Chapter 2 Anatomy of Economic Sanctions

advertisement

CHAPTER 2

THE EVOLUTION OF CROSS-STRAIT ECONOMIC

RELATIONS AND GLOBAL ECONOMIC INTERDEPENDENCE

[Cross-Strait] economic ties have been suspended for many years. Now, construction

is going on vigorously in the motherland and we also wish Taiwan growing economic

prosperity. There is every reason for us to develop trade between us, each making up what

the other lacks and create economic interflow. This is our mutual need and will benefit

both parties without doing any harm.

-- The Standing Committee of Chinese National People’s Congress,

January 1, 19791

Faced with the global trend of going all out to develop the economy, Chinese should

supplement and benefit each other and share experiences with each other. Taiwan should

make Mainland China its hinterland in developing its economy, whereas Mainland China

should draw lessons from Taiwan in developing its economy.

-- Lee Teng-hui, Taiwanese President, April 8, 19952

Facing the development of the world economy in the 21st century, big efforts should

be made to accelerate the pace of cross-strait economic exchanges and cooperation, to

bring benefits for the common prosperity of the economies of both the Mainland and

Taiwan and happiness to the entire Chinese nation.

-- Jiang Zemin, Chinese President, August 19963

1

2

3

“N.P.C. Standing Committee’s Message to Compatriots in Taiwan,” Xinhua General Overseas News

Service, January 1, 1979.

President Lee Teng-hui’s comments were in response to President Jiang Zemin’s earlier eight-point

proposition. Mainland Affairs Council (Taiwan) (ed.), Dalu Gongzuo Cankao Ziliao [The Reference

Document of Mainland Work], vol. 1 (Taipei: Mainland Council, 1998), p. 425.

President Jiang Zemin’s comments were made after the 1995-96 Taiwan Strait crisis. “Chinese President

Says Political Differences Should Not Hamper Trade with Taiwan,” BBC Summary of World Broadcast,

August 31, 1996, FE/D2705/F.

18

[Taiwan and China] should leave alone the disputes and instead should step up

economic and trade exchanges.

-- Chen Shui-bian, Taiwanese President, March 20014

I. Statistical Issues of Cross-Strait Economic Relations

Before discussing the evolution and interdependence of cross-Strait economic

relations, we need to address the huge discrepancy between Taiwanese and Chinese

statistics on cross-Strait trade and investment. This discrepancy can be mainly attributed

to the following three reasons: First, the Taiwanese government officially prohibits

Taiwanese businesspeople from conducting “direct” trade and investment with China

despite the fact that, as of 2000, China had become the largest recipient of Taiwan’s

outward investment and Taiwan’s third largest trading partner, next to the United States

and Japan. The nature of this “indirect” trade and investment relationship results in

serious statistical problems. Second, triangular trade and investment, coupled with the

global division of labor, make the precise national origin of international trade and

investment even harder to distinguish using statistics. Many products undergo

value-added processing in several countries and areas. Third, Taiwan’s enterprises can

raise funds through international capital markets and invest in China through a shell

company in a third country.

Statistics on trade between Taiwan and China should include the transit exports

4

“Taiwan President Urges Mainland to Step Up Economic, Trade Exchanges,” Hong Kong AFP, March 26,

2001, in FBIS-CHI-2001-0326.

19

(re-exports) to China via Hong Kong, and other places, trans-shipment5, transit-shipment6,

direct trade (small-scale trade often conducted by fishermen, legal for China, but not for

Taiwan), and smuggling (illegal for both Taiwan and China). Some portion of Taiwan’s

exports to northern China transit through Japan and Korea, in particular through Japan’s

Ishigaki-jima (Shiyuan Islands). According to Kao Charng and Sung Yun-wing, in 1993

Taiwan’s exports to China via Japan’s Ishigaki-jima were valued at about $1 billion, or

one-tenth of Taiwan’s exports to China via Hong Kong. One estimate by the Chung-Hwa

Institution for Economic Research (CIER) shows that in the late 1980s direct trade of

Chinese goods to Taiwan (small-scale trade among fishermen) accounted for around

one-third of Hong Kong re-exports of Chinese goods to Taiwan. For 1989, this estimate

put the value of such direct trade at $195 million. According to China’s customs figures,

direct cross-Strait trade totaled $100 million in 1993, and gradually declined year by year

thereafter. With the gradual relaxation of Taiwan’s bans on Chinese imports and the “mini

three links” -- which legalized trade between the offshore islands and adjacent Chinese

ports in 2001 -- the discrepancy created by illicit “direct trade” between Taiwan and

China should be significantly reduced.7

In addition to the official customs figures reported from Taiwan, Hong Kong, and

China, there are two major estimates of cross-Strait trade -- one by Kao Charng and Sung

5

6

7

Transshipment means that goods are consigned directly from the exporting country to a buyer in the

importing country, though the goods are transported via Hong Kong and are usually loaded into another

vessel for further journey. In Taiwan’s statistics, such exports are put under exports to Hong Kong.

Transit-shipment means that the goods do not change vessels and they just pass through Hong Kong on

their way to the final destination. Exporters from Taiwan claim that their goods are going to Hong Kong

when they leave Taiwan, and then claim in Hong Kong that they are going to China.

Charng Kao and Yun-wing Sung, Liangan Shuangbian Maoyi Tongji Zhi Tantao [The Analysis on the

Statistics of Bilateral Trade between Taiwan and China] (Taipei: Mainland Affairs Council, 1998), pp.

1-13. Kwok Chiu Fung, Trade and Investment: Mainland China, Hong Kong and Taiwan. (Hong Kong:

City University of Hong Kong Press, 1997), pp. 34-37. K. C. Fung, “Accounting for Chinese Trade:

Some National and Regional Considerations,” NBER Working Paper Series, Working Paper 5595, May

1996, pp. 22-25.

20

Yun-wing and the other by Taiwan’s MAC. For example, in 1996 Taiwan’s exports to

China were $623 million reported by Taiwanese customs, $9.7 billion reported by Hong

Kong customs, and $16.2 billion reported by Chinese customs. Kao Charng and Sung

Yun-wing’s estimate was $20.3 billion, and MAC’s $20.7 billion. In that same year,

Taiwan’s imports from China totaled $3.1 billion reported by Taiwan customs, $1.6

billion reported by Hong Kong customs, and $2.8 billion reported by Chinese customs.

Kao Charng and Sung Yun-wing’s estimate was $4 billion, and MAC’s was $3.1 billion.

(See Table 2.1 and 2.2.)

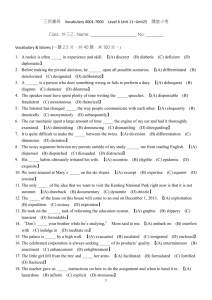

Table 2.1. Comparison of Estimates of Taiwan’s Exports to China, 1994-96

Unit: $ million

Period

1994

1995

1996

Taiwan

Customs

132

377

623

Hong Kong

Customs

8,517

9,883

9,718

China Customs

14,085

14,784

16,182

Kao Charng &

Sung Yun-wing

15,575

19,020

20,260

Mainland Affairs

Council

16,023

19,434

20,727

Table 2.2. Comparison of Estimates of Taiwan’s Imports from China, 1994-96

Unit: $ million

Period

1994

1995

1996

Taiwan

Customs

1,859

3,091

3,060

Hong Kong

Customs

1,292

1,574

1,582

China Customs

2,242

3,098

2,803

Kao Charng &

Sung Yun-wing

2,896

3,686

4,014

Mainland Affairs

Council

1,859

3,091

3,060

Source:

Taiwan Economic Research Institution (ed.), Cross-Strait Economic Statistics Monthly (Taipei), no. 92

(April 2000), p. 19.

Charng Kao and Yun-wing Sung, Liangan Shuangbian Maoyi Tongji zhi Tantao [The Analysis on the

Statistics of Bilateral Trade between Taiwan and China] (Taipei: Mainland Affairs Council, 1998), p.

28.

The Taiwanese and Hong Kong customs services routinely underestimate the levels

of Taiwanese exports to China. The MAC estimates that Taiwan’s exports to China are

21

equal to transit trade plus the difference between Taiwan’s exports to Hong Kong and

Hong Kong’s imports from Taiwan. (See Table 2.3.) Although Kao Charng and Sung

Yun-wing use a more comprehensive formula to estimate Taiwan’s exports to China, they

reach figures similar to those of the MAC. These two estimates should be better than the

figures from China’s customs service because China’s figures do not take different types

of Taiwan exports to China into account and thus underestimate the total amount. 8

Because the MAC has provided a consistent series of estimates since 1981, this study will

adopt its estimated figures for Taiwan exports to China.

Table 2.3. Estimation of Taiwan’s Exports to China by the Mainland Affairs Council,

1994-96

Unit: $ million

Period

1994

1995

1996

(1)

Transit trade from

Taiwan to China

via Hong Kong

8,517

9,883

9,718

(2)

Taiwan exports

Hong Kong

(F.O.B.)

21,263

26,124

26,805

(3)

H.K. imports

from Taiwan

(C.I.F.)

13,758

16,573

15,795

(4)=(2)-(3)

Difference

between

(2) and (3)

7,505

9,551

11,010

(5)=(1)+(4)

Estimation of Taiwan

exports to China

16,023

19,434

20,727

Note:

(1) and (3) are from Hong Kong (H.K.) Customs Statistics, and (2) is from Republic of China Customs

Statistics.

Source:

Taiwan Economic Research Institution (ed.), Cross-Strait Economic Statistics Monthly (Taipei), no. 92

(April 2000), p. 20.

Taiwan’s customs statistics show Taiwan’s imports from China amounted to $3.1

billion in 1996 and $4.5 billion in 1999 while China customs statistics put these figures at

$2.8 billion for 1996 and $4 billion for 1999. Taiwan’s figures were only $257 million

8

Charng Kao and Yun-wing Sung, Liangan Shuangbian Maoyi Tongji Zhi Tantao [The Analysis on the

Statistics of Bilateral Trade between Taiwan and China] (Taipei: Mainland Affairs Council, 1998), pp.

14-27.

22

and $570 million larger than China’s in 1996 and 1999, respectively. Therefore, the

discrepancy between Taiwan customs and China customs statistics is very limited and can

be considered as statistical errors, including the differences between the price of the free

on board and that of cost, insurance, and freight. The MAC does not provide its own

estimate of China’s exports to Taiwan and simply adopts Hong Kong customs statistics

prior to 1993 and then Taiwan customs statistics thereafter.9 Kao Charng and Sung

Yun-wing provide a more sophisticated estimate by considering the gross revenue of

transit trade and adjusting the different import prices among Taiwan, Hong Kong, and

China. Their estimates are 20 to 30 percent higher than the equivalent Taiwan customs

statistics.10

Nevertheless, these differences do not significantly affect the general trend of

cross-Strait economic relations, in particular the degree of cross-Strait economic

dependence, because Taiwan’s imports from China are relatively small in comparison to

overall cross-Strait trade. Because the MAC has provided a consistent series of statistics

since 1981, this study will also adopt its figures for Taiwan’s imports from China.

Regarding investment, as Taiwanese enterprises have become more internationalized,

it has become harder for the Taiwanese government to track and control capital flows to

China. In addition to raising funds directly in Taiwanese capital market, there are at least

five approaches for Taiwanese enterprises to fund their projects in China: (1) raising

funds in the international or Chinese capital markets; (2) forming joint ventures with

Chinese or foreign partners; (3) re-investing foreign exchange earned from exports in

China; (4) investing by their branch companies or subsidiaries in a third country; and (5)

9

10

Both Taiwan and China began to register indirect cross-Strait trade via Hong Kong after 1990.

Charng Kao and Yun-wing Sung, Liangan Shuangbian Maoyi Tongji Zhi Tantao [The Analysis on the

Statistics of Bilateral Trade between Taiwan and China] (Taipei: Mainland Affairs Council, 1998), pp.

23

investing by offshore shell companies in tax-exempt countries, mainly the British Virgin

Islands and the British Cayman Islands.

According to various surveys, small-medium Taiwan-invested enterprises (TIEs) in

China acquired about 56 to 59 percent of their capital from Taiwan, 25 percent from

China, and 13 percent from a third country. It is plausible that large TIEs would have

more opportunity to raise funds in either China or a third country. For example,

Wong-Wong Cookie Company has raised more than $63 million in the Singaporean stock

market. In May 1996, China’s State Council approved the $3 billion investment project of

Formosa Plastics. Of the $3 billion investment, the parent company in Taiwan contributed

only $400 million, or approximately 14 percent of the total. It was Formosa’s overseas

subsidiaries that played the major role. In addition, it was reported in late 2000 that

Winston Wang, the son of Formosa Plastics Chairman Wang Yung-ching, and Jiang

Mianheng, the son of President Jiang Zemin, will establish a $1.63 billion cooperative

venture, the Shanghai Grace Semiconductor Manufacturing Corporation. Most Taiwan

investment in this project will be made through offshore shell companies. The U.S.

Silicon Storage Technology Inc. has taken a $50 million stake and the Chinese side

promised to provide two-thirds of the total capital, or $1.1 billion.11

Furthermore, it is very plausible that many TIEs, particularly beginning in the later

half of the 1990s, were investing in China through their capital holding companies in

tax-exempt countries. There is a coincidence between the increase of Taiwan’s investment

11

27-35.

Ralph N. Clough, Cooperation or Conflict in the Taiwan Strait? (Lanham, Maryland: Rowman &

Littlefield Publishers, Inc., 1999), p. 53. Tse-Kang Leng, “Dynamics of Taiwan-Mainland China

Economic Relations,” Asian Survey, vol. 38, no. 5 (May 1998), pp. 501-504. Craig S. Smith,

“Taiwan-China Plant Break Ground; Chip Factory Signals Shift in Industry and Growth in Cross-Strait

Ties,” International Herald Tribune (France), November 25, 2000, p. 16. “Silicon Invests $50 mln in

China Foundry,” Reuters, March 15, 2001, 5:51 am Eastern Time. Dehua Bai, “Shanghai Grace Acquires

NT$ 35 Billion Loan from Mainland,” Zhongguo Shibao [China Times], November 21, 2000.

24

in the Virgin Islands and the increase of the Virgin Islands’ investment in China in the

later half of the 1990s. Taiwan’s investment in British Central America (mainly the

British Virgin Islands and the British Cayman Islands) increased from $370 million in

1995 to $1.36 billion in 1999 with the share of Taiwan’s total outward investment

doubling from 15 to 30 percent. By comparison, the Virgins Islands’ outward investment

to China increased from $304 million in 1995 to $2.659 billion in 1999, with the share of

China’s total FDI inflow growing from 0.8 percent to 6.6 percent. (See Table 2.4.)

Table 2.4. Taiwan’s Investment in British Central America and the Virgin Islands’

Investment in China, 1995-99

Period

1995

1996

1997

1998

1999

Taiwan’s Approved Outward Investment in

British Central America

(Virgin Islands and Cayman Islands)

Amount

Share of Taiwan’s

($ million)

Total Outward FDI

370

15.1%

809

23.8%

1,051

23.3%

1,838

38.2%

1,360

30.1%

Virgins Islands’ Outward

Investment in China

Amount

($ million)

304

538

1,717

4,031

2,659

Share of China’s

Total FDI Inflow

0.8%

1.3%

3.8%

8.9%

6.6%

Source:

Investment Commission, Ministry of Economic Affairs (Taiwan) (ed.), Statistics on Outward Investment,

September 1999, pp. 7-8, 48.

Taiwan Economic Research Institution (ed.), Cross-Strait Economic Statistics Monthly (Taipei), no. 92

(April 2000), pp. 27, 44.

Mainland Affairs Council (ed.), Cross-Strait Economic Statistics Monthly (Taipei), no. 71 (July 1998), p. 48.

According to some reports, many famous TIEs invested in China through this

channel. For instance, in 1992 Taiwan Ting Hsin Group (whose Master Kang-brand

instant noodles have been a great success in China) invested in China through its

subsidiary, Tingyi Holdings, registered in the Cayman Islands. As of 1996, President

Enterprises Group invested $333 million in China through its holding company in the

25

Cayman Islands, in addition to its investment through Hong Kong. In late 2000, Taiwan’s

Yulon Motor Company announced plans to invest in China through their Yufa Investment

Company, also registered in the Cayman Islands. 12 D.C. Yang, former President of

Taiwan-invested Enterprises Association in Shanghai and some TIEs confirmed that the

majority of China’s inward FDI from the Virgin Islands are in fact Taiwan’s capital.13

Thus, it is not surprising that there is a huge gap between Taiwanese and Chinese

statistics on Taiwan’s investment in China. As of 1999, Taiwan’s cumulative investment

in China approved by Taiwan’s Ministry of Economic Affairs (MOEA) was $14.5 billion,

while China’s official data showed Taiwan’s cumulative realized investment in China was

$23.9 billion, almost two times Taiwan’s figure. Perng Fai-Nan, governor of Taiwan’s

Central Bank, estimated that in 2000 the real figure of Taiwan’s cumulative investment in

China was between $40 and $50 billion.14 This is due to the fact that many Taiwanese

businesspeople conducted investment in China without the approval of the Taiwan

government, or they underreported the value of their investments.15 Since it is mandatory

for TIEs to register their investment with the Chinese government, China’s statistics seem

more reflective of the real situation and provide a more consistent series of data.

Therefore, this study will use China’s official figures for Taiwan’s investment in China.

12

13

14

15

Ralph N. Clough, Cooperation or Conflict in the Taiwan Strait ? (Lanham, Maryland: Rowman &

Littlefield Publishers, Inc., 1999), p. 53. Chung-Hua Institution for Economic Research, Liangan Chanye

Fengong Zhengce Zhixing Chengxiao Pinggu [Assessment on the Implementation of Cross-Strait Policy

of Industrial Division of Labor] (Taipei: Bureau of Industry, Ministry of Economic Affairs, 1997), pp.

224-228. Guo-wei Chen, “Most of Taiwan Business’s Profit Is Remitted to Overseas Share Holding

Companies,” Gongshang Shibao [Commerce Times], November 10, 2000. Mei-xing Shen, “An

Investment Plan in China: Yulong Plans to Establish an Investment Company,” Zhongguo Shibao [China

Times], December 8, 2000.

D.C. Yang, former president of the TIEA in Shanghai, interview with author, June 20, 2001. A Taiwan

businessman in Shanghai, interview with the author, June 18, 2001. Jing-ren Ma, deputy

secretary-general of the TIEA in Chengdu, July 24, 2001.

Pei-xiou Liu, “The Central Bank: Capital Remitted to Mainland Is About $70 Billion,” Gongshang

Shibao [Commerce Times], November 10, 2000.

Chung-Hua Institution for Economic Research, Dalu ji Liangan Jingji Qingshi Baogao (1997/1998)

[Report on the Economic Situation of Mainland China and the Two Sides of the Taiwan Strait

26

II. Trade Relations Between Taiwan and China

Because of political and military hostilities, economic exchange between Taiwan and

China was virtually nonexistent between 1949 and 1979. On January 1, 1979, after

adopting reforms and open policy in late 1978, China proposed establishing the three

links between Taiwan and China. In 1980, China organized a mission to Hong Kong and

purchased $80 million worth of Taiwanese products. In the same year, to further

encourage trade, China announced a tariff-free policy on Taiwan-made imported goods.

However, the zero tariff lasted for only one year.

Beijing’s initiatives received no response from Taipei until the mid-1980s. In 1985

Taiwan for the first time responded to China’s request for cross-Strait trade by

announcing the “Non-interference Principle of Indirect Exports to the Mainland.” From

then on, cross-Strait trade started to grow rapidly along with China’s increasing economic

reforms and Taiwan’s gradual relaxation of limits on cross-Strait economic interaction.

Nevertheless, Taiwan’s imports from China are still under strict regulations. Only 56

percent (or 5,777 items) of 10,238 Harmonized Tariff Schedule (HS) system coded

10-digit trade commodities were permitted to be imported from China to Taiwan by

December 2000 and 73 percent (or 7,696 items) by March 2002, respectively.16

16

(1997/1998)], (Taipei: Mainland Affairs Council, 1999), pp. 193-194.

Lee-in Chen Chiu, “The Economic Reunification of Taiwan and Mainland China: The Impact on

Industrial Development,” in Chien-nan Wang (ed.), Globalization, Regionalization, and Taiwan’s

Economy (Taipei: Chung-hua Institution for Economic Research, 1994), pp. 115-118. Guo-qing Yu,

“Dalu Wuping Deng Tai Hueigu” [Review on China’s Imports to Taiwan], Zhongguo Shibao [China

Times], December 5, 2000. Lee-in Chen Chiu, “Taiwan’s Economic Influence: Implications for

Resolving Political Tensions,” in Gerrit W. Gong (ed.), Taiwan Strait Dilemmas: China-Taiwan-U.S.

Policies in the New Century (Washington, DC: Center for Strategic and International Studies, 2000), pp.

131-133. Guo-qing Yu, “2058 Items of Mainland Goods Are Permitted to Be Imported,” Zhongguo

Shibao [China Times], February 16, 2002.

27

Taiwan’s indirect trade with China via Hong Kong was only $460 million in 1981

and $279 million in 1982. Thereafter, cross-Strait trade increased tremendously to $3.9

billion in 1989, $17.9 billion in 1994, and $31.2 billion in 2000. In the last two decades,

Taiwan’s trade with China has increased 112 fold, or an average annual growth rate of 26

percent, far exceeding the growth rate of Taiwan’s or China’s foreign trade during the

same period.

In addition, Taiwan has enjoyed a continuous and large trade surplus with China for

the past two decades. In 1981, Taiwan ran a trade surplus of $310 million, with $385

million of exports to, and $75 million of imports from, China. In 1989, Taiwan ran a trade

surplus of $2.7 billion, with $3.3 billion of exports to, and $587 million of imports from,

China. In 2000, Taiwan ran a trade surplus of $18.8 billion, with $25 billion of exports to,

and $6.2 billion of imports from, China. (See Table 2.5.)

Table 2.5. Trade between Taiwan and China, 1981-2000

Unit: $million

Period

1981

1985

1989

1990

1991

1992

Taiwan’s Exports to

China

385

987

3,332

4,395

7,494

10,548

Taiwan’s Imports Total Trade between

Taiwan’s Trade

from China

Taiwan and China Surplus with China

75

460

310

116

1,103

871

587

3,919

2,745

765

5,160

3,629

1,126

8,619

6,368

1,119

11,667

9,429

28

1993

1994

1995

1996

1997

1998

1999

2000

13,993

16,023

19,434

20,727

22,455

19,841

21,313

25,010

1,104

1,859

3,091

3,060

3,915

4,111

4,522

6,223

15,097

17,881

22,525

23,787

26,371

23,951

25,835

31,233

12,890

14,164

16,342

17,668

18,540

15,730

16,790

18,787

Note: These figures are estimated by Taiwan’s Mainland Affairs Council.

Source:

Taiwan Economic Research Institution (ed.), Cross-Strait Economic Statistics Monthly (Taipei), no. 105

(May 2001), p. 22.

Since 1993 China has become Taiwan’s third largest trading partner, after the United

States and Japan. In 2000, Taiwan’s trade with the United States, Japan, and China was

$60 billion, $55.2 billion, and $31.3 billion, respectively. In addition, since 1993 China

has also become Taiwan’s second largest export market, next to the United States.

Nevertheless, if trade between Taiwan and Hong Kong was included in China’s share,

since 1994, China has been Taiwan’s largest export market. This is particularly true after

Hong Kong reverted to China sovereignty in July 1997. According to Taiwan customs

figures, in 2000, Taiwan’s exports to China (including Hong Kong), the United States,

and Japan were $41 billion, $34.8 billion, and $16.6 billion, respectively.

In comparison, since 1990 Taiwan has become China’s fourth largest trading partner,

next to Japan, the United States, and Hong Kong. In 2000, China’s trade with Japan, the

United States, Hong Kong, and Taiwan was $83.1 billion, $74.5 billion, $54 billion, and

$31.3 billion, respectively. In addition, since 1993 Taiwan has also become China’s

second largest supplier (Japan is its largest supplier). In 2000, China’s imports from Japan

and Taiwan were $41.5 billion and $25 billion, respectively.

29

The Merchandise Structure of Taiwan’s Exports to China

Based on Taiwan’s customs statistics, Taiwan’s exports to China were concentrated

in four of the 22 sections in the HS system: section 7 (plastics and rubber); section 11

(textiles); section 15 (base metals); and section 16 (machinery, mechanical appliances,

electrical equipment, parts, and accessories). These four sectors included 61 percent of

Taiwan’s total exports to China in 1992, 75 percent in 1994, 77 percent in 1996, and 79

percent in 1998. Moreover, between 1992 and 1998, the merchandise structure of

Taiwan’s exports to China was similar to that of Taiwan’s total exports and these four

sections were the same four largest sections of Taiwan’s overall exports.17

In particular, the share of both section 15 and section 16 has been increasing

exponentially. In 1992, section 15 represented 5 percent of Taiwan’s total exports to

China and section 16 represented 25 percent. In 1998, section 15 represented 13 percent

of Taiwan’s total exports to China and section 16 represented 33 percent. These two

sections accounted for about 46 percent of Taiwan’s total exports to China in 1998. By

contrast, section 12 (footwear, headgear, and artificial flowers) accounted for 16 percent

of Taiwan’s total exports to China in 1992, but then declined dramatically to 2 percent by

1998. (See Figure 2.1.) This trend is closely related to Taiwan’s investment in China. In

the late 1980s and early 1990s, most of Taiwan’s investment in China was in the shoe,

textile, apparel, and plastics industries (sections 7 and 12). By the mid-1990s, the bulk of

Taiwan’s investment in China was concentrated in electronic and electric appliances, and

basic metals industries (sections 15 and 16).

17

Chung-Hua Institution for Economic Research, Dalu ji Liangan Jingji Qingshi Baogao (1997/1998)

[Report on the Economic Situation of Mainland China and the Two Sides of the Taiwan Strait

(1997/1998)], (Taipei: Mainland Affairs Council, 1999), pp. 212-219.

30

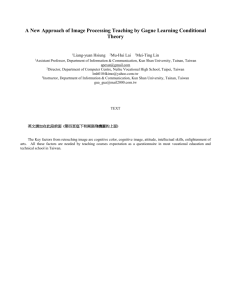

Figure 2.1. The Merchandise Structure of Taiwan's Exports to

China, 1992-98

Percent

35

30

25

20

15

1

2

3

4

5

6

7

8

9 10 11 12 13 14 15 16 17 18 19 20 21 22

1994

0

1992

Section

1998

5

1996

10

Year

Note:

Section 1. Live animals; animal products

Section 2. Vegetable products

Section 3. Animal or vegetable fats, oils, and waxes

Section 4. Prepared foodstuffs, beverages, and tobacco

Section 5. Mineral products

Section 6. Products of the chemical or allied industries

Section 7. Plastics and rubber, and articles thereof

Section 8. Hides and skins; leather and articles thereof; travel goods, handbags and similar containers

Section 9. Articles of wood, cork, or plaiting materials

Section 10. Wood pulp; paper, paperboard, and articles thereof

Section 11. Textiles and textile articles

Section 12. Footwear, headgear, and artificial flowers

Section 13. Articles of stone or ceramics; glass and glassware

Section 14. Pearls; precious stones and metals; jewelry; coin

Section 15. Base metals and articles of base metal

Section 16. Machinery and mechanical appliances; electrical equipment; parts and accessories thereof

Section 17. Vehicles, aircraft, and other transport equipment

Section 18. Optical, photographic, measuring, and medical apparatus; clocks and watches; musical

31

instruments

Section 19. Arms and ammunition; parts and accessories thereof

Section 20. Miscellaneous manufactured articles

Section 21. Works of art, collectors' pieces and antiques

Section 22. Special classification provisions

Source:

Chung-Hua Institution for Economic Research, Dalu ji Liangan Jingji Qingshi Baogao (1997/1998)

[Report on the Economic Situation of Mainland China and the Two Sides of the Taiwan Strait

(1997/1998)], (Taipei: Mainland Affairs Council, 1999), pp. 216-218.

The Merchandise Structure of Taiwan’s Imports from China

According to Taiwan’s customs statistics, the merchandise structure of Taiwan’s

imports from China was also concentrated in four of 22 sections in the HS system: section

5 (mineral products); section 6 (products of chemical or allied industries); section 15

(base metals); and section 16 (machinery, mechanical appliance, electrical equipment,

parts, and accessories). These four sectors accounted for 61 percent of Taiwan’s total

imports from China in 1992, 61 percent in 1994, 69 percent in 1996, and 73 percent in

1998. These four sections were also the same four largest sections of Taiwan’s overall

imports between 1992 and 1998.18

In particular, section 16 (machinery, mechanical appliance, electrical equipment,

parts, and accessories) has increased rapidly, from 0.3 percent of Taiwan’s total imports

from China in 1992 to 37 percent in 1998. In addition, section 15 and section 16

accounted for about 57 percent of Taiwan’s total imports from China in 1998. By contrast,

in 1992, section 2 (vegetable products) accounted for 15 percent of Taiwan’s total imports

18

Chung-Hua Institution for Economic Research, Dalu ji Liangan Jingji Qingshi Baogao (1997/1998)

[Report on the Economic Situation of Mainland China and the Two Sides of the Taiwan Strait

(1997/1998)], (Taipei: Mainland Affairs Council, 1999), pp. 213-225.

32

from China, then declined sharply to 3 percent in 1998. Furthermore, section 5 (mineral

products) also declined from 28 percent of Taiwan’s total imports from China in 1992 to 9

percent in 1998. Overall, Taiwan’s imports from China are no longer China’s basic

agricultural and industrial raw materials, but products closely related to Taiwan’s

investment in China (sections 15 and 16).19 (See Figure 2.)

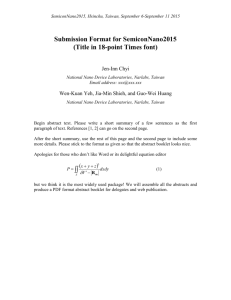

Figure 2.2. The Merchandise Structure of Taiwan's Imports from

China, 1992-98

Percent

40

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22

Section

1994

0

1992

10

1996

20

1998

30

Year

Source:

Chung-Hua Institution for Economic Research, Dalu ji Liangan Jingji Qingshi Baogao (1997/1998)

[Report on the Economic Situation of Mainland China and the Two Sides of the Taiwan Strait

(1997/1998)], (Taipei: Mainland Affairs Council, 1999), pp. 221-223.

III. Financial Relations Between Taiwan and China

19

Chung-Hua Institution for Economic Research, Dalu ji Liangan Jingji Qingshi Baogao (1997/1998)

[Report on the Economic Situation of Mainland China and the Two Sides of the Taiwan Strait

(1997/1998)], (Taipei: Mainland Affairs Council, 1999), p. 220. For more detailed classification of

Taiwan’s imports from China, see Taiwan Economic Research Institution (ed.), Cross-Strait Economic

Statistics Monthly (Taipei), various issues.

33

In 1987 Taiwan’s government deregulated the control of foreign exchange leading to

a rapid increase in outward investment by Taiwan entrepreneurs. Before the mid-1980s,

the majority of Taiwan’s foreign direct investment (FDI) focused on the United States,

accounting for $163 million (or 60 percent) of Taiwan’s total outward investment between

1952 and 1986. But as Taiwan’s labor-intensive industries began to lose their comparative

advantage after the mid-1980s, Taiwanese firms began investing in the member countries

of the Association of South East Asian Nations (mainly the Philippines, Indonesia,

Thailand, Malaysia, and Vietnam, hereafter ASEAN-5).20

By the 1990s, Taiwan’s investors rapidly shifted their attention to China. Such

investors were primarily attracted by China’s cheap labor (the most important reason) and

the potential local market (the second important reason). 21 In addition, the Chinese

government promulgated several regulations and laws to attract and protect Taiwan’s

investment in China, which is referred to investment by companies, enterprises, and other

economic organizations or individuals from Taiwan in China.22 In July 1988, in order to

attract Taiwan enterprises, China’s State Council promulgated the “Regulations for

Encouraging Investment by Taiwan Compatriots” (the so-called “22 clauses”). China

offered preferential treatment, with numerous cities and provinces setting up special

investment zones, which granted TIEs many privileges, including tax exemption or

reduction. In March 1994, China’s National People’s Congress promulgated the “Taiwan

Compatriot Investment Protection Law of the People’s Republic of China.” In December

20

21

22

Wen-chen Kuo, “The Review and Prospect of Taiwan’s Outward Investment” [Taiwan Duiwai Touzi de

Hueigu yu Qianzhan], Economic Outlook, no. 54 (November 1997), pp. 57-59.

Ministry of Economic Affairs (Taiwan), Zhizaoye Duojiaohua ji Guojihua Diaocha Baogao [The

Investigation Report on Diversification and Internationalization of Manufacturing Industry] (Taipei:

Ministry of Economic Affairs, 1995), pp. 380-391.

“PRC Law on Protection of Taiwan Investment” (in Chinese), Beijing Xinhua Domestic Service,

December 12, 1999, in FBIS-CHI-2000-0107.

34

1999, China’s State Council issued the “Implementing Rules for the Taiwan Compatriot

Investment Protection Law of the People’s Republic of China.”

At the same time, Taiwan’s government gradually relaxed the regulations on

cross-Strait economic exchange at a crucial moment (1987-88) when Taiwan exports were

suffering due to a strong New Taiwan dollar, high cost of labor, and environmental

controversies. Along with the relaxation of foreign exchange control, Taiwan’s

government liberalized its China policy by nullifying martial law and allowing Taiwanese

to visit China. In October 1990, Taiwan’s MOEA formally lifted the ban on indirect

investment in China by promulgating the “Regulations on Indirect Investment and

Technology Cooperation with the Mainland Area.” As a result, since 1992, Taiwanese

investment in China has surpassed its investment in the United States and ASEAN-5.

However, as of 2001, all Taiwanese outward investment to China is still subject to

the regulation and review of the Taiwan government. Every six months, Taiwan’s MOEA

reviews approximately 8,000 items of HS coded 8-digit commodities and classifies them

into either permitted items, prohibited items, or case-by-case evaluation items. By

September 1999, 6,658 items were classified as permitted and only 342 items were

prohibited.23

Although investment from Taiwan to China began to increase rapidly in the late

1980s, Taiwan’s Investment Commission did not compile formal statistics until 1991.24

According to Taiwan’s official figures, in 1991 Taiwan’s FDI into China was only $17

million. Since 1992, however, China has become the largest recipient of Taiwan’s

23

24

Lee-in Chen Chiu, “Taiwan’s Economic Influence: Implications for Resolving Political Tensions,” in

Gerrit W. Gong (ed.), Taiwan Strait Dilemmas: China-Taiwan-U.S. Policies in the New Century

(Washington, DC: Center for Strategic and International Studies, 2000), pp. 131-133.

On October 6, 1990, Taiwan government requested TIEs spontaneous registration and reporting of

previous investment in China by April 8, 1991.

35

outward investment. In 1993, the numbers increased dramatically to nearly $3.2 billion,

which was 66 percent of Taiwan’s total FDI for that year. By the end of 2000, Taiwan’s

cumulative FDI in China was $17.7 billion, or 39 percent of the $44.1 billion of total

Taiwan outward FDI. In just one decade, China became the destination with the most

accumulated Taiwan’s outward FDI. Overall, Taiwan’s FDI in the late 1980s and early

1990s involved mainly small-medium, labor-intensive enterprises looking for overseas

manufacturing bases, most of them focusing on China as well as ASEAN-5. After the

mid-1990s, Taiwan’s FDI in China involved more and more large enterprises with high

capital and technology intensities, companies looking for both overseas manufacturing

bases and access to China’s huge potential market.25

As discussed above, Taiwan’s official figures considerably underestimate the extent

of Taiwan’s investment and accordingly, this study will use China’s official data on

Taiwan’s investment in China. According to China’s statistics, the first TIE in China

opened in 1983, and by 1991 Taiwan’s total realized investment in China was $844

million divided among 3,446 projects, with a cumulative contracted amount of $2.78

billion and an average contracted amount of $0.81 million per project. Since 1991,

Taiwan’s investment in China has been increasing dramatically with an average annual

contracted amount of $5.1 billion or an average realized amount of $2.9 billion. By the

end of 2000, Taiwan’s accumulated contracted investment in China was $47.8 billion

(46,624 projects), of which $26.2 billion was actually utilized, with an average contracted

amount of $1 million per project -- average project size has grown by about 20 percent.

(See Table 2.6.)

25

Wen-Chen Kuo, “The Review and Prospect of Taiwan’s Outward Investment” [Taiwan Duiwai Touzi de

Hueigu yu Qianzhan], Economic Outlook, no. 54 (November 1997), pp. 57-59. Charng Kao, Dalu

Jinggai yu Liangan Jingmao Guanxi [Mainland Economic Reforms and Cross-Strait Economic

36

Table 2.6. Taiwan’s Investment in Chinaa, 1991-2000

Unit: $ million

Period

1991b

1992

1993

1994

1995

1996

1997

1998

1999

2000

Accumulated to 2000

Average between

1992 and 2000

Projects (Cases)

Contracted Amount

3,446

6,430

10,948

6,247

4,778

3,184

3,014

2,970

2,499

3,108

46,624

4,798

2,783

5,543

9,965

5,395

5,777

5,141

2,814

2,982

3,374

4,042

47,816

5,004

Average Contracted

Amount

0.81

0.86

0.91

0.86

1.21

1.61

0.93

1.00

1.35

1.30

1.03

1.04

Realized Amount

844

1,050

3,139

3,391

3,162

3,475

3,289

2,915

2,599

2,296

26,160

2,813

Note:

a: Data is from the Ministry of Foreign Trade and Economic Cooperation, PRC.

b: The 1991 figure includes data before 1991.

Source:

Taiwan Economic Research Institution (ed.), Cross-Strait Economic Statistics Monthly (Taipei), no. 105

(May 2001), p. 26.

In addition, as of March 2001, the share of Taiwan’s cumulative realized investment

in China was 7.5 percent of total FDI in China. Taiwan was the fourth largest source of

FDI in China, next to Hong Kong (48.6 percent), the United States (8.6 percent), and

Relations], second edition (Taipei: Wu-Nan, 1999), pp. 168-171.

37

Japan (8 percent).26 Nevertheless, Chinese figures might underestimate Taiwan’s “real”

investment in China because many Taiwan businesspeople began in the mid-1990s to

invest in China through their holding companies in British Central America.27

Regarding Taiwan’s investment in China by industry, there is no available Chinese

data and thus this study will rely on Taiwan’s official data. As of 1999, according to

Taiwan’s MOEA Investment Commission, Taiwan’s total investment in China included:

$3.33 billion (23 percent) in electronics and electrical appliances; $1.24 billion (9 percent)

in basic metals and metal products; $1.24 billion (9 percent) in food and beverage

processing; $1.15 billion (8 percent) in plastic products; $1.0 billion (7 percent) in

chemicals; $867 million (6 percent) in non-metallic minerals; $787 million (5 percent) in

textile; $772 million (5 percent) in precision instruments; $671 million (5 percent) in

transportation equipment; and $467 million (3 percent) in machinery equipment. As of

September 1999, Taiwan’s investment was focused in the manufacturing industry, which

accounted for 91 percent of Taiwan’s total investment in China.28

Figure 2.3 illustrates the geographic distribution of Taiwan’s cumulative investment

in China as of 1999. Taiwan’s total investment in China included: $5.02 billion (35

percent) in Guangdong; $4.64 billion (32 percent) in Jiangsu (including Shanghai); $1.57

million (11 percent) in Fujian; $880 million (6 percent) in Hebei (including Beijing);

$655 million (5 percent) in Zhejiang; and $368 million (3 percent) in Shandong. Based on

26

27

28

Taiwan Economic Research Institution (ed.), Cross-Strait Economic Statistics Monthly (Taipei), no. 92

(April 2000), p. 42.

A Taiwanese businessman in Shanghai, interview with author, June 18, 2001. D.C. Yang, former

president of the Taiwan-Invested Enterprises Association in Shanghai, interview with author, June 20,

2001. Jing-ren Ma, deputy secretary-general of the Taiwan-Invested Enterprises Association in Chengdu,

July 24, 2001. Li-qi Lin and Zhu-song Liu, “March to Mainland, Huayu Increases Investment in Its

Holding Company,” Gongshang Shibao [Commerce Times], October 12, 2001.

Taiwan Economic Research Institution (ed.), Cross-Strait Economic Statistics Monthly (Taipei), no. 92

(April 2000), p. 26. Investment Commission, Ministry of Economic Affairs (Taiwan) (ed.), Statistics on

Indirect Mainland Investment, September 1999, pp. 65-68.

38

Taiwan’s statistics, these six coastal provinces comprised 92 percent of Taiwan’s total

cumulative investment in China. (See Figure 2.3.)

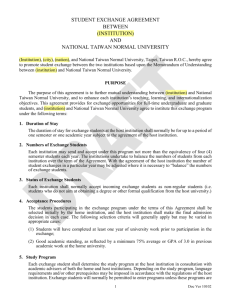

Figure 2.3 Taiwan's Cumulative Investment in China by Area,

1999

Shandong

3%

Zhejiang

5%

Others

9%

Guangdong

34%

Hebei

6%

Fujian

11%

Jiangsu

32%

Source: Taiwan Economic Research Institution (ed.), Cross-Strait Economic Statistics Monthly

(Taipei), no. 92 (April 2000), p. 25.

Note: Jiangsu includes Shanghai.

In addition, TIEs tend to partner with local and foreign enterprises when they invest

in China. According to a 1993 investigation by the CIER, 69 percent of TIEs established

joint ventures with other partners. According to a 1996 report by Taiwan’s MOEA, which

included a sample size of 1,312 companies, 36 percent of TIEs established joint ventures

with other partners. Fifty-six percent (multiple choices) of TIEs who entered joint

39

ventures cooperated with local Chinese enterprises, 35 percent cooperated with Chinese

local governments, and 28 percent cooperated with foreign enterprises. According to a

1999 report by Taiwan’s MOEA, which included a sample size of 1,627 companies, 38

percent of TIEs established joint ventures with other partners. Fifty nine percent of these

TIEs held less than a 50 percent share in the joint ventures. Thirty one percent (multiple

choices) of these TIEs cooperated with local Chinese enterprises, 20 percent cooperated

with Chinese local governments, and 26 percent cooperated with foreign enterprises.29

The Taiwanese government began to compile statistics on individual remittances to

China on May 21, 1990, and on both Taiwan business remittances to China and

remittances from China to Taiwan on July 29, 1993.30 In 1993, Taiwan

remitted $254

million to China31 and China remitted $26 million to Taiwan. In 1999, Taiwan remitted

$843 million to China and China remitted $509 million to Taiwan. As of end-1999,

Taiwan had remitted a cumulative $4,543 million to China and China had remitted a

cumulative $1,298 million to Taiwan. Nevertheless, the Taiwanese government’s figures

hardly tell the truth of capital flow across the Taiwan Strait. For example, Taiwan’s

Central Bank estimated in late 2000 that Taiwan’s total capital flow to China was around

$70 billion, of which $40-50 billion was Taiwan’s FDI in China. That is, Taiwan might

have remitted as much as $20-30 billion in total to China, including portfolio flows to

29

30

31

Chung-Hwa Institution for Economic Research, Analysis on Cross-Strait Economic Situation [Liangan

Jingji Qingshi Fenxi] (Taipei: Mainland Affairs Council, 1997), p. 203. Ministry of Economic Affairs

(Taiwan), Zhizaoye Duiwai Touzi Shikuang Diaocha Baogao [The Investigation Report on Outward

Investment of Manufacturing Industry] (Taipei: Ministry of Economic Affairs, 1997), p. 77. Ministry of

Economic Affairs (Taiwan), Zhizaoye Duiwai Touzi Shikuang Diaocha Baogao [The Investigation

Report on Outward Investment of Manufacturing Industry] (Taipei: Ministry of Economic Affairs, 2000),

pp. 220, 223, 226.

Individual remittance figures include household remittance, donation, and other transfer payments,

excluding travel expenditures.

This number includes both individuals and companies.

40

China.32

IV. Cross-Strait Economic Division of Labor

Industrial Level: FDI-Driven Trade and Intra-Industry Trade

Essentially, the comparative advantage of resource endowment, capital, technology,

and management capability determines the basic pattern of the division of labor between

Taiwan and China. According to a 1997 study by Taiwan’s CIER, three types of division

of labor exist across the Taiwan Strait. Type I: China provides Taiwan with raw materials

for food, construction materials, petroleum-chemistry, and paper industries. Taiwan

typically processes these raw materials and exports final goods to other countries. Type II:

Taiwan provides China with raw materials and critical intermediate goods for plastics,

apparel, consumer electronics, information, and motor vehicle industries. Then China

manufactures, processes, and exports finished goods to other countries. Type III: Both

Taiwan and China, based on their particular production advantages, provide critical parts

for one another’s machinery industries, but only Taiwan exports finished machines to

other countries. 33 These types of division of labor can be further illuminated by

examining FDI-driven trade and intra-industry trade between Taiwan and China.

32

33

Taiwan Economic Research Institution (ed.), Cross-Strait Economic Statistics Monthly (Taipei), no. 92

(April 2000), pp. 28-30. Pei-xio Liu, “The Central Bank: Capital Remitted to Mainland Is About $70

Billion,” Gongshang Shibao [Commerce Times], November 10, 2000.

Chung-Hua Institution for Economic Research, Liangan Chanye Fengong Zhengce Zhixing Chengxiao

Pinggu [Assessment on the Implementation of Cross-Strait Policy of Industrial Division of Labor]

(Taipei: Bureau of Industry, Ministry of Economic Affairs, 1997), pp. 54-63.

41

Along with the expansion of Taiwan’s outward investment beginning in the

mid-1980s, Taiwan began exporting more intermediate and capital goods (semi-finished

goods, equipments, parts, and machinery, etc.) and fewer consumer products. 34 The

proportion of intermediate goods to Taiwan’s total exports increased from 33 percent in

1987 to 49 percent in 1993. The share of capital goods (machinery and transportation

equipment) in Taiwan’s total exports increased from 8 percent in 1987 to 20 percent in

1993. By contrast, the share of non-durable consumer goods in Taiwan’s total exports

declined dramatically from 34 percent in 1987 to 18 percent in 1993. There was little

variation in other product categories.35

Kao Charng and Cheng Chu-yuan argue that the changes in Taiwan’s export pattern

were driven principally by overseas affiliates of Taiwan companies in China (and the

ASEAN-5). Taiwan’s MOEA Board of Foreign Trade also asserts that the boom of

Taiwan’s exports to China were driven mainly by TIEs purchasing Taiwan intermediate

and capital goods, such as raw materials, parts and equipments, and machinery. In

particular, in the initial stage of investment, the majority of TIEs heavily relied on the

supply of machinery and raw materials from Taiwan and re-exported finished goods

created with Taiwan inputs and low-cost Chinese labor.36

Indeed, China’s official figures also show that China’s imports were overwhelmingly

34

35

36

There are two types of intermediate goods. Type A intermediate goods refer to products that can be used

for consumer goods or producer goods after processing. Type B intermediate goods refer to products that

can be used for consumer goods or producer goods without processing.

Chen-yuan Tung, “Trilateral Economic Relations among Taiwan, China, and the United States,” Asian

Affairs: An American Review, vol. 25, no. 4 (Winter 1999), p. 225.

Charng Kao, Liangan Jingmao Guanxi zhi Tantao [The Review on Cross-Strait Economic Relations]

(Taipei: Tianyi, 1997), pp. 82-85. Chu-yuan Cheng, “Economic Relations Across the Taiwan Straits:

Mutual Dependence and Conflicts,” paper presented for the 16 th International Conference on Asian

Affairs at St. John’s University on October 3-4, 1998, pp. 2-5. Board of Foreign Trade, Ministry of

Economic Affairs, “Dalu Duiwai Maoyi Fazhan ji Liangan Maoyi Hudong Gaikuang [The general

Situation on the Development of Mainland’s External Trade and Cross-Strait Trade Interaction],” April

2000, http://www.moeaboft.gov.tw/prc&hk/trade-roc&prc-5.html, accessed December 5, 2000, p. 33 of

34.

42

driven by foreign direct investment. In 1995, the value of foreign goods imported by

foreign-invested enterprises (FIEs) in China was $62.9 billion or 48 percent of China’s

total imports, while it was $12.3 billion and 23 percent in 1990. The value of foreign

goods imported by FIEs in China was $76.7 billion or 55 percent of China total imports in

1998; $117.3 billion or 52 percent in 2000, respectively.37

The bulk of Taiwan’s exports to China are comprised of textile fabrics, plastic

materials, machinery and equipment, and electric machinery and electronic equipment,

which are intermediate and capital goods.38 In 1994, these four categories accounted for

67 percent of Taiwan exports to China, indicating that the export boom, to a great extent,

was investment driven. According to Chung Chin, as of 1995 the share of intermediate

products remained as high as 74 percent of Taiwan’s total indirect exports to China.

According to Taiwan and Hong Kong customs, in 1996 and 1998, two-thirds of Taiwan’s

exports to China were focused on three sections classified by the HS system, which are

basically intermediate and capital goods. In 1996, plastics and rubber, and articles,

accounted for 12 percent of Taiwan’s total exports to China; textiles and textile articles,

25 percent; and machinery and mechanical appliances, electrical equipment, parts and

accessories, 29 percent. In 1998, plastics and rubber, and articles, accounted for 12

percent of Taiwan’s total exports to China; textiles and textile articles, 22 percent; and

machinery and mechanical appliances, electrical equipment, parts and accessories, 33

percent.39

37

38

39

Nicholas Lardy, Integrating China into the Global Economy (Washington, D.C.: Brookings Institution

Press, 2002), p. 7.

For more detailed classification of Taiwan’s exports to China, see Taiwan Economic Research Institution

(ed.), Cross-Strait Economic Statistics Monthly (Taipei), various issues. Board of Foreign Trade,

Ministry of Economic Affairs (Taiwan), 1998 Nian Taihai Liangan Maoyi Xingshi Tongji [1998 Statistics

of Cross-Strait Trade Situations] (Taipei: Board of Foreign Trade, 1999), pp. 10-76.

Chin Chung, “Double-Edged Trade Effects of Foreign Direct Investment and Firm-Specific Assets:

Evidence From the Chinese Trio”, in Y.Y. Kuen (ed.), The Political Economy of Sino-American Relations

43

In 1998, Taiwan’s top export items to China were electric machinery, machinery and

parts, plastics, man-made filaments, iron and steel. These items amounted to $10.4 billion,

or 57 percent of Taiwan’s total exports to China. In 1999, Taiwan’s top exports to China

were electric machinery, machinery and parts, plastics, iron and steel, man-made

filaments, and textile articles for industry. These items accounted for $13.9 billion, or 66

percent of Taiwan’s total exports to China.40 These items are typical intermediate and

capital goods, which are driven by the need of TIEs.

According to a 1992 survey of 431 Taiwanese firms from different manufacturing

sectors, 71 percent of raw materials, components and parts necessary for their subsidiaries

in China were purchased from parent and other firms in Taiwan. A similar survey

conducted among 285 firms indicates, however, that sourcing from Taiwan had declined

to a mere 36 percent in 1995. The same studies showed TIEs procured 69 percent of their

machinery and equipment from Taiwan in 1995, as compared with 86 percent from

Taiwan in 1992. 41 According to a 1998 study by Kao Charng, 65 percent of TIEs

purchased raw materials from Taiwan. However, the trend for TIEs to import inputs from

Taiwan has been declining.42 According to two reports by Taiwan’s MOEA, Taiwanese

factories abroad preferred to obtain raw materials and intermediate goods from Taiwan. In

40

41

42

(Hong Kong: Hong Kong University Press, 1997), p. 143. Chung-Hua Institution for Economic Research,

Dalu ji Liangan Jingji Qingshi Baogao (1997/1998) [Report on the Economic Situation of Mainland

China and the Two Sides of the Taiwan Strait (1997/1998)], (Taipei: Mainland Affairs Council, 1999), pp.

216-218.

Ministry of Economic Affairs (Taiwan), 1998 Dalu Jingji Qingshi Pinggu [Assessment on Mainland

Economic Situation in 1998] (Taipei: Minstry of Economic Affairs, 1999), pp. 33-34, 50-51. “Dalu

Duiwai Maoyi Fazhan ji Liangan Maoyi Hudong Gaikuang [The General Situation on the Development

of Mainland’s External Trade and Cross-Strait Trade Interaction],” Board of Foreign Trade, Ministry of

Economic Affairs, April 2000, http://www.moeaboft.gov.tw/prc&hk/trade-roc&prc-5.html, accessed

December 5, 2000, pp. 21-23 of 34.

Chin Chung, “Double-Edged Trade Effects of Foreign Direct Investment and Firm-Specific Assets:

Evidence from the Chinese Trio,” in Y.Y. Kuen (ed.), The Political Economy of Sino-American Relations

(Hong Kong: Hong Kong University Press, 1997), pp. 146-147.

Cited from Chung-Hua Institution for Economic Research, Dalu ji Liangan Jingji Qingshi Baogao

(1997/1998) [Report on the Economic Situation of Mainland China and the Two Sides of the Taiwan

44

1995 and 1998, Taiwan supplied 53 percent and 44 percent of the raw material for TIEs,

respectively. During the same period, 56 percent and 48 percent of parts and

semi-finished products also came from Taiwan, respectively. (See Table 2.7.)

Table 2.7. Sources of Inputs for Taiwan-Invested Enterprises in China, 1995-98

Unit: %

Period

Taiwan

Taiwan-invested

enterprises in China

Non-Taiwan-invested

enterprises in Chinaa

Other countries

a

1995

53

Raw Materials

1996 1997

46

49

1998

44

Parts and semi-finished products

1995

1996

1997

1998

56

51

53

49

17

21

17

19

18

21

20

23

18

21

22

23

19

21

19

22

12

13

13

13

7

7

8

8

Including Chinese enterprises and other foreign-funded enterprises.

Source:

Ministry of Economic Affairs (Taiwan), Zhizaoye Duiwai Touzi Shikuang Diaocha Baogao [The

Investigation Report on Outward Investment of Manufacturing Industry] (Taipei: Ministry of

Economic Affairs, 1997), pp. 89, 92, 95, 98.

Ministry of Economic Affairs (Taiwan), Zhizaoye Duiwai Touzi Shikuang Diaocha Baogao [The

Investigation Report on Outward Investment of Manufacturing Industry] (Taipei: Ministry of

Economic Affairs, 2000), pp. 29-30.

According to several studies by the CIER, MOEA, Charles H. C. Kao, Chu-chia

Steve Lin, Kao Charng, and Chung Chin, in the early 1990s, FDI-driven exports

accounted for approximately one-third of Taiwan’s total exports to China.43 According to

Chen Xiangming, in 1996, FIEs in China accounted for 67 percent of total cross-Strait

43

Strait (1997/1998)], (Taipei: Mainland Affairs Council, 1999), pp. 198-200.

Chung-Hua Institution for Economic Research, Cross-Strait Economic Yearbook [Liangan Jingji

Nianbao], Taipei, 1993, p. 176. Kong-Lien Kao, Liangan Jingmao Xiankuang yu Zhanwang [The

Current Situation and Prospect of Cross-Strait Economic Relations] (Taipei: Mainland Affairs Council,

1994), p. 26. Charles H. C. Kao and Chu-chia Steve Lin, “The Economic Impact of Taiwan’s Investment

in the Mainland,” Issues & Studies, vol. 30, no. 6 (June 1994), pp. 19-20. Charng Kao, Dalu Jinggai yu

Liangan Jingmao Guanxi [Mainland Economic Reforms and Cross-Strait Economic Relations] (Taipei:

Wu-Nan, 1994), pp. 164-166. Chin Chung, “Double-Edged Trade Effects of Foreign Direct Investment

and Firm-Specific Assets: Evidence from the Chinese Trio,” in Y.Y. Kuen (ed.), The Political Economy

of Sino-American Relations (Hong Kong: Hong Kong University Press, 1997), pp. 143-144.

45

trade.44

To a lesser extent, Taiwan’s imports from China were also related to Taiwan’s

investment in China, especially in the electronics and electrical appliances, and basic

metals and metal products sectors. According to three reports by Taiwan’s MOEA, as of

1998 around 10 to 13 percent of products made by TIEs were sold back to Taiwan.45 In

addition, Taiwan’s imports from China were largely the products of those industries in

which Taiwan had invested most heavily. For example, in 1998, Taiwan’s top import

items from China were electric machinery, iron and steel, machinery and parts, mineral

fuel and oil, earth, stone, and cement. These items comprised 57 percent of Taiwan’s total

imports from China in 1998. In 1999, the main items of Taiwan’s imports from China

were electric machinery, machinery and parts, iron and steel, mineral fuel and oil, zinc

and articles, and earth, stone, and cement. These items accounted for $2.8 billion, or 62

percent of Taiwan’s total imports from China in 1999.46

The rapid increase of intra-industry trade between Taiwan and China also reflects the

division of labor between Taiwan and China at the industrial level, with particular

reference to type III division of labor across the Taiwan Strait. Intra-industry trade (IIT)

refers to simultaneous exports and imports of commodities in the same industry or

44

45

46

Xiangming Chen, “Business Over Politics,” China Business Review, March-April 1999, p. 9.

Ministry of Economic Affairs (Taiwan), Zhizaoye Duojiaohua ji Guojihua Diaocha Baogao [The

Investigation Report on Diversification and Internationalization of Manufacturing Industry] (Taipei:

Ministry of Economic Affairs, 1995), pp. 376-377. Ministry of Economic Affairs (Taiwan), Zhizaoye

Duiwai Touzi Shikuang Diaocha Baogao [The Investigation Report on Outward Investment of

Manufacturing Industry] (Taipei: Ministry of Economic Affairs, 1998), pp. 180, 183. Ministry of

Economic Affairs (Taiwan), Zhizaoye Duiwai Touzi Shikuang Diaocha Baogao [The Investigation

Report on Outward Investment of Manufacturing Industry] (Taipei: Ministry of Economic Affairs, 2000),

pp. 289, 292.

Ministry of Economic Affairs (Taiwan), 1998 Dalu Jingji Qingshi Pinggu [Assessment on Mainland

Economic Situation in 1998] (Taipei: Minstry of Economic Affairs, 1999), pp. 33-34, 50-51. “Dalu

Duiwai Maoyi Fazhan ji Liangan Maoyi Hudong Gaikuang [The general Situation on the Development

of Mainland’s External Trade and Cross-Strait Trade Interaction],” Board of Foreign Trade, Ministry of

Economic Affairs, April 2000, http://www.moeaboft.gov.tw/prc&hk/trade-roc&prc-5.html, accessed

December 5, 2000, pp. 21-23 of 34.

46

production group during a given time. The upsurge of the IIT index verifies that the

cross-Strait division of labor has rapidly emerged through Taiwan’s FDI in China due to

four reasons: (1) differentiation of commodity; (2) differentiation of production

technology; (3) labor intensity of production; and (4) economies of scale.47

According to a 1992 study by Yen Zong-da, Lin Yuh-Jiun, and Chung Chin, the

cross-Strait IIT index increased from 0.8 in 1980 to 28.8 in 1991 within the

manufacturing industry. Yen, Lin, and Chung derived these figures by examining

cross-Strait trade classified in the 3-digit descriptions of the Standard International Trade

Classification.48 Based on the classification of the HS system by section, the cross-Strait

IIT index for the manufacturing industry increased from 16 in 1992, to 16.2 in 1994, then

21.2 in 1996, and 30.4 in 1998. In particular, the IIT index for sections 16, 17, 18, and 20

increased tremendously between 1992 and 1998. The IIT index for section 16 was 0.5 in

1992 and 38 in 1998; that for section 17 was 1.5 in 1992 and 32.3 in 1998; that for section

18 was 0 in 1992 and 42.5 in 1998; and that for section 20 was 2.6 in 1992 and 78.5 in

1998. (See Table 2.8.)

47

48

Charng Kao, Dalu Jinggai yu Liangan Jingmao Guanxi [Mainland Economic Reforms and Cross-Strait

Economic Relations], 2nd edition, (Taipei: Wu-Nan, 1999), p. 219. Chonira Aturupane, Simeon Djankov,

and Bernard Hoekman, “Determinants of Intra-Industry Trade between East and West Europe,” working

paper, August 1997, http://www.worldbank.org/ecspf/html/papers/IIT-EJ.html, accessed January 10,

2001.

Charng Kao, Dalu Jinggai yu Liangan Jingmao Guanxi [Mainland Economic Reforms and Cross-Strait

Economic Relations], 2nd edition, (Taipei: Wu-Nan, 1999), pp. 218-219.

47

Table 2.8. Intra-Industry Trade Index for Cross-Strait Trade, 1992-98

Merchandise sections of the HS system

Section 6. Products of the chemical or allied

industries

Section 7. Plastics and rubber, and articles thereof

Section 8. Hides and skins; leather and articles

thereof; travel goods, handbags and

similar containers

Section 9. Articles of wood, cork, or plaiting

materials

Section 10. Wood pulp; paper, paperboard, and

articles thereof

Section 11. Textiles and textile articles

Section 12. Footwear, headgear, and artificial flowers

Section 13. Articles of stone or ceramics; glass and

glassware

Section 14. Pearls; precious stones and metals;

jewelry; coin

Section 15. Base metals and articles of base metal

Section 16. Machinery and mechanical appliances;

electrical

equipment;

parts

and

accessories thereof

Section 17. Vehicles, aircraft, and other transport

equipment

Section 18. Optical, photographic, measuring, and

medical apparatus; clocks and watches;

musical instruments

Section 19. Arms and ammunition; parts and

accessories thereof

Section 20. Miscellaneous manufactured articles

Section 6-20 Manufacturing goods

1992

67.2

1994

43.6

1996

43.4

1998

43.7

1.9

11.9

2.1

10.3

2.5

15.5

5.1

16.8

72.4

84.8

90.2

83.4

0.8

6.4

11.6

10.3

4.1

14.8

19.6

2.2

43.8

16.1

2.3

51.3

18.0

4.3

54.7

33.4

44.8

79.4

24.1

24.6

91.9

0.5

50.7

12.8

44.7

23.7

49.0

38.0

1.5

1.7

9

32.3

0.0

8.9

26.8

42.5

n.a.

n.a.

n.a.

n.a.

2.6

16.0

14.1

16.2

52.8

21.2

78.5

30.4

Note:

1.

For a good j with exports Xj and imports Mj, the level of Intra-industry trade (IIT) index, Bj is:

Bj={1-[|Xj-Mj|/(Xj+Mj)]}x100. Bj varies between 0 (complete inter-industry trade) and 100 (complete

intra-industry trade).

2.

Merchandise sections are classified by the Harmonized Tariff Schedule.

3.

Cross-Strait trade figures are from Chung-Hua Institution for Economic Research, Dalu ji Liangan

Jingji Qingshi Baogao (1997/1998) [Report on the Economic Situation of Mainland China and the Two

Sides of the Taiwan Strait (1997/1998)], (Taipei: Mainland Affairs Council, 1999), pp. 215-222. These

figures of cross-Strait trade are almost the same as the estimates of Taiwan’s Mainland Affairs Council.

Source: Calculated by the author.

48

Firm Level: Inter-Firm and Intra-Firm Division of Labor

Before the mid-1980s, Taiwan was characterized as a “dual economic structure” with

small-medium enterprises producing labor-intensive goods for export while large

enterprises made intermediate and capital goods for the domestic market. After 1987,

when Taiwan began to invest abroad heavily, the domestic economic structure changed

significantly: labor-intensive, small-medium enterprises migrated abroad and capital and

technology intensive large enterprises replaced small-medium enterprises as Taiwan’s

prime exporters. In 1987, the share of exports of small-medium enterprises to Taiwan’s

total exports was 67 percent; in 1997, the export share of small-medium enterprises

declined dramatically to 49 percent. Compared with the 1982 to 1987 period, the export

share of small-medium enterprises declined by only 2.6 percent. In the next decade, the

export share of small-medium enterprises declined by 18.3 percent.49

After the mid-1980s, the destination of Taiwan’s exports also changed dramatically.

Prior to that time, the main market for Taiwan’s exports was the United States. Following

Taiwan’s huge outward FDI, the export market shifted significantly to China and the

ASEAN-5, where Taiwan’s exports mainly consisted of FDI-driven sales of intermediate

and capital goods. That is, the inter-firm domestic labor division existing inside Taiwan

before the mid-1980s was transformed into an inter-firm international labor-division

driven by the FDI of Taiwan’s small-medium enterprises. Labor-intensive, small-medium

enterprises established production bases overseas (including in China), with the provision

49

Kai Ma, “Chanye Fazhan zhi Zhanwang yu Yenyeng Zhengce [Prospect and Policy of Industrial

Development],” in Chung-hua Institution for Economic Research (ed.), Woguo Maixiang Xianjin Guojia

de Chanye Zhengce zhi Yanjiu [Conclusion Report: Study on Taiwan’s Industrial Policies toward a

49

of intermediate and capital goods by large enterprises, and then the products of Taiwan’s

overseas affiliates were exported to the United States, Japan, and Europe. That Chinese

exports produced by TIEs will be elaborated upon later.

In addition to inter-firm (including both intra-industry and inter-industry)

international labor-division, there was an intra-firm international labor-division. 50

According to a 1998 report by Taiwan’s MOEA, which included a sample of 1,264

companies, 35 percent of Taiwan enterprises with FDI in China explicitly stated that their

products produced in Taiwan were superior or had more value-added than those made by

their overseas bases, and only 4 percent gave the opposite response. Divided by enterprise

scale, 44 percent of large enterprises with FDI said that their products in Taiwan were

superior or had more value-added, while only 2 percent took an opposite view; by

comparison, only 24 percent of small enterprises with FDI held the same view and 4

percent the opposite view. Therefore, the larger the enterprises, the more they tend to have

an intra-firm division of labor across borders, with Taiwan producing superior or more

value-added goods and China manufacturing labor-intensive products. Nevertheless, there

still exist some forms of intra-firm international labor-division for small enterprises,

although the degree is much less than that for large enterprises.51

50

51

Developed Economy] (Taipei: Chung-hua Institution for Economic Research, 1997), pp. 391-392.

FDI may result in three kinds of industrial restructuring: intra-firm, intra-industry, and inter-industry.

Tain-Jy Chen, Yi-Ping Chen, and Ying-Hua Ku, “ Taiwan’s Outward Direct Investment: Has the

Domestic Industry been Hollowed Out?” in Nomura Research Institute and Institute of Southeast Asian

Studies, compiled, The New Wave of Foreign Direct Investment in Asia (Singapore: Institute of Southeast

Asian Studies, 1995), pp. 103-104.

Ministry of Economic Affairs (Taiwan), Zhizaoye Duiwai Touzi Shikuang Diaocha Baogao [The

Investigation Report on Outward Investment of Manufacturing Industry] (Taipei: Ministry of Economic

Affairs, 1998), pp. 142-143.

50

Production Level: Inputs, Production, Marketing, and Technology

In addition to Taiwan’s provision of inputs for TIEs, as explained at the industrial

and firm levels, Taiwan’s parent firms also provide marketing service and production

technology for TIEs. For example, according to a 1995 study by Kao Charng and Ji

Sheng-guo, Taiwan’s parent enterprises provided export service for 46 percent of their

affiliates in China and provided production techniques for 54 percent of their China

branches.52 According to another 1995 study by Charles Kao, Chu-Chia Steve Lin, Cher

Hsu, and Wennie Lin, parent firms in Taiwan provided marketing and sales services,

including export service, for 81 percent (multiple choice) of TIEs while 35 percent of

TIEs also provided their own marketing service. In addition, parent firms in Taiwan were

in charge of information collection, product development, design, testing, and research

and development, for around 85 percent (multiple choice) of TIEs, while 25 percent of

TIEs also conducted these services for themselves.53

According to the 1999 report by Taiwan’s MOEA, Taiwan’s parent enterprises

provided marketing services for 68 percent (multiple choice) of TIEs while 57 percent of

TIEs also provided their own marketing services. Further, Taiwan’s enterprises provided

production techniques for 92 percent (multiple choice) of TIEs, while partners of TIEs

provided production techniques for only 12 percent of TIEs and 18 percent of TIEs

developed such techniques by themselves.54 In another report by Taiwan’s MOEA, the

52

53

54

Charng Kao and Thung-hai Hsu, “The Development of the Trend of Taiwanese Investment in Mainland

China and the Issue of ‘Three Links’,” East Asia Quarterly, vol. 27, no. 3 (January 1996), pp. 65-67.

You-tien Hsing, Making Capitalism in China: the Taiwan Connection (New York: Oxford University

Press, 1998), p. 68.

Ministry of Economic Affairs (Taiwan), Zhizaoye Duiwai Touzi Shikuang Diaocha Baogao [The

Investigation Report on Outward Investment of Manufacturing Industry] (Taipei: Ministry of Economic

Affairs, 2000), pp. 488-489, 509.

51

ratio of “Taiwan taking orders and mainland exporting goods [Taiwan Jiedan, Dalu

Chukou]” was as high as 26.3 percent in 1998, rising from 23.6 percent in 1997. That is,

26.3 percent of total orders received by Taiwan parent firms were exported by their

subsidiaries in China in 1998.55

V. Cross-Strait Economic Interdependence

Trade Dependence

Based on an estimate by Taiwan’s MAC, Taiwan has grown highly dependent on

China’s market, from 2.3 percent (the share of Taiwan’s exports to China as a percentage

of Taiwan’s total exports) in 1987 to 17.5 percent in 1999. Since 1993 China has been

Taiwan’s second largest market, next only to the United States. Partly due to Taiwan’s

unilateral restrictions against China’s imports, Taiwan’s dependence on China as a

supplier was only 4.1 percent (the share of Taiwan’s imports from China as a percentage

of Taiwan’s total imports) in 1999. Overall, Taiwan’s trade dependence on China was 11.1

percent (the share of cross-Strait trade in Taiwan’s total foreign trade) in 1999. In the

same year, China’s dependence on Taiwan as a supplier was 12.9 percent, and its

dependence on the Taiwanese market was only 2.3 percent. Since 1992 Taiwan has been

China’s second largest import supplier, second only to Japan. Overall, China’s trade

dependence on Taiwan was 7.2 percent in 1999. (See Table 2.9.)

Table 2.9. Trade Interdependence between Taiwan and China, 1987-99

55

Guo-qin Yu, “The Ratio of Taiwan Receiving Orders and Mainland Exporting Goods Is More Than 26

Percent,” Gongshang Shibao [Commerce Times], March 6, 2000.

52

Unit: %

Period

1987

1990

1993

1996

1999

Taiwan’s trade dependence on China

Export

Import

Total trade

dependence dependence

dependence

2.3

0.8

1.7

6.5

1.4

4.2

16.5

1.4

9.3

17.9

3.0

11.0

17.5

4.1

11.1

China’s trade dependence on Taiwan

Export

Import

Total trade

dependence

dependence

dependence

0.7

2.8

2.1

1.2

8.2

4.5

1.2

13.5

7.7

2.0

14.9

8.2

2.3

12.9

7.2

Note:

1.

All figures of cross-Strait trade are based on the estimation by Taiwan’s Mainland Affairs Council.

2.

Trade (export or import) dependence refers to the share of cross-Strait trade (exports or imports) in

Taiwan’s or China’s total foreign trade (exports or imports).

Source:

Taiwan Economic Research Institution (ed.), Cross-Strait Economic Statistics Monthly (Taipei), no. 92

(April 2000), pp. 22-23.

Trade Economic Dependence