Government Purchase Card Program Audit Program

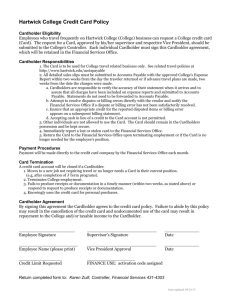

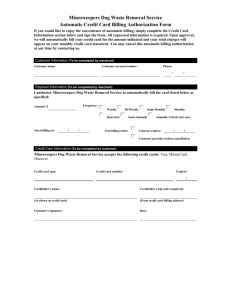

advertisement