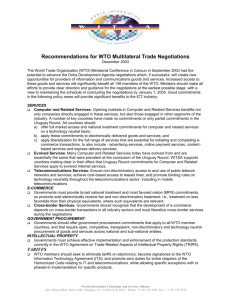

II. The Agreement on Agriculture

advertisement