Results - Department of Agricultural Economics

advertisement

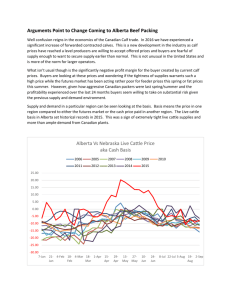

Game Theory Application to Fed Cattle Procurement in an Experimental Market Jared G. Carlberg, Robert J. Hogan, Jr., and Clement E. Ward Revision submitted to Agribusiness: An International Journal February 2007 The authors are Assistant Professor, University of Manitoba, Assistant Professor and Extension Economist, University of Arkansas, and Professor and Extension Economist, Oklahoma State University, respectively. The authors acknowledge Wayne Purcell, former Director of the Research Institute on Livestock Pricing at Virginia Tech University, for financial support of this research. 1 Game Theory Application to Fed Cattle Procurement in an Experimental Market Abstract Consolidation in meatpacking has elicited many market power concerns and studies. A game theory model was developed and an empirical model estimated to measure beef packing firm behavior. Experimental market data from three semester-long classes using the Fed Cattle Market Simulator were used. Collusive behavior was found for all three data periods though the extent of collusion varied by data periods, due in part to market conditions imposed by the experimenters. Findings underscore the need for applying game theory to real-world transaction-level, fed cattle market data. Key Words Collusion, Meatpacking, Fed Cattle, Game theory, Industry conduct, Prices 2 Game Theory Application to Fed Cattle Procurement in an Experimental Market Comprehensive literature reviews identify many studies related to noncompetitive behavior of meatpacking firms (Azzam and Anderson; Ward 2002; Whitley). The high four-firm concentration ratio in steer and heifer procurement, i.e., approaching or exceeding 80% since 1990 (Grain Inspection, Packers and Stockyards Administration) is a primary structural characteristic in meatpacking leading to charges of noncompetitive behavior. A similarly high concentration ratio exists for wholesale beef sales as well. Previous studies differ significantly in data aggregation, data period length, and methodology chosen (see summary table in Ward 2002). Several studies attempted to link industry structure with performance, following the traditional structure-conductperformance (SCP) paradigm attributed to Bain. Much of the SCP empirical work was based on the price-concentration hypothesis; namely, that output (input) prices increase (decrease) with increasing seller (buyer) concentration. Critics of the SCP approach cite its failure to have a solid theoretical foundation. Empirical applications have been questioned regarding the measurement of key variables, causality direction between prices or profitability and concentration, and model specification (Azzam and Anderson). The preferred approach in recent literature is NEIO (new empirical industrial organization) which links firm behavior more directly with firm or industry performance. Most NEIO research involves estimating a conjectural variation (CV), thereby tying a specific type of firm conduct or behavior to performance. Since Schroeter’s first application of this approach to the meatpacking industry, several studies have relied on similar methodology. However, NEIO is not without criticism; such as its use of aggregated data, potentially unrealistic assumptions about firm conduct, static nature of the analysis, and functional form in estimations (Azzam and Anderson; Hunnicutt and Weninger; Sexton). An extension of the NEIO approach with application to beefpacking procurement includes concepts from game theory (Koontz, Garcia, and Hudson; Koontz and Garcia). Use of game theory allows the repeated strategic interaction of packers to be modeled more fully and provides a theoretical basis for observed behavior. The objective of this paper is to develop and estimate a game-theoretic model of industry conduct and supergame strategies in a dynamic oligopsony using experimental market data gathered under varying experimental conditions. Specifically, the effects of imposing a marketing agreement onto the market and limiting public information to market participants are compared to a base market period. This research extends previous game theory applications to fed cattle procurement. Because experimental market data are more detailed than available industry data for prior game theory applications, packer conduct was estimated with known, key parameters rather than first estimating these unknown variables. Studying the effects of varying market conditions on packers’ ability to collude provides further insight about market behavior. Results presented here from an experimental market have significance for further investigations of meatpacking firm behavior by regulatory agencies and further research by economists. Implications include, most importantly, the 2 need to collect detailed, transaction-level data from the real-world fed cattle market for game theory model estimation. Theoretical Foundation Friedman’s (1971) specification provides an appropriate basis for modeling beefpacker behavior in a fed cattle procurement market.1 The single period, noncooperative ordinary procurement game consists of a fixed, finite set of beefpacking firms which are restricted from making binding agreements. Each player (firm) is aware of the strategy sets and payoff functions that apply to all participants but players are unable to observe completely the strategic decisions made by others, i.e., thus complete but imperfect information. For instance, each packer is unaware of exact prices paid or quantities purchased by all rival packers for each trading period though each is aware of the prevailing market price and quantity. Quantity of fed cattle purchased is the strategic variable in the procurement game and the strategy set for the overall game consists of all possible quantities procured for all packers in a single period. The profit payoff to the ith player from processing fed cattle into boxed beef is a function of its own strategy as well as those of other players. Interdependence indicates the volume of cattle procured by each packer affects the volume available to remaining packers, which in turn affects their payoff. Nash equilibrium exists where each packer maximizes its payoff with respect to its own choice of strategy, given the strategy choices of other players in the game. Friedman (1971) noted that when the payoff functions are profit functions, the players are firms, and the strategy choices are quantities, the game is a single period oligopoly and 3 the non-cooperative (Nash) equilibrium is the same as the Cournot quantity-setting solution. Under the Cournot solution, firms take each rival’s output as given, and a change in the quantity purchased by one firm does not affect quantities purchased by other firms. Packers in a single-period game choose a quantity to achieve static profit maximization, but this strategy may not hold for a repeated game in which the same ordinary game is played at each iteration (Friedman 1986). If players are able to tacitly collude in a multi-period game, they may be able to achieve profits in excess of those generated in a single-period game. The Nash equilibrium of a single-period game can differ substantially from that which prevails in a repeated game because alternate strategies can produce higher payoffs than in the single-period game. A sequence of ordinary games with individual player strategy sets and payoff functions, i.e., a supergame in extensive form, allows for the association of differing strategies and payoffs across time. Players seek to maximize their payoffs over time for a given discount parameter. Since all players’ past strategies form part of the information set available to each player, the supergame strategy chosen by each player in the current period is some mapping of the strategy vectors of players in previous periods. In the beefpacking industry, past fed cattle purchase prices and volumes of rivals, to the extent they are known for individual firms or the aggregate market, are taken into account when setting quantity in the current procurement period. Further, Driscoll, Kamphampaty, and Purcell concluded that static profit maximization was not necessarily packers’ goal. Rather, they seek to maximize a discounted profit stream. 4 The concept of a trigger strategy equilibrium is central to the idea that packers can tacitly collude to keep fed cattle prices from approaching those that would prevail in a competitive market. Trigger strategy equilibria facilitate collaboration between players that allow them to achieve cooperative (cartel) outcomes in games that have a noncooperative structure. A trigger strategy is a tacit agreement in each period to choose a strategy vector that results in lower fed cattle prices than those occurring in an ordinary game where each player chooses a Cournot strategy. Any player can increase its single period payoff for any iteration within the supergame by choosing a defection strategy. In beefpacking procurement, such a strategy would see player pay slightly higher than the collusive price for fed cattle, thus increasing its processing volume. If any player defects from the tacitly collusive strategy vector, it triggers a reversionary (non-cooperative) episode in which the other players, who observe that market prices have risen above some trigger level, must follow suit. As a result, all players will choose the non-cooperative strategy for each remaining time period. Because all players opt for a strategy resulting in the lowest price paid across each ordinary constituent game of the supergame, there is no incentive for any player to defect, as long as the chosen strategy exceeds the ordinary game strategy plus the discounted payoff. The fed cattle market exhibits patterns consistent with periodic reversionary episodes. Based on the Green and Porter model, these episodes occur because cattle supply fluctuations are not directly observed by firms, rather than due to defection by any of the cartel members. Green and Porter assert that the punishment period does not necessarily last for the remainder of the game after defection, but rather is T ordinary 5 game periods in length. They further suggest T may depend on the amount by which the trigger price and market price differ in the first reversionary period. If one or more players choose a defection strategy, the fed cattle market then enters a reversionary period. Packer i’s expected aggregate procurement volume from this strategy may not equal the cooperative strategy and payoff in normal (nonreversionary) periods. Each packer’s expected payoff in reversionary periods is the expected discounted return to packer i in a single-period Cournot environment, plus the discounted gain in returns due to participation in the cartel. Then the Nash equilibrium, stated as a trigger strategy equilibrium, means that no strategy can produce a higher payoff for players than the trigger strategy. The associated first order condition for this expression indicates the marginal return to defecting from collusive output levels must be exactly offset by the risk of suffering a loss in returns by triggering a reversionary episode of length T. A resulting implication is that the observed market price reveals information about supply only, and does not cause players to revise their interpretation of what their competitors have procured. Industry reversion from collusive states occurs regardless of actual intentional defections by cartel members. The critical extension of this result is that even though participants are aware reversionary episodes occur as a result of supply conditions rather than intentional defection, it is rational for them to participate in the episodes anyway. If firms failed to participate in the reversionary episodes when high prices prevailed, i.e., due to low fed cattle supply conditions, the first order condition would not hold during normal game periods and collusive behavior would not be individually optimal for packers. 6 The beefpacking industry can be expected to exhibit both reversionary and collusive periods. Reversionary periods may be caused by either unanticipated fluctuations in the supply of fed cattle which cause higher prices that appear as defections, or actual choice of a defection strategy by any individual packing firm. If plant shutdown costs are sufficiently high, firms may purposely choose a defection strategy as their optimal strategy. If fed cattle supply is particularly low, players will understand this and the punishment period length T will be very short. Experimental Market Description and Data Plant-specific, transaction-level data for fed cattle are confidential and not publicly available. Generally, such data cannot be accessed without Congressional or regulatory authority due in part to industry consolidation, proprietary nature of the data, and either pending or potential civil antitrust litigation. Limited access to detailed market data led a team of economists to develop the Fed Cattle Market Simulator (FCMS). As noted by Ward et al. (1996), the FCMS integrates features of business simulation (Gentry) and experimental economics (Plott). The market simulator generates plant-specific, transaction-level data similar to that not publicly available for research. The empirical application of game theory to beefpacking procurement utilized data from the experimental market. Therefore, an understanding of the structure, operation, and economic behavior of participants in the experimental market is important. The FCMS was designed to resemble a real fed cattle procurement region, in which there are typically several cattle feedlots (sellers) and only a few packers (buyers). 7 The experimental market consists of four packing firms of different sizes and eight feedlots of nearly equal size. Packer and feedlot teams of 2-4 people trade paper pens of fed cattle, each sheet of paper representing 100 head of steers. Participants trade in sevenminute, open-negotiation sessions with each trading period representing one week of real time business. Participants negotiate cash (spot) or forward contract transactions, and may either hedge or speculate in the futures market component of the experimental market. Individual packing firms are aware of their efficient (minimum cost) procurement volumes, which for packers 1 through 4 are 8, 9, 11, and 12 pens per trading period, respectively. Output (boxed beef) price is determined by the volume of fed cattle processed, both number and weight of fed cattle. Packers use the most recent boxed beef price to determine their breakeven bid or price bid with a specified target margin. Cattle feeders use known feeder cattle and grain costs to determine their breakeven offer prices for various weights of fed cattle. Market-ready fed cattle are placed on a “show list” for the packers at 1100 pounds and continue to gain 25 pounds per week until they are sold, somewhere between 1100 and 1200 pounds. The number of new placements on the show list follows a preprogrammed, irregular but somewhat cyclical pattern, similar to a cattle cycle in the beef industry. Thus, at times, supplies are plentiful and each packer can reach its minimum cost volume relatively easily; and as a group, packers have the negotiating advantage over price (Ward 2005). At other times, fed cattle supplies are tight relative to packing capacity and each packer finds it difficult to purchase its minimum-cost volume. During these tight-supply periods, negotiating strength in the market shifts to cattle feeders. This finding parallels the asymmetric bargaining power argument of Sexton and Zhang. 8 Considerable market and performance information is provided to market participants during and after each trading session. This information parallels what is available to the real fed cattle market by the U.S. Department of Agriculture’s Agricultural Marketing Service (AMS) and National Agricultural Statistics Service (NASS) and from the Chicago Mercantile Exchange (CME). Current market data (e.g., volume and price range) on the most recent cash-market and futures-market transactions are continuously scrolled across an electronic information display during each trading period. End-of-week summary information (weekly volume traded, and average prices for fed cattle, feeder cattle, and boxed beef) is posted each week. Cattle on feed reports are issued every four trading weeks. Income statements are provided to each packer and feedlot firm during the short intervals between trading sessions. Participants can access private information from other teams depending on their propensity for such information and willingness of rival teams to divulge the information. Such a scenario, which Fama refers to as strong-form information efficiency, may be necessary for packers to behave non-competitively. Research reported here used data from three semester-long classes (1994, 1995, and 1996), each of which used the FCMS weekly throughout the semester. In two of the three semesters, a designed experiment was imposed on the experimental market. In 1995, researchers estimated impacts from imposing a marketing agreement between the largest packer and the two largest feedlots at two, 16-week intervals (Ward et al.1999). Student teams received cash awards for their profit performance during randomly selected periods, as suggested for experimental economics research (Friedman and Sunder). In 1996, researchers varied the amount and type of information available to 9 participants in randomly selected, 4- to 8-week periods to determine the impact public market information had on marketing behavior and efficiency (Anderson et al.). Again, a cash reward system was incorporated into the experiment based on team profit performance.2 Data from the 1994 semester consisted of 2,748 transactions from 74 trading periods; 1995, 3,530 transactions from 93 trading periods, and 1996, 2,197 transactions from 60 trading periods. Figure 1 illustrates how consistent market prices were over the three semesters, especially recognizing that two experiments were superimposed on market participants in two of the three semesters. This consistency is further evidenced by the fact that no significant differences were found across packers and semesters for fed cattle purchases, i.e., both prices and volumes (Table 1). Thus, the game theory application uses data from one semester featuring a normal functioning fed cattle market, i.e., the FCMS market without an imposed experiment, and two semesters with designed experiments. Differences in the data series provide the basis for comparing game theory application results across three market scenarios to test how market conditions and subsequent behavior affect results. Empirical Model Development Beefpacking at the industry level is modeled to determine whether or not firms behave in the hypothesized non-competitive manner. The methodology focuses on firm processing margins similar to previous work (Richards, Patterson, and Acharya; Schroeter and Azzam). However, firm-level data for this application facilitates making significant changes from previous models. 10 The objective function for packer i in the ordinary constituent game of the supergame is (1) max i = pqi – w(X,z)xi – c(qi) where p and q are the price and quantity, respectively, of boxed beef sold in the wholesale market, w(X,z) is the price of fed cattle, X is the total quantity of fed cattle available for sale, z is a vector of supply shifting exogenous variables, and c(qi) is the ith firm’s cost as a function of the quantity of cattle processed. The input transformation function of the ith firm, which describes how fed cattle are processed into boxed beef, is (2) qi = xi where is the dressing percentage. Incorporating the input transformation function, the firm’s objective function can be restated as (3) max i = pxi – w(X,z)xi – c(xi) and then the first order condition for profit maximization is (4) i / xi = (p-cqi) – wi(X,z) – [(wi / X) (X / xi )] xi = 0 where cqi is the marginal cost of firm i. The conjectural variation of a firm describes its response to changes in output by other firms, is denoted = dxi / dxj. Since must lie between -1 and +1, the market conduct parameter, which describes the degree of oligopsony power being exerted by packers, falls between 0 and 2 for extremes of perfect competition where dxi / dxj = -1, and a monopsony where dxi / dxj = +1 (Binger and Hoffman; Richards, Patterson, and Acharya). The intermediate case where = 1 represents Cournot conduct. The processing margin for packer i, having aggregated equation (4) over all packers and assuming the conjectural variations are all the same, is 11 (5) mi = cq + ηX where cq is marginal cost and η is the inverse slope of the fed cattle supply function. The generalized Leontief (GL) cost function is of the form c(q,w) = λ1q2w1 + λ2q2w2 + λ3q(w1w2)1/2 with w1 = live cattle prices and w2 = per-pen processing costs. The supply function for fed cattle provided to packers by feedlots is (6) X(w,z) = 0 + η-1(w(X,z) / zj) + i z i + et i j where zj is the cost of gain, zi are other exogenous variables, and et is the disturbance term. Richards, Patterson, and Acharya note that processors’ ability to exert market power is a function of capacity utilization. During periods when supply is plentiful, coinciding with lower prices and higher capacity utilization, firms can be expected to engage in collusive behavior. Conversely, during periods when supply is tight with associated higher prices and lower capacity utilization, collusive behavior would be expected to decline. The conduct parameter measuring this behavior is specified as: (7) (k) = 0 + 1k where k represents industry plant capacity utilization. Methodology A finite mixture estimation (FME) approach is used to estimate the percentage of collusive and reversionary periods for each year as well as the degree of market power that firms exert during these periods. This approach recognizes that packer margins during collusive and reversionary periods are drawn from different distributions 12 characterized by distinct sets of parameters (Titterington, Smith, and Makov). The probability density function for the margin is then a weighted average of the densities for collusive and reversionary conduct, each of which possesses a mixing weight denoted τi for i = 1, 2 which are collusive and reversionary periods, respectively. As a result, the margin equation (5) can be written in regime-specific form. Then the processing margin, with the GL cost function incorporated, becomes (8) mc = λ1q2w1 + λ2q2w2 + λ3q(w1w2)1/2 + ηcXc during collusive periods, and mr = λ1q2w1 + λ2q2w2 + λ3q(w1w2)1/2 + ηrXr during reversionary periods. However, since there is no obvious way to discern collusive from reversionary periods, an estimation technique is needed that allows data membership within one type of regime vs. the other to be decided. The expectation/maximization (EM) algorithm of Dempster, Laird, and Rubin is a latent variable method that may be used to assign periods into the collusive or reversionary category. As Richards, Patterson, and Acharya describe, the algorithm begins with the expectation step, during which segment weights are calculated, then assigns observations to one regime or the other depending upon its dominant posterior probability. In the maximization step, generalized least squares is used to calculate new parameter estimates for the margin equations. New aggregate shares for the regimes are then calculated, and a new iteration begins. The process thus iterates between expectation and maximization until the log-likelihood function changes with each iteration by some pre-selected amount. This allows the final mixing weights and market conduct parameters for each regime to be observed. 13 Such a procedure presupposes that data are, in fact, generated by two separate regimes. In practice, it is necessary to test whether this assumption holds. Wolfe’s likelihood ratio test is used for this purpose. The calculated test statistic for each year is compared to critical values from the Chi-Square distribution with a null hypothesis of a single model (no switching behavior) vs. the alternative of a two-regime model. Results Equation (8) was estimated for each of the three data sets via the EM algorithm using the IML procedure in SAS (SAS Institute). Tables 2 through 4 show the results of OLS estimation of the single-regime model as well as the FME results for the dualregime model. Results focus on the market conduct parameter (), both differences in magnitude and statistical significance between collusive and reversionary periods and differences across data periods and experimental conditions. The null hypothesis of the single model was rejected for the 1994 semester in favor of a dual-regime framework. The estimated collusive conduct parameter was 1.237 with collusive behavior occurring 78.5% of the time (Table 2). The reversionary conduct parameter (0.924) was not significant. Therefore, the existence of distinct collusive and reversionary periods was found, during which the degree of market power being exerted by packers differed markedly. Recall that the 1994 semester did not have an experiment imposed on the simulated market, thus arguably mimicking most closely normal market behavior. Results suggest during normal market behavior, supply conditions provide an opportunity for firms to collude. This is consistent with the hypothesized effects from higher supplies, lower prices, and higher capacity utilization rates. Evidence of the dual-regime 14 behavior is consistent with findings by Koontz, Garcia, and Hudson with real-market data. The null hypothesis of a single regime was rejected again for the 1995 semester (Table 3). The FME collusive conduct parameter was significant (1.954) with packers colluding 40.5% of the time. The punishment parameter again was not significant (0.733). The conduct parameter for this semester was the highest of the three, suggesting considerable levels of collusive behavior and, in fact, approaching the monopsonistic value of 2.0. The 1995 semester was the one during which a marketing agreement was imposed between the largest packer and the two largest cattle feeding firms. This experimental design resulted in fewer available cattle to satisfy the procurement needs of the three packers not involved in the agreement. This raises the question whether the marketing agreement gave the largest packer, the three packers not participating in the agreement, or all packers together, more opportunity to behave collusively. In an examination of price behavior during the experiment, Ward et al. (1999) found prices were higher but much more variable during the marketing agreement periods. As a consequence, no conclusive evidence exists that the marketing agreement adversely affected buyer competition. Results for the 1996 semester were similar in several respects to those for the two previous semesters (Table 4). The single regime was again rejected and the FME collusive conduct parameter (1.201) was significant. Collusive behavior occurred 40.7% of the time and the punishment parameter (1.178) was not significant, as was the case in the previous two semesters. 15 During the 1996 semester, the amount of information available to the marketplace varied systematically. The conduct parameters for the collusive and reversionary periods were more nearly the same than for the other two semesters. Anderson et al. (1998) found that limited information from the designed experiment caused increased price variation and marketing inefficiencies. Cattle feeders were adversely affected by a lack of information, as they were unable to use market data to better negotiate with packing firms. The uncertainty created by limiting market information also may have hampered packers from exercising collusive behavior. This finding is consistent with the corollary situation when too much information can contribute to increased collusive behavior, as shown by Albaek, Mollgaard, and Overgaard. For two of the three semester-long periods (1995 and 1996), higher prices (λ1) were associated with lower margins (Tables 2 and 3). For the 1996 semester, there was a significant inverse relationship also between increased per pen processing costs (λ2) and packer margins. In all three semesters (Tables 2-4), as plant utilization increased (δ1), consistent also with higher supplies and lower prices, collusive behavior increased. Summary and Conclusions The objective of this paper was to develop and estimate a game theoretic model of industry conduct and supergame strategies in a dynamic oligopsony, i.e., beefpacking procurement. Data from the Fed Cattle Market Simulator (FCMS), an experimental market for fed cattle, for three semester-long classes were used because real market data were not publicly available. A non-cooperative, infinitely repeated game of beefpacker procurement was developed in which players were hypothesized to behave differently 16 depending on fed cattle supply conditions and strategic considerations within the game. Player goals were assumed to be maximization of a discounted stream of processing profits. The methodology focused on firm processing margins similar to previous work. A finite mixture estimation (FME) approach was used to estimate the percentage of collusive and reversionary periods for each data period as well as the degree of market power that firms exert during these periods. This approach recognizes that packer margins during collusive and reversionary periods are drawn from different distributions characterized by distinct sets of parameters. The expectation/maximization (EM) algorithm was used to assign periods into the collusive or reversionary category. For all three semester-long periods, the single-regime model was rejected in favor of a dual-regime alternative, consistent with a trigger-strategy equilibria. The market conduct parameter was significant for the collusive regime in each semester, exceeding the competitive value of zero and the Cournot level of 1.0. In the 1995 semester, it approached a monosonistic solution (2.0). The reversionary period coefficients were lower than the collusive values in each semester but were not significant for any period. Higher fed cattle prices were associated with lower packer margins as were higher processing costs. Higher plant utilization was associated with a higher level of collusive behavior, as hypothesized. Market conditions imposed by experimenters in two of the three semesters may have contributed to results found. Imposing a marketing agreement between the largest packer and two feedlots may have enhanced the ability to packers to behave collusively. However, limiting the amount and type of public market information available to 17 participants, may have created sufficient uncertainty so as to reduce the opportunity to behave collusively. In the “normal” market period where no designed experiments were imposed onto the marketplace, packers were able to collude nearly twice as frequently as in the other two semester-long periods. Application of a game theory approach to data from an experimental market is instructive because of the use of plant-specific, transaction-level data, given that such data for a real-world application are not publicly available. While the structure of the FCMS closely resembles that of the real fed cattle market, care must be exercised in inferring conclusions from the experimental market directly to those existing in the realworld market. If – given similar conditions – firms in the real market behave in similar ways to firms in the experimental market, then the evidence discovered here supports the claims of those cattle industry stakeholders who assert that packers extract excess rents from cattle feeders and in turn, from producers. However, the issue cannot be resolved until regulatory agencies apply similar game theory models to industry data or provide the necessary data they possess to academic researchers. Results from the game theory approach applied to market simulator data in this article is consistent in terms of evidencing a dual-regime, trigger-pricing strategy by packers which was found in the only other game theory research applied to the beefpacking industry by Koontz, Garcia, and Hudson. Evidence of collusive behavior found in this research is also consistent with several previous studies using alternative methodologies and data. In conclusion, this research provides evidence that a game theory approach applied to beefpacker conduct needs to be conducted with real-world, transaction-level data. Results potentially may differ according to regional differences in 18 buyer competitiveness, extent of pre-committed supplies to packers, and seasonal or cyclical differences in cattle supply conditions. 19 Notes 1. Mathematical development of the theory can be found in Carlberg and Ward. 2. In comparing prices and volumes across the three semester-long classes, there is no conclusive evidence that cash rewards contributed consistently and significantly to eliciting desired economic behavior by participants. 20 References Albaek, S., P. Mollgaard, and P.B. Overgaard. “Government-Assisted Oligopoly Coordination? A Concrete Case.” Journal of Industrial Economics 45(1997):42943. Anderson, J.D., C.E. Ward, S.R. Koontz, D.S. Peel, and J.N. Trapp. “Experimental Simulation of Public Information Impacts on Price Discovery and Marketing Efficiency in the Fed Cattle Market.” Journal of Agricultural and Resource Economics 23(1998):262-78. Azzam, A.M., and D.G. Anderson. Assessing Competition in Meatpacking: Economic History, Theory, and Evidence. Grain Inspection, Packers and Stockyards Administration report GIPSA-RR 96-6, Washington, D.C.: United States Department of Agriculture, 1996. Bain, J.S. “Relation of Profit Rate to Industry Concentration: American Manufacturing, 1936-1940.” Quarterly Journal of Economics 65(1951):488-500. Binger, B. and E. Hoffman. Microeconomics with Calculus, 2nd ed. Reading, MA: Addison Wesley. 1998. Carlberg, J.G. and C.E. Ward. “Applying Game Theory to Meatpacker Behavior in an Experimental Market: Implications for Market Regulation.” Virginia Tech University, Research Institute on Livestock Pricing, Research Report 2-2002, November 2002. 21 Dempster, A.P., N.M. Laird, and D.B. Rubin. “Maximum Likelihood from Incomplete Data via the EM Algorithm.” Journal of the Royal Statistical Society, Series B 39,1(1977):1-38. Driscoll, P.J., S.M. Kamhampaty, and W.D. Purcell. “Nonparametric Tests of Profit Maximization in Oligopoly with Application to the Beef Packing Industry.” American Journal of Agricultural Economics 79(1997):872-79. Fama, E.F. “Efficient Capital Markets: A Review of Theory and Empirical Work.” Journal of Finance. 25(1970):383-417. Friedman, J.W. Game Theory With Applications to Economics. New York, NY: Oxford University Press, 1986. Friedman, J.W. “A Non-cooperative Equilibrium for Supergames.” Review of Economic Studies 38(1971):1-12. Friedman, D. and S. Sunder. Experimental Methods: A Primer for Economists. New York: Cambridge University Press. 1994. Gentry, J.W., ed. Guide to Business Gaming and Experiential Learning. Association for Business Simulation and Experiential Learning. London: Nichols/GP Publishing. 1990. Grain Inspection, Packers and Stockyards Administration. Packers and Stockyards Statistical Report, 2004 Reporting Year. Washington, D.C.: United States Department of Agriculture, SR-06-1, 2006. Green, E.J., and R.H. Porter. “Noncooperative Collusion Under Imperfect Price Information.” Econometrica 52(1984):87-100. 22 Hunnicutt, L. and Q. Weninger. “Testing for Market Power in Beef Packing: Where Are We and What’s Next?” Virginia Tech University, Research Institute on Livestock Pricing, Research Bulletin 7-99, 1999. Koontz, S.R., P. Garcia, and M.A. Hudson. “Meatpacker Conduct in Fed Cattle Pricing: An Investigation of Oligopsony Power.” American Journal of Agricultural Economics 75(1993):537-48. Koontz, S.R. and P. Garcia. “Meat-Packer Conduct in Fed Cattle Pricing: MultipleMarket Oligopsony Power.” Journal of Agricultural and Resource Economics 22(1997):87-103. Plott, C.R. “Industrial Organization Theory and Experimental Economics.” Journal of Economic Literature. 20(1982):1485-1527. Richards, T.J., P.M. Patterson, and R.N. Acharya. “Price Behavior in a Dynamic Oligopsony: Washington Processing Potatoes.” American Journal of Agricultural Economics 83(2001):259-71. SAS Institute, Inc. SAS/ETS User’s Guide, Version 9.1, Cary, NC: SAS Institute, Inc., 2003. Schroeter, J., and A. Azzam. “Marketing Margins, Market Power, and Price Uncertainty.” American Journal of Agricultural Economics 73(1991):990-99. Schroeter, J.R. “Estimating the Degree of Market Power in the Beef Packing Industry.” Review of Economics and Statistics 70(1988):158-62. Sexton, R.J. “Industrialization and Consolidation in the U.S. Food Sector: Implications for Competition and Welfare.” American Journal of Agricultural Economics 82(2000):5 1087-1104. 23 Sexton, R.J. and M. Zhang. “An Assessment of the Impact of Food Industry Market Power on U.S. Consumers. Agribusiness: An International Journal 17,1(2001):59-79. Titterington, D.A., A. Smith, and U. Makov. Statistical Analysis of Finite Mixture Distributions. New York: John Wiley, 1985. Ward, C.E. “A Review of Causes for and Consequences of Economic Concentration in the U.S. Meatpacking Industry.” Current Agriculture, Food & Resource Issues 3(2002):1-28. Ward, C.E. “Price Discovery and Pricing Choice Under Divergent Supply Scenarios in an Experimental Market for Fed Cattle.” Journal of Agricultural and Resource Economics 30(2005):580-96. Ward, C.E., S.R. Koontz, T.L. Dowty, J.N. Trapp, and D.S. Peel. “Marketing Agreement Impacts in an Experimental Market for Fed Cattle.” American Journal of Agricultural Economics 81(1999):2 347-58 Ward, C.E., S.R. Koontz, D.S. Peel, and J.N. Trapp. “Price Discovery in an Experimental Market for Fed Cattle.” Review of Agricultural Economics 18(1996):449-66. Whitley, J. “The Gains and Losses from Agricultural Concentration: A Critical Survey of the Literature.” Journal of Agricultural & Food Industrial Organization 1(2003) www.bepress.com/jafio . 24 Table 1. ANOVA Results for Prices ($/cwt.) and Volumes by Packers, Three Semester-Long Classes, 1994-1996. Team 1994 1995 1996 Semester Semester Semester Price Price Price Price Price Price Mean Variance Mean Variance Mean Variance p-Value Packer 1 78.72 11.22 78.75 12.84 78.14 13.92 0.601 Packer 2 78.28 12.08 78.34 12.48 78.10 14.48 0.935 Packer 3 78.52 11.30 78.50 12.41 78.29 12.35 0.922 Packer 4 78.75 11.53 78.68 11.48 78.66 10.38 0.989 All Packers 78.67 11.06 78.66 11.73 78.43 11.11 0.906 Team 1994 1995 1996 Semester Semester Semester 25 Volume Volume Volume Volume Volume Volume p-Value Mean Variance Mean Variance Mean Variance Packer 1 7.8 6.0 7.8 2.2 8.0 4.2 0.761 Packer 2 8.1 7.2 8.3 3.2 8.7 3.3 0.381 Packer 3 10.5 6.8 10.6 7.1 10.6 2.6 0.993 Packer 4 12.0 4.0 11.6 5.1 11.9 6.2 0.548 All Packers 36.6 39.3 36.8 37.5 36.7 57.9 0.983 26 Table 2. Ordinary Least Squares and Finite Mixture Estimation Results, 1994 ________________________________________________________________________ OLS Finite Mixture Estimation Parameter Single Reversionary Collusive Model Regime Regime ________________________________________________________________________ λ1 -4.933 (-1.625) -4.652 (-0.132) λ2 -0.014 (-0.392) 0.033 (0.011) -0.039 (-1.029) λ3 786.480 (0.954) 46.761 (0.006) 1501.040 (1.586) δ0 -1.450 (-1.499) -0.488 (-0.004) -2.560** (-2.238) δ1 2.236** (2.408) 0.559 (0.051) 3.498** (3.131) 1.056** (2.653) 0.924 (0.611) 1.237* (1.885) τ — -7.956** (-2.150) 0.785** (5.779) ________________________________________________________________________ Note: t-ratios are given in parentheses. Double and single asterisks denote statistical significance at the α = 0.05 and α = 0.10 levels, respectively. 27 Table 3. Ordinary Least Squares and Finite Mixture Estimation Results, 1995 ________________________________________________________________________ OLS Finite Mixture Estimation Parameter Single Reversionary Collusive Model Regime Regime ________________________________________________________________________ λ1 -3.777 (-0.963) 7.056 (0.920) -15.282** (-2.134) λ2 -0.056 (-1.174) -0.066 (-0.654) -0.105 (-1.142) λ3 342.366 (0.292) -1787.761 (-0.759) 3259.438 (1.352) δ0 -4.760** (-2.516) -5.913 (-1.472) -3.301 (-1.126) δ1 5.845** (3.215) 6.583* (1.729) 5.287* (1.846) 1.202** (3.045) 0.733 (0.593) 1.954** (3.034) τ — 0.405** (2.064) ________________________________________________________________________ Note: t-ratios are given in parentheses. Double and single asterisks denote statistical significance at the α = 0.05 and α = 0.10 levels, respectively. . 28 Table 4. Ordinary Least Squares and Finite Mixture Estimation Results, 1996 ________________________________________________________________________ OLS Finite Mixture Estimation Parameter Single Reversionary Collusive Model Regime Regime ________________________________________________________________________ λ1 -7.893 (-1.039) -9.393 (-0.388) -11.482** (-2.754) λ2 -0.051 (-0.500) 0.047 (0.167) -0.187** (-4.163) λ3 1287.357 (0.669) 154.442 (0.024) 4289.764 (4.335) -2.485* (-1.940) δ0 -2.126 (-0.895) -1.369 (-0.156) δ1 3.050* (1.416) 1.549 (0.182) 4.370** (3.846) 1.137** (1.968) 1.178 (0.818) 1.201** (1.969) τ — 0.407** (3.757) ________________________________________________________________________ Note: t-ratios are given in parentheses. Double and single asterisks denote statistical significance at the α = 0.05 and α = 0.10 levels, respectively. 29 Figure 1. Weekly average fed steer prices for semester-long classes of the experimental market, 1994-1996. 95 90 80 75 70 Week AveP94 AveP95 30 AveP96 93 95 89 91 85 87 81 83 77 79 73 75 71 67 69 63 65 59 61 55 57 51 53 47 49 43 45 41 65 37 39 $/cwt. 85