Whatcom Math Project - Bellingham Public Schools

advertisement

Whatcom Math Project

Piecewise Income Tax Functions

Course: Algebra II or Precalculus

Grade Level: Grades 10-11

College Readiness Standard Names and Numbers:

Standard 2-Communication

The student can interpret and communicate mathematical

knowledge and relationships in both mathematical and

everyday language.

Standard 3-Connections

The student extends mathematical thinking across

mathematical content areas, and to other disciplines and real life situations.

Standard 7-Algebra

The student accurately describes and applies concepts and procedures from

algebra.

Standard 8-Functions

The student accurately describes and applies function concepts and procedures

to understand mathematical relationships.

Student Attributes:

Demonstrates intellectual engagementEvidence of Achievement: Actively explores new ideas, posing questions about their

meaning, significance, implications.

Student Learning Outcome- College Readiness Standard Component and

Number:

3.1- Use mathematical ideas and strategies to analyze relationships within mathematics

and in other disciplines and real life situations.

7.1- Recognize and use appropriate concepts, procedures, definitions, and properties to

simplify expressions and solve equations.

8.2- Represent basic functions (linear, quadratic, exponential, and reciprocal) and

piecewise-defined functions (varying over subintervals of the domain) using and

translating among words, tables, graphs, and symbols.

8.3- Analyze and interpret features of a function.

8.4- Model situations and relationships using a variety of basic functions (linear,

quadratic, logarithmic, exponential, and reciprocal) and piecewise-defined functions.

1

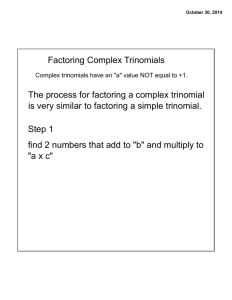

Learning Objectives:

Students will be able to write the equation of a line in slope-intercept form, standard

form, point slope form, and transformation form by demonstrating it on an end of the unit

assessment.

Student will be able to graph and come up with full equations with numerical analysis of

piece-wise functions by demonstrating it on an end of the unit assessment.

Students will be able to calculate one’s federal income tax numerically given any

taxable income by demonstrating it on an end of the unit assessment.

Students will be able to write functions for incremental tax structures or a tax bracket

system by demonstrating it on an end of the unit assessment.

Prerequisite Skills: A deep understanding of slope-intercept form for a line, finding the

equation of a line given two points, simple inequalities and/or interval notation for sets of

numbers, and the ability to manipulate equations and formulas in generic forms.

Material for Students: Pencil, eraser, graphing calculator, and provided resource

packet

Teaching Aids: Graphing calculator and provided resource packet. A document

camera would be nice to have, but is not essential.

Estimated Time for Completion: 1 week

References:

Tax Foundation http://www.taxfoundation.org/

IRS http://www.irs.gov/

Wikipedia

2

PREASSESSMENT:

This lesson could be done any time after Algebra I. It is written for an Algebra II

class; however the sky is the limit with extensions. You can add in enough extensions

to challenge a Precalculus student.

The lesson’s prerequisite skills are graphing lines in slope-intercept form, finding

linear equations given two points, and a basic knowledge of vertex form of a parabola.

Most of the lesson is focused on tax theory and applying simple mathematical concepts

and to create income tax functions.

3

Pre-Test of Target Skills and Strategies

1. Find the slope of the line that passes through (22,500, 225) and (43,650, 1,435).

121

a)

2115

b)

2115

121

c)

d)

2115

121

121

2115

2. Solve for y:

5

y 4 x

a)

3

b)

y 5 x 4

c)

5

y x4

3

d)

y

5 x 3 y 12

5

x4

3

3. What is the ordered pair for the y-intercept given the equation 3x 2 y 7 ?

7

a)

0,

2

b)

0,7

c)

7

0,

2

d)

7

,0

3

4

4. Find the equation of the line that passes through the points (2,5) and (8,15) .

5

5. Graph y x 2

3

6. Graph y ( x 4) 2 1

5

Pre-Test of Target Skills and Strategies (KEY)

1. Finding slope of the line that passes through (22,500, 225) and (43,650, 1,435).

121

a)

CORRECT

2115

b)

2115

121

c)

d)

2115

121

121

2115

2. Solve for y:

5

y 4 x

a)

3

(switching around Δy with Δx)

(opposite slope)

(opposite reciprocal slope)

5 x 3 y 12

(missed negative sign for y-int)

b)

y 5 x 4

(only divided 12 by negative 3)

c)

5

y x4

3

(simplified slope wrong)

d)

y

5

x4

3

CORRECT

3. What is the coordinate for the y-intercept given the equation 3x 2 y 7 ?

7

a)

(missed negative sign)

0,

2

b)

0,7

(added 3x and did not divide by -2)

c)

7

0,

2

CORRECT

d)

7

,0

3

(found the x-int instead, made y = 0)

6

4. Find the equation of the line that passes through the points (2,5) and (8,15) .

2-point response – The student shows understanding of determining a linear

equation given two points by doing the following:

Determines slope m = -2 and y-intercept b = 1

Writes y = –2x + 1

1-point response – The student shows some understanding of determining a linear

equation given two points by doing one of the following:

Determines a y-intercept by substituting a coordinate for (x,y) and solving for b.

Writes y = –2x + b for any determined value of b.

0-point response – The student shows little or no understanding of determining a

linear equation given two points.

Example:

15 5 20

2

8 2

10

y 2 x b

m

5 2(2) b

b 1

y 2 x 1

7

5

5. Graph y x 2

3

2-point response – The student shows understanding of graphing a linear function

given in slope-intercept form by doing the following:

Shows a rise of -5 and a run of 3 or equivalent ratio

Passes through the point (0, 2)

1-point response – The student shows some understanding of graphing a linear

function given in slope-intercept form by doing one of the following:

Shows a rise of -5 and a run of 3 or equivalent ratio

Passes through the point (0, 2)

0-point response – The student shows little or no understanding of graphing a

linear function given in slope-intercept form.

6. Graph y ( x 4) 2 1

2-point response – The student shows understanding of graphing a quadratic

function given vertex form by doing the following:

Shows the correct x-value of 4 for the vertex.

Shows the correct y-value of 1 for the vertex.

Shows the correct graph of y x 2 based off the vertex

1-point response – The student shows some understanding of graphing a quadratic

function given vertex form by doing one of the following:

Shows the correct x or y-value of the vertex

Shows the correct graph of y x 2 based off their vertex

0-point response – The student shows little or no understanding of graphing a

quadratic function given vertex form.

8

I.

INTRODUCTION:

This lesson is a terrific way to introduce or cover piece-wise defined (or domain

restricted) functions because of the application to every person’s life.I It gives students a

direct connection to why almost every function is a piece-wise one when it really gets

down to it.

Hook: Pose the following questions to your class. Provide plenty of wait time. Have

around a 10 minute teacher led discussion. Encourage every student to brainstorm

even if they are not speaking.

Q1. Will you or do you currently pay taxes?

Possible responses: Yes or they do not understand at minimum sales tax.

Q2. What taxes do you currently pay?

Possible responses: Sales tax (state, county, and city), gas tax (federal and state), FICA

(payroll tax if they have a job that they filled out a W-2 for).

Q3. What taxes will you eventually pay (if not already)?

Possible responses: Federal income tax, FICA, property tax, capital gains tax, “sin”

taxes (alcohol, tobacco, and fructose), and other fee based taxes such as vehicle tabs,

business licensing, and many permits.

Depending on your comfort level and understanding of other interesting tax information,

you may choose to go into more depth here if you feel it would be a worthwhile

endeavor to motivate your class. Students appreciate snapshots from your life.

Describe how taxes have affected it or other little quick tax stories. Perhaps you wait

until the last minute to submit your income taxes each year while your neighbors get

them out of the way early because they anticipate a return.

End with something like this. “Well, since all of you pay taxes currently and will only pay

more in the future, how about we study the mathematics of the federal tax structure that

you will pay on every paycheck you receive?”

Remind students they will first need to extend some of their prior basic knowledge in

order to apply it to tax settings.

NOTES:

9

II.

LESSON

Things to be aware of prior to the lesson (mini unit):

I am a firm believer of the teacher making a lesson their own and creating their own

examples based on classroom needs.

To familiarize yourself with where you are going for this lesson; refer to the graph and

summary below. This is so you understand the skill sets required to make sure the

mathematics behind the tax structure do not become a barrier.

y3 .25( x 32,550) 4,481, 32,550 x 78,850

y2 .15( x 8,025) 803, 8,025 x 32,550

y1 .10 x, x 8,025

Federal taxation on a typical employee’s paycheck has 3 parts to it. These are

Income tax (which is often referred to as federal withholding), Social Security, and

Medicare. This lesson focuses on income tax. The lesson’s extensions add in Social

Security and Medicare.

The big misconception students will have (and most people) is that one’s entire

income is taxed at their bracket’s rate. After some introductory skill work, a problem

will be provided to address this issue. If the misconception were true, then there would

10

be major gaps at each bracket ending (and beginning). If the misconception were true,

then every function would have a y-intercept of (0, 0).

Students will start by calculating income tax numerically in each bracket to

understand this incremental tax structure, and then they will write the piece-wise

function in entirety. Students can always fall back on using two points to determine an

equation of a line (and more often than not write their linear equation in slope-intercept

form). Ultimately, students should value the transformation form of a line (essentially

point-slope form) where you can use a point at the end of a bracket and the slope of the

next bracket (see below).

You will notice the provided 2008 Tax Brackets below have a “plus “some dollar

amount after the income bracket. That amount is the tax already paid in the previous

lower brackets. It may be good for you to skip ahead and do a few calculations yourself

on Day 4, but here is a quick example.

On $80,000 of taxable income:

.10(8,025) + .15(32,550 – 8,025) + .25(78,850 – 32,550) + .28(80,000 – 78,850)

= $16,378.25

This amount is 16,056.25 plus the rest of the income within the 28% bracket or

(80,000 – 78,850). Notice income only within each bracket is taxed at that bracket’s

rate.

2008 Tax Brackets

10%

15%

25%

28%

33%

35%

on

on

on

on

on

on

income between $0 and $8,025

the income between $8,025 and $32,550; plus $802.50

the income between $32,550 and $78,850; plus $4,481.25

the income between $78,850 and $164,550; plus $16,056.25

the income between $164,550 and $357,700; plus $40,052.25

the income over $357,700; plus $103,791.75

11

The 2008 Tax Brackets can be written in Excel as:

G

Tax Rate

3

4

5

6

7

8

H

Taxable Income

0.1

0.15

0.25

0.28

0.33

0.35

8025

32550

78850

164550

357700

400000

I

Tax

=0.1*H3

=I3+0.15*(H4-H3)

=I4+0.25*(H5-H4)

=I5+0.28*(H6-H5)

=I6+0.33*(H7-H6)

=I7+0.35*(H8-H7)

Which yields the graph of:

12

Resource Packet

Social Security tax for

individuals:

6.2% of gross income up to a

cap limit of $102,000.

Medicare tax for individuals:

1.45% of gross income with no

cap limit.

2008 Income Tax Brackets (on taxable income) for Individuals:

10% on taxable income between $0 and $8,025

15% on the taxable income between $8,025 and $32,550; plus $802.50

25% on the taxable income between $32,550 and $78,850; plus $4,481.25

28% on the taxable income between $78,850 and $164,550; plus $16,056.25

33% on the taxable income between $164,550 and $357,700; plus $40,052.25

35% on the taxable income over $357,700; plus $103,791.75

The $802.50 above comes from the amount of tax in the 10% bracket. So if

you look at the 25% bracket, then the $4,481.25 is the total tax accrued in the 10% and

15% bracket. Any remaining income above $32,550 but less than $77,100 is taxed at

25%. This is all illustrated for the teacher and students in Day 4.

For 2008, the employee's share of the Social Security portion of the tax is 6.2%

of gross compensation up to a limit of $102,000 of compensation (resulting in a

maximum of $6,324.00 in tax). For 2009, the employee's share is 6.2% of gross

compensation up to a limit of $106,800 of compensation (resulting in a maximum tax of

$6,621.60).[4] This limit, known as the Social Security Wage Base, goes up each year

based on average national wages and, in general, at a faster rate than the Consumer

Price Index (CPI-U). The employee's share of the Medicare portion is 1.45% of wages

with no limit. The employer is also liable for separate 6.2% and 1.45% Social Security

and Medicare taxes, respectively, making the total Social Security tax 12.4% and the

total Medicare tax 2.9% of wages (Wikipedia).

If an individual's taxable income falls within a particular tax bracket, the individual

pays the listed percentage of income on each dollar that falls within that monetary

range. For example, a person who earned $10,000 in 2003 would be liable for 10% of

each dollar earned from the 1st dollar to the 7,300th dollar, and then for 15% of each

dollar earned from the 7,301st dollar to the 10,000th dollar, for a total of $1,135. This

ensures that every rise in a person's salary results in an increase of after-tax salary

(Wikipedia).

13

Contrary to a popular belief, there is no point at which one is better off earning less

money (or giving to charity to obtain deductions). That is, because the marginal tax rate

is always far less than 100%, an individual is financially "better off" realizing "more"

income than "less" income, even though the marginal tax rate applicable to the highest

level of income of that person increases as income increases (Wikipedia).

The complete tax bracket history can be found and downloaded at:

http://www.taxfoundation.org/publications/show/151.html (Wikipedia)

To discuss who pays taxes and for discussion purposes the following tax burden

and types is found at:

http://www.taxfoundation.org/research/show/23341.html (Tax Foundation)

Tax burden and Types

Quintiles of Household Cash Money Income, Calendar Year

2004

Income

Payroll (SS

and Medicare)

Corporate

Income

Gasoline

Alcoholic

Beverages

Tobacco

Diesel Fuel

Air Transport

Other Excise

Customs,

Duties, etc.

Second

Bottom 20 20

Percent

Percent

$171

$1,431

Third 20

Percent

$3,720

Fourth 20

Percent

$7,973

Top 20

Percent

$29,257

$917

$3,656

$6,788

$10,737

$18,470

$271

$69

$999

$138

$1,734

$202

$2,894

$286

$6,597

$493

$34

$51

$10

$22

$43

$52

$67

$38

$51

$66

$75

$73

$65

$81

$89

$102

$68

$109

$147

$124

$141

$59

$248

$312

$177

$96

$147

$200

$279

$396

$0

$0

$0

$1,362

$6,644

$13,028

$22,719

$57,512

Estate and Gift $0

Total Federal

$1,684

14

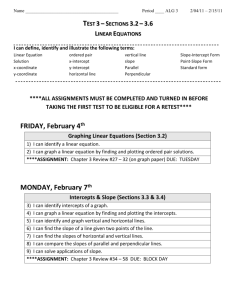

Tax Day 1 Teacher Notes:

Review slope-intercept and standard form of a line. Show the transformation form.

Warm-Up

Find the equation of the line that travels through the points (18,2) and (3,5) .

1) Write your equation in slope-intercept form y mx b .

2) Write your equation in point-slope form y y1 m( x x1 ) .

3) Write your equation in standard form ax by c .

4) Take your equation in point-slope form and add y1 to both sides. Your new

equation now has y isolated. We will call this transformation form.

5) Distribute and simplify to verify you end up with your slope-intercept form from

number 1.

Mini Lecture

Review transformation forms of a parabola and a sinusoid (if they have seen them

before). f ( x) a( x h) 2 k and f ( x) a sin( b( x h) k

Present the transformation form of a line to reinforce the warm-up. Add y1 to both sides

and substitute k y1 and h x1 to get f ( x) m( x h) k .

Assign Tax Day 1 Activity

NOTE: For question 7 students are to change y2 in their calculator to a “ball” graph

style. This is achieved by moving the calculator cursor to the left of the y2 and hitting

enter 4 times so you see the symbol “ ” .

15

Tax Day 1 Activity: Equations of Lines Review

NAME:

PERIOD:

DATE:

1. What are the x- and y-intercepts for the function y = 3x + 7?

2. What are the x- and y-intercepts for the equation 3x - 2y = 4?

3. What are the x- and y-intercepts for the equation f(x) = 2x - 8?

4. What are the x- and y-intercepts for the equation f(x) = 2x?

16

5. Change the equation y 3x 7 into:

● point-slope form using the point (2, 1)

● standard form

● transformation form using the point. Confirm you are correct.

6. You know a line goes through the point (12, 5) and has a slope of .15. Find the

equation of the line in point-slope form and in transformation form.

7. You know a line goes through the point (43,500, 6,000) and has a slope of .28. Find

the equation of the line in point-slope form and in transformation form. Convert the

transformation form the slope-intercept form. Using your calculator, type your

transformation form into y1 and your slope-intercept form into y2. Use the “ball” graph

type for y2. Do you have the same graph?

17

Tax Day 2 Teacher Notes:

Have students complete Tax Day 2 Activity in groups. Before they start, have students

be clear on the variable definitions. x is taxable income and t(x) is your tax amount.

Focus them on the input and output or that the amount of tax one pays depends on their

taxable income.

Taxable income is not gross income. Each taxpayer has their own unique financial

situation and a good explanation of taxable income is the income the government

deems fair to tax an individual on after deductions and exemptions.

Important: tax credits are actual dollar amounts subtracted from a tax amount t(x). If

you feel comfortable, pass out a 1040 form for the current year.

Question 3 is designed to see if students intuitively understand the piecewise structure

of our income tax system.

Discuss answers and functions with any remaining time.

18

Tax Day 2 Activity: Introduction to Tax Functions

NAME:

PERIOD:

DATE:

So we can stay consistent when writing tax functions:

the independent variable, x = taxable income

the dependent variable, t(x) = your tax

1.

Write an expression for t(x) if there is a flat tax rate for every person of 25%.

What is the slope of the line?

t1 ( x) .25 x

2.

Graph t2 ( x) .25 x 2000 simultaneously on your graphing calculator. Set your

t3 ( x) .000005 x 2

window to

a)

0 x 100,000

0 y 50,000

Sketch your results:

19

b)

Find t1 , when x = 0, 25,000, 50,000, and 75,00

c)

Find t 2 , when x = 0, 25,000, 50,000, and 75,000

d)

Find t3 , when x = 0, 25,000, 50,000, and 75,000

e)

What do you like or dislike about t1 ?

f)

What is different about t 2 compared with t1 ?

20

g)

What type of function is t3 ? Do you think a tax function should look similar to

this? Why or why not?

h)

Find t 3 (200,000) . Is this a reasonable answer?

3.

If your first $20,000 is taxed at 10% and anything greater than $20,000 is taxed

at 20%, write two different functions to represent this situation. Define the

domain and range of each function. Graph your results.

21

Tax Day 3 Teacher Notes:

This day focuses on basic linear and quadratic piece-wise defined functions. If your

students are familiar with domain, then emphasize these functions as domain restricted

ones.

Warm Up

Lightly sketch the following functions on the same axis:

y1 5

y 2 3

y3 x 2 1

y4 x 4

Erase your sketch so the domain of each graph is:

y1 : 7,4

y 2 : 4,1

y 3 : 1,2

y 4 : 2,7

Demonstrate to students how these “pieces” can be written as one piecewise function using proper notation.

Now have students work on the activity in groups.

Important: Let students know the knowledge of Day 1, Day 2, and today (Day 3) will all

be applied in Day 4.

Depending on your students’ progress, you may need to provide a few more examples

of graphing piece-wise functions given the equation. Writing the function from the graph

typically assists students in graphing these functions from the equations.

22

Tax Day 3 Activity: Piece-Wise Functions

NAME:

PERIOD:

DATE:

Graph the piecewise function below.

5, x 6

8, - 6 x 2

2

f ( x ) x , 2 x 2

x 2, 2 x 5

1, x 5

23

f (x)

Find

For

For

For

Find the x-intercept(s)

f (4)

f (2)

f (0)

f (1)

Find the y-intercept(s)

Domain:

Find the Intervals where the function is:

Range:

Increasing:

Maximum:

Decreasing:

Minimum:

Constant:

24

f (x)

Find

For

For

For

Find the x-intercept(s)

f (4)

f (2)

f (0)

f (1)

Find the y-intercept(s)

Domain:

Find the Intervals where the function is:

Range:

Increasing:

Maximum:

Decreasing:

Minimum:

Constant:

25

f (x)

Find

For

For

For

Find the x-intercept(s)

f (4)

f (2)

f (0)

f (1)

Find the y-intercept(s)

Domain:

Find the Intervals where the function is:

Range:

Increasing:

Maximum:

Decreasing:

Minimum:

Constant:

26

APPLICATION:

Tax Day 4 Teacher Notes:

This is the day where students will compute federal income tax on taxable income

numerically. Some examples are provided for you to go over with your students. This

goes back to the “Things to be aware of prior to the lesson” section. The Warm-up will

show the students’ misconceptions.

Warm-Up

2008 Tax Brackets

10% on income between $0 and $8,025

15% on the income between $8,025 and $32,550

25% on the income between $32,550 and $78,850

28% on the income between $78,850 and $164,550

33% on the income between $164,550 and $357,700

35% on the income over $357,700

1. Given the 2008 Tax Brackets, how much tax would someone who earns $8,000

0.10(8,000) 800 , so $800 of tax

pay?

2. Given the 2008 Tax Brackets, how much tax would someone who earns $8,100

0.10(8,025) .15(8,100 8,025) 813.75 , so $813.75 of tax. This is

pay?

important. Most students will put $1,215! This is because they taxed all

the income at 15% which is the big misconception. It is fun to ask the class

if someone should pay (or if it makes sense) $401 for making only $100

more! The answer is no, of course.

PASS OUT THE RESOURCE PACKET (PAGES 12, 13, AND 14 of this document)

Example 1:

Suppose an individual has a taxable income of $20,000. Calculate the amount they

would pay for federal income tax.

This individual falls into the 15% bracket just like the 2nd Warm Up question.

Demonstrate their tax is 0.10(8,025) .15(20,000 8,025) $2,598.75

You can add then that their actual percent tax is 12.994% (2,598.75/20,000)

27

Example 2:

Suppose an individual has a taxable income of $100,000. Calculate the amount

they would pay for federal income tax.

This individual falls into the 28% bracket. We know they will pay less than

28% in

taxes

0.10(8,025) .15(32,550 8,025) .25(78,850 32,550) .28(100,000 78,850) $21,978.25

The percentage here is easy. Remind students that people with $100,000 of

taxable income may have a gross income of say $120,000, $140,345, or

$171,091- we just do not know. It depends on their deductions and a

variety of other complex tax codes (laws).

Example 3:

Demonstrate to students how to start their piece-wise tax function for the 2008

bracket structure. Write the first function with the domain restriction and remind

them that the next piece must start where the previous one left off. In other

words, the last coordinate point of one piece is the first coordinate point on the

next piece.

Provide as much or as little instructional support here as you feel necessary.

Groups can be beneficial or a little demonstration followed by mainly individual

work.

Remind students that all they need is a point and the slope (or two points) to find

the equation of a line. For the students that really reach a roadblock, have them

pick two taxable income amounts within the same bracket to numerically

compute the tax. These can be used as their two points.

Assign Tax Day 4 Activity

IMPORTANT! The quickest way to see if students are writing functions correctly

is that they do not have y-intercepts or transformations (they are taxing all of

one’s taxable income at a particular rate if they are doing this they are missing

the point).

Refer students to the resource packet for Social Security and Medicare taxes.

See provided answer keys to make sure you know how to get the numbers.

28

Tax Day 4 Activity: Income Tax, Social Security Tax, and Medicare Tax Individual

Calculations

NAME:

PERIOD:

DATE:

1. A person earns $53,000 in gross income and has $39,000 in taxable income.

Calculate the following (SHOW ALL WORK!):

a) Income Tax? What percent of taxable income is this amount?

b) Social Security Portion?

c) Medicare Portion?

d) TOTAL FICA?

e) TOTAL Federal Tax?

f) What percent of the gross income is this TOTAL Federal Tax amount?

29

2. A person earns $190,000 in gross income and has $144,000 in taxable income.

Calculate the following (SHOW ALL WORK!):

a) Income Tax? What percent of taxable income is this amount?

b) Social Security Portion?

c) Medicare Portion?

d) TOTAL FICA?

e) TOTAL Federal Tax?

f) What percent of the gross income is this TOTAL Federal Tax amount?

30

3. Write a piece-wise function for the 2008 US income tax system.

4. Write a piece-wise function for Social Security.

5. Write a piece-wise function for Social Security and Medicare combined.

31

III.

ASSESSMENT:

End of Lesson Assessment

Name:

PERIOD/CLASS:

1. Write the equation of a line in transformation form when the slope is 5 and the

line goes through the point (3, 1).

2. Write the equation of a line in slope-intercept form when the slope is 5 and the

line goes through the point (3, 1).

3. Write the equation of a line in point-slope form when the slope is 5 and the line

goes through the point (3, 1).

4. What is the equation of the line in slope-intercept form with a slope of 0.15 that

goes through the point (10,500, 1,260)?

a)

y 1,260 0.15( x 10,500)

b)

y 0.15 x 315

c)

y 0.15( x 10,500) 1,260

d)

y 0.15 x 10,311

32

10

8

6

4

2

-10 -8

-6

-4

-2

2

4

6

8

10

-2

-4

-6

-8

Figure

1

-10

5. Refer to figure 1 above. What is the range of the function?

a)

5,6

b)

5,1

c)

8,2 1,3 4,10

d)

5,1 5,3 3,3

6. Refer to figure 1 above. At what intervals is the function increasing?

a)

8,0

b)

5,6

c)

8,2 1,0

d)

0,3 4,10

7. Refer to figure 1 above. If you were to describe the quadratic piece of figure 1,

then your piece would say:

y x 2 6, for 2 x 4

a)

b)

y x 2 6, for 1 x 3

c)

y x 2 6, for 3 x 6

d)

y x 6, for 1 x 0

33

2 x ,

x 3

8. Sketch: f ( x) x 1, 3 x 1

x 2 6, 1 x 3

• Be accurate for each piece.

• Illustrate open and closed points correctly.

10

8

6

4

2

-10 -8 -6 -4 -2

2

4

6

8 10

-2

-4

-6

-8

-10

9. Use the 2007 US Federal Income Tax Brackets to calculate a person's federal

income tax with a taxable income of $47,000.

2007 US Federal Income Tax Brackets:

Income from $1 to $7,550, tax bracket is 10%

Income from $7,550 to $30,650 tax bracket is 15%

Income from $30,650 to $74,200, tax bracket is 25%

Income from $74,200 to $154,800, tax bracket is 28%

Income from $154,800 to $336,550, tax bracket is 33%

Income $336,550 and above, tax bracket is 35%

a)

$4,700

b)

$8307.50

c)

$11,750.00

d)

$15,107.50

34

10. Use the 2007 US Federal Income Tax Brackets to calculate a person's federal

income tax with a taxable income of $110,000.

2007 US Federal Income Tax Brackets:

Income from $1 to $7,550, tax bracket is 10%

Income from $7,550 to $30,650 tax bracket is 15%

Income from $30,650 to $74,200, tax bracket is 25%

Income from $74,200 to $154,800, tax bracket is 28%

Income from $154,800 to $336,550, tax bracket is 33%

Income $336,550 and above, tax bracket is 35%

a)

$21,450.00

b)

$25,131.50

c)

$30,800.00

d)

$37,675.50

11. Change the line y 250 2x 900 into slope-intercept form.

a)

y 2( x 900) 250

b)

y 2 x 250

c)

y 2 x 1,550

d)

y 2 x 2,050

35

1

( x 5) 2 on the grid provided. Be sure to:

2

Provide an accurate sketch the graph

12. Graph y

Determine and label at least one coordinate on the graph

10

8

6

4

2

-10 -8 -6 -4 -2

2

4

6

8 10

-2

-4

-6

-8

-10

13. Find the equation of a line that passes through the points (8,025, 401.25) and

(32,550, 2,853.75).

Be sure to show your steps used to determine the slope

Write your equation in transformation form

Write your equation in slope-intercept form

Transformation form: _______________________________

Slope-intercept form: _______________________________

36

14. Write a piecewise function for the following incremental tax bracket system:

Income from $1 to $35,000, tax bracket is 5%

Income from $35,000 to $111,000 tax bracket is 20%

Income from $111,000 and above, tax bracket is 40%

● Use correct notation

● get correct functions

● restrict domain appropriately

15. You are implementing a new tax n(x) on gross income x. Your tax is 0% (or no

tax) on income up to $255,000 and is 2.3% on gross income over $255,000. Write a

piece-wise function n(x) that outputs the amount of this new tax one pays given any

income.

● Use correct notation

● get correct functions

● restrict domain appropriately

37

End of Lesson Assessment (KEY)

NOTE: Each multiple choice item is one point. Each extended response question

is worth two points and has a rubric to score based off a 0, 1, or 2 point response.

1. Write the equation of a line in transformation form when the slope is 5 and the

line goes through the point (3, 1).

y 5( x 3) 1

Target: GLE 1.5 algebraic representation of linear functions, prerequisite to CRS 8.2:

represent basic functions (linear, quadratic, exponential, and reciprocal) and

piecewise-defined functions (varying over subintervals of the domain) using and

translating among words, tables, graphs, and symbols.

2. Write the equation of a line in slope-intercept form when the slope is 5 and the

line goes through the point (3, 1).

y 5 x 14

Target: GLE 1.5 algebraic representation of linear functions, prerequisite to CRS 8.2:

represent basic functions (linear, quadratic, exponential, and reciprocal) and

piecewise-defined functions (varying over subintervals of the domain) using and

translating among words, tables, graphs, and symbols.

3. Write the equation of a line in point-slope form when the slope is 5 and the line

goes through the point (3, 1).

y 1 5( x 3)

Target: GLE 1.5 algebraic representation of linear functions, prerequisite to CRS 8.2:

represent basic functions (linear, quadratic, exponential, and reciprocal) and

piecewise-defined functions (varying over subintervals of the domain) using and

translating among words, tables, graphs, and symbols.

38

4. What is the equation of the line in slope-intercept form with a slope of 0.15 that

goes through the point (10,500, 1,260)?

a) y 1,260 0.15( x 10,500)

(point-slope form)

b) y 0.15 x 315

CORRECT

c) y 0.15( x 10,500) 1,260

(transformation form)

d) y 0.15 x 10,311

(switched x and y while substituting)

CRS Target 8.2: represent basic functions (linear, quadratic, exponential, and

reciprocal) and piecewise-defined functions (varying over subintervals of the

domain) using and translating among words, tables, graphs, and symbols.

10

8

6

4

2

-10 -8

-6

-4

-2

2

4

6

8

10

-2

-4

-6

-8

Figure

-10 1

5. Refer to figure 1 above. What is the range of the function?

5,6

a)

CORRECT

b)

5,1

(only did left function range)

c)

8,2 1,3 4,10

(did domain, not range)

d)

5,1 5,3 3,3

(tried to many things for range)

CRS Target 8.3: Analyze and interpret features of a function.

39

10

8

6

4

2

-10 -8

-6

-4

-2

2

4

6

8

10

-2

-4

-6

-8

Figure

1

-10

6. Refer to figure 1 above. At what intervals is the function increasing?

a)

(included values not in domain)

8,0

b)

5,6

(did y values)

c)

8,2 1,0

CORRECT

d)

0,3 4,10

(decreasing interval)

CRS Target 8.3: Analyze and interpret features of a function.

10

8

6

4

2

-10 -8

-6

-4

-2

2

4

6

8

10

-2

-4

-6

-8

Figure

1

-10

7. Refer to figure 1 above. If you were to describe the quadratic piece of figure 1, then

your piece would say:

y x 2 6, for 2 x 4 (from end of other functions)

a)

b)

y x 2 6, for 1 x 3 CORRECT

c)

y x 2 6, for 3 x 6

(correct function, but used range)

d)

y x 6, for 1 x 0

(a line and not correct domain for quad.)

CRS Target 8.3: Analyze and interpret features of a function.

40

2 x ,

x 3

8. Sketch: f ( x) x 1, 3 x 1

x 2 6, 1 x 3

• Be accurate for each piece.

• Illustrate open and closed points correctly.

10

8

6

4

2

-10 -8 -6 -4 -2

2

4

6

8 10

-2

-4

-6

-8

-10

CRS Target 8.2: Sketch the graph of a piecewise-defined function given the

algebraic representation.

2-point response - The student shows understanding of piecewise-defined

functions by doing the following:

Sketching the three pieces accurately (see example)

Indicating domain with open and closed points

1-point response - The student shows some understanding of piecewisedefined functions by doing one of the following:

Sketching one or two of the three pieces accurately and indicating domain

with open and closed points

Sketching the three pieces accurately

Indicating domain with open and closed points

0-point response - The student shows little or no understanding of graphing

piecewise-defined functions

41

9. Use the 2007 US Federal Income Tax Brackets to calculate a person's federal

income tax with a taxable income of $47,000.

2007 US Federal Income Tax Brackets:

Income from $1 to $7,550, tax bracket is 10%

Income from $7,550 to $30,650 tax bracket is 15%

Income from $30,650 to $74,200, tax bracket is 25%

Income from $74,200 to $154,800, tax bracket is 28%

Income from $154,800 to $336,550, tax bracket is 33%

Income $336,550 and above, tax bracket is 35%

a) $4,700

(only taxed all income at 10%)

b) $8307.50

CORRECT

c) $11,750.00

(all income taxed at 25%)

d) $15,107.50

(forgot to stop at $47,000 and went to $74,200)

CRS Target 3.1: Use mathematical ideas and strategies to analyze relationships

within mathematics and in other disciplines and real life situations.

10. Use the 2007 US Federal Income Tax Brackets to calculate a person's federal

income tax with a taxable income of $110,000.

2007 US Federal Income Tax Brackets:

Income from $1 to $7,550, tax bracket is 10%

Income from $7,550 to $30,650 tax bracket is 15%

Income from $30,650 to $74,200, tax bracket is 25%

Income from $74,200 to $154,800, tax bracket is 28%

Income from $154,800 to $336,550, tax bracket is 33%

Income $336,550 and above, tax bracket is 35%

a) $21,450.00

(averaged the lowest for rates multiplied by $110,000)

b) $25,131.50

CORRECT

c) $30,800.00

(taxed whole income at 28%)

d) $37,675.50

(taxed up to $154,800)

CRS Target 3.1: Use mathematical ideas and strategies to analyze relationships within

mathematics and in other disciplines and real life situations.

42

11. Change the line y 250 2x 900 into slope-intercept form.

a)

y 2( x 900) 250

(not simplified, can’t see y-intercept in equation)

b)

y 2 x 250

(forgot to distribute -2 to the -900)

c)

y 2 x 1,550

(forgot to change signs while distributing)

d)

y 2 x 2,050

CORRECT

CRS Target 7.1: Recognize and use appropriate concepts, procedures, definitions, and

properties to simplify expressions and solve equations.

43

1

( x 5) 2 on the grid provided. Be sure to:

2

Provide an accurate sketch the graph

Determine and label at least one coordinate on the graph

12. Graph y

10

8

6

4

2

-10 -8 -6 -4 -2

2

4

6

8 10

-2

-4

-6

-8

-10

CRS Target 8.2: Represent basic functions (linear, quadratic, exponential, and

reciprocal) and piecewise-defined functions (varying over subintervals of the

domain) using and translating among words, tables, graphs, and symbols.

2-point response - The student shows understanding of linear function graphs

by doing the following:

Providing an accurate sketch the graph with points within at least 0.5 units

Labeling at least one coordinate on the graph

1-point response - The student shows some understanding of linear function

graphs by doing one of the following:

Providing a sketch the graph that is not accurate in some places

Plot and labeling at least two correct coordinates on the graph

0-point response - The student shows little or no understanding of graphing a

linear function.

44

13. Find the equation of a line that passes through the points (8,025, 401.25) and

(32,550, 2,853.75).

Be sure to show your steps used to determine the slope

Write your equation in transformation form

Write your equation in slope-intercept form

m 0.1

y 0.1( x 8,025) 401.25

y 0.1( x 32,550) 2,853.75

y 0.1 x 401.25

Transformation form: _______________________________

Slope-intercept form: _______________________________

CRS Target 8.2: Represent basic functions (linear, quadratic, exponential, and

reciprocal) and piecewise-defined functions (varying over sub-intervals of the domain)

using and translating among words, tables, graphs, and symbols.

2-point response – The student shows understanding of finding the equation of a line

given two points by doing the following:

Providing the proper calculation of finding the slope of the line.

Writing the equation of the line in transformation form.

Writing the equation of the line in slope-intercept form.

1-point response - The student shows some understanding of finding the equation of a

line given two points by doing two of the following

Providing the proper calculation of finding the slope of the line.

Writing the equation of the line in transformation form using their slope (which

may not be correct).

Writing the equation of the line in slope-intercept form using their slope (which

may not be correct).

0-point response - The student shows little or no understanding of finding the equation

of a line given two points.

45

14. Write a piecewise function f(x), for the following incremental tax bracket system:

Income from $1 to $35,000, tax bracket is 5%

Income from $35,000 to $111,000 tax bracket is 20%

Income from $111,000 and above, tax bracket is 40%

In your response, be sure to:

Use function notation

Provide the domain restrictions

.05 x

for

f ( x ) 0.20(x - 35,000) 1,750

for

0.40(x - 111,000) 16,950 for

x 35,000

35,000 x 111,000

111,000 x

CRS Target 8.4: Model situations and relationships using a variety of basic functions

(linear, quadratic, logarithmic, exponential, and reciprocal) and piecewise-defined

functions.

2-point response – The student shows understanding of modeling a piecewisedefined function by doing the following:

Provide the correct equations of the 3 linear functions

Use correct piecewise function notation

Include the correct domains for each of the linear functions

1-point response - The student shows some understanding of modeling a

piecewise-defined function by doing one the following:

Provide equations of 3 linear functions with the correct slope

Use correct piecewise function notation and include the correct domains for each

of the linear functions

0-point response - The student shows little or no understanding of modeling a

piecewise-defined function.

46

15. You are implementing a new tax n(x) on gross income x. Your tax is 0% (or no tax)

on income up to $255,000 and is 2.3% on gross income over $255,000. Write a piecewise function n(x) that outputs the amount of this new tax one pays given any income.

● Use correct notation

● get correct functions

● restrict domain appropriately

0

for

f ( x)

0.023(x - 255,000) for

x 255,000

x 255,000

CRS Target 8.4: Model situations and relationships using a variety of basic functions

(linear, quadratic, logarithmic, exponential, and reciprocal) and piecewise-defined

functions.

2-point response – The student shows understanding of modeling an incremental tax

bracket system using a piecewise-defined function by doing the following:

Providing the 2 different equations of the linear functions correctly.

Using correct piecewise function notation and including the correct domains for

each of the 2 linear functions.

1-point response - The student shows some understanding of modeling an incremental

tax bracket system using a piecewise-defined function by doing one the following:

Providing 2 different linear functions with the correct slope, but not necessarily

the correct transformation or y-intercept for the 2nd equation.

Using correct piecewise function notation and including the correct domains for

each of the 2 linear functions.

0-point response - The student shows little or no understanding of modeling an

incremental tax bracket system using a piecewise-defined function.

47

EXTENSIONS:

Extension 5 and 6 are musts and explanations are provided with them. At minimum

display these examples for students because they will be paying these taxes shortly!

1. It is always fun to look up stars/professional sports people’s salaries and find their

income tax amounts. Just keep in mind most salary data is gross income, not taxable.

Again, arriving at ones taxable income depends on a lot of factors. We do know it has

to be lower than gross income. Perhaps a good estimate is 70% of ones gross income.

2. You can make any tax problem by creating different bracket structures. You can

make a 50% bracket, you can add more brackets which were common historically, and

you can pick any taxable income to work with.

3. Explore how to cut taxes and how to raise taxes. Explore targeted tax cuts and

target tax cuts. The minimum possible tax rate is 0% unless you go in to a hypothetical

negative rate. The maximum possible tax rate is 100% unless you would have one pay

all there income and still owe more.

4. What is the difference in income tax between an income of $32,550 and $32,551? Is

this reasonable?

5. Refer to the resource packet to study Social Security and Medicare. Say the same

individual form question 5 had a gross income of $62,500. Calculate how much they

would pay towards Social Security AND Medicare.

Social Security is a tax on ones gross income at 6.2% up to the amount of

$102,000 in 2008. Any income above that amount is not taxed for Social Security.

So in this case it would be .062(62,500), which is $3,875. Medicare is a tax of

1.45% on all of ones gross income with no limiting cap. So this individuals

Medicare tax would be .0145(62,500), which is $906.25. Keep in mind ones

employer matches both of these amounts.

6. If a person had a gross income of $115,000. How much Social Security tax would

they pay? How much Medicare would they contribute? Show work.

Anyone who made over $102,000 in 2008 paid the same Social Security amount.

This is simply .0625(102,000), which is $6,375 for this individual. On the other

hand, Medicare is still a tax on all of one’s gross income no matter what. So the

Medicare tax would be .0145(115,000), which is $1,667.50. These two taxes are

often referred to as FICA or the payroll tax.

7. I’m sure you can think of more if you are interested and/or have time. Perhaps your

class will too.

48

APPENDIX:

Contents:

1.

2.

3.

4.

Tax Day 1 Activity: Equations of Lines Review (KEY)

Tax Day 2 Activity: Introduction to Tax Functions (KEY)

Tax Day 3 Activity: Piece-Wise Functions (KEY)

Tax Day 4 Activity: Income Tax, Social Security Tax, and Medicare Tax

Individual Calculations (KEY)

5. Optional Parent/Guardian Survey

49

Solutions:

Tax Day 1 Activity: Equations of Lines Review

NAME:

PERIOD:

DATE:

1. What is the x- and y-intercepts for the function y = 3x + 7?

7

x-intercept is ,0

3

y-intercept is 0,7

2. What are both the x- and y-intercepts for the equation 3x - 2y = 4?

4

x-intercept is ,0

3

y-intercept is 0,2

3. What is the x- and y-intercepts for the equation f(x) = 2x - 8?

x-intercept is 4,0 y-intercept is 0,8

4. What are both the x- and y-intercepts for the equation f(x) = 2x?

x-intercept is 0,0 y-intercept is 0,0

50

5. Change the equation y 3x 7 into:

● point-slope form using the point (2, 1)

● standard form

● transformationform using the point. Confirm you are correct.

Point-slope form is y 1 3( x 2) using the point (2, 1).

Standard form is 3x y 7 .

Transformation form using (2, 1) is y 3( x 2) 1 . Expand out to confirm.

6. You know a line goes through the point (12, 5) and has a slope of .15. Find the

equation of the line in point-slope form and in transformation form.

Point-slope form is y 5 .15( x 12)

Transformation form is y .15( x 12) 5

7. You know a line goes through the point (43,500, 6,000) and has a slope of .28. Find

the equation of the line in point-slope form and in transformation form. Convert the

transformation form the slope-intercept form. Using your calculator, type your

transformation form into y1 and your slope-intercept form into y2. Use the “ball” graph

type for y2. Do you have the same graph?

Point-Slope form is y 6,000 .28( x 43,500)

Transformation form is y .28( x 43,500) 6,000

Slope-intercept form is y .28 x 6,180

The y1 will graph and then the “ball” will graph over it. Discussing the window

may also be helpful.

51

Tax Day 2 Activity: Introduction to Tax Functions

NAME:

PERIOD:

DATE:

So we can stay consistent when writing tax functions:

the independent variable, x = taxable income

the dependent variable, t(x) = your tax

1.

Find t(x) if there is a flat tax rate for every person of 25%. What is the slope of

the line?

t ( x) .25 x

t1 ( x) .25 x

2.

Graph t2 ( x) .25 x 2000 simultaneously on your graphing calculator. Set your

t3 ( x) .000005 x 2

window to

a)

0 x 100,000

0 y 50,000

Sketch your results:

52

b) Find t1 , when x = 0, 25,000, 50,000, and 75,000

t1 (0) 0

t1 (25,000) 6,250

t1 (50,000) 12,500

t1 (75,000) 18,750

c) Find t 2 , when x = 0, 25,000, 50,000, and 75,000

t 2 (0) 2,000

t 2 (25,000) 4,250

t 2 (50,000) 10,500

t 2 (75,000) 16,750

d) Find t3 , when x = 0, 25,000, 50,000, and 75,000

t 3 ( 0) 0

t 3 (25,000) 3125.00

t 3 (50,000) 12,500

t 3 (75,000) 2,8125.00

e) What do you like of dislike about t1 ?

I like the flat idea. It is hard to argue fairness here. Everyone pays the same rate.

The more you make, the more you are taxed at 25%

f) What is different about t 2 compared with t1 ?

There is a $2,000 “lag” in the taxpayers favor. If you make nothing, you get

$2,000 back! This is not very fair.

g) What type of function is

Why or why not?

t3

? Do you think a tax function should look similar to this?

53

Quadratic. It would initially decrease the “burden” on the poor; however, it takes

off way too fast as x-> .

h)

Find t 3 (200,000) . Is this a reasonable answer?

t 3 (200,000) 200,000

NO! All income is taxed

3.

If your first $20,000 is taxed at 10% and anything greater than $20,000 is taxed

at 20%, write two different functions to mathematically represent this situation. Define

the domain and range of each function. Graph your results.

for

0.10 x,

t ( x)

0.20( x 20,000) 2,000 for

x 20,000

20,000 x

54

Tax Day 3 Activity: Piece-Wise Functions

NAME:

PERIOD:

DATE:

Graph the piecewise function below.

5, x 6

8, - 6 x 2

f ( x ) x 2 , 2 x 2

x 2, 2 x 5

1, x 5

Note: This Graph does not have the

open and closed points.

55

3

f ( x ) x 2 1

3

2( x 3)

Find:

For

5 x 4

For

4 x 2

For

2 x4

NOTE: The ABS function

can also be described

using two linear functions.

Find the x-intercept(s)

f ( 4) 3

f ( 2) 0

f ( 0) 1

f (1) 2

( 3,0), ( 1,0), ( 3,0)

Find the y-intercept(s)

(0,1)

Domain: (5,4]

Find the Intervals where the function is:

Range: [3,4]

Increasing: ( 4,2) ( 2,4]

Maximum: (4,2)

Decreasing: (2,2]

Minimum: many at y = -3

Constant: ( 5,4]

56

( x 5) 3 4

f ( x ) 1

2

( x 2) 4

Find:

For

For

For

6 x 4

4 x 1

1 x 5

Find the x-intercept(s)

f ( 4) 1

f ( 2) 1

f (0) 1

f (1) 3

( 4 ,0 )

Find the y-intercept(s)

( 0,1)

Domain: [6,5]

Find the Intervals where the function is:

Range: [5,6]

Increasing: [1,2]

Maximum: (6,6)

Decreasing: [6,4) ( 2,5]

Minimum: (5,5)

Constant: [4,1)

57

x 3

f ( x ) x 2 3

3

( x 2) 1

Find:

For

5 x 2

For

2 x 1

For

1 x 3

Find the x-intercept(s)

f ( 4) 1

f ( 2) 1

f (0) 3

f (1) 1

( 3,0), ( 2,0), ( 3 1 2,0)

Find the y-intercept(s)

( 0, 3 )

Domain: [5,3]

Find the Intervals where the function is:

Range: [3,3]

Increasing: [2,0]

Maximum: (0,3)

Decreasing: [5,2) (0,3]

Minimum: (5,5)

Constant: { }

58

Tax Day 4 Activity:

Income Tax, Social Security Tax, and Medicare Tax Individual Calculations

NAME:

PERIOD:

DATE:

1. A person earns $53,000 in gross income and has $39,000 in taxable income.

Calculate the following (SHOW ALL WORK!):

a) Income Tax? What percent of taxable income is this amount?

0.10(8,025) 0.15( 32,550 8,025) 0.25( 39,000 32,550) $6,093.75

6,093.75

100 15.625%

39,000

b) Social Security Portion?

.062(53,000) $3,286

c) Medicare Portion?

.0145(53,000) $768.50

d) TOTAL FICA?

3,286 768.50 $4,054.50

e) TOTAL Federal Tax?

6,093.75 4,054.50 $10,148.25

f) What percent of gross income is this TOTAL Federal Tax amount?

10,148.25

100 19.148%

53,000

59

2. A person earns $190,000 in gross income and has $144,000 in taxable income.

Calculate the following (SHOW ALL WORK!):

a) Income Tax? What percent of taxable income is this amount?

0.10(8,025) 0.15( 32,550 8,025) 0.25(78,850 32,550) .28(144,000 78,850)

$34,298.25

34,298.25

100 23.818%

144,000

b) Social Security Portion?

.062(102,000) $6,324

c) Medicare Portion?

.0145(190,000) $2,755

d) TOTAL FICA?

6,324 2,755 $9,079

e) TOTAL Federal Tax?

34,298.25 9,079 $43,377.25

f) What percent of gross income is this TOTAL Federal Tax amount?

43,377.25

100 30.123%

144,000

60

3. Write a piece-wise function for the 2008 US income tax system.

for 0 x 8,025

.10 x ,

.15( x 8.025) 802.50,

for

8

,

025

x

32

,

550

.25( x 32,550) 4,481.25,

for 32,550 x 78,850

f income ( x )

.28( x 78,850) 16,056.25, for 78,850 x 164,550

.33( x 164,550) 40,052.25, for 164,550 x 357,700

.35( x 357,700) 103,791.75, for 357,700 x

4. Write a piece-wise function for Social Security.

.062 x ,

f ss ( x )

6,324,

for

for

0 x 102,000

102,000 x

5. Write a piece-wise function for Social Security and Medicare combined.

for

.0765 x ,

f fica ( x )

.0145 x 6,324, for

0 x 102,000

102,000 x

61

Optional Parent/Guardian Survey

DO NOT WRITE YOUR NAME, Thank you!

Survey Questionnaire

Please provide your best answers (possibly guesses) to the 4 questions below. You may use a

calculator, but nothing else.

1. What is your occupation and age?

2. How much state tax do you pay for each gallon of gas in the state of Washington?

3. What is the Social Security tax or payroll tax rate?

4. Using the United States Federal income tax table below, please calculate how much

a filer would pay if they had $20,000 of taxable income. Yes, you may use a calculator.

$1 to $7,550, tax bracket is 10%

$7,550 to $30,650 tax bracket is 15%

$30,650 to $74,200, tax bracket is 25%

$74,200 to $154,800, tax bracket is 28%

$154,800 to $336,550, tax bracket is 33%

$336,550 and above, tax bracket is 35%

Thank you for your participation

Optional Parent/Guardian Survey

DO NOT WRITE YOUR NAME, Thank you!

Survey Questionnaire

Please provide your best answers (possibly guesses) to the 4 questions below. You may use a

calculator, but nothing else.

1. What is your occupation and age?

2. How much state tax do you pay for each gallon of gas in the state of Washington?

3. What is the Social Security tax or payroll tax rate?

4. Using the United States Federal income tax table below, please calculate how much

a filer would pay if they had $20,000 of taxable income. Yes, you may use a calculator.

$1 to $7,550, tax bracket is 10%

$7,550 to $30,650 tax bracket is 15%

$30,650 to $74,200, tax bracket is 25%

$74,200 to $154,800, tax bracket is 28%

$154,800 to $336,550, tax bracket is 33%

$336,550 and above, tax bracket is 35%

Thank you for your participation

62