Alpine Head Tax Accounting Sheet

advertisement

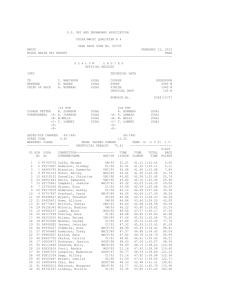

Alpine Head Tax Accounting Sheet (Use to calculate and verify USSA’s Head Tax Calculations) Division USSA Race Code Numbers Race Name Race Date Race Location Was this event changed from its original scheduling on the Alpine Schedule Agreement? ____________________ If so, was USSA notified via email, compservices@ussa.org, of the change? ______________________________ Race Code # Total Actual Starts ___________ _______ ______ ______ ___________ _______ ______ ______ ___________ _______ ______ ______ ___________ _______ ______ ______ ___________ _______ ______ ______ ___________ _______ ______ ______ ___________ _______ ______ ______ ___________ _______ ______ ______ - Waivers Paid Total = *Total Paid Starts = ___________ *Total Paid Starts ________ x $ 10.00 = National Head Tax Due $ __________ Amount Paid $ __________ Check # __________ (Payable to USSA) Total Paid Starts ________ x $__________ = Regional Head Tax Due $ __________ Amount Paid $ __________ Check # __________ (Payable to Region) Total Paid Starts ________ x $__________ = Divisional Head Tax Due $ _________ Amount Paid $ __________ Check # __________ (Payable to Division) Person Completing Calculations: email: USSA National Head Tax is always due; these other categories may or may not apply to your race. Please check with your Region and Division organizations if you are unsure which additional head taxes you need to submit. Date: Phone: Note: This form may also be used by those Race Administrators whose clubs have not used USSA’s online Event Registration System and who do not have access to club login information. If used, this form, Head Tax Waiver list and required Head Tax checks should be submitted as required by Region/Division. 1 5 -1 6 Head Tax Accounting Instructions 1. 2. 3. Process all event race results (alpineresults@ussa.org) Use your ROC access and log into My USSA Use the Schedule Agreement Tool to view your club’s events 4. Click on the icon to see the Head Tax and Reconciliation information for the Event. If USSA Online Event Registration System was used, the statement will include the amount collected through Online Event Registration, minus the Head Tax. Refunds for registrations collected and any questions about the amounts need to be sent to competitionservices@ussa.org. Otherwise the report needs to be accepted and USSA will send the amount owed to the ROC. If additional amounts are owed, the ROC needs to send the additional Head Tax amount to USSA along with a copy of the above report. If the event did not use USSA Online Event Registration System, a statement similar to the following will be displayed. Below is a breakout per race of the starts minus USST members. If there are additional waived athletes or questions about athlete count, contact competitionservices@ussa.org to reconcile that. Otherwise print the page and submit with Head Tax payment. 1 5 -1 6