- The University of Chicago Booth School of Business

advertisement

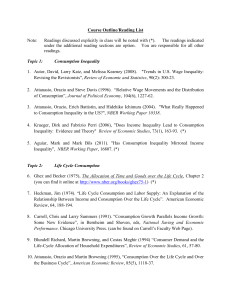

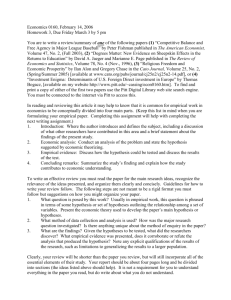

Erik Hurst 38001: Empirical Macroeconomics – Micro Data for Macro Models Fall 2009 Office: Email: Course Meeting: Office Hours: 410 Harper Center erik.hurst@ChicagoBooth.edu Thursdays, 6:00 – 8:40 (no break), Room C06, Harper Center By Appointment T.A. Laura Pilossoph (pilossoph@gmail.com) Overview The goals for this course are the following: (i) Introduce students to a variety of data sources which can be used to test and calibrate models which are of interest to macro economists. (ii) Introduce students to important papers and research areas that are primarily empirical in nature and which have made fundamental advances to areas of interest to macro economists (broadly defined). (iii) Get students to think hard about the genesis of research questions and the inputs into successful research. Course Requirements There is a lot of work in this course. Hopefully, all of it will be beneficial with respect to sharpening your research skills. Aside from attending class, doing the course readings, and participating in lectures, you will have three additional requirements: handing in homework assignments, replicating an existing paper, and writing an original “virtual” paper. Below I discuss these requirements. Note: Auditors are expected to complete some components of the weekly assignments (those relevant to class discussion). (1) Weekly assignments (5 out of 9 weeks). The weekly assignments will have three components. All assignments should be done individually. A. Two page “referee reports” (max) on assigned papers. Students will be required to critically assess selected papers and then be prepared to discuss both the benefits and potential limitations of the papers in class. The goal of these assignments is to get students to start critically assessing existing empirical research. Students should be prepared to discuss their report in class. 1 B. Small data projects. Students will be required to use various micro data sets to compute statistics of interests. The goal of these assignments is to get students to familiarize themselves with existing micro data sets. These projects will be discussed in more depth in class. The goal of these assignments is to get students familiar using empirical data sets. An example of an assignment would be: use the Panel Study of Income Dynamics (PSID) and document the time trend of real wages for low and high educated households from 1975 through 2005. C. Each week, I will provide students with a broad research question like “Why has the U.S. Savings Rate Declined?”. Most of these questions will not have a consensus correct answer. (The reason I will pick these questions is because I am not convinced of the available answers). Each week, students will have to provide a one to two page approach to answering such questions. In particular, students will provide a written hypothesis that can potentially explain at least part of the question at hand. Then, the students will provide a brief written discussion of how they could test their hypothesis in an ideal world and then how they might test it using potentially available data. We will allocate 15-20 minutes of each class to discuss these questions. Students should be prepared to discuss and defend their answers during class. All homework will be graded for effort. Much of these homework problems will not have one correct answer. However, the learning comes from struggling to think hard about how to approach the problems. In order to participate in the class, auditors are expected to complete parts A (referee reports) and C (short write ups to a research approach) of the weekly assignments. The reason for this is to foster interesting class discussions. Note: All questions on the homework should be directed to the T.A. (not me). I will handle questions on the paper requirements below. Laura will handle questions on the homework. (2) Paper replication. Each student will be required to pick a paper published in a top academic journal and replicate the main findings (you do not need to replicate the robustness tables or the minor tables – just the main findings of the paper). Four additional requirements are necessary. First, the paper has to have a substantial empirical component that uses micro data. Second, the paper must be of interest to macroeconomists (broadly defined). Third, you should try to choose a paper where the data and code were not made publically available by the authors (that would make this too easy). If you do choose a paper where the results were made publically available, you should proceed as if they were not made available. I want you to start with raw data and see if you can approximate the author’s main results. Fourth, you need to be able to get the data in its original form. You should assure yourself of these restrictions (particularly the fourth one) early in the process. In your write up, you should comment on how robust the author’s results were by exploring alternate specifications. As you will find, some results are surprisingly robust while others are very fragile. 2 Dates associated with the paper replication: Clear your paper with me by October 15th (week 3). There will be a sign up sheet in class during week 2. Each registered student will have a 15 minute meeting with me on 10/15 (Thursday) to go over their paper with me. Students should send me their proposed paper – via email - by 10/14 (Wednesday). Present a 15 minute overview of the paper in class on October 22th (week 4). No original work is necessary at this time. Just a presentation of the actual paper. What the paper tries to do, why it is interesting, what are empirical contributions, and how the empirical contributions were made. The class will then provide feedback about ways in which to explore the robustness of the paper’s conclusions. Your write up of the paper’s replication (including data and code) are due January 15 th. You should write it up as a replication (there is no need to rehash their literature review, their motivation, etc.). Your paper will discuss why you replicated that paper, why the paper is important (in your eyes), the data you used, how you constructed the sample, the methodology you used, your replication of the main results, comparing your results to the paper’s main results, and then exploring the robustness of the papers main results by examining alternate specifications. My estimates are that such replications should be roughly 20 pages (give or take) plus tables/figures. (3) Writing an original “virtual empirical paper”. This will be your main project for the course. It is a virtual empirical paper in that you do not actually have to generate the paper’s results. What I want you to do is to pick an original research idea and then develop how you would set out to empirically confront this idea. Your paper should take the following form: Introduction: What is the question and why is the question of interest? Literature Review: How does your paper fit into the broader literature? Theoretical Motivation: This could be actual theory or just a sketch of the relevant theory that underlies your question. Data: What data would you use to answer/address this question? Why would this data be ideal? Empirical Methodology: How would you use the data to answer your question? Remember to keep in mind the concepts of identification and causality along with the idea that the same set of empirical facts can often support many theories. Falsification Tests: Is there any other specifications that would either bolster or cast doubt upon your primary tests of your hypotheses. 3 No empirical work actually needs to be done for this project. I just want to get you to start thinking about potential original research questions. Your only restriction for this project is that the data has to conceivably exist. It doesn’t mean that the data actually has to exist – it just means that it could exist. For example, you can imagine conducting a survey that elicits the data that you need or, you can imagine getting access to classified household/firm data. Dates associated with the virtual paper. Clear your paper with me by October 29th (week 5). Again, we will have a 15 minute office meeting. Present your virtual paper in class on December 3rd. Most of the work for the paper needs to be done by this time. You should treat this as the due date for the conceptual component of the paper. I will give you more guidelines on your presentation as the quarter progresses. Your formal write up of the paper is due to me on January 15th. Your write up will incorporate the comments from the class that you received during your presentation. My sense is that the write up will be 15-20 pages (or so). Grading 40% of the course grade will be on the virtual paper (20% for the presentation and 20% for the write up). 30% of the course grade will be on the weekly assignments. 30% of the course grade will be on the paper replication. We will provide letter grades when grading the virtual paper (both components) and the paper replication. These will be based both on effort, originality/insight, and execution. We will provide √+, √, √-, 0 for the homework assignments (each component separately). These grades will be based solely on effort. Course Readings Each week in lecture, we will cover a different topic. I include many papers under the topics we are covering. These papers are designed to give students an overview of the (mostly) empirical papers that have contributed substantially to the literature at hand. Papers that I will cover in class are indicated with a (**). Papers that are particularly noteworthy are indicated with a (*). You should read all the (**) papers prior to class. All readings can be found online. Unless otherwise noted, you should read the published version. 4 Course Outline/Reading List Weeks 1 and 2: Household Consumption (A Thorough Reading List) Surveys of Consumption 1. Deaton, Angus (1992). Understanding Consumption, Clarendon Lectures in Economics, Oxford: Clarendon Press, 1992. (This is a good book to purchase). 2. Attanasio, Orazio (1999). “Consumption”, Handbook of Macroeconomics, vol 1B, Chapter 11, pp. 741-812. (*) (I will provide a copy of this on my web page). Life Cycle Consumption 3. Ghez and Becker (1975), The Allocation of Time and Goods over the Life Cycle, Chapter 2 (you can find it online at http://www.nber.org/books/ghez75-1) (**) 4. Heckman, Jim (1974). “Life Cycle Consumption and Labor Supply: An Explanation of the Relationship Between Income and Consumption Over the Life Cycle”. American Economic Review, 64, 188-194. (*) 5. Carroll, Chris and Larry Summers (1991). “Consumption Growth Parallels Income Growth: Some New Evidence”, in Bernheim and Shoven, eds, National Saving and Economic Performance. Chicago University Press. (can be found on Carroll’s Faculty Web Page). 6. Blundell, Browning, and Meghir (1994) “Consumer Demand and the Life-Cycle Allocation of Household Expenditures” (*) 7. Attanasio, Orazio and Martin Browning (1995), “Consumption Over the Life Cycle and Over the Business Cycle”, American Economic Review, 85(5), 1118-37. 8. Gourinchas, Pierre-Olivier and Jonathan Parker (2002). Econometrica, 70, 47-89. (**) “Consumption over the Life Cycle”, 9. Aguiar, Mark and Erik Hurst (2009). “Deconstruction Life Cycle Consumption”, working paper (can be found on my web page – use the web page version). (**) Some Important Additional Empirical Consumption Papers (in Chronological Order) 10. Hall, Robert (1978). “Stochastic Implications of the Life Cycle-Permanent Income Hypothesis: Theory and Evidence”, Journal of Political Economy, 86(6), 971 - 87. (Tests of PIH Model) (*) 5 11. Zeldes, Steve (1989). “Consumption and Liquidity Constraints: An Empirical Investigation”, Journal of Political Economy, 97 (2), 305-46. (Liquidity Constraints) (**) 12. Cochrane, John (1991). “A Simple Test of Consumption Insurance” Journal of Political Economy, 99(5), 957-976. (Risk Sharing) (**) 13. Deaton, Angus (1992) “Saving and Liquidity Constraints”, Econometrica, 59, 1221-48. (Precautionary Savings) (*) 14. Attanasio, Orazio and Steve Davis (1996) “Relative Wage Movements and the Distribution of Consumption”, Journal of Political Economy, 104(6), 1227-62 (Between Group Consumption Insurance) (**) 15. Carroll, Chris (1997), “Buffer Stock Saving and the Life Cycle/Permanent Income Hypothesis”, Quarterly Journal of Economics, 112(1), 1-55. (Precautionary Saving) (*) 16. Hsieh, Chang-Tai (2003), “Do Consumers React to Anticipated Income Changes? Evidence from the Alaska Permanent Fund”, American Economic Review, 93(1), 397-405. (Testing Response to Predictable Income Changes). (*) 17. Aguiar, Mark and Erik Hurst (2005). “Consumption versus Expenditure”, Journal of Political Economy, 113(5), 919-948. (Retirement Consumption) (**) 18. Charles, Kerwin, Erik Hurst and Nick Roussanov (2009). “Conspicuous Consumption and Race”, Quarterly Economic Review, 124(2), 425-467. (Signaling and Consumption) (**) Note: Homework #1 due at the beginning of week 2 (see information on the web site) Week 3: Housing Price Dynamics 19. Topel, Bob and Sherwin Rosen (1988). “Housing Investment in the United States”, Journal of Political Economy, 96(4), 718-40. (**) 20. Glaeser, Ed and Joe Gyourko (2007). “Housing Dynamics”, Harvard Institute of Economic Research paper 2137 (can be found on Glaeser’s website). (*) 21. Case, Karl and Robert Shiller (1989). “The Efficiency of the Market for Single Family Homes”, American Economic Review, 79(1), 125-37. (**) 22. Gyrouko, Joe (2008). “Housing Supply”. copy on Joe’s web site). (*) Annals of Economics (forthcoming). (You can find a 6 23. Saiz, Albert (2009). “On Local Housing Supply Elasticity”, Quarterly Journal of Economics (forthcoming). (You can find a version on Albert’s web site). (**) 24. Davis, Morris and Jonathan Heathcote (2005). “Housing and the Business Cycle”, International Economic Review, 46(3), 751-84. 25. Kiyotaki, Nobu, Kalin Nikolov, and Alex Michaelides (2009), “Winners and Losers in Housing Markets”, working paper (you can download this from Nobu’s Princeton Faculty Page). 26. Favilukis, Jack, Sydney Ludvigson, and Stijn Van Nieuwerburgh (2009). “Macroeconomic Implications of Housing Wealth, Housing Finance, and Limited Risk Sharing in General Equilibrium”, working paper (see Stijn’s web site). 27. Van Nieuwerburgh, Stijn and Pierre-Olivier Weill (2009). “Why Has House Price Dispersion Gone Up?”, working paper (see Stijn’s web site). 28. Guerrieri, Veronica, Dan Hartley and Erik Hurst (2009). “Neighborhood Externalities and Housing Price Dynamics”, working paper (I will email a copy). (**) Note: Homework #2 due at the beginning of week 3 (see web page for details). Week 4: Student Replication Papers The readings will be the papers chosen by the class as part for replication. The papers will be posted on the web page as soon as all papers are approved. Weeks 5: Labor Supply Elasticities and Home Production 29. Altonji, Joseph, “Intertemporal Substitution in Labor Supply: New Evidence from Micro Data”, Journal of Political Economy, 94(3, Part 2). (**) 30. Mincer, Jacob (1962). “Labor Force Participation of Married Women: A Study of Labor Supply”, in Aspects of Labor Economics (found here: http://www.nber.org/chapters/c0603.pdf) 31. Gronau, Ruben (1986). “Home Production: A Survey”, in Ashenfelter, O. and Layard, R (eds), Handbook of Labor Economics, North-Holland, Amsterdam, 273-304. (this can be found here: http://econpapers.repec.org/bookchap/eeelabchp/1-04.htm). (**) 7 32. Benhabib, J, Richard Rogerson, and Randy Wright (1991), “Homework in Macroeconomics: Household Production and Aggregate Fluctuations”, Journal of Political Economy, 99, 1166-87. (**) 33. Rupert, Peter, Richard Rogerson, and Randy Wright (2000), “Homework in Labour Economics: Household Production and Intertemporal Substitution”, Journal of Monetary Economics, 46, 557-79. 34. Aguiar, Mark and Erik Hurst (2007). “Life Cycle Prices and Production”, American Economic Review, 97(5), 1533-59. (**) 35. Aguiar, Mark and Erik Hurst (2007). “Measuring Trends in Leisure: The Allocation of Time Over Five Decades”, Quarterly Journal of Economics, 12293), 969-1006. (**) 36. Chetty, Raj, John Friedman, Tore Olsen, and Luigi Pistaferri (2009). “The Effect of Adjustment Costs and Institutional Constraints on Labor Supply Elasticities”, working paper (see Raj’s web site). (*) Note: Homework #3 due at the beginning of week 5 (see web page for details). Week 6: More on Labor Markets Local Labor Markets 37. Blanchard, Olivier and Larry Katz (1992). “Regional Evolutions”, Brookings Papers on Economic Activity, 1992 (1), 1 – 75. (**) 38. Topel, Bob (1986). “Local Labor Markets”, Journal of Political Economy, 94(3), S111-43. (**) Trends in Relative Well Being 39. Katz, Larry and Kevin Murphy (1992). “Changes in Relative Wages, 1963-1987: Supply and Demand Factors”, Quarterly Journal of Economics, 107(1), 35-78. (**) 40. Katz, Larry and David Autor (1999). “Changes in the Wage Structure and Earnings Inequality” in Orley Ashenfelter and David Card, eds. Handbook of Labor Economics, Volume 3A, Amsterdam: Elsevier-North Holland. (*) 41. Attanasio, Orazio and Steve Davis (1994). “Relative Wage Movements and the Distribution of Consumption”, Journal of Political Economy, 104(6), 1227-62. (*) 42. Krueger, Dirk and Fabrizio Perri (2006). “Does income Inequality Lead to Consumption Inequality? Evidence and Theory”. Review of Economic Studies, 73(1), 163-193. (**) 8 43. Blundell, Richard, Luigi Pistaferri and Ian Preston (2009). “Consumption Inequality and Partial Insurance”, American Economic Review, 98(5), 1887-1921. (*) Long Run Trends In Unemployment 44. Juhn, Chinhui, Kevin Murphy, and Bob Topel (1991), “Why Has the Natural Rate of Unemployment Increased Over Time?”, Brookings Papers on Economic Activity, 1991(2), 75-142. (*) 45. Juhn, Chinhui, Kevin Murphy, and Bob Topel (2002), “Current Unemployment, Historically Contemplated”, Brookings Papers on Economic Activity, 2002(1), 79-136. (*) 46. Autor, David and Mark Duggan (2003). “The Rise in the Disability Rolls and the Decline in Unemployment”, Quarterly Journal of Economics, 118(1), 157-206. (**) Note: Homework #4 due at the beginning of week 6 (see web page for details). Week 7: Entrepreneurship, Bankruptcy and Default Entrepreneurship 47. Evans, David and Boyan Jovanovic (1989). “An Estimated Model of Entrepreneurial Choice Under Liquidity Constraints”, Journal of Political Economy, 97(4), 808-27. (**) 48. Evans, David, and Linda Leighton, “Some Empirical Aspects of Entrepreneurship”, American Economic Review, 79(3), 519-35. (**) 49. Buera, Fancisco (2009). “A Dynamic Model of Entrepreneurship with Borrowing Constraints: Theory and Evidence”, Annals of Finance, 50. Holtz-Eakin, Douglas, David Joulfaian, and Harvey Rosen, (1994). “Sticking It Out: Entrepreneurial Survival and Liquidity Constraints.” Journal of Political Economy, 102, 53-75. (**) 51. Hurst, Erik and Annamaria Lusardi (2004). “Liquidity Constraints, Household Wealth, and Entrepreneurship”, Journal of Political Economy, 11292), 319-47. (**) 52. Hamilton, Bart (2000). “Does Entrepreneurship Pay? An Empirical Analysis of the Returns to Self Employment”, Journal of Political Economy, 108, 604-31. (**) 53. Cagetti, Marco and Mariacristina De Nardi, 2006. "Entrepreneurship, Frictions, and Wealth," Journal of Political Economy, 114(5), 835-70. (**) 9 54. Hall, Bob and Susan Woodward, (2009). “The Burden of the Nondiversifiable Risk of Entrepreneurship” American Economic Review, forthcoming (http://www.stanford.edu/~rehall/HallWoodward6.pdf) 55. Moskowitz, Toby and Annette Vissing Jorgensen. “The Returns to Entrepreneurial Investment: A Private Equity Premium Puzzle?”, American Economic Review, 94(2), 745-78. 56. Hurst, Erik and Ben Pugsley (2009). “The Non-Pecuniary Benefits of Entrepreneurship”, working paper (a link will be provided as soon as we finish a draft). Credit, Bankruptcy and Default 57. Fay, Scott, Erik Hurst and Michelle White (2002). “The Household Bankruptcy Decision”, American Economic Review, 92(3), 706-18. (**) 58. Gross, David and Nick Souleles (2002). “An Empirical Analysis of Personal Bankruptcy and Delinquency”, Review of Financial Studies, 15(1), 319-47. (*) 59. Mian, Atif and Amir Sufi (2009). “The Consequences of Mortgage Credit Expansion: Evidence from the U.S. Mortgage Default Crisis”, Quarterly Journal of Economics (forthcoming), get the version from Sufi’s web site. (*) 60. Gropp, Reint, John Karl Scholz, and Michelle White (1997). "Personal Bankruptcy and Credit Supply and Demand," The Quarterly Journal of Economics, 112(1), 217-51. (*) Note: Homework #5 due at the beginning of week 7 (see web page for details). Week 8: Overflow and Other Areas of Interest We will use this to carry over any topics that I couldn’t cover during the early classes. If time allows, we will address some questions related to health. I may add other topics as the course progresses. Health Spending 61. Hall, Bob and Chad Jones (2007). “The Value of Life and the Rise in Health Spending”, Quarterly Journal of Economics, 122(1), pp. 39-72. (**) 62. Murphy, Kevin and Robert H. Topel, 2006. "The Value of Health and Longevity," Journal of Political Economy, 114(5), 871-904. (**) 63. Gary S. Becker & Tomas J. Philipson & Rodrigo R. Soares, 2005. "The Quantity and Quality of Life and the Evolution of World Inequality," American Economic Review, 95(1), 277-91. (**) 10 Week 9: Student “Virtual Paper” Presentations No additional papers. 11