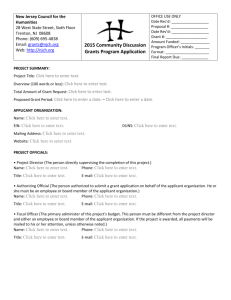

Request for Disabled Facilities Grant shortfall funding

advertisement

Gloucestershire County Council CONTRIBUTION TO DISABLED FACILITIES GRANT ADAPTATIONS AS A MEANS OF MEETING ASSESSED NEED AUTHOR Victoria Williams AUTHOR’S TITLE Strategic Planning and Policy Officer DATE OF POLICY March 2007 AUTHOR OF REVISION (if applicable) REVISER’S TITLE (if applicable) DATE OF REVISION (if applicable) REVISION NUMBER (if applicable) 1 GCC CONTRIBUTION TO DFG ADAPTATIONS AS A MEANS OF MEETING ASSESSED NEED Contents Page 3 Policy statement 3 purpose 3 Scope 3–5 Definitions 5–6 Legal context Mandatory procedures Occupational Therapist Assessment Process FAB Team Assessment Process G.C.C Financial Assessment Administration of G.C.C. Financial Contribution Nil Grant Process Conditions of provision of financial assistance 6 – 10 6–7 7 8 8–9 9 – 10 10 Practice Guidance 11 Implementation Monitoring and Review 11 Appendix 1:The G.C.C. Financial Assessment Form Appendix 2 : The Paediatric OT Panel Request Form 2 12- 15 16 Gloucestershire County Council contribution to DFG adaptations as a means of meeting assessed need 1. Statement 1.1 Gloucestershire County Council is committed to ensuring that assessed needs are appropriately met and that finite Directorate resources assist those who are in most need. 2. Purpose 2.1 This purpose of this guidance is to establish a fair and transparent method of assessing an applicant’s and their spouse or partner or, in the case of a child, parents/those with parental responsibility (PR), ability to finance the amount they have been asked to contribute towards an essential adaptation on their home. 3. Scope 3.1 This guidance applies to Occupational Therapists, working under S31 agreements of the Health Act 1999, Social Care staff working with adults and children with disabilities and to the Financial Assessment and Benefits Team. 3.2 All owner-occupiers, tenants (council, registered social landlords and private), licencees and children are potentially eligible to apply for a DFG and therefore may also be considered for G.C.C. financial assistance under this guidance. However, tenants of Borough/District Council Housing or Registered Social Landlords should initially seek assistance from their landlord. Where a private landlord refuses permission for the works to be undertaken a grant cannot be given. 3.3 For adults, aged 18 years and older, only needs that are eligible under the Fair Access to Care Services eligibility criteria (FACS) will be considered for financial assistance from the Community and Adult Care Directorate (C&ACD). These will be needs that are assessed as being critical or substantial. 3.4 Only ‘actual’, not prospective tenants, can apply for a DFG. 4. Definitions C&ACD – Community and Adult Care Directorate CRAG – Charging for Residential Accommodation Guide CYPD – Children and Young People’s Directorate DFG - Disabled Facilities Grant EHO - Environmental Health Officer 3 FAB Team – Financial Assessment and Benefits Team FACS – Fair Access to Care Services Eligibility Criteria OT - Occupational Therapist PR - Parental Responsibility. Those awarded PR by the courts have all the rights, duties, powers, responsibilities and authority which by law a parent of a child has in relation to the child and his/her property. Those with PR can include foster parents and Special Guardians. For a full definition please click on the following link. http://www.everychildmatters.gov.uk/_files/30ACDD5E0B1C8BA035F48F763B21A401.pdf TOR - Test of Resources 4.1 Disabled Facilities Grants (DFGs) are used to fund major adaptations to a property in order to meet the assessed needs of adults and children with permanent and substantial disabilities. The Occupational Therapists (OTs) will carry out an assessment and make recommendations to apply for a DFG from the City and District Councils. The maximum DFG available in England is £25,000. Some major adaptations may cost more than £25,000. Requests can be made to the Community and Adult Care Directorate (C&ACD) and to the Children and Young Persons Directorate (CYPD) to contribute to the shortfall in funding for adaptations that cost over £25,000 and for any shortfalls in the DFG funding, where the applicant is unable to fund the shortfall. 4.2 Mandatory DFGs are awarded where the works are required for a person with a disability to: Facilitate access to and from the dwelling/to a principal family room/sleeping room, toilet, bathing or shower facilities Make the dwelling safe for the disabled occupant and other persons residing with him/her Facilitate the preparation of food by the disabled occupant Improve/provide a heating system Enable the use of power, light or heat Enable a person to fulfil their caring responsibilities 4.3 To determine whether the work is ‘necessary and appropriate’ the Borough/District Council Grants Officer/Environmental Health Officer has a duty to consult with OTs working in the Local Authority Social Care Directorates. The OTs assess an individual’s needs and propose works/adaptations that are both ’necessary and appropriate’ to meeting those needs. 4.4 The Housing Authority’s assessor, usually a Grants Officer or an Environmental Health Officer (EHO), assesses whether the proposed works are ‘reasonable and practicable’. 4.5 For applicants over the age of 19 the EHO/Grants Officer applies a national means test that calculates if the applicant is eligible for a DFG and 4 how much they should receive. This test of resources (TOR) is applied to the disabled occupant (19 years and over) and their spouse or partner. 4.6 There is no national means test for children/young people under 19. This means that if a young person’s needs are eligible for a DFG, they can be awarded a maximum grant of up to £25,000. If there is more than one young person eligible for a DFG within one family a maximum of up to £25,000 can be awarded for each child. 5. Legal Context The National Assistance Act (1948) The Chronically Sick and Disabled Persons Act 1970 The NHS and Community Care Act 1990 The Children Act 1989 The Health and Social Services and Social Security Adjudications Act 1983 (s17) The Housing Grants, Construction and Regeneration Act 1996 Regulatory Reform (Housing Assistance) (England and Wales) Order 2002 (Article 3) The Health Act 1999 (s31) The Disability Discrimination Act 2005 The Race Relations (Amendment) Act 2000 The Human Rights Act 1998 5.1 Assessments of individual need are carried out by C&ACD and CYPD under the National Assistance Act (1948), The Chronically Sick and Disabled Persons Act 1970, The NHS and Community Care Act 1990 and The Children Act 1989. 5.2 Where a need has been identified and work has been recommended as being ‘necessary and appropriate’ in meeting this need but a DFG has been refused, or the amount awarded does not cover the full cost of the adaptation, the local authority still has a duty to meet this need under (Section 2 (1) (e) of The Chronically Sick and Disabled Persons Act 1970). The Local Authority may consider using their powers under The Health and Social Services and Social Security Adjudications Act 1983 (s17) to charge for their services, where appropriate. 5.3 C&ACD and CYPD can look at the applicant’s, their spouse or partner, or, if the applicant is under 19, parent/those with PR means when considering whether to allocate Local Authority money to fund the adaptation. 5.4 R v Gloucestershire County Council and the secretary of state, ex parte Barry resulted in the Department of Health issuing LASSL(97)13 – Responsibilities of local authority social services departments: “Implications of recent legal judgements” which states: “It has been the understanding of successive governments that local authorities are able to take their resources into account in assessing a person’s need for the services listed in section 2 of the CSDP Act; 5 deciding what services to arrange; and arranging those services.” 5.5 A recent ruling, R v Wandsworth LBC, March 2005 resulted in the judge deciding that local authorities have the right to take the income of parents into account before agreeing to fund any part of an adaptation for a child with disabilities: ‘’ a local authority could, in circumstances such as those in the instant case, properly decline to be satisfied that is was necessary to provide services to meet the needs of disabled children until it had been demonstrated that, having regard to their means, it was not reasonable to expect their parents to provide them,’’ 5.6 The current legislative framework governing DFGs (including eligibility criteria; definitions of mandatory works and of the terms ‘reasonable and practicable’ and ‘necessary and appropriate’) is laid out in The Housing Grants, Construction and Regeneration Act 1996. Housing Grants, Construction and Regeneration Act 1996 5.7 Housing Authorities may offer discretionary assistance in addition to, or as an alternative to a mandatory DFG under the Regulatory Reform (Housing Assistance) (England and Wales) Order 2002 (Article 3). 5.8 In Gloucestershire, OTs employed by the local Primary Care Trust assess the needs of individuals on behalf of C&ACD and CYPD under the terms laid out in section 31 of the Health Act 1999. 6. Mandatory Procedures 6.1 Occupational Therapists (OT) Assessment Process 6.2 Referrals are made to the adult OT teams via the Customer Services Officers, and then to the Paediatric OT teams via the Access Team. 6.3 An OT carries out an assessment under the appropriate Acts from which the need for an adaptation may be identified. The OT assessment process is detailed in the Gloucestershire Occupational Therapy Good Practice Guide (available in hard copy only) and on the following process maps. Paediatric OT process maps Add hyperlink to Adult OT process maps – currently under review. For more information contact Sian Waygood. 6.4 Before assisting the applicant, or their parents, in completing a DFG application the OT will ensure that the proposed work is the most cost effective solution to meeting eligible assessed needs. In certain circumstances, a DFG will not be appropriate and alternative solutions must be explored. In very rare circumstances this may involve considering alternative housing options, eg moving. 6 6.5 OTs will offer to refer all applicants, and/or their parent/carers, to the Financial Assessment and Benefit (FAB) team. The FAB Team will ensure the applicant is claiming all the benefits they are entitled to and will apply the G.C.C test of resources (TOR), in order to determine whether the applicant, or their parent/carer, is entitled to a financial contribution towards their adaptation from the Local Authority. 6.6 Applicants, or their parents/people with PR (if the applicant is under 19 years old) have a responsibility to complete and return all relevant financial and non-financial assessments and paperwork in a timely and honest manner that enables all appropriate staff to respond accordingly. 7. FAB Team Assessment Process 7.1 The OT sends a referral to the FAB Team. The FAB team clerk records the referral and arranges an appointment for a FAB Visiting Officer to meet with the applicant, or their parent/people with PR if the adaptation is for someone under 19. 7.2 The Visiting Officer completes the financial assessment form (the County Council Test of Resources) with the applicant, or their parent/ people with PR (if the adaptation is for someone under 19), gathering as much information as possible. This assessment is then given to the FAB team manager. 7.3 The FAB team manager calculates a weekly amount that the applicant, or their parent/ people with PR, could afford to pay towards the DFG shortfall and advises the referring OT of the results. 7.4 The appropriate Team Manager applies the Branton formula to the calculated weekly figure. This sum will result in the amount of top-up Gloucestershire County Council will agree to pay towards the adaptation. (The FAB Team assessed weekly figure is multiplied by 216 to arrive at the amount of money an applicant, or their parent/ people with PR, could be expected to contribute to their DFG. This is the amount they could reasonably expect to secure a loan for.) 1 7.5 The calculated amount is then taken to the appropriate panel for approval. 7.6 In the CYPD, OTs will complete the short OT panel request form for a contribution to a DFG. Add link to new FAB policy and procedures (due June 2007). ‘For loans repayable over 5 years with an APR of 8% then some 16.7% of the total repayments goes on interest and 83.3% on capital. Given the FAB assessment arrives at a weekly figure, then over 260 weeks (5 years x 52) some 216 weeks will be on capital repayment (i.e. 83.3% of 260).’ Thus to arrive at the amount people could be expected to contribute to their loan is calculated by multiplying the FAB assessed weekly figure by 216’. Mark Branton 08/05. 1 7 8. Gloucestershire County Council financial assessment 8.1 The current national DFG means test takes no account of major outgoings such as individuals’ mortgage repayments, other significant financial commitments or circumstances. The County Council TOR will take this expenditure into account. Tenants in council or registered social housing should initially apply to their landlord for assistance. 8.2 The financial assessment is intended to identify, on the basis of income and fixed outgoings, whether the applicant, or their parent/ people with PR, might be able to secure a loan from a high street bank or building society over a five year period in order to make their contribution to the cost of the adaptation. For adults the assessment will take into account the income and savings of the applicant and their spouse or partner. 8.3 If the works are to help a young person (under 16, or under 19 years of age if still in full-time, non-advanced education) it is the income and savings of the parent/ people with PR that are assessed. 8.4 Two sets of adaptations may be required in the case of split care arrangements for children/young people with a disability. However, “a mandatory DFG is only available at the address which is the main residence of the disabled occupant, as determined by the Local Authority” from Delivering Housing Adaptations for Disabled People: A Good Practice Guide (DCLG, 2006) 8.5 All applications for financial assistance from either Directorate will be considered by the appropriate locality panel in the C&ACD and by the Children and Young People with Disabilities (CYPwD) panel (panel proformas under development, see Alison Cathles).. 8.6 Once financial assistance has been agreed by panel this is entered in the finance schedule on ERIC as a one off payment by the adult clerk in C&ACD adult clerk against the Community Care budget code. In the CYPD financial assistance agreed by panel has it’s own DFG budget code. This is recorded on the Service Manager’s, Children and Young People with Disabilities/SEN, DFG spreadsheet. 8.7 Criminal Injuries Compensation Awards and Vaccine Damage payments will not be taken into account when assessing income (in line with CRAG). However, civil compensation awards will be included as capital. 8.8 Any capital over £21,000, as set by CRAG in April 2006, should be used by the household to contribute towards the cost of an adaptation. 9. Administration of County Council Financial Contribution to DFGs 9.1 Work on any agreed adaptation will only commence once all the money needed to finance the whole of the adaptation has been guaranteed. 8 9.2 In order to reduce the possibility of fraud, applicants will not receive any agreed C&ACD or CYPD funding directly. 9.3 The local District Council Grants Officers or local HIA will act as agent both for the administration of DFG funding and for the agreed County Council contribution. 9.4 The local District Council Grants Officer will clarify what works are eligible for grant aid and will manage and check the quality of building works. 9.5 The OT will visit at completion of the work to confirm whether it meets the functional needs of the disabled person. 9.6 If contractors need interim payments prior to finishing an adaptation this will initially be sought from the applicant, or their parent/carer’s contribution, then the County Council contribution and finally from any DFG. 9.7 The final instalment of the grant and top up should not be released to the contractor until the works has been checked by someone from the OT service and assessed as being ‘fit for purpose’. 9.8 If the GCC financial contribution to a DFG is going to be administered by a HIA/Grants Officer the money will be given over to them as soon as panel has agreed the contribution. 9.9 If the building work is not satisfactory then no monies will be paid to the builder. (See section 39 of the Housing Grants, Construction and Regeneration Act 1996 “Where an amount of grant is payable, but the works in question have not been executed to the satisfaction of the applicant, the local housing authority may at the applicant's request and if they consider it appropriate to do so withhold payment from the contractor. If they do so, they may make the payment to the applicant instead.”) 9.10 To secure financial assistance for unforeseen costs OTs will initially make a request for this funding from the Grants Officer, then, if necessary, they will complete a panel application to meet these expenses. 9.11 If the applicant dies or ceases to live at home before work on the adaptation has started the work will be cancelled and all money returned. 9.12 If the work on the adaptation has started but the applicant dies or ceases to live at home before it has been completed the Grants Officer will ensure that any work is completed to a reasonable standard and in the most cost effective way. How the work is completed will depend upon how far the adaptation has progressed. 10. Nil grant process 9 10.1If an applicant is not awarded any money from a DFG, this is recorded as a ‘nil-grant’ by the Grants Officer/EHO. This may prove significant if the applicant has to apply again for a different adaptation need in the future. 10.2 Applicants who are given a ‘nil-grant’ outcome for an adaptation that has been deemed ‘necessary and appropriate’ will be referred to the FAB Team for financial assessment. 10.3 As above, any agreed County Council contribution will be managed by the local Grants Officer/EHO who will manage and run the case as a ‘nilgrant’. 11. Conditions of provision of financial assistance 11.1 Where the C&ACD or CYPD contribution is for £1,000 or less, this would be given as a grant and will not be recoverable. 11.2 Where the C&ACD or CYPD contribution exceeds £1,000 and the adaptation is for a disabled person living in an owner occupied residence this would be regarded as a loan and will be registered as an equitable charge on the property to be repaid when the house is sold. 11.3 A legal charge will not be placed on a property where an adaptation will depreciate the value of the property, eg. where a through floor lift is installed. Click on hyperlink to Deferred Payments and Legal Charges 11.4 Changes to the applicant/family’s personal circumstances during the application process will be reassessed using the G.C.C. financial TOR. 11.5 If the applicant wants the adaptation to be completed by a competent family member or friend monies from a DFG and any G.C.C. contribution will be given towards the cost of materials but not labour. (Housing Grants, Construction and Regeneration Act 1996) 12 . Practice Guidance 12.1 Where possible, any building work or adaptation that receives financial support from the C&ACD or CYPD should be carried out by builders in receipt of the Department of Trade and Industry Quality Mark or appropriate British Standard for the work undertaken. 12.2 It would be good practice to explore the possibility of creating a countywide database that holds information on adapted properties in the area. This would enable other disabled/older people to have access to purchasing a property that could be readily adapted to meet their needs in the future. 12.3 Where an applicant, or in the case of young people under the age of 19 their parent/people with PR, is neither an owner occupier nor a tenant the decision to contribute to an adaptation will be decided upon on a case by case basis. 10 13.Implementation 13.1 Staff will be made aware of this policy via: This Week in the CYPD and the C&ACD, the C&ACD/CYPD Planning, Policy and Projects Website. 13.2 It is the responsibility of Managers to ensure that operational staff are aware of this policy and have received appropriate training to enable them to implement it efficiently. 14. Monitoring and Review 14.1 National changes to the Disabled Facilities Grant are expected to be proposed and to come into effect before the end of 2007. This guidance will be reviewed in 12 months time or when the changes are implemented, whichever comes first. 14.2 The responsibility for monitoring and reviewing the policy lies jointly with the appropriate Managers in the CYPD and the C&ACD. 11 The Assessment The assessment is adapted from the DfES standardised means test for adoption and special guardianship financial support. The assessment differs from the current adult charging policy as it considers the income of the household rather than the individual service user. This has been suggested for all owner-occupiers as an adaptation could add value to a property and could benefit more than just the service user. If adaptations are likely to devalue a property a legal charge will not be placed on the property. Only adults with parental responsibility for a child/young person (c/yp) with disabilities will be assessed for their ability to pay for an adaptation to meet the c/yps needs. Service users and their families will be encouraged to note all disability related expenses. The relevant panel in children/adults services must approve all applications made to the CYPD or C&ACD to contribute to essential adaptations. Criminal Injuries Compensation Awards and Vaccine Damage payments will not be taken into account when assessing income (in line with CRAG). However, civil compensation awards will be included as capital. GCC FINANCIAL ASSESSMENT FOR DFG FINANCIAL SUPPORT ( based on the DFES adoption support and special guardianship financial support model means test) MEANS TEST All figures should be calculated on a weekly basis 1) PROJECTED FAMILY INCOME i) Pay Basic net weekly pay Drawings if self employed Total subsection 1i ii) Benefits and pensions (household) Employers' sick pay (after compulsory deductions) Incapacity benefit Statutory maternity, paternity and/or adoption pay and/or maternity allowance Bereavement benefit Working tax credit (if paid directly and not as part of pay and excluding any childcare element paid) All pension payments being received 12 Income 1 0 0 0 Incom Parent 1 0 0 Pare 0 0 0 0 Other benefits Total subsection 1ii iii) Benefits Income Support/Jobseeker's Allowance per household Child tax credit per household Child benefit for each child, excluding child/children who are the subject of this assessment application Total subsection 1iii 0 0 0 0 0 0 iv) Other sources of income Income from capital, savings and investments over £21k - net weekly interest eg Bank/Building Society Accounts, Savings/Income Bonds, Stocks and Shares less 10%, ISAs, PEPs, TESSAs etc, Premium bonds Income from boarders/lodgers (see guidance for details of calculation) Income from unfurnished properties Income from furnished properties Maintenance payments received for any child in household Existing adoption or special guardian 'allowances' (including any enhancements or specific payments for special needs) paid for any child Total subsection 1iv 0 0 0 0 0 0 0 v) Income relating to child(ren) being adopted or becoming a special guardian child Any regular interest on capital and/or income in which the child(ren) has a legal interest and entitlement e.g. trust fund, property or other type of legacy. Do not include payments from Criminal Injuries Compensation Awards/VDP – do include other compensation payments Any other income Total subsection 1v 0 0 0 TOTAL PROJECTED FAMILY INCOME FAMILY INCOME FOR PURPOSES OF TEST 0 0 2) PROJECTED FAMILY EXPENDITURE i) Home Mortgage payments (capital and interest) including any endowment payments linked to mortgage Rent (after any housing benefit payable) Council tax (after any council tax benefit payable) Total subsection 2i 13 0 0 0 0 ii) Other outgoings Loan repayments for essential purposes (see guidance notes) Maintenance payments Court orders Private pension contributions National insurance if self employed Disability Related Expenses 0 0 0 0 0 0 Cost of Social Care Services 0 Reasonable child care costs including nursery fees (after any childcare element paid as part of the working tax credit) Total subsection 2ii 0 0 iii) Core regular family expenditure Based on 125% income support allowances per household Total subsection 2iii 0 0 TOTAL PROJECTED FAMILY EXPENDITURE: 0 CALCULATION Total projected net family income (per week): Total projected family expenditure (per week): Applicable amount AA (per week): Apply Branton formula = AA x 216 Total amount household could afford to contribute to DFG top-up 0 0 0 0 The ‘Branton formula‘ - For loans repayable over 5 years with an APR of 8% then some 16.7% of the total repayments goes on interest and 83.3% on capital. Given the FAB assessment arrives at a weekly figure, then over 260 weeks (5 years x 52) some 216 weeks will be on capital repayment (i.e. 83.3% of 260).’ Thus to arrive at the amount people could be expected to contribute to their loan is calculated by multiplying the FAB assessed weekly figure by 216’. Mark Branton 08/05. 14 Request for Disabled Facilities Grant shortfall funding Date: PRN: Name of child: DOB: Family name if different: Address: Brief description of child’s condition: Brief description of adaptation work being done and reason: Total cost of work: Results of FAB assessment: Shortfall Amount requested: Signed: Occupational Therapist…………………………Date: Signed…………………………………………Date: Team Manager Children's Occupational Therapy Service Signed………………………………………. Date: Children and Young People with Disabilities Service Manager 15 References: Cornwall ref cc11 East Sussex County Council Delivering Housing Adaptations for Disabled People: A Good Practice Guide ODPM Nottinghamshire County Council Middlesborough Community Practice and the Law, M. Mandelstam, 2005 disabled facilities grant booklet, ODPM 2006 16