Fundamentals 10 Script - Train Agents Real Estate Licensing

advertisement

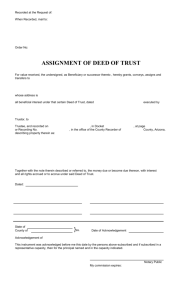

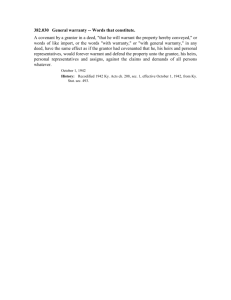

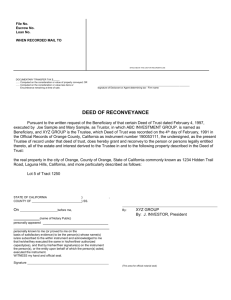

(Begin with Sect 10 – 00 Begin Slide ) CONVEYING PROPERTY The instrument that is used with a Voluntary Conveyance of Real Property When selling or gifting property to others, the legal instrument that is used to convey title to another is called a deed. When a personal representative of a deceased person conveys property to heirs it is called an executor's deed. The DEED is evidence of having title to the real property. The title is recorded with the County Assessor's Office. The deed is only used once by the applicable party on the deed. It cannot be assigned to another party. When the deed holder sells the real property, the new owner has to obtain a new deed. (On the next page put slide Sect 10 – 001 and 001A) 1 DEED - REQUIREMENTS Document conveying title in real property or an interest in real property to another party. A valid deed must have the following requirements: 1. Written form - Under the Statute of Frauds, a deed has to be in written form. Any real estate document must be in written form. The only exception is a lease that is less than 1 year in length. 2. Name of Grantee and Grantor - They must show who the seller (grantor) was. The person granting the deed to the new owner. It must show the buyer (grantee) who is being granted the real property ownership or interest. 3. Identifiable - When granting title, the deed must identify the real property the grantor is conveying to the grantee. Either can be an individual, trust, corporation, association, partnership, etc. They have to be a legal identifiable entity. 4. The Grantor must be Competent - If an individual, the grantor must be at least age 18 and not determined incompetent by a court of law. Example: The grantor is age 88 and mentally incompetent. The deed would have to be drawn by the grantor's court appointed guardian/custodian. The grantee does not need to be competent on the deed, but the grantee could back out of the agreement if they want to. (On the next page put slide Sect 10 – 002 and 002A) 2 REQUIREMENTS cont. Additional requirements of a valid deed include: 1. Recital of Consideration - The parties must give value under the deed. Consideration IS value under contract law. 2. Consideration - Value may be "good" consideration such as "love and affection" or it can be "valuable" consideration, which is money, something convertible to money, or forbearance of an act. 3. Granting Clause - The statement in the deed showing intent to convey the title on the property to the grantee. 4. Type of Deed - The wording showing intent to convey will vary with the type of deed that is being used. a. Example: The wording used to transfer title could be "I convey and warrant my property to the grantee", or "I grant my property", or "I grant, bargain, and sell my property", or "I remise, release, and quitclaim my property". 5. Habendum Clause - This defines and explains the ownership or interest being conveyed by the grantor to the grantee. Habendum is a Latin term that means "to have to hold". If this clause were conveying ownership it would say "I convey title in fee simple to have and to hold". If the deed was conveying a life estate it would say "I convey as a life estate to have and to hold". If the deed was conveying an easement it would say "I convey as an easement appurtenant to have and to hold". 6. Purpose - If the Habendum clause did not specify any limitation on the deeded property, the deed would infer a fee simple absolute conveyance. The Habendum clause is utilized in most State examinations because it is such a unique sounding term. The Habendum clause is pretty much always ON THE TEST in some way, shape, or form. 7. Subject To Clauses - The "subject to" clauses show any deed restrictions, reservations, and exceptions that might be applicable to the real property. Example: "I deed my property to grantee, but I reserve the right to fish the banks of Jones creek during fishing season." If there were no restrictions, reservations, and exceptions, the subject clause would be blank. (On the next page put slide Sect 10 – 003 and 003A) 3 GOOD LEGAL DESCRIPTION The deed must have a clear and concise legal description of the property being conveyed. 1. County Description - The deed could use the County assessor's legal description or the description from a former deed. Example: "I convey Lot 5, Block 3, of Forest Park Estates separated from all other property...establish boundaries." 2. Appurtenances Not Described - Improvements such as homes, buildings, barns, fences, etc. do not need to be separately described. These are appurtenances to the land. Example: - "I convey Lot 5, Block 3, of Forest Park Estates separated from all other property....establish boundaries." All the buildings, the house, pool, fence, etc. that are located on Lot 5 will be conveyed without description. (On the next page put slide Sect 10 – 004 and 004A) 4 SIGNATURES OF GRANTORS ON DEED Some States, like the State of Washington, will also require an acknowledgment (notary). Other States such as Oregon do not. We will go over your State's requirements later in the course. When ownership is not an individual, the following signatures would have to be done: 1. Limited Partnership - Co-owned partnership property deeds require signatures of all general partners. Limited partners are simply investors and do not need to sign. 2. Corporation - If the property is sold by a corporation, the property is deeded by the corporation as the grantor. The Board of Directors would have to pass a resolution authorizing the sale. a. Officer Only - It must only be conveyed by an authorized officer of the corporation such as the President, Secretary, or Treasurer. The deed may be signed by any officer authorized by the Board. b. Corporate Seal - Each corporation has its own corporate seal and this must be affixed to the deed. (On the next page put slide Sect 10 – 005 and 005A) 5 DEED ACCEPTANCE BY GRANTEE/BUYER When a deed is delivered to the buyer/grantee, it is presumed ACCEPTED if: 1. No Change - Buyer/grantee holds the deed without requesting a correction OR 2. Records Deed - The buyer/grantee records the deed with the County Assessor's Office OR 3. Held by a Neutral Party - If the deed is delivered to a neutral party such as a bank, it is the intent to deliver during grantor's lifetime and intent to accept during grantee's lifetime. This is enough to be considered delivery and acceptance. : Wendy, the grantor, sells to Bob under a 20-year land sales contract. The bank will hold the deed until Bob makes all the payments. The bank holds the deed because Wendy or Bob could die before 20 years. (On the next page put slide Sect 10 – 006 and 006A) 6 RECORDING - VALIDITY ISN'T GUARANTEED The recording of a deed does not affect its validity. If there are clouds on title, they are still there when recorded. Whether it is a recorded deed or an unrecorded deed, it is still effective between grantee and grantor. If there are clouds on title the deed may not be valid against a subsequent innocent purchaser in the future. It would be good to search out a good real property lawyer. FUTURE PURCHASERS Chain of Title - When property is sold later, the involved escrow company will go to the County and search out the chain of owners known as the Chain of Title. Here is where "clouds on title" will be picked up. It might be necessary to go to court and clear up the chain of title by quiet title action through a court ruling. Title Search - It might be necessary to find all liens on the property and clear them up at the same time. This is known as a title search. (On the next page put slide Sect 10 – 007 and 007A) 7 DEEDS - 4 TYPES The following diagram shows the 4 different types of deeds. These different types are important because they show the safety of purchase regarding possible encumbrances that haven't been recorded with the County. The deed shows how much the seller/grantor is willing to guarantee against loss of any unknown encumbrance against the property to the grantee. Example: Jim deeds to Sue a fee simple absolute estate (all the rights intact); all four of the following deeds could be used to convey title. (On the next page put slide Sect 10 – 008) 8 GENERAL WARRANTY DEED This type of deed is the best for the purchaser. The seller (grantor) warranties/guarantees all factors of the deed. This obviously exposes the seller to the most liability because he/she is guaranteeing title clear back to the original patent (deed) from the government. Hence the term general warranty. Contains 5 Covenants - A general warranty deed contains 5 different covenants or promises on the part of the grantor/seller to the grantee/buyer. 1. Covenant of Seizen: This promises true ownership; seizen means ownership. The seller/grantor promises that he/she is the true owner and has the power to convey title. a. Problem - If the grantor is not the owner and does not have the power to convey title, the remedy for this breach of warranty is damages up to full purchase price. b. Still Guaranteed - Damages in a court case can include other factors such as costs, time, suffering, etc., but the covenant of seizen only guarantees the return of the full purchase price. 2. Covenant Against Encumbrances - This promises that there are no encumbrances against the property other than those stated on the deed. This goes back to the original patent on the land granted by the government. The encumbrances ON the deed have to be accepted or rejected by the buyer. Any encumbrance not on the deed would be guaranteed by the seller/grantor. a. Grantor Guarantees - If an encumbrance comes up in the future that was not on the deed, the remedy for this breach of warranty is to sue for the expense of removing the encumbrance. 3. Covenant of Quiet Enjoyment - This promises that no person (individual, trust, corporation, partnership, etc.) has a better title to the property than the seller/grantor. a. Seller Still Guarantees - If a person comes forward claiming a better title to the property the remedy for this breach of warranty is for the seller/grantor to pay damages up to full purchase price of the property. b. No Time Limit on the Guarantee - There is no time limit on this guarantee. 4. Covenant of Further Assurance - This is a promise by the seller to obtain and deliver any instrument needed to make the title good. If an encumbrance comes forward any time in the future, the seller/grantor will work to provide any and all information necessary to remove the cloud on title. Writ of Mandamus - The remedy for breach of any warranty is to force the seller to provide the necessary instrument(s) under a Writ of Mandamus. Go out and clear up this cloud. 5. Covenant of Warranty Forever: This is a promise for all the above promises. This guarantees that there shall be no time limit regarding the buyer/grantee's rights under this warranty. a. Buyer Can Sue - The remedy for breach of this warranty is to sue and to be compensated for losses suffered. (On the next page put slide Sect 10 – 009 and 009A) 9 SPECIAL WARRANTY DEED This type of deed is the second (2nd) best form of deed for the purchasers/grantee's protection. It does not guarantee against encumbrances back to the original government patent (deed). It only guarantees against encumbrances made during the seller/grantor's ownership period. If the owner owned the property for 40 years or 4 days, this only guarantees the ownership period. It still is the second best protection for purchaser/grantee. Only 1 Covenant - Instead of 5 covenants it only has one covenant. 1. Covenant Against Encumbrances - This covenant will guarantee against encumbrances not listed on the deed, but the guarantee is limited to only the period during the grantor's ownership and control. 2. Example: If an Indian tribe came forward and claimed they held title by a Federal treaty written in 1844, the special warranty deed would not require the seller to guarantee this encumbrance. A general warranty deed would require the owner to guarantee. 3. Used by Non-Individuals - The special warranty deed is often used by fiduciaries, trustees, executors, guardians, corporations, taxing bodies, or legal agencies (the Sheriff). They are working with real property that they are not truly aware of. So they do not want to guarantee back to the original patent. (On the next page put slide Sect 10 – 010 and 010A) 10 BARGAIN AND SALE DEED This deed is exactly what the name implies. It implies that the seller/grantor has title to the property. 3rd Best - This is the third best deed for purchaser. 1. Implied Ownership - Grantor/seller only implies he/she has ownership. No other warranties are provided the buyer/grantee. 2. Emergency Sale - Real property that utilizes a Bargain and Sale deed is usually a "bargain sale"; an emergency. This allows an immediate sale between the seller and buyer. 3. Complete Title Transfer - The grantor is saying that he/she has authority and conveys title. There are no guarantees. It does convey TOTAL title from the grantor to the grantee. (On the next page put slide Sect 10 – 011 and 011A) 11 QUITCLAIM DEED This provides no protection for the buyer/grantor. It simply conveys whatever interest the seller has in the property. It could be a fee simple absolute title or it could only be an easement. This deed conveys the seller's interest only. Conveys ONLY - There is no promise of ownership at all. It only conveys any interest the grantor may have in the property. 1. For Corrections - Quitclaim deeds are often used to cure defects (cloud on title) of former owners. The current owner is trying to correct any clouds. For this reason it is sometimes called a Correction Deed, Deed of Confirmation, or Reformation Deed. 2. Quick Action - It is often used to destroy a legal interest in another's land such as terminating an easement. Example: Dick doesn't use the easement on Mary's land anymore. He goes to Mary and says he will sell the easement back to her for $500. They would simply use a quitclaim deed. It is fast, quick, and simple. It is sometimes used to give up a possible inheritance right as well. If an heir doesn't want the property, he/she can quitclaim deed the property to another heir. (On the next page put slide Sect 10 – 012 and 012A) 12 STATUTORY (LAW) FORM When the courts or government take over the control of real property from the title holder, the courts will utilize statutory deed forms to convey title to the buyer/grantee. Example: A title holder is ruled incompetent by the courts and a guardian is appointed to sell the property. The guardian would become the grantor and convey title to a buyer. There are statutory deed types that require wording under State law. Each State has its own statutory forms. The deed where the property is located would use that State's form. Example: Oregon uses all 4 types under statutory law. Washington only uses 3 of the deeds under its statutory form. The 4 statutory deed forms are often "renamed for the way they are used": 1. Court Ordered Deeds - When cases go through the courts involving real property, the court has "special types" that are utilized for the needs of the court. These are court ordered deeds of the special warranty form that are named for their use in the legal matters. a. Executor/Administrator's Deed - Probate court calls its special warranty deed an administrator's deed or executor's deed when conveying title of the decedent's property to an heir. b. Guardian's Deed - If a recipient is a minor the court will call a special warranty deed a guardian's deed for conveying property of a minor ward. c. Referee's Deed - When multiple owners of property can't get along and go to court under a partition lawsuit, the special warranty deed is called a referee's deed. d. Sheriff's Deed - When a sheriff implements a sheriff's sale for property being foreclosed, the property purchased at auction will be transferred to the highest bidder by a sheriff's deed. e. Trustee's Deed - If property is financed by a trust deed, the trustee in charge of the trust will foreclose and sell at auction. The property will be conveyed to the highest bidder by a trustee's deed. f. Tax Deed - If the government forecloses on property to pay for back taxes, the winning bidder will be conveyed title through the use of a tax deed. (On the next page put slide Sect 10 – 013 and 0013A) 13 CAREFUL - DEED OF TRUST or TRUST DEED 1. Trust Deed Financing - Instead of financing a purchase of property with a mortgage, the buyer can use a trust deed or deed of trust. This deed is held by a 3rd party (trustee) instead of a mortgage. This only conveys power to sell the property if the debt payments are not made by the purchaser. This is done without going before a judge... trustee's sale. So.... A deed of trust or trust deed is NOT a deed. It is a lien against property when financing the purchase of real property. 2. Deed of Reconveyance - This is a satisfaction piece given when a trust deed is fully paid. One of the four deed forms reconveys the power of sale clause. It conveys title to the new owner of property. This removes the trust deed lien on the owner's property. Title Search - Chain of Title - Quiet Title Action 1. Title Search - When an insurance company is to write a title insurance policy guaranteeing no clouds on title, it is called a title search. This is done through all the recorded conveyances of title within the County where the property is located. 2 Chain of Title - The sequence of all recorded conveyances and liens on property is called the chain; the chain of title. When conducting a title search the month-to-month recording of claims on the property will be this chain of title. 3. Quiet Title Action - If a claim or lien in the chain is not shown to be cleared up, it would be a cloud on title and would have to be cleared up by court action. This is known as quiet title action. It clears up the cloud on title quietly in court. (On the next page put slide Sect 10 – 014 and 0014A) ERIC, PLEASE NOTE THAT THE REST OF THIS SECTION HAS REVIEW PAGES I DID NOT DO SLIDES FOR(SOME OF WHICH ARE IN BIG FONT) AND ALSO THE REST OF THE SLIDES ARE MELIA’S 14