/o Allaparthi Gopalkrishnamurthy,

Partner of M/s Milroc Development Company

Having its office at 501,

Milroc Lar Menzes,

Swami Vivekanand Road,

Panaji, Goa.

........ Petitioner (s)

Vs.

Mrs. Antonieta Ribeiro De Souza

W/o Jose Feliciano de Souza

R/o Flat No. G-1/B-31,

Rabindar Retreat, Rabinder

…….Respondent (s)

Ilhas, Goa

BEFORE:

HON'BLE MR. JUSTICE J.M. MALIK, PRESIDING MEMBER

HON’BLE MR. VINAY KUMAR, MEMBER

For the Petitioner

:

For the Respondent

Pronounced on

:

Mr. Kaustubh Sinha, Advocate with Mr. Dewat Singh, Advocate

NEMO

1st November, 2012

ORDER

JUSTICE J. M. MALIK, PRESIDING MEMBER

1.

This revision petition has been filed by M/s Milroc Development Co. and its partners,

Mr. Kantipudi Kulasekhar,

Mr. Kamlesh Shantilal Jhaveri,

Mrs. ShobhaKamlesh Jhaveri and

Mr. Allaparthi Durga Prasad. The complainant, Mrs. Antonieta Ribeiro de Souza and the

petitioners/opposite parties entered into an agreement wherein the complainant agreed to

purchase flat in the apartment project developed by the opposite parties for construction cum sale

of a flat having a built up area of 135 sq. mt. The possession of the flat was given to the

complainant on 8.7.1998. The sale deed was executed and registered by the parties on

29.3.2006.

2.

The complainant filed a consumer complaint before the District Forum, North Goa

at Porvorim alleging deficiency in service coupled with defective construction and seeking

certain directions. In the complaint, it is averred that brochure described the project as a

township consisting of 350 apartments and an exclusive shopping centre, a club house as well as

community hall. The brochure further stated that the complex would be walled on four sides,

with gates, entry way, manned by security personal round the clock. Again, it would have a

shopping complex enabling the purchasers to live a self contained existence within the Retreat by

providing daily amenities and services, such as provision stores, bank, beauty parlour, shopping

arcade and restaurants. The brochure also promised a Club House with well-equipped health

club. Consequently, the complainant booked one flat for which she paid Rs.9,47,500/- and one

time maintenance costs of Rs.39,813/-. However, in the sale deed, the amenities mentioned

above found no place. It is further averred that the quality of the construction is very poor. It

transpired that there was lot of absorption of water on all the outer walls of the apartment, cracks

had developed practically on all inner walls and there was dampness on the walls resulting into

formation of fungus, particularly, in the bedroom walls. This dampness attracted and provided

an ideal media for insects and other microscopic life. Those affected the skin of the complainant

and her husband. Again, there was tremendous absorption of water on the roof of the toilet of

the master bedroom. Dark brown and gray patches developed all over the roof of the toilet of the

master bedroom resulting in the formation of fungus and foul smell pointing to corrosion of the

street wires in the slab above the bedroom. It affected the health of the complainant and her

husband. They were medically treated. Again, there was seepage of water even through the

beams and walls, which had affected the crockery of the complainant. Moreover, the glazed tiles

in the bathroom are of poor quality as the tiles of the master bedroom had developed cracks and

holes and the holes need replacement. The granite stone on the platform of the kitchen is full of

holes and beautifully filled with cement of the same colour, which could not be seen at the time

of taking the possession. After sometime, the cement started peeling off and the holes have

started showing clearly indicating that second quality material was used.

3.

Shri S. N. Bhobe, an Architect visited the flat on 3.10.2003 and gave its report ext.

‘E’. The Architect has opined that the dark patches on the walls show that there is seepage of

water through the beams, thereby the steel has started corroding thereby endangering the entire

structure of the building. As per agreement, for Construction-cum-Sale, each unit was to be

provided with underground sump with an electric pump and an overhead tank. The same was

not provided. On the other hand, the petitioners had constructed the huge massive tank which is

connected to the water supply. In addition, the petitioners have dug 2/3 Bore Wells and they

pump water from the bore wells also into the tank, which mixes with the water from the Public

Works System. From this tank, water is supplied to all the apartments. For quite some time, the

water was being supplied to the apartments, including the apartment of the complainant. The

people are not getting clean water. It was prayed that the opposite parties be directed to execute

the deed of rectification so as to incorporate all the clauses of the agreement of Construction cum

Sale, which were not incorporated therein and which have been in the agreement for

Construction cum Sale dated 31.3.1997. The opposite parties be further directed to rectify the

problem of dumpness in the outer walls and inner walls and ceiling of the apartment including

the roof of the master bedroom and to repair all cracks in the walls and to replace the glazed tiles

which have cracked both in the kitchen as well as in the bathroom, to provide clean and potable

water to the complainant’s apartment. Besides this, compensation in the sum of Rs.1

lakh be granted in favour of the complainant.

4.

The opposite parties contested this case. In the written statement, the opposite parties

submitted that the complainant is not a consumer. No negligence on their part has been spelt

out. The case for rectification is not maintainable. The case is barred by time. The relief for

mandatory injunction or specific performance cannot be granted and all the pleas have been

denied.

5.

The District Forum partly allowed the complaint. It directed the opposite parties to rectify

the problems of dampness in the outer walls and inner walls and ceiling of the apartment

including the roof of the master bedroom; to repair all cracks in the walls; to replace the glazed

tiles which have cracks both in the kitchen as well as in the bathroom and to provide clean and

potable water to the complainant’s apartment. It also granted compensation in the sum of

Rs.50,000/- towards inconvenience and discomfort caused to her.

6.

The State Commission dismissed the appeal filed by the opposite parties.

7.

The revision petition has been filed by the opposite parties. Argument advanced by the

learned counsel for the petitioners has two prongs.

He vehemently argued that the present case

is barred by time. He places reliance on two authorities reported in Raja Ram Maize Products

Etc. etc. vs. Industrial Court of M.P. and Ors. AIR 2001 SC 1676 and Annu Enterprises

India vs. Haryana Urban Development Authority & Ors. I(2012) CPJ 552 (NC).

8.

The facts of these authorities are different. This is a case of continuing cause of

action. The main document in this context has been placed on record, which is the agreement

entered into between the two parties. Last portion of clause 7 reads as follows:“Upon possession any cracks to the plaster/dampness in external plaster walls shall not be

considered as defective work unless the architect of the Vendor opines otherwise.”

7.

The

petitioners-opposite

parties

also

took

an

expert

opinion

from

Mr. Jayant V. Pai Vernekar, who inspected the spot and gave the following report dated

14.10.2003.

“This has reference to our visit to the above flat with you to assess the Spot/patches on the toilet

ceilings of the above flat on 11/10/2003.

We checked the ceilings of both the bathrooms of this flat and found that the ceiling were

thoroughly dry everywhere. We noticed some spots and patches on the ceiling of one toilet and

the beam side of the other toilet. These were earlier leakages spots, which were found to be

completely dried up during the inspection. The whole ceiling had old fungus marks created due

to condensation of atmospheric moisture on the cold surface of the ceiling.

You mentioned that a few months back the nahani traps in the upper toilets were grouted with

cement water and waterproofing compound to plug any crevices and avoid the possibility of any

moisture in the toilet below. This has stopped the ingress of moisture that was earlier noticed

causing marks on the ceiling as mentioned above.

We also noticed condensation marks on the wall between the bedroom and the living

room. These are caused due to the cool air from the air conditioner in the bedroom, mainly when

atmospheric humidity is high. These marks have nothing to do with the toilet of the upper flat.

In case you need any further assistance in the matter, please do get in touch.

Thanking you,”

8.

The report of this expert engaged by the petitioners themselves reveals so many defects. It

is surprising to note that the walls are incapable to tolerate the cool air coming from the Air

conditioner. It shows the poor quality of the material used there. The facts of this case speak for

themselves. The allegations leveled against the petitioner stand proved.

9.

The petitioners themselves admit that the development of cracks of tiles in bathroom was

due to wear and tear and rough handling by the complainant. It was observed that the granite

stone placed in the kitchen was in good shape and had no blemishes. It was also communicated

that filling of holes with cement is only imaginary and cannot be technically possible. It was

communicated that if cement is filled, the holes cannot be lost even one month as it is a natural

stone. This cannot be said to lucid explanation.

10.

The complainant has also produced the report of Architect, Mr. S. N. Bhobe, which goes to

support the case of the complainant. The case of the complainants is supported by adequate

evidence discussed above.

11.

It is also noteworthy that all the terms and conditions mentioned in the agreement were not

included in the sale deed.

12.

The revision petition is without merit and the same is therefore dismissed.

..…………Sd/-………..………

(J.M. MALIK, J.)

PRESIDING MEMBER

……………Sd/-….……………

(VINAY KUMAR)

MEMBER

Naresh/reserved

NATIONAL CONSUMER DISPUTES REDRESSAL COMMISSION NEW DELHI

REVISION PETITION NO. 2920 OF 2011

(From the order dated 5.4.2011 in Appeal No.1075/06 of the Haryana State Consumer

Disputes Redressal Commission, Panchkula)

Sukhbir Singh S/o Sh. Ami Chand R/o House No.1922, Sector – 8 Faridabad (Haryana)

… Petitioner/Complainant

Versus

Haryana Urban Development Authority, Faridabad, Through its Estate Officer, HUDA,

Faridabad.

… Respondent/Opposite party

BEFORE

HON’BLE MR. JUSTICE K.S. CHAUDHARI, PRESIDING MEMBER

For the Petitioner

:

Mr. Manoj Kumar Sood,

Advocate

PRONOUNCED ON 2nd November, 2012

ORDER

PER JUSTICE K.S. CHAUDHARI, PRESIDING MEMBER

This revision petition has been filed against the order dated 05.04.2011 passed by the

Haryana State Consumer Disputes Redressal Commission, Panchkula (in short, ‘the State

Commission’) in Appeal No. 1075/06 – HUDA Vs. Sukhbir Singh by which while accepting

appeal order dated 20.2.2006 passed by District Forum was set aside and complaint was

dismissed.

2.

Brief facts of the case are that petitioner/complainant was allotted plot No.1607-P, Sector

65, Faridabad by the opposite party vide allotment letter dated 29.10.2001. Complainant

deposited Rs.27,110/- i.e. 10% of the tentative price of the plot with application on 29.12.2000

and thereafter deposited Rs.47,441/- i.e. 15% of the tentative price of the plot on

28.11.2001. The remaining price of the plot was to be paid in instalments. As the opposite party

failed to develop the area and deliver possession of the plot within the stipulated period to the

complainant, the complainant moved application on 17.9.2002 to the opposite party for surrender

of plot with prayer to refund the entire deposited amount. The opposite party accepted prayer of

complainant, cancelled allotment of the plot and refunded Rs.24,504/- vide letter dated 10.3.2003

after deducting 10% of the total consideration, as per HUDA policy. After accepting refund,

complainant filed complaint before the District Forum alleging that the plot was surrendered

under compelling circumstances and requested that original plot or an alternate plot of the same

size in the same sector may be allotted to him. Opposite party filed written statement and

submitted that as the complainant had surrendered the plot voluntarily and requested refund,

complainant is no more a consumer, hence, prayed for dismissal of the complaint. District

Forum after hearing both the parties allowed the complaint and directed opposite party to reallot

the same plot or alternate plot of the same price along with interest etc. On appeal, learned State

Commission vide impugned order while allowing appeal dismissed complaint against which this

revision petition has been filed.

3.

Heard learned counsel for the petitioner at admission stage and perused record.

4.

Learned counsel for the petitioner submitted that learned State Commission passed the

order without hearing petitioner, hence, order of State Commission may be set aside and order of

District Forum may be confirmed.

5.

Learned State Commission has observed in its order that –

“Respondent has been served but failed to appear either in person or through his

agent/representative. Waited sufficiently. No request or intimation has been

received so far. Hence, respondent is proceeded exparte”.

This observation clearly reveals that petitioner did not appear before the State Commission even

after service and in such circumstances, impugned order was passed. Learned Counsel for the

petitioner has drawn my attention towards different order sheets from the year 2006 to

11.2.2011. In the last order sheet dated 11.2.2011, learned State Commission observed as under

:

“Service not effected. Fresh notice be issued to the respondent registered post for

5.4.2011 along with the documents relied upon by the appellant at own

responsibility. In addition to this office is also directed to issue notice to the

respondent for the date fixed. Till then stay is extended. Notice be givendasti as

requested”.

It appears that after this order notices were sent to the petitioner by registered post

and after service of notice petitioner did not appear before the State Commission

and in such circumstances exparte order was passed which is in accordance with

law.

6.

As far merits of the case are concerned, it is an admitted case of the petitioner that the plot

was surrendered by him and he received refund amount and after 5 months of receiving refund,

complaint was filed before the District Forum for reallotment of plot. Learned State Commission

has rightly placed reliance on judgment of Punjab and Haryana High Court and judgement of the

State Commission in HUDA Vs. Pashu Lal Nagpal – 2010 (1) CPC 277 wherein it was held

that after surrendering plot and taking refund the complainant has no right to get the surrendered

plot.

7.

The State Commission has rightly allowed appeal and dismissed complaint as petitioner

had already surrendered plot and received refund. I do not find any illegality or material

irregularity in the impugned order and in such circumstances, the revision petition is liable to be

dismissed at admission stage.

8.

Consequently, the revision petition filed by the petitioner is dismissed without any order as

to cost.

..………………Sd/-……………

( K.S. CHAUDHARI, J)

PRESIDING MEMBER

k

NATIONAL CONSUMER DISPUTES REDRESSAL COMMISSION NEW DELHI

REVISION PETITION NO. 1279 OF 2012

(Against the order dated 17.10.2011 in First Appeal No. 471 of 2011 of the

Bihar State Consumer Disputes Redressal Commission, Patna)

Bihar State Housing Board Through its Managing Director,

6 Mangles Road, Patna, Bihar

... Petitioner

Versus

1. Smt. Geeta Choudhary W/o Late Abhay Narain Choudhary

2. Arun Kumar Chaudhary

3. Anil Kumar Choudhary Both sons of Late Abhay Narain Choudhary

All residents of Village Nehra, P.S. Manigachi, District Darbhanga

4. Smt. Manju Jha, Wife of Sri Shivanand Jha, Resident of

Village Deorh P.S. Ghoghardeha, District Madhubani

... Respondents

BEFORE:

HON'BLE MR. JUSTICE J.M. MALIK, PRESIDING MEMBER

HON’BLE MR. VINAY KUMAR, MEMBER

For the Petitioner

: Mr.

Amit Pawan, Advocate

Pronounced on : 1st November, 2012

ORDER

JUSTICE J. M. MALIK, PRESIDING MEMBER

1.

The first appeal filed by the Bihar State Housing Board, the petitioner, was dismissed as

barred by time by the State Commission vide its order dated 17.10.2011. There was delay of 15

months in filing the said appeal.

2.

Aggrieved by that order, the revision petition has been filed. The explanation given by the

petitioner under Section 5 of the Limitation Act read with Section 15 of the Consumer Protection

Act before the State Commission was as follows, the order passed by the District Forum was

communicated on 25.6.2010, which was received by the petitioner’s counsel and the same was

sent to the legal advisor of the Housing Board, who received it on 6.7.2010. The permission was

granted by the Managing Director, Housing Board to file appeal on 14.7.2010. It was sent to

empanelled

lawyer

of

the

petitioner

on

16.7.2010

but

the

empanelled

lawyer Shri Nawal Kishore Prasad Singh expressed his inability to appear before the State

Commission

and

thereafter

another

counsel

empanelled

for

the

Housing

Board,

namely, Rakesh Kumar Singh was handed over the file for drafting of memo of appeal, which

was received by Sri Singh on 23.07.2010 but even after several reminders, Sri Singh returned the

record with the draft copy of memo of appeal on 16.12.2010. Thereafter several paraphernalia

were observed by the Board officials and ultimately the office had to obtain necessary directions

from the Managing Director, Housing Board and after direction of the Managing Director, the

appeal was filed on 13.09.2011. It took 15 months in filing this appeal. The State Commission

did not condone the delay and dismissed the appeal.

3.

The alarm bells should have rung when the case was dismissed on the point of limitation

but it did not leave any impact on the petitioner-Bihar State Housing Board. The filing of this

revision petition was further delayed by 55 days. No application for condonation of delay was

filed with the revision petition.

4.

We have heard the learned counsel for the petitioner. He argued that in the interest of

justice, opportunity of being heard should be granted in favour of the petitioner.

5.

We find that the State Commission has rightly given the short shrift to this matter. We are

unable to take a different view from the one taken by the State Commission. State Commission

has made a perspicacious decision which cannot be faulted. The petitioner must show that

besides acting bona fide, it had taken all possible steps within its power and control and had

approached the court without any unnecessary delay. The test is whether or not a cause is

sufficient to see whether it could have been avoided by the party by the exercise of due care and

attention. Advanced Law Lexicon, P. Ramanatha Aiyar, 3rd Edition, 2005 as quoted by the Apex

Court in Balwant Singh (Dead) Vs. Jagdish Singh & Ors., (Civil Appeal no. 1166 of

2006), decided by the Apex Court on 08.07.2010 wherein it was held:

“The party should show that besides acting bona fide, it had taken all possible steps within its power

and control and had approached the Court without any unnecessary delay. The test is whether or

not a cause is sufficient to see whether it could have been avoided by the party by the exercise of

due care and attention. [Advanced Law Lexicon, P. Ramanatha Aiyar, 3rd Edition, 2005]”

6.

The Apex Court in recent authority reported in Office of the Chief Post Master General

& Ors. Vs. Living Media India Ltd. & Anr. 2012 STPL (Web) 132 (SC) was pleased to hold:

“13. In our view, it is the right time to inform all the

government bodies, their agencies and

instrumentalities that unless they have reasonable and acceptable explanation for the delay and

there was bonafide effort, there is no need to accept the usual explanation that the file was kept

pending for several months/years due to considerable degree of procedural red-tape in the

process. The government departments are under a special obligation to ensure that they perform

their duties with diligence and commitment. Condonation of delay is an exception and should not

be used as an anticipated benefit for government departments. The law shelters everyone under

the same light and should not be swirled for the benefit of a few. Considering the fact that there

was no proper explanation offered by the Department for the delay except mentioning of various

dates, according to us, the Department has miserably failed to give any acceptable and cogent

reasons sufficient to condone such a huge delay.

Accordingly, the appeals are liable to be dismissed on the ground of delay.”

7.

In

other

case,

titled

as “Mahindra

Holidays

&

Resorts

India

Ltd.

Versus Vasantkumar H. Khandelwal & Anr.” [Revision petition No. 1848 of 2012 decided on

21.05.2012], the Bench of this Commission headed by Hon’ble Mr. Justice Ashok Bhan, has

rejected the explanation that the file was moving from table to table to get the permission to file

that appeal. It was further held that under the Consumer Protection Act, 1986, the District Forum

is supposed to decide the complaint within a period of 90 days from the date of filing and in case

of some expert evidence is required to be led then within 150 days. The said Bench dismissed the

revision petition on the ground that it was delayed by 104 days.

8.

In the celebrated authority reported in Anshul Aggarwal v. New Okhla Industrial

Development Authority, IV (2011) CPJ 63 (SC), it has been held that “It is also apposite to

observe that while deciding an application filed in such cases for condonation of delay, the

Court has to keep in mind that the special period of limitation has been prescribed under the

Consumer Protection Act, 1986 for filing appeals and revisions in consumer matters and the

object of expeditious adjudication of the consumer disputes will get defeated if this Court was

to entertain highly belated petitions filed against the orders of the Consumer Foras”.

9.

Again, no explanation is forthcoming as to why the filing of this revision petition was

delayed by 55 days. The silence on the part of the petitioner ispernious.

10.

The attempt to kick against the pricks miserably fails. The revision petition is, therefore,

dismissed.

………Sd/-……………….

(J. M. MALIK, J.)

PRESIDING MEMBER

………Sd/-………………

(VINAY KUMAR)

MEMBER

Naresh/reserved

NATIONAL CONSUMER DISPUTES REDRESSAL COMMISSION NEW DELHI

REVISION PETITION NO. 1955 OF 2012

(Against the order dated 14.11.2011 in First Appeal Nos.527/2010 & 363/2010 of the State

Commission, Andhra Pradesh)

Bajaj Allainz Life Insurance Company Ltd. Through its Branch Manager

Mancherail, District Adilabad Andhra Pradesh

…Petitioner

Versus

1. Sowbhagyalaxmi W/o late Sunka Anandam

2. V. Swapna W/o Sh. Srinivas

3. Swathi W/o Sh. Laxminarasaiah

4. S. Aditya S/o late Sh. Sunka Anandam

All residents of H.N. 12-9/2 Gowthaminagar, Mancherial, Adilabad

.....Respondents

REVISION PETITION NO. 1956 OF 2012

(Against the order dated 14.11.2011 in First Appeal Nos.527/2010 & 363/2010 of the State

Commission, Andhra Pradesh)

Bajaj Allainz Life Insurance Company Ltd. Through its Branch Manager

Mancherail, District Adilabad Andhra Pradesh

….Petitioner

Versus

1. Sowbhagyalaxmi W/o late Sunka Anandam

2. V. Swapna W/o Sh. Srinivas

3. Swathi W/o Sh. Laxminarasaiah

4. S. Aditya S/o late Sh. Sunka Anandam

All residents of H.N. 12-9/2 Gowthaminagar, Mancherial, Adilabad

.....Respondents

BEFORE

HON’BLE MR. JUSTICE J. M. MALIK,

PRESIDING MEMBER

HON’BLE MR. VINAY KUMAR, MEMBER

For the Petitioner

: Mr. Pankul Nagpal, Advocate

For the Respondents/Caveator : NEMO

PRONOUNCED ON: 02.11.2012.

ORDER

PER MR.VINAY KUMAR, MEMBER

These two revision petitions arise out of a common impugned order passed by the AP

State Consumer Disputes Redressal Commission in FA No.527 of 2010 and FA No.363 of

2010. In the first, the appeal of the Complaint has been allowed and the OP/Insurance Company

has been directed to pay Rs.10,00,000/- with 9% interest. In the second, the appeal of the OP

against the order of the District Forum in which an award of Rs.2,00,000/- in favour of the

Complainant was made, has been dismissed.

2.

Both revision petitions have been filed with delay of 69 days, which is sought to be

explained in an application for condonation thereof. The application does not even mention the

exact date on which the petitioner came to know about the passing of the impugned order. It

may be stated that a copy was received in the second week of December. Apparently, some time

was spent in movement of papers from the Zonal office Chandigarh and the Delhi office of the

revision petitioner, but no details are indicated. Even the following statements in

the condonanation application offer no help in determining either the duration or the cause for

delaya) After it was decided that the revision petition should be filed, the relevant files kept lying in the

Delhi office without any action.(para 4)

b) Zonal Legal Manager spent considerable amount of time in collecting the data from the various

branches. (para 6)

c) Only in the last week of April it was discovered that the case had not been assigned to any

Advocate. (para 8)

3.

It is clear from the above that no conscious afford had been made to clearly explain the

delay at various stages in the office of the petitioner/ Bajaj Allianz Life Insurance Company

Ltd. We therefore, reject the explanation and consider the revision petition liable for dismissal

on account of limitation.

4.

Coming to the merits, we find that the petitioner has challenged the common impugned

order on several grounds most of which are only in the nature of reiteration of the contention that

the petitioner has rightfully repudiated the claim on the ground of failure to disclose material

particulars in the proposal form for insurance. This question has been considered at a great

length by the State Commission with reference to the records. The State Commission has

observed that:“11. The Insurance Company entrusted the matter to Satyam Investigation Private

Limited to enquire into the claim. If found that that the deceased had suffered from

blood motions for one and half years, and he was a known alcoholic and smoker and

consequently died. The fact that Satyam Investigations had conducted enquiry is not

evidenced either by a report or affidavit evidence of the investigator, who said to have

conducted investigation and visited Dr. T.Srinivas. No certificate was even taken

from Dr.T.Srinivas to state that Sunka Anandam had the above ailment. In fact in Ex. A.1

repudiation letter dated 28.02.2008, the fact that they have entrusted the matter to

Satyam Investigations and that it made an enquiry with Dr. T. Srinivas does not even find

a place. What all it was stated was:

“However, on receiving the death claim intimation for the above said policy, the

various medical records received confirm that lateMr. Sunka Anandam was suffering

from bleeding PR off and on since one year from June, 2007. This fact known to

late Mr. SunkaAnandam was not disclosed in the proposal form dated 29.08.2007.”

12. The Insurance Company did not disclose the material from which it could gather

the above information. In fact the complainants themselves filed a report, Ex.A.4 issued

by Dr. T. Sreenivas, M.D. The Ultra Sound Abdomen report discloses that he was not

suffering

from

ABNORMALITY

any

ailment. The

impressions

NOTED. SUGGESTED

were

CLINICAL

“NO

SONOGRAPHIC

CORRELATION.”

Equally,

Haemotology Report and Bio-Chemistry Report do not confirm that he was suffering

from any ailment. The complainants themselves submitted Ex. A.11 certificate issued

by Dr. T. Srinivas, M.D. dated 24.12.2007, obviously a family doctor, who certified that

he had some viral fever. He did not state any where that he was admitted as an in patient,

nor the fact that he was suffering from blood motions, etc.”

5.

It needs to be observed that the insurance company has substantially relied upon the report

of Satyam Investigation Pvt. Ltd., but the report has not been proved before the fora below. The

investigator has not been examined. Before the District Forum OP/Insurance Company had

marked seven exhibits which did not include the investigation report.

6.

Similarly, the O P/Insurance Company relied upon the report of the investigator that

according to Dr. T. Srinivas, the deceased had certain ailments. But, he was not examined. As

observed by the State Commission, no report from Dr. Srinivas was produced on the alleged

ailments. On the other hand, the Complainants themselves have filed a report given

by Dr. Srinivas as Ext. A-4. We may add that haematology and biochemistry reports relied upon

by the OP/Insurance Company as Ext. B-5 and B-6 also do not carry any adverse comments with

respect of the health of the deceased. We are therefore, in agreement with the finding of the State

Commission that the insurance company could not prove from their investigation or from

medical reports that the deceased suffered from those ailments.

7.

In the light of the details examined above, revision petition Nos. 1955 of 2012 and 1956 of

2012 are dismissed on the ground of limitation as well as merit.

.……………Sd/-……………

(J. M. MALIK, J.)

PRESIDING MEMBER

…………Sd/-……………….

(VINAY KUMAR)

MEMBER

s./-

NATIONAL CONSUMER DISPUTES REDRESSAL COMMISSION NEW DELHI

REVISION PETITION NO. 3904 OF 2012

(Against the order dated 24.02.2012 in First Appeal No. 700 of 2011 of the Gujarat State

Consumer Disputes Redressal Commission, Ahmedabad)

Heir

of

deceased Sidikbhai

Mohamadshah Muhamadshah

Gulamahmed Saiyed

Mohmedshah Gulamahmed Saiyed Res. At Yoginagar Dhari Taluka Dhari Dist. Amreli Gujarat

... Petitioner

Versus

1. Manager Axis (UTI) Bank, Nr. Nathnath Temple, Nagnath Complex, 1st Floor, Amreli

2. Bajaj Allianz General Insurance Co. Ltd. 204-206 Time Square, Nr. Pariseema Complex, C G.

Road, Ellis Bridge Ahmedabad

... Respondents

BEFORE:

HON'BLE MR. JUSTICE J.M. MALIK, PRESIDING MEMBER

HON’BLE MR. VINAY KUMAR, MEMBER

For the Petitioner

: Mrs. Hariharan, Advocate

Pronounced on : 2nd November, 2012

ORDER

JUSTICE J. M. MALIK, PRESIDING MEMBER

1.

The State Commission dismissed the first appeal filed by the complainant as time

barred. There was delay of 204 days in filing the said appeal. Before the State Commission, the

petitioner explained the delay in para 4 of his application for condonation of delay, which is

reproduced as under:“4. The applicant submits that the order of the Hon’ble Forum is dated 15.3.2011. The advocate

for the applicant had written a letter to the applicant regarding the same but the applicant didn’t

receive the letter and was under impression that the complaint is still pending. The applicant

submits that thereafter when the applicant confirmed about the status from his advocate he came

to know that the complaint is dismissed and the order copy is already received and handed over

the same to the applicant.”

2.

It is also interesting to note that the petitioner did not learn a lesson and delayed the filing

of this revision petition before this Commission by further 10 days.

3.

We

have

heard

the

learned

counsel

for

the

petitioner. He

reiterated

the

pleas raised in para 4 above. The petitioner has put up a fragile excuse. Such like story can be

created at any time. There can be no reason as to why did not the petitioner receive the letter

sent by his advocate. Moreover, it is required that a litigant must be vigilant and diligent in

pursing his case. It is expected from a litigant to keep himself posted with the next date of

hearing. The petitioner should have gone to the office of his Advocate and enquire about the

then status of his case. Negligence, inaction and passivity is writ large on these pleas.

4.

The following authorities further weaken the case of the petitioner.

5.

In Banshi Vs. Lakshmi Narain – 1993 (1) R.L.R. 68, it was held that reason for delay was

sought to be explained on the ground that the counsel did not inform the appellant in time, was

not accepted since it was primarily the duty of the party himself to have gone to lawyer’s office

and enquired about the case, especially when the case was regarding deposit of arrears of rent.

The statute also prescribes a time bound programme regarding the deposit to be made.

6.

In Jaswant Singh Vs. Assistant Registrar, Co-operative Societies – 2000 (3) Punj. L.R.

83, it was observed that cause of delay was that the counsel of the appellant in the lower Court

had told them that there was no need of their coming to Court and they would be informed of the

result, as and when the decision comes, was held to be a story which cannot be believed.

7.

In Bhandari Dass Vs. Sushila, 1997 (2) Raj LW 845, it was held that accusing the lawyer

that he did not inform the client about the progress of the case nor has he sent any letter, was

disbelieved while rejecting an application to condone delay.

8.

In Anshul Aggarwal v. New Okhla Industrial Development Authority, IV (2011) CPJ 63

(SC), it has been held that “It is also apposite to observe that while deciding an application filed

in such cases for condonation of delay, the Court has to keep in mind that the special period of

limitation has been prescribed under the Consumer Protection Act, 1986 for filing appeals and

revisions in consumer matters and the object of expeditious adjudication of the consumer

disputes will get defeated if this Court was to entertain highly belated petitions filed against the

orders of the Consumer Foras”.

9.

In Balwant Singh (Dead) Vs. Jagdish Singh & Ors., (Civil Appeal no. 1166 of

2006), decided by the Apex Court on 08.07.2010, it was held:

“The party should show that besides acting bona

fide, it had taken all possible steps

within its power and control and had approached the Court without any unnecessary delay. The

test is whether or not a cause is sufficient to see whether it could have been avoided by the party

by the exercise of due care and attention. [Advanced Law Lexicon, P. Ramanatha Aiyar, 3rd

Edition, 2005]”

10.

In

other

case,

titled

as “Mahindra

Holidays

&

Resorts

India

Ltd.

Versus Vasantkumar H. Khandelwal & Anr.” [Revision petition No. 1848 of 2012 decided on

21.05.2012], the Bench of this Commission headed by Hon’ble Mr. Justice Ashok Bhan, has

rejected the explanation that the file was moving from table to table to get the permission to file

that appeal. It was further held that under the Consumer Protection Act, 1986, the District Forum

is supposed to decide the complaint within a period of 90 days from the date of filing and in case

of some expert evidence is required to be led then within 150 days. The said Bench dismissed the

revision petition on the ground that it was delayed by 104 days.

11.

See also the law laid down in Office of the Chief Post Master General & Ors. Vs. Living

Media India Ltd. & Anr. 2012 STPL (Web) 132 (SC).

12.

Thus the version put forward by the petitioner does not just stack up. In view of this

discussion, the revision petition is dismissed.

……………Sd/-………….

(J. M. MALIK, J.)

PRESIDING MEMBER

…………Sd/-……………

(VINAY KUMAR)

MEMBER

Naresh/reserved

NATIONAL CONSUMER DISPUTES REDRESSAL COMMISSION NEW DELHI

CONSUMER COMPLAINT NO.123 OF 2012

Sapient Corporation Employees Provident Fund Trust, DLF Cyber Greens,

DLF Phase-III, Sector -25 A, Gurgaon 122 001

(Through Shri Amit Khera, Trustee and Director Legal)

….Complainant

Versus

1. HDFC Bank Ltd., a Scheduled Commercial Bank carrying on

banking business in the private sector and having its Registered

Office at HDFC Bank House, Senapati Bapt Marg, Lower Parel,

Mumbai- 400013 Maharashtra (Through its Managing Director Sh. Aditya Puri)

2. M/s. HDFC Bank Ltd. K.G. Marg Branch situated at G-3/4,

Surya Kiran Building, 19 K.G. Marg, New Delhi-110001

(Through its Manager Ms. Varna Bhattacharjee)

3. Mr. Anand Somiach, Manager (FIG Delhi), HDFC Bank, 3rd Floor

B-6/3, DDA Commercial Complex Safdarjung Enclave,

Opp. Deer Park New Delhi -110029

....Opposite Parties

BEFORE

HON’BLE MR. JUSTICE J. M. MALIK,

PRESIDING MEMBER

HON’BLE MR. VINAY KUMAR, MEMBER

For the Complainant

: Mr. Pradeep K. Dubey, Advocate

For the Opposite parties : Mr. Rishab Raj Jain, Advocate

PRONOUNCED ON: 01.11.2012

ORDER

PER MR.VINAY KUMAR, MEMBER

Consumer Complaint No.123 of 2012 is filed by M/s. Sapient Corporation Employees

Provident Fund Trust (hereinafter referred to as the Complainant), against the HDFC bank

Ltd. The Complainant has also impleaded two Managers of the Bank as OPs 2 and 3. According

to the Complainant, the short point for consideration is whether the OP-Bank has committed any

deficiency of service in terms of the provisions of the Consumer Protection Act, 1986, by

debiting the account of the Complainant. It is alleged that the demand of recovery was against

the Sapient Corporation not against the Complainant i.e. Sapient Corporation Employees

Provident Fund Trust, which is a separate legal entity.

2.

Brief facts of the case, as per the Complaint petition, are—

"that on 21.08.2010 Opposite Party No.1, through O.P. No.2, informed the officials of

the Company and followed it up by an email to the Company, informing that they are in

receipt of an order/notice dated 20.08.2010 from the Employee Provident Fund

Organization (EPFO) for the recovery of Rs.1,47,52,766/- (Rupees One Crore Forty

Seven Lac Fifty Two Thousand Seven Hundred Sixty Six only) against the Company and

for prohibiting from making any payments out of the amount lying in the credit of M/s.

Sapient Corporation Pvt. Ltd. (Company). It was further informed that they had put on

hold on the account of the complainant to the tune of said amount and if the company

wishes to make the account operational, then it should bring the stay order by 12:00

noon of 23.08.2010.”

3.

Allegedly, the OPs were advised that no debit should be made to the account of the trust

since it was a different entity under the law from the Company. The officials of the Company

sent a reply e-mail to the OP-Bank in this behalf. However, on 25.8.2010 the OPs informed the

Company that they have already issued a demand draft on 23.8.2010 in compliance with the

notice of the Employees Provident Fund Organization dated 20.8.2010.

4.

It is alleged that the OPs have acted with wilful negligence in wrongly paying out an

amount of Rs.1,47,52,766/- (Rupees One Crore forty seven lakh fifty two thousand seven

hundred sixty six only), without any authority or mandate, from the account of the Complainant

and are therefore guilty of deficiency in service and hence are liable to refund the said amount

along with interest and damages together with legal expenses and costs of this

complaint. Accordingly, the Complaint Petition seeks the following reliefs:“a.

ORIGINAL AMOUNT Rs. 1,47,52,766 (Rupees One Crore forty seven lakh fifty

two thousand seven hundred sixty six only).

b.

INTEREST @ 36% per annum from the date of debiting the account of the

complainant i.e. 23.08.2010 till the date of realisation.

c.

DAMAGES on account of deficiency in service causing harassment misery,

hardships and agony etc. being Rs.50,00,000/- (Rupees Fifty Lac Only).

d.

LEGAL Expenses incurred by the Complainant, computed at Rs.1,10,000/-

(Rupees One Lac ten thousand only.)”

5. We have perused the records and heard the counsels for the two parties. A perusal of the

records as submitted by the Complainant and the facts as stated in the Complaint Petition shows

that the Bank had received order no.HR/GGN/COMP-I/26147/5466 dated 20.08.2010 from the

Assistant Provident Fund Commissioner, Gurgaon. It clearly mentioned the account no. as C/A00031110000846 which is the number of the account held by the complainant Trust with the OP

Bank directed the Bank to pay a sum of Rs.14752766/- (Rupees one Crore forty seven lakhs fifty

two thousand seven hundred and sixty six) only to the credit of the regional Provident Fund

Commissioner through a demand draft. The order also directed the Bank as follows:“It may further be noted that no payments out of future receipts in the account

/accounts or any interest accuring or becoming payable in the accounts or Fixed

Deposit Receipts of the defaulting establishments may be made in favour of anybody till

the balance payable towards PF damages stand fully liquidated and this order of

attachment stands withdrawn.

Evidence of the above payments or payments having been made in compliance of

this order may be produced before the undersigned immediately.

It may be noted that in the event of non-compliance of the requirements of this

order the undersigned will have no other alternative but to deem you personally to be

the Employer in default to the extent of Rs.14752766/- (Rupees one Crore forty seven

lakhs fifty two thousand seven hundred and sixty six only), under the provisions of the

clause (x) of the sub-section 3 of Section 8F of the Act and further action to recover the

said amount as if the same is arrears due from you will be initiated in accordance with

the relevant provisions of the E.P.F. & M.P. Act, 1952.”

Copies of e-mails produced on record by the Complainant show—

a. that the OP/bank had informed the complainant about the order of APFC, Gurgaon on the very

next day i.e. on 21/8/2010, stating categorically that it would wait for stay or revocation of the

order till 1200 hrs on 23/8/2010 and thereafter “would be debiting the a/c with the recovery

amount and remitting the funds to the authorities.”

b. Admittedly, the notice for payment of the above amount was received by the Sapient on

11.8.2010 in which 15 days time, from the date of receipt, was given to make the payment. But,

the reply sent to the Bank does not show if any action to either pay or to obtain stay/revocation

of the order had been taken in the 10 days preceding the complainant’s reply of 21.10.2010. It

only says “We are in a process of challenging the said order by filing an appeal with EPFAT

(Employees Provident Fund Appellate Tribunal on 25.8.10 i.e. Wednesday (since

Monday/Tuesday courts being closed due to festivals.”(Page 34 of the Paperbook).

c. The reply of 21.8.2010 from the Complainant to the OP/bank states that “The RPFC letter of

20.8.10 does not specify any deadline for the bank to make the payment.” Therefore, the

complainant had advised the bank not to make any payment on 23.8.2010. This is factually not

true. The relevant part of the APFC order, reproduced earlier in this order, would show that the

bank, under the threat of legal action, had been directed by the authority that “Evidence of above

payment or payments having been made in compliance of this order may be produced before

the undersigned immediately.”

6.

In para 10, the Complaint petition says that “ the Opposite Parties have acted with wilful

negligence in wrongly debiting an amount of Rs 1,47,52,766 (Rupees one crore forty seven lac

fifty two thousand seven hundred sixty six only), without any authority or mandate, in account of

the Complainant and are therefore guilty of deficiency in service”. But, neither the complaint

petition nor the counsel for the complainant have made any attempt to explain how does action in

compliance with the direction of a statutory authority become wilful negligence and deficiency

in service.

7. We find that a copy of the Legal Notice issued by the complainant, before filing the

consumer complaint, has been annexed as Annexure C-14. In para 3 it says “That the account

of my above client was debited by you inspite of clear instructions from my client not to effect

the debit specifically bringing to your notice that the said orders of recovery caused by the

EPFO are without any basis, without authority and hence against law.” Subsequently, in para 8

the Legal Notice says “That now, through this notice my client wishes to inform you that in an

appeal preferred by the Company challenging the alleged recovery before the EPF Appellate

Tribunal (EPFAT), the appeal has been allowed against the RPFC, Gurgaon and needless to say

this has vindicated the stand of my client.” From this it is clear that the complainant knew that

his remedy against the order of recovery, lay in challenging its legality before the appellate

authority. It did eventually file an appeal. The Appellate Authority allowed the appeal and set

aside the recovery order.

8.

The question that arises here is whether the fact of appeal being allowed by the EPFAT in

2011 will render compliance in 2010 by the OP/bank with the order of the EPFO, an act of

deficiency in service. Section 2(1)(g) of the Consumer Protection Act, 1986 has defined

“deficiency” to mean—

“any fault, imperfection, shortcoming or inadequacy in the quality, nature and manner

of performance which is required to be maintained by or under any law for the time

being in force or has been undertaken to be performed by a person in pursuance of a

contract or otherwise in relation to any service;”

It is not the case of the complainant that the act of the bank in paying the amount, in compliance

with the orders of a statutory authority and after giving the complainant due notice of the same,

amounts to a deficiency of service. The allegation in the complaint petition is that the payment

has been made by the OPs, despite request and advice of the complainant not to make it. In

support, the complainant has relied upon the decision of this Commission in Saraswati Co-Op

Bank Ltd Vs. Dean Leslie Roy 1 (2008) CPJ 163 (NC), wherein it was held that unauthorised

debit in complainant’s SB account, without his consent, amounted to deficiency of service. Facts

of the case cited are that the Directorate of Enforcement had imposed a penalty of Rs 50,000 on

the complainant. But the OP/Bank had remitted an amount of Rs 2.5 lakhs, debiting it to the

account of the complainant. Allegedly, this was done on oral instructions of the complainant.

The National Commission held that in the absence of the name of the Bank officer who had

allegedly received the oral instruction and the date thereof, there was no reason to disbelieve the

complainant that no such instruction was given. The facts of the case before us are on an entirely

different footing. The OP bank has paid the amount, in spite of the advice of the complainant not

to pay. Therefore, the question is not whether there was any instruction from the complainant to

pay. The question is whether the action of the OP bank in not implementing the complainant’s

direction to disobey specific, written directions of a statutory authority, would amount to a

deficiency of service, as defined under the Act.

9.

In view of the detailed consideration of the facts and circumstances of the case before us,

we hold that the action taken by OP bank was proper, legal and after reasonable notice to the

complainant. It does not amount to a deficiency of service and no cause of action would arise

from it. We therefore reject the contention of the complainant that the cause of action first arose

when the bank informed the company on 21.8.2010 about the communication received from the

EPFO and arose again when the OP debited the account of the complainant on 23.8.2010. The

complaint petition is accordingly held to be devoid of any merit.

10. We also deem it necessary to consider whether this complaint would attract the provision in

Section 26 of the Consumer Protection Act, 1986. This provision requires the consumer fora to

dismiss a complaint if it is found to be frivolous or vexatious in nature. In other words, we need

to see whether the complaint lacks seriousness and is filed without sufficient cause or without

sufficient grounds. Significance of this provision lies in the fact that the Consumer protection

Act, 1986 is a social legislation to provide economic justice and to protect the consumer from

exploitation. For this reason, no court fees are payable for filing a complaint, as required in civil

suits. Consumer Protection Rules, 1987 prescribes a maximum fee of Rs 5000 for making a

complaint, involving total value above Rs one crore. Therefore simultaneously, there is need to

guard against possibility of such absence of court fee being misused for pursuing false and

frivolous litigation in the consumer fora. In this context, the following facts acquire special

significance—

a. The complaint is filed after the complainant had already won his appeal in the EPFAT against the

recovery of Rs 1,47,52,766 (Rupees one crore forty seven lac fifty two thousand seven hundred

sixty six only) made as per order of the EPFO, Gurgaon.

b. The complaint does not disclose whether consequent action, in pursuance of the order of EPFAT,

for obtaining refund of the excess/wrong recovery has been initiated by the complainant Trust or

by the company. If not, why?

c. If refund is already claimed or received from the EPFO as per the order of EPFAT, the complaint

makes no attempt to explain what is that other loss which is sought to be recovered from the OP

bank, as the appeal before the EPFAT also included claim for interest.

11. We therefore, hold that the complaint is not only without merit but also frivolous and

vexatious in nature. It has been filed with a very palpable purpose to harass the OP bank.

Consequently, Consumer Complaint No. 123 of 2012 is dismissed for want of merit as well as

for being vexatious and frivolous in nature. We therefore, deem it just and proper to impose cost

of Rs.25,000 on the complainant. The same shall be paid to the OP/HDFC Bank within a period

of three months. Failing this, the amount shall also carry interest at 10% for the duration of

delay.

.……………Sd/-……………

(J. M. MALIK, J.)

PRESIDING MEMBER

…………Sd/-……………….

(VINAY KUMAR)

MEMBER

S./-

NATIONAL CONSUMER DISPUTES REDRESSAL COMMISSION NEW DELHI

REVISION PETITION NO. 1227 OF 2012

(Against the order dated 28.11.2011 in First Appeal No.931/2009 of the State Commission,

Haryana)

Dharambir, S/o Sh. Jhangi Ram R/o H No.89, Ram Nagar, Karnal Haryana

……….Petitioner

Versus

New India Assurance Co. Ltd. Divisional Office Gagan Building G T Road, Karnal

Haryana Also at New India Assurance Co. Ltd.,Regional Office: SCO no.36-37 Sector- 17-A,

Chandigarh

.....Respondent

BEFORE

HON’BLE MR. JUSTICE J. M. MALIK,

PRESIDING MEMBER

HON’BLE MR. VINAY KUMAR, MEMBER

For the Petitioner

: Ms. Renu Verma, Advocate

For the Respondent