Equity Wk 4-6

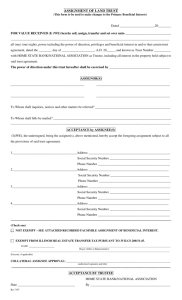

advertisement

LWB334 Murray McCarthy Week 4-6 ASSIGNMENTS – The Requirements of Writing and Form ELEMENT 1: State the Parties Eg – Mary v Bryan The whole crux is that you are trying to specifically enforce someone to go through with the assignment BUT they don’t want to. So, see if Bryan can get off by there being non-compliance with the writing requirements or FORM. ELEMENT 2: Identify the Type of Property and the Interest 1. Legal or Equitable Real (legal property assignable at law) Chose in possession (legal property assignable at law) Chose in action - legal (shares, debt) - Equitable (interest of beneficiary under trust or interest in p’ship) Everett 2. Present or Future ELEMENT 3: Have the R’ments of Writing been satisfied? SUB - ELEMENT 1: Identify the type of Assignment? “Assignment means the immediate transfer of an existing proprietary right, vested or contingent, from the assignor to the assignee”: Norman v. Federal Commissioner of Taxation Property can be legal or equitable Assignments can be effected in five ways: 1. direct assignment to third party 2. directions to trustees to hold property on trust for 3rd party 3. contract for valuable consideration to assign equitable interest to third party 4. declaration as trustee for 3rd party 5. direction to trustee to transfer trust property to 3rd person. If you try and assign by one method and it fails, it can’t be saved by construing it as another form: Milroy v. Lord 1. Direct Assignment to 3rd party Tina gives her car to her brother – gift, voluntary assignment. Car transferred – full ownership (legal and equitable) move to her brother. 2. Direction to Trustees to HOLD property on trust for 3rd party It contemplates a pre-existing trust. John holds car on trust for Tina (she is the beneficiary) and has the equitable title. Tina says that the equitable title should now be transferred to her brother Nick. John still has legal title as trustee. Nick is now the new beneficiary (substitution of a new beneficiary) Requirement that trust continues. 3. Contract for Valuable consideration Tina contracts to sell her car to her brother for $2000. Full ownership moves from Tina to her brother for an exchange of money. Could also be a sale of equitable interest. At the point consideration passes, a constructive trust arises. Page 1 LWB334 Murray McCarthy 4. Declaration as trustee for 3rd party Tina declares that from now on she will hold her car on trust for her brother. She had full o’ship, the moment she declares the trust, there’s a separation of interests. Tina holds legal title, and Nick holds equitable title. Does this need to be in writing? 5. Direction to Trustee to TRANSFER the trust property to 3rd person Pre-existing trust. John is trustee (legal title). Tina is beneficiary (Equitable). Assignment to Nick (full o’ship – legal and equitable). Rule in Saunders v. Voitier. Instead of Tina saying to John transfer the legal title to her, she says transfer the title to her brother, both legal and equitable title pass to Nick. If the writing requirements have been complied with in legal terms, does there have to be further writing to pass equitable interest (No – Vandervell) SUB - ELEMENT 2: Identify the Property Disposed of If the Property disposed of is LAND: s.11(1)(a) or (b) or (c) will apply. If the Property disposed of is PERSONALTY: only s.11(1)(c) will apply. SUB-ELEMENT 3: The Requirements of Writing Legislative Provisions The legislative provisions relevant are: s.11 PLA – Instruments required to be in writing s.59 PLA – Contracts for sale of land s.3 PLA - meaning of the word “disposition” S.11(1)(A) : ACTUAL WRITING (a) no interest in LAND can be created or disposed of except by writing signed by the person creating or conveying the same, or by his agent thereunto lawfully authorised in writing, or by will, or by operation of law. S.11(1)(a) requires actual writing for transfer, if it’s evidentiary, it is void. E.g. Tina owns a property at Noosa and she declares that she holds it on trust for her brother. A few days later, she writes to Nick and tells him of her intentions. If all he needs to show is evidentiary writing, that would be enforceable. But if it needed actual writing, it would have to be at the time Tina said it. Sub-Element 1: Land It refers to land only NOT personalty A mining lease is an interest in land. Adamson v. Hayes Generally includes leaseholds Sub-Element 2: Legal And Equitable Adamson v Hayes held both legal and equitable interests were within s.11(1)(a) but compare Menzies J which said that the section only related to legal interests only. Sub-Element 3: Creation or Disposition of Interest Disposition is defined in s.3 PLA to include a declaration of trust This problem causes an overlap between s.11(1)(a) and (b) Cases have gone beyond this with judicial interpretation Page 2 LWB334 Murray McCarthy Look at the 5 forms of Assignment: 1. Direct Assignment to a Trustee A direct assignment to a trustee is a disposition – transfer of property from one to another. When I vest property in someone else that is clearly held to be a disposition. If you create a trust by transferring land to a trustee, then it has to be in writing under s.11(1)(a) 2. Declaration of Trust Is a declaration of trust a disposition for the purposes of s.11(1)(a)? In Adamson v. Hayes , Gibbs, Stephen & Walsh JJ said it was a disposition within s.11(1)(a) (which means it has to be in writing) Criticism of that approach: - If declaration within s.11(1)(a) applies, then s.11(1)(b)would be an obsolete provision as the former is more onerous: DSS v. James Mrs bought unit – intended for 35yr invalid daughter when she died (Unwritten trust). Applied to DSS for pension – said no because of unit. HELD if s.11(1)(a) applies, Dss wouldn’t have to pay. Lee refused to apply Adamnson and said s.11(b) should apply S.3 will only apply “unless contrary intention appears” – Argue s.11(1)(b) is contrary intention. Therefore state: If Adamson v Hayes is followed, actual writing will be required here……… BUT the better view is that there is NO overlapping so therefore look at s.11(1)(b) requirements 3. A direction to the trustee to HOLD property IS a disposition: Direction to trustees are held to be a disposition Therefore they require actual writing by transferee or agent. Grey v. IRC - Hunter (grandfather) made a series of settlements in favour of his grandchildren and appointed A as trustees. - He transferred shares to these trustees and orally directed them to hold the property on trust. - A executed documents (declarations of trust) confirming they held on H’s direction - These declarations were assessed to stamp duty because they said the oral directive was ineffective (it had to be in writing). - H appealed assessment. Held: - Ct said that if you give disposition its broad, ordinary meaning, it includes where a person divests themselves of an interest in property and vests it in someone else. - When he transferred the shares to trustees, they were holding on trust for his grandchildren. He was divesting himself of the shares and vesting them in trustees for children… therefore it was a disposition. - Writing was required and it would have been assessed to stamp duty anyway. 4. Disposition may include contract: A disposition might include a K for sale of land unless 11(2) applies. 1. Is there an overlap between s.11(1)(a) and s.59? S.59 of the PLA says contracts must be in writing OR evidenced in writing. However s.11(1)(a) only allows actual writing. Adamson v Hayes - Gibbs suggested overlap an between s.11(1)(a) and s.59 existed Page 3 LWB334 Murray McCarthy Abjornson v Urban Newspapers - Criticism of suggestion – No overlap. If contract for the sale of land is in s.11(1)(a), then s.59 would have no independent operation and would always be in s.11(1)(a) requiring actual writing. Therefore apply section 59 as it is specific to contracts If Adamson v Hayes is followed actual writing will be required here……… BUT the BETTER view is no overlap between s.59 PLA and s.11(1)(a) and therefore evidentiary writing is sufficient here…… 2. If there IS an overlap and s.11(1)(a) does apply, can the actual writing requirements by avoided by relying on s.11(2)?? S.11(2) says that s.11 does not affect the creation or operation of resulting, implied or constructive trusts Oughtred v. IRC 1. When you Sign a contract, an interest in equity arises = specific performance 2. Consideration passing = fully blown constructive trust. On consideration passing, the conscience of the recipient is bound. - Mrs O was a life tenant under an estate and the primary asset were shares in a coy (Y shares) - Her son P was the remainder (P would get absolute entitlement to shares when she died) - Mrs O also owned shares in another coy (X) - She wanted to have control over the Y shares - 18 June 1956 Mrs O and P orally agreed that P would transfer his remainder interest in Y shares to Mrs O and Mrs O would transfer her X shares to P. - She would end up owning Y shares and P would own X shares. - 26 June three documents were executed: transfer of x shares from O to P; release to trustees; transfer of Y shares to O. (evidentiary) - They were trying to effect the agreement orally so that they didn’t have to pay stamp duty. - Were the oral transactions effective, if they weren’t, the Stamps office could charge duty. Held: - Minority judges (Radcliffe and Cowen) have been adopted in subsequent cases. - They said there was a specifically enforceable agreement. These shares were in private coys (shares in a private coy are ltd in terms of transfer, shares in public coy are available freely – couldn’t get SP in terms of public coy). So because of the nature of the property it was enforceable. - Radcliffe @227-28 and Cowen @230-31 when you enter into a specifically enforceable K, that gives rise to an equitable interest, a trust sub-modo (a progression towards trusteeship) and becomes a full constructive trust at the point consideration passes. - Constructive trust is an exception to writing requirements - If consideration has passed, may be able to get around writing requirements 5. The direction to trustees to transfer property to 3rd Person: If you comply with writing requirements to transfer the legal interest to the property, you don’t need to comply with further writing requirements to transfer equitable interest Donovan J, “the transfer o the legal title carries with it the transfer beneficial interest and you do not need any further writing. The greater carries the less.” Vandervell v. IRC - A bank was a trustee of shares on trust for V - V orally directed bank to transfer shares to Royal College of Surgeons & option to repurchase shares granted – avoiding tax. - IRC taxed V on dividends alleging oral direction ineffective – they said that he needed to comply with evidentiary writing requirements for equitable interests and he didn’t, so he had to pay tax. Held: - Ct said that the oral direction was effective. - Upjohn L. said that transfer of legal title carries with it the equitable title. Because the shares were registered, that complied with the writing requirements. Page 4 LWB334 - Murray McCarthy Oral direction was effective but the shares were held on resulting trust for V. Because of the option to repurchase it meant that he… Even though a direction to trustees to transfer to 3rd party is disposition, if you comply with legal writing requirements, you don’t need to comply with equitable… Sub-Element 4: Signed by the settlor or his agent, or by will, or by operation of law. Failure to comply = void PLA 11(1)(b) s.11(1)(b) a declaration of trust respecting any land must be proved by some writing signed by some person who is able to declare such trust or by his will. 1: Land It refers to land only NOT personalty A mining lease is an interest in land. Adamson v. Hayes Generally includes leaseholds 2: Declaration of Trust Overlap with s.11(1)(a) discussed above – better view is that this section applies to declarations. 3: Evidentiary writing sufficient must include terms of the trust, parties, beneficiaries, trust property and nature of the trust. – Forster v Hale may be correspondence – Forster v Hale may be combination of documents capable of being read together – DSS v James person who signs the writing must generally be the beneficial owner – Tierney v Wood 11(1)(c) – Okay if Oral s.11(1)(c) a disposition of an equitable interest or trust subsisting at the time of the disposition, must be manifested and proved by some writing signed by the person disposing of the same, or by his agent thereunto lawfully authorised in writing, or by will. S.11(1)deals with Subsisting Equitable Interests, DOESN’T APPLY WHERE AN EQUITABLE INTEREST HAS BEEN CREATED held to include land and personalty if you have a dealing with personalty, 11(1)(c) is the only section that can apply 1: Land AND Personalty Applies to land and personalty: Adamson cf Menzies held it only applies to land 2: Subsisting Equitable Interest - S.11(1)(c) applies ONLY to the disposition of subsisting equitable interests or trusts. Consequently, 11(1)(c) does NOT apply where interests are created. Eg where full legal owner declares trust (e.g. I declare that I hold share on trust for my brother) where equitable owner declares subtrust and active duties. (I’m the beneficiary of a car, and I transfer my equitable interest to my brother) 3: Evidentiary Writing Sufficient SUB- ELEMENT 4: Exceptions to writing Requirements Page 5 LWB334 Murray McCarthy FRAUD Equity will NOT allow a party to rely on another party’s lack of writing to set up a fraus and will therefore admit oral evidence in such circumstances despite th statutory requirements. PLA S.11(2) S.11(2) provides that “this section does NOT affect the creation or operation of resulting, implied, or constructive trusts. PART PERFORMANCE AND UNCONSCIONABLE CONDUCT In addition to the fraud and constructive and resulting trusts exceptions, the writing requirements will not have to be satisfied in cases where an equity arises due to unconscionability or where there are sufficient acts of part performance. ELEMENT 4: Have the Requirements Of Form been complied with? SUB-ELEMENT 1: Is the Property Capable of Assignment? Most types of property can be assigned either at CL or in equity. A prohibition against assignment will be due to statutory restrictions or general law restrictions STATUTORY RESTRICTIONS Certain statutes may prohibit or declare void the assignment of various forms of property For example, alimony or maintenance payments are unassignable (public policy) GENERAL LAW RESTRICTIONS 1. Interest in a corpse is unassignable – Doodeward v Spence 2. Pay by the holder of a public office is invalid – Arbuthnot v Norton 3. Rights to Litigate Bare Rights To Litigate General Rule: Bare right to litigate could NOT be assigned on public policy grounds because the assignment savoured of maintenance & champerty: Glegg v Bromley Policy is that people with no interest in litigation should not be allowed to litigate. However, the courts have developed qualifications to the rule and rights to litigate are assignable if: 1. Property with an Incidental Right to Litigate Instead of assigning a bare right to litigate, if you assign property that has an incidental right to litigate, then you’re assigning a proprietary right, not a bare right to litigate. This is deemed to be valid. Criticised as being very fine distinctions based on artificial reasoning and not satisfactory Dickeson v. Burrell - someone (A) transferred property to another person (B). - It was found out that the transfer was able to be set aside on equitable grounds (undue influence?). - The person who originally transferred the property, sold the property to C. - Can C maintain that action against B (the undue influencer) to get the property back? - The Ct looked to whether there was an assignment of the right to litigate or a proprietary right. There was an equitable interest in the owner which carried with it the right to litigate (it was incidental). - Verdict assignable 2. In Trendex, the Courts developed a new better test to determine the assignability of rights – General Commercial Interest Test: Trendtex v. Credit Suisse - T had proceedings on foot to sue a Nigerian bank which had failed to honour a letter of credit to the Page 6 LWB334 Murray McCarthy extent of $14 million. - While the appeal was pending, T started to run out of money, and decided they would assign the cause of action to CS, one of their major creditors for 800,000 pounds. - The bank settled the litigation for $8 million. - T got upset b/c sold something for 800,000 pounds for $8 mill. - T argued that the assignment was invalid. Was it against maintenance and therefore void. Held: - The Ct of Appeal held the assignment to be valid. Oliver LJ discussed the rule about the distinction b/w bare rights and incidental rights to assign litigation. - Here there was a right to enforce a K by way of damages for breach. So a right to enforce a K as provided by law was, in his view, a property right, not a bare right to litigate. - H of L did not abolish the rule of bare right/incidental right distinction but held the court has developed a new better rule. - They said another way of determining this question is to ask – is property being assigned to a party with a genuine and substantial interest (Wilberforce L) or genuine commercial interest (Roskill L) in litigation. Such an interest will be valid. - If you assign to a creditor, then you do have an interest in the outcome – greater chance of recovering the debt. - CS were owed money by S and had also guaranteed T the costs of litigation. - Although prima facie, CS did have a genuine commercial interest, the facts showed that CS took the assignment so that they could immediately reassign to someone else for $1.1 mill. - This in fact invalidated the assignment. Although they had a genuine interest, b/c that subsequent assignment was an interest in getting profit, not an interest in the litigation. - If they had a genuine commercial interest, they would have continued with the litigation themselves. - Appeal was dismissed and they were told to take it to Switzerland – relevant jurisdiction. 3. Browntown v Edward Moore (Profit Case) applied the Genuine Commercial Interest test and extended the notion of whether profit could be made from the assignment Crt said “just because there is prospect of party making a profit from assignment wont make the champerdess. Browntown v. Edward Moore - Litigation arose out of the installation of a computer system. - One coy recommended that a system be installed and the other installed it. - P contracted with D2 to install the computer on advice of D1. - Computer was inadequate and did not work. - P sued both D1 and D2 for breach of K and also sued D1 in negligence. - P settled the action against D1 for 300,000 pounds (costs outstanding) - D1 agreed to indemnify the P for further costs against D2 if the P assigned action against D2 to D1) - Was that assignment to the other party valid? Held: - Ct upheld the assignment - Why would there be a genuine commercial interest? - D1 had a genuine commercial interest because looking at the totality of the transaction, although they were separate contracts, they were in respect of the same transaction (one provided advice, one provided computers), & sued for same damage - E.g. a co-defendant in litigation has a genuine interest. - Ct had to consider the question of making a profit on this assignment. - Ct said just b/c there’s some notion that a profit might be made on the assignment doesn’t mean that the assignment will be invalid – that you didn’t have a genuine interest. - But an excessive profit might be taken into account. - If a profit’s going to be made, focus on the intention of the party – did they have an intention to focus on the litigation, or an intention to profit. If it’s an excessive profit, it may invalidate the assignment. - Intention to make a profit doesn’t take away from there being a genuine interest, but a gross, excessive profit might. Ordinary creditor and insurers would have the requisite interest in a litigation RE Timothys and Compania Colombiana v Pacific Steam Page 7 LWB334 Murray McCarthy Also a major creditor who is guaranteed legal costs has an interest: Trendtex Co defendants in litigation have a genuine commercial interest. 4. Verdicts (Fruits of Action) A verdict (future property) is always held to be assignable – no policy against it – The assignment of a verdict isn’t interfering in the outcome of litigation.: Glegg v Bromley Future property is assigned at equity because until the judgement is handed down it doesn’t exist – there is only a possibility of it coming into existence. The right arises when the successful judgement is handed down and becomes present property. Future property is only assignable in equity and for consideration (Equity wont assist a volunteer). If the verdict has been handed down and you assign it, then it is ok to assign it al law. 5. Certain Contractual Rights If there is a subsisting contract and no breach has occurred, the right to the benefit of the contract could be assigned. It takes the effect as a chose in action. Such chose in action can be assigned subject compliance with s.199 PLA. If breach occurs after assignment, then assignee can sue provided it does not involve personal services: Bruce v Tyler A contract may specifically provide that rights under it are not assignable – but it is a question of construction: Linden Gardens v Lenesta Sludge IF PROPERTY NOT CAPABLE OF ASSIGNMENT – FAILS IF PROPERTY CAPABLE OF ASSIGNMENT – MOVE ON SUB -ELEMENT 2: Was there an Intention to Assign? In order to assign or transfer property, you need to have a clearly manifested intention to divest assignor of property and vest in assignee. This applies equally to legal property (Shepherd v FCT) and equitable property (Norman v FCT) Where the assignment is in writing, the intention is gleaned from the instrument: Shepherd v FCT Distinguish with a revocable mandate (authority): CSD v. Howard-Smith - H was the beneficiary under his wife’s will. S was the power of attorney. - Before the estate was distributed, H wrote a letter to the executors asking them to pay out certain debts to certain people. - “I request you, as executors and trustees, and as my attorney under power, to pay out of my interest as residuary beneficiary in such estate, either in shares or money at your discretion, to the persons & institutions hereunder mentioned, the amounts set out opposite to their names or titles respectively”. - Consider whether there’s an intention to assign or to do something else. - H argued that it was an authority payment and the letter did not amount to assignment. - Stamp Office Commissioner said it was either an immediate gift or creation of an immediate trust = assignment. Held: - Court Held the letter was an authority to make payments rather than a creation of an immediate trust or assignment (transfer irrevocable). - The court said there was NO evidence of irrevocability. Instead, there was contrary evidence the recipient may not get the benefit especially if H could change it before it was enforced. - Assignment only becomes effective when authority acted upon. IF NO INTENTION – FAILS IF INTENTION – MOVE ON SUB-ELEMENT 3: Has the Property been assigned at Law or Equity? Page 8 LWB334 Murray McCarthy Look at the nature of the property you are trying to assign. Note: Future Property is NOT assignable at Law Examples: Shares – Legal Chose in Action assignable at Law Land/House – Legal Property assignable at Law Interest from Debt/Loan – Legal Chose in Action (set time frame) Trust – Equitable Chose in Action Defamation Action – Future Royalties – Future Property LEGAL PROPERTY ASSIGNABLE AT LAW (Not Future Property or Parts of Debt) Formalities at Law: LAND - Torrens Title: If it’s Torrens title land, there are procedural aspects that need to be fulfilled: s.181 and 182 LTA. s.182 LTA requires registration of transfer to pass legal title in real property CT; writing; Transfer Docs; Registration Choses in Possession Choses in possession is personal property and has a tangible, physical existence. QN: Are you effecting a gift or are you selling? If it’s a gift of a chose in possession, then it may be made by delivery with the appropriate intention to give – manifested by a deed of gift: Cochrane v Moore If you are trying to sell and you pass legal possession, you have to comply with SOGA. Choses in Action - Legal A chose in action is only enforceable by court proceedings e.g. debts, coy shares, an interest in a p’ship, an interest of a beneficiary under a trust. Need to distinguish b/w a legal chose in action and an equitable chose in action. - Legal choses in action are the interest from a debt, coy shares. – BUT Note is it Future or Present? - Equitable choses in action – interest of beneficiary under a trust and interest of partner in p’ship. Generally speaking, choses in action must be assigned in accordance with s.199 of the PLA. EXCEPT for shares PLA s.199 There are 5 elements to be satisfied: 1. Intention to assign There must be an intention to assign rather than an authorisation that the debtor pay another person: CSD v Howard Smith 2. Property has to be properly described: Percival 3. The assignment must be absolute: If it’s not, you can’t assign it at law, only assignable in equity. There’s two ways in won’t be absolute: 1. By way of a charge or 2. By way of debt. 4. Assignment in writing signed by assignor 5. Written notice to debtor, trustee etc. Page 9 LWB334 Murray McCarthy s 199 – Things to Note 1. Assignment under the PLA “subject to equities having priority over the right of assignee” Assignee takes interest subject to prior equities. The result is although it is an assignment in law, for priorities purposes because the assignee takes subject to prior equities, it may in effect be an assignment in equity. This means the rule in Dearle v Hall applies. Priorities The Rule in Dearle v Hall: Competing Equitable Assignments of Personalty The rule states that if there are several assignments of the one chose in action, priority is determined by the first to give notice, not by the order in which the assignments are made. Re Dallas The rule applies to equitable assignments of personalty and competing equitable assignments of legal choses in action as well (e.g. debts) – Marchant v Morton Downs The rule does NOT apply to competing equitable assignments of realty. A later assignee is entitled to priority over an earlier assignee in time where: 1. The later assignee gave value for assignment (does not apply to volunteers) - first assignee can be volunteer, as long as notice given – Spencer v Clarke 2. At time of consideration, later assignee must not have notice of earlier assignment. - need not be in any specific form nor in writing – Lloyd v Banks 3. Later assignee gave notice to trustee, debtor or fundholder - must be given to trustee, debtor or fundholder – or to an agent if authorised – Saffron Walden v Rayner - notice to one trustee sufficient even if co-trustees unaware – Ward v Duncombe - notice to all remains effective notwithstanding any changes in the identity of the trustee–Re Wasdale - notice to one trustee remains effective indefinitely even after death or retirement. - but if it is a transaction effected after death of trustee, then others must know about it. - notice to prospective trustees ineffective and is not cured by later appointment of that person as trustee without fresh notice being given - if both notices arrive on same day – then first assignee takes priority - Notice is not required to perfect an equitable assignee’s title. It is not part of an equitable assignment – it simply relates to priority. But without notice the assignment is vulnerable. 4. Trustee, debtor or fundholder must not have notice of interest of earlier assignee upon receipt of notice from later assignee. D v. H - The person was entitled to income from their father’s estate. - They assigned the income to D as security for a debt and then assigned the income to S and then sold the right to income to H who did not know of the earlier assignment. - H gave notice to the trustees of the estate. - Neither D nor S gave notice to the trustee. Held: - H got the assignment because they were a bona fide purchaser for value without notice who also gave notice first. 2. voluntary assignments of choses in action possible under s 199 – Re Westerton 3. future choses in action cannot be assigned under s 199 because it is not a presently existing chose in action it cannot be assigned at law – Norman v FCT (future choses in action can only be assigned in equity and for consideration). 4. does s 199 PLA apply to equitable choses in action? FCT v Everett at 447 held s 199 to apply to legal and equitable choses in action. – criticism Page 10 LWB334 Murray McCarthy better view is that it doesn’t apply intention of s 199 was to allow assignee to sue debtor without joining with assignor. This is already available under equitable choses in action. but you may want to follow s 199 anyway even if you have an equitable chose in action simply because of the notice requirements which can give you priority. They said that the section refers to a trustee Legal choses in action construed to mean lawfully assignable choses in action – includes equitable choses in action. FCT v. Everett involved an assignment of an interest in a p’ship – an equitable chose in action. Criticism PLA 199 doesn’t apply: The better view is probably that s.199 doesn’t apply to equitable choses in action. The assignment should be capable of being enforced w/o joining the assignor in the litigation. With equitable choses in action, equity would always make it so you didn’t have to join the assignor – it wasn’t necessary to have s.199. Suggestions that “trustee” doesn’t mean trustee but means “trustee in bankruptcy” because often a debt will be payable by a trustee in bankruptcy. H of L held that the section doesn’t apply to equitable choses in action in England. William Barendt v Dunlop Rubber It would however, be sensible to adopt the mechanism in s.199 because then you’ll preserve priority. (If you’ve followed s.199, you’ll have given notice and therefore preserved priority). Shares: 5 steps for effective transfer at law of shares (a) assignor signs a prescribed transfer form (b) transfer and share certificates delivered to assignee (transferee) (c) assignee has to sign it (d) transfer and share certificates delivered to company (e) company registers the transfer **If formalities have NOT been complied with - Go to Equity** Formalities in Equity: 1. Legal Property Assignable at Law – but Failed ISSUE: Has consideration Passed?. Equity regards as done what ought to be done. If consideration is given, there is an immediate assignment in equity (legal or equitable property) – FCT v Everett If contract is executed, but consideration has not yet passed, then equitable remedies provide relief through injunction or specific performance. Oughtred v IRC IF no consideration and its Legal, then go to s.200 ISSUE: s.200 If there has been a failed assignment at law (eg transfer not lodged ) the assignment will be effective in equity if it complies with s 200 PLA. S.200 gives statutory effect to the view of Griffith CJ in Anning a view which was adopted by HC in Corin v. Patton The test in s.200: Has the assignor done everything to be done by the assignor that is necessary in order to transfer the property to the assignee? Can assign even if there remains something to be done for complete transfer which can be done without the assignor. Page 11 LWB334 Murray McCarthy Corin v. Patton - Mason and McHugh in C v. P – looked at whether assignment was effective. - CT looked at Milroy v. Lord – Turner J said that the settlor must have done everything necessary to be done to transfer the property. It didn’t answer whether the donor had to do everything necessary to transfer the property or whether he had to have done everything necessary to be done. Anning – Griffiths, Isaac, Higgins… ***APPLY TO FACTS IN QN*** Assignors Actions Sufficient Under s.200PLA Shares: A transfer signed by the assignor Delivery of the transfer, with share certificates to the assignee Legal Choses in Action Transfer in writing of a debt No need for assignor to give notice as assignee can (therefore if doesn’t meet s199 because of notice can be an effective assignment in equity) Assignors Actions Insufficient under s.200PLA Transfer never signed or registered by A even though delivered shares to B Milroy v Lord Land Registration of transfer and title deed (may or may not be a title deed in QLD) The assignor doesn’t have to personally register the title, but has to give authority for another to do that. Colvin v Patton Registration of the title did not happen Colvin v Patton Examples of Property Assignable At Law Shares – Milroy v Lord a power of attorney was not acted upon by assignor before he died upon death, power was revoked thus not effectively assigned in equity as not everything was done that was necessary for the assignor to do. 5 steps for effective transfer at law of shares 1. assignor signs a prescribed transfer form 2. transfer and share certificates delivered to assignee (transferee) 3. assignee has to sign it 4. transfer and share certificates delivered to company 5. company registers the transfer Assignor MUST do 1 AND 2. for there to be an equitable assignment 1. 2. Legal Choses in Action (Debt) example of transfering by writing a debt by assignor to assignee if no notice is given, then failed assignment at law but because notice may be given by either assignor or assignee, assignor has done all that is necessary – therefore successful assignment in equity 3. Torrens Title Land transfer of land takes effect at law on registration of transfer with title deed. though note that Qld may or may not have title deed. Page 12 LWB334 Murray McCarthy Corin v Patton - title deed held by bank and a transfer of property was not registered together with the title deed to be handed over. - she (assignor) did not give authority to bank to hand over title deed for registration before she died - but even if such an authority existed, authorities are revoked upon death. - but her solicitor was also acting for the assignee. - so it was unclear who solicitor was acting for, assignor or assignee - if solicitor was acting for assignor, then authority not revoked and assignment in equity still possible. EQUITABLE PROPERTY AND PROPERTY UNASSIGNABLE AT LAW (Future Property and Parts of Debts) Assignments in Equity may arise where: 1. Property is legal property and either: a ) not capable of assignment at law; b) failed attempt to assign at law. (refer above) 2. Property is future property (legal and equitable) 3. Consideration has passed (legal and equitable) 4. Property is equitable property No form of words is required for an equitable assignment, but the intention to assign must be clear Shepherd v Federal Commissioner of Taxation. The assignment need not purport to be an assignment. William v Dunlop A. Legal Property Unassignable at Law Not all property is assignable at law e.g. part of a debt or part of a chose in action (not assignable at law because s199 PLA requires it to be absolute). All that is required is a clear intention to assign – Shepherd v FCT NOT required consideration– Normal v FCT writing– s 11(1)(c) not apply because no subsisting interest. B. Future property (Legal and Equitable) Future property is ONLY ASSIGNABLE only in equity IF there has been VALUABLE CONSIDERATION for the assignment– Holroyd v Marshall; Norman v FCT When consideration passes, assignees conscience bound – equity regards as done what ought to be done As soon as property comes into existance, there is an equitable interest fixed on the property – like a floating charge. Examples: interest hoped for under a will or intestacy (which may be subject to change) freight not yet earned future royalties – e.g. copyright in songs not yet written future book debts – e.g. accounts receivables verdict – no present property until judgement handed down rent or interest to be paid in the future Page 13 LWB334 Murray McCarthy 1. What is the distinction between future property and present property? Determined by construing deed of assignment. Fct v Everett Each case will depend on the construction of the instrument of assignment Shepherd v FCT consider nature of settlor’s rights – Everett v FCT present rights with rights to arise in the future entirely future rights (mere expectancy) Determine 1. What rights the assignor has – see if the have any present rights at all. If so 2. What rights have they actually transferred, (present or future component?) Dividends of particular shares - no obligation to pay dividends until dividends declared - dividends may or may not be declared - therefore future property. Norman v FCT - assigned interest payable on loan – loan repayable by borrower at will (no fixed time set) - In this case it was the “right to interest” that was being assigned. - The interest could be repaid at anytime. - The interest was future property because there was no guarantee that the underlying right to interest would continue with regard to the relevant period of time - In 1956 they weren’t assigning interest that was due straight away but income for 2yrs – the loan could be repaid at any time and come 1958, the interest may not exist - There were 2 rights – which may be assigned separately 1. right to be repaid principal - present 2. right to receive interest – future cos loan could be determined at any time without notice. Williams v CIR - What was assigned was ‘first 500 pounds of net income’ This was future property – so assigned the result, not the cause The present right would have been the interest in the trust, but that wasn’t assigned, only the income was assigned. Shepherd v FCT - Tree (underlying contractual right in the loan) or fruit (interest) - ‘right, title and interest’ meant assignment of present property with future right. - How do we know if theyre assigning the tree or the fruit? – Look at the intention and the words used. Everett v FCT - Assignment of a share in a partnership. - Right to receive partnership’s profits was integral component of interest in partnership – cannot be severed with partner’s interest. - In Norman, loan and interest were severable, i.e. assignor could have assigned one or both - Interest in partnership is present property, income of partnership is future property. Present rights Declared dividends Assigning interest in trust Williams v CIR Assignment of all right, title, interest in income which may arise from royalties Shepherd v FCT Assignment of portion of partnership together with all those rights including the right to receive an appropriate share of the profits Future rights Dividends because not payed until declared. Norman v FCT Receiving Interest on a loan because loan itself could be determined at any time without notice. Cf minority Norman v FCT Assigning money received under trust Williams v CIR Page 14 LWB334 Murray McCarthy Portion of partnership not severable from portion of future profit 2. Basis for Enforcement of Assignments of Future Property Enforceable only if contract was specifically performable. Holroyd v Marshall HOWEVER this has been rejected: Tailby v Official Receiver The elements needed to be fulfilled are: (a) an agreement to assign expectancy or future property supported by valuable consideration; and (b) the consideration has been paid or executed (c) A acquires property which falls within the description of that which he agreed, or purported presently, to assign, then in equity that property vests in B as soon as it is acquired by A and can be identified, without any further assurance by A and without any action by B equity regards as done what ought to be done the property should be described with sufficient particularity to permit its identification when it comes into existence or into the possession of the assignor. Nature of Assignee’s Rights Concerned with the nature of the assignee’s interest in the period after the contract of assignment and prior to the property coming into existence or being acquired by the assignee. There is debate as to whether the right is contractual or proprietary. If the rights contractual: If bankrupt the assignor will be discharged from all obligations. S 153(3) Bankruptcy Act 1966 Coyllyer v Issac If rights proprietary: an equitable interest arises upon signing of contract and thus assignee’s interest survives the bankruptcy. – Re Lind This is the approach adopted in Australia ISSUE: Has consideration Passed (Legal and Equitable). Equity regards as done what ought to be done. If consideration is given, there is an immediate assignment in equity (legal or equitable property) – FCT v Everett If contract is executed, but consideration has not yet passed, then equitable remedies provide relief through injunction or specific performance. Oughtred v IRC C. Purely Equitable Present Property only To assign equitable property without consideration, all that is required is an INTENTION to assign. –CSD v Howard-Smith Note the statutory requirement of writing in s 11 Notice is not necessary for an assignment but may be important for priorities. CSD v Howard-Smith but opposite view in Timpsons’s Executors v Yerbury Communication from the assignor to assignee with directly or indirectly is a necessary condition of an assignment. s 199 does not apply to equitable property – note discussion above. This is despite FCT v Everett to the contrary. Page 15