Bank Reconciliation Statement Worksheet

advertisement

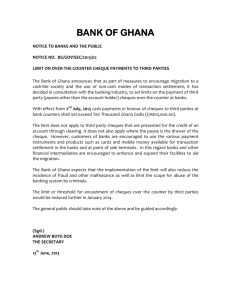

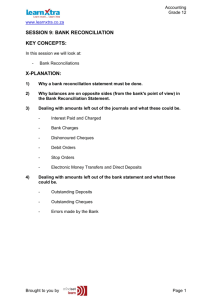

MARYKNOLL SECONDARY SCHOOL Principles of Accounts 10 Bank Reconciliation Statement Bank Statement At regular intervals, usually monthly, a bank statement will be received from the bank setting out the transactions recorded by the bank. There are likely to be differences between the cash book balance and that of the bank statement. Bank Reconciliation Statement A Bank Reconciliation Statement is to reconcile the differences between the bank balance in the cash book and the bank balance in the bank statement. Causes of differences: (A) Items shown in the Bank Statement but not entered in the Cash Book a. b. c. d. e. f. g. Bank Charges Bank Interest Bank Interest Allowed Direct Debit Standing Order Credit Transfer Dishonoured Cheques (B) Items shown in the Cash Book but not entered in the Bank Statement: a. b. c. Unpresented Cheques Uncredited Cheques Bank Lodgement (C) Errors Example 2002 Dec 27 Dec 29 Dec 31 Bal b/f W. Ping K. Tong 2003 Jan 1 Bal b/d 2005 Dec 27 Dec 29 Dec 30 Cash Book (Bank Columns) $ 2002 400 Dec 28 T. Kwok 60 Dec 30 M. Chin 220 Dec 31 Bal c/d 680 105 15 560 680 560 Bank Statement Dr. $ Balance b/f Cheque T. Kwok Credit transfers: L Fat Bank Charges $ Cr. $ 60 105 70 20 Balance $ 400 Cr. 460 Cr 355 Cr 425 Cr 405 Cr 1 MARYKNOLL SECONDARY SCHOOL Principles of Accounts Ex. 10.1 At the close of business 28 February 1989 the Cash Book of Mr. Chong showed a balance of $625 in his bank. This figure differed from the bank balance as shown on his bank statement. The following matters account for the difference: (1) On 28 February 1989 one of his debtors had paid direct to Mr. Chong’s banking account the sum of $42. This transaction had not been entered in the Cash Book. (2) During February 1989 the bank had allowed Mr. Chong interest amounting to $54 but this had not yet appeared in the Cash Book. (3) Certain cheques drawn by Mr. Chong during February 1989 had not been presented for payment by the close of business on 28 February 1989. These were for $21, $17, $57 and $61. (4) A standing order for $75 being one quarter’s rent had been paid by the bank on Mr. Chong’s behalf but this had not yet been entered in the Cash Book. (5) During February 1989 Mr. Chong had paid into his banking account a cheque for $44 which he had received from a debtor. On 28 February 1989 this cheque had been returned unpaid by the debtor’s bank. The appropriate entry appeared on the bank statement but not in Mr. Chong’s Cash Book. Required: Draw up the Bank Reconciliation Statement at 28 February 1989 commencing with the Cash Book balance of $625 and ending with the balance as shown on the bank statement. Ex. 10.2 At the close of business on 31 May 1985, the Bank Statement of Amos Jones, a sole trader, showed that his balance with the bank amounted to $1,960. This does not agree with bank balance according to his Cash Book, and the following transactions account for the difference: (1) On 31 May the Bank allowed Jones interest amounting to $76, but this had not yet been entered in the Cash Book. (2) During May 1985 the bank had paid on behalf of Jones, under a banker’s standing order, the rent of his business premises amounting to $110. This had not been entered in the Cash Book. (3) On 31 May William Smith, a debtor of Jones paid direct to Jones’ account with his bankers the sum of $89, but this had not yet appeared in the Cash Book. (4) During May, Jones had drawn several cheques but, at the close of business on 31 May 1985, the following three cheques had not yet been presented for payment. $21, $44 and $39. Required: Commencing with the Bank Statement balance of $1,960 prepare the Bank Reconciliation Statement of Amos Jones as at 31 May 1985, ending with the correct bank balance as shown in his Cash Book. 2 MARYKNOLL SECONDARY SCHOOL Principles of Accounts Ex. 10.3 On 30 September 1990, the credit balance of $11 020 in the bank column of Kammy’s cash book did not agree with that shown in the bank statement on the same date. The following items accounted for the difference: (1) On 30 September 1990, overdraft interest of $1 720 charged by the bank had not been entered in the cash book. (2) Cheques received on 30 September 1990 amounting to $13 460 were entered in the cash book on that date but were not credited by the bank until the following day. (3) A customer’s cheque for $5 620 was returned by the bank due to insufficient funds. This had not been recorded in the cash book. (4) On September 1990 a payment by cheque of $6 600 was recorded on the debit side of the cash book as $6 060. (5) Kammy had invested $300 000 on 8% debentures of another company. Interest for the half year was paid directly into the bank account on 28 September 1990 but no entry was made in the cash book. (6) On 15 September 1990, a payment of $4 200 for rates by standing order had not been recorded in the cash book. (7) Cheques drawn but not yet presented his month amounted to $3 200. Required: Prepare a bank reconciliation statement on 30 September 1990, beginning with the cash book balance. Ex. 10.4 On 30 September 1999, the bank statement for Canton Ltd. showed an overdraft of $81,200 and the cash book showed a credit balance of $73,200 on its account at the bank. In reconciling the bank statement with cash book balance, the following items were discovered: (1) The bank statement showed that the company was charged with bank service charges of $320, and a cheque drawn by another firm for $6,540 was incorrectly charged to Canton Ltd.’s account. (2) Canton Ltd. had entered a payment of $560 in the cash book as $650. (3) The bank statement did not show receipts on 30 September 1999 totally $4,290, which were mailed to the bank on that date but not yet received by it. (4) Cheques drawn, but not yet presented to the bank, were found to be $3,260. Among the cheques umpresented was one for $200 drawn 7 years ago. The company decided to cancel it and had the cash book balance adjusted in the middle of September. Required: Prepare a bank reconciliation statement as at 30 September 1999. 3 MARYKNOLL SECONDARY SCHOOL Principles of Accounts Reconciliation With Adjusted Cash Book Ex. 10.5 G Ko, a sole trader, received his bank statement for the year ended 31 March Year 6. At that date, it showed that his balance in the bank amounted to $12,900 whereas the balance at bank in his Cash Book was $13,399. Upon checking the bank statement with his Cash Book, Ko found the following: (1) (2) (3) (4) (5) (6) (7) A standing order payment for rent of $762 had not been entered in his Cash Book. Cheues drawn by Ko amounting to $1,215 had not been presented to the bank. A credit transfer of $511 from William Chan had not been entered in his Cash Book. Ko had entered a payment of $690 to Eric Pang $960 in his Cash Book. Bank charges of $68 had not been entered in his Cash Book. The bank had not credited Ko with receipts of $2,186 paid into the bank on 31 March Year 6. A cheque for $408 form D Ho had been returned by the bank marked “refer to drawer” but this had not been recorded in his Cash Book. (8) Ko had omitted sales receipts amounting to $929 form his cash book but they were shown on his bank statement. Required: (a) Complete Ko’s Cash Book at 31 March Year 6 (b) Prepare a Bank Reconciliation Statement commencing with the Bank Statement balance. Ex. 10.6 The financial year of Johnson Lee, a sole trader, ends on 30 June. At 30 June 1997, his Cash Book showed a balance of $3,200. This did not agree with the bank statement balance, the difference being accounted for by the following items: 1. On 27 June the bank paid $200 by standing order for a subscription to a trade publication. This had not yet been entered in Johnson’s Cash Book. 2. During June, the bank allowed Johnson interest on his account amounting to $260. This had not yet been entered in Johnson’ Cash Book. 3. The business had entered a payment of $560 in the Cash Book as $650. 4. A cheque for $500, received from E Tong on 25 June, had been duly recorded in the Cash Book and paid into the bank. On 28 June Johnson’s bank notified him that the cheque had been dishonored: this had not yet been recorded in the Cash Book. 5. A cheque $100 receipt from Miss Wong had been recorded twice in the Cash Book. 6. The following cheques were drawn by Johnson during June but had not yet been presented for payment; A Hung $43; F Lee $200; T Sum $37. 7. A cheque from B Wong for $180 had been recorded in the Cash Book and paid into the bank on 30 June. It did not appear on the bank statement until 2 July 1997. 8. The bank statement showed that a cheque drawn by another firm for $700 was incorrectly charged to Johnson’s account. Required (a) Make the necessary adjustments to the Cash Book on 30 June 1997. (b) Prepare a bank reconciliation statement as at 30 June 1997, commencing with the adjusted Cash Book balance. 4 MARYKNOLL SECONDARY SCHOOL Principles of Accounts Ex. 10.7 5 MARYKNOLL SECONDARY SCHOOL Principles of Accounts Ex. 10.8 6 MARYKNOLL SECONDARY SCHOOL Principles of Accounts Ex. 10.9 7 MARYKNOLL SECONDARY SCHOOL Principles of Accounts Ex.10.10 8