Before Merging, Check for FDA Problems

advertisement

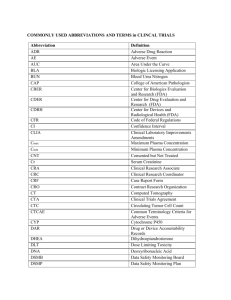

TEXT OF ARTICLE THAT FIRST APPEARED IN: National Law Journal, September 4, 2000, pages B13-B14. FDA Aspects of Due Diligence in Biomedical Transactions by Michael A. Swit In the fiercely competitive pharmaceutical and medical device industries – whether those based in traditional or biotechnology-driven technology – growth by acquisition, either via outright corporate absorptions or more targeted product licensing, has become a key strategy to ensure the continued profitability and growth of players both big and small. Indeed, in 1996 and 1997 alone, the number of pharmaceutical industry mergers almost doubled from 285 to 426.1 And, while recent consolidation statistics are less readily available, a number of well-publicized large mergers have dominated business headlines in these industries.2 While scrutiny from the Federal Trade Commission (“FTC”) as to the anti-competitive aspects of such mergers is routine and vigilant,3 another significant federal hurdle to a successful transaction in the biomedical4 industry is the Food and Drug Administration (“FDA”). As FDA issues can impact deals both large and small, this article will identify for the non-food and drug law practitioner some of the key FDA considerations that can affect biomedical industry transactions. In approaching these concerns, a useful framework for understanding where problems may lurk for a party to such a transaction is to focus on three key roles FDA plays relative to regulated industry. First, FDA is the gatekeeper to the marketplace as prior FDA approval, clearance or review is required to market the vast majority of biomedical products.5 Second, the agency is the enforcer, invested with the duty to ensure that regulated companies comply with the Federal Food, Drug, and Cosmetic Act (“the Act”) so as to not market adulterated or misbranded drugs6, biologics, and medical devices. Persons violating those provisions face seizure of violative products,7 injunction8 or criminal prosecution,9 as well as such non-judicial enforcement remedies as warning letters10 and recalls,11 and often pointed negative publicity from the agency.12 Third, the agency acts as a key federal sentinel of new public health concerns, primarily through the surveillance requirements embodied in the adverse reporting requirements applicable to marketed drugs,13 medical devices14 and biologics.15 In any deal involving an alliance between FDA-regulated companies, the transactional attorneys responsible for the deal, as part of their due diligence inquiry, must ensure that the FDA-regulated firm or product involved in the deal has either complied with – or not run afoul of – all gatekeeping, enforcement and surveillance requirements overseen by FDA. In several major transactions in the last ten years, had FDA-related problems been discovered through the due diligence process earlier, the negative results of those deals – either collapse or a buyer facing significant lost value – in hindsight, may have been avoided.16 The challenge to the lawyer seeking to close a deal involving an FDA-regulated product or company will be balancing the need to meet its legal obligations for an adequate due diligence FDACounsel.com FDA Aspects of Due Diligence in Biomedical Transactions Michael A. Swit Page 2 inquiry with the expertise, expense and time involved in doing the inquiry. In the FDA arena, this often means transactional counsel will need to employ experts well-versed in the intricacies of FDA regulatory requirements to review company operations and applications to gain comfort that the target company or product is in substantial compliance with FDA requirements.17 Product Line Reviews – Go Beyond First Impressions Most FDA-regulated deals involve some transfer of all or part of the rights that the seller may have in a product that is subject to agency approval under its gatekeeper role. To meet its due diligence requirements, the buyer usually first will obtain from the seller copies of approval letters issued by FDA that explicitly sanction the marketing of the product in question.18 On its face, an approval letter would appear to answer whether the seller has the legal right to market – and thus also transfer -- the product. However, in the FDA arena, the approval letter does not end the inquiry because approvals of new drug applications (“NDAs”) and other FDA marketing clearances are specific to the conditions covered by the original marketing approval. Thus, in conducting due diligence, it is essential to assure that any changes in the original terms of the approval have been properly processed with the agency in the form of a supplement19 or other regulatory submission, many of which require FDA prior approval before the change can be implemented relative to commercially-distributed products.20 The challenge for counsel is discerning whether the application holder has, in its current operations, improperly varied the original approval terms in the product’s application. Before the generic drug scandal of the late 1980’s, the extent of inquiry into such issues probably was considerably more limited and transactions relied more on the representations and warranties sections of contracts to provide comfort to the parties. However, in the light of well-publicized disclosures that certain generic drug houses had filed false submissions with FDA,21 the intensity of pre-closing FDA submission auditing by purchasers increased markedly. NDA and other marketing application audits involve detailed reviews of, inter alia, an application’s history to compare the conditions originally approved in the application, adjusted for any properly filed supplements or other regulatory changes, with those encountered in the actual production and labeling of the product. While such audits are not infallible, there simply is so much collateral documentation required to be maintained at all levels of a drug’s or device’s manufacturing operations that it would be difficult to cover up a change that had not been properly processed with FDA. It is the task of the expert auditor to identify any such discrepancies and evaluate their significance, with counsel, relative to the underlying approval. GMP and Quality Systems Audits – Making Sure the “House” and its Housekeepers Are In Order The best FDA-approved application and finest formulated product will be of minimal value if the facility in which it is made – or the people who make it – do not all possess a high degree of quality as to design, maintenance, equipment, training and experience. In the FDA FDACounsel.com FDA Aspects of Due Diligence in Biomedical Transactions Michael A. Swit Page 3 realm, the watchwords of quality are Good Manufacturing Practices (“GMP”) for drugs and biologics and the Quality Systems Regulations (“QSR”) for medical devices. A certain amount of the due diligence review of a company’s compliance with the GMP or QSR rules can be done without even visiting the target facility. Under the Freedom of Information Act,22 reports of completed FDA inspections generally are disclosable.23 Also available – and generally on the Internet -- are regulatory communications to companies such as warning letters and notices of violation. However, depending on the nature of the transaction, a detailed site visit by the acquiring company may be indicated to ensure, by direct observation, that the target firm is meeting its obligations under FDA’s quality rules. An illustration of how FDA quality issues can adversely impact a deal was last year’s aborted Abbott Laboratories/Alza merger. While FTC anti-competitive concerns played a role in the deal’s collapse,24questions on quality at an Abbott division that depressed Abbott stock values also were linked to the failure of the deal..25 With Abbott/Alza, after the merger was originally announced in the summer of 1999, Abbott entered into a settlement agreement with FDA to resolve quality allegations in its diagnostic products division and agreed to pay – in the form of disgorgement – $100 million to the agency. While nothing suggests that Alza officials knew of the upcoming Abbott/FDA settlement before the proposed merger was first publicized, a review of the agency’s web page26 documentation on the Abbott consent agreement makes clear that the questionable QSR conditions at Abbott’s diagnostics division had existed for some time unresolved to FDA’s satisfaction. Thus, even if the consent decree had not occurred, it is likely that an aggressive audit by Alza would have revealed similar concerns to those memorialized in the Abbott/FDA consent decree and given Alza an opportunity to pull out of the deal. The quality challenge to transactional attorneys in such deals is to structure the due diligence review to best assure that any concerns about quality (product or process) are identified and resolved at the front end of the transaction. Adverse Event Analyses – Don’t Inherit Products Liability Woes Analyzing a target company or product’s future vulnerability to products liability litigation requires a keen review of the data FDA requires be tracked and reported on adverse events involving drugs, biologics and medical devices.27 In so doing, counsel should attempt to ensure that any trends in unanticipated28 adverse events are carefully examined to learn whether the novel adverse events do not forebode more significant concerns. Attention also will need to be paid to whether an unanticipated increase in the frequency or intensity of known adverse events has already occurred. By closely examining adverse event records – which should be readily available from the target company – the due diligence professional will be in the best position to assure the acquiring party that it also is not buying into a new round of products liability litigation arising out of the target company’s past operations. FDACounsel.com FDA Aspects of Due Diligence in Biomedical Transactions Michael A. Swit Page 4 *** In summary, the challenges of due diligence in transactions involving FDA-regulated companies or products are significant. To be addressed correctly, they require expertise in the minutiae of food and drug law, strong familiarity with the regulatory submissions that govern entrance to the marketplace, extensive practical experience in the applicable quality systems, and an ability to review emerging epidemiological data to forecast new potential areas of products liability. While not a place for the uninitiated, non-FDA practitioners should endeavor to understand some of the key aspects of the roles that FDA plays in the regulatory process prior to becoming immersed in a transaction involving a company or product subject to FDA oversight. Source: National Law Journal, September 4, 2000, pages B13-B14. 1 MarketLetter, June 8, 1998. See, e.g., Cost Savings Spur Pharmaceuticals’ Urge of Merge. Huge Spending Needed for New Products, THE GLOBE AND MAIL, January 18, 2000, at B14. 2 3 See, e.g., Antitrust Enforcement in Pharmaceutical Industry Mergers, Balto, David I. and Mongoven, James F. 54 Food & Drug L.J. 255 (1999). This article uses the term “biomedical industry” to denote those companies that market drugs as defined in 21 U.S.C. § 321(g), devices as defined in 21 U.S.C. § 321(h), or biologics as described in 42 U.S.C. § 351(a) and further defined at 21 C.F.R. § 600.3(h). 4 See, e.g., 21 U.S.C. § 355 (requiring approval of any “new drug”product), and 21 U.S.C. §§ 360c to 360k (medical device 5 6 The drug and device adulteration and misbranding provisions of the Act appear at 21 U.S.C. §§ 351 and 352, respectively. 7 21 U.S.C. § 334. 8 21 U.S.C. § 332. 9 21 U.S.C. § 333. A “Warning Letter” is a written communication from FDA notifying an individual or firm that the agency considers one or more products, practices, processes, or other activities to be in violation of the Act, or other acts, and that failure of the responsible party to take appropriate and prompt action to correct and prevent any future repeat of the violation, may result in administrative and/or regulatory enforcement action without further notice. See FDA Regulatory 10 FDACounsel.com FDA Aspects of Due Diligence in Biomedical Transactions Michael A. Swit Page 5 Procedures Manual (“RPM”), Chapter 4, “Advisory Actions,” Subchapter, Warning Letters, at http://www.fda.gov/ora/compliance_ref/rpm_new2/ch4.html#purp. 11 21 C.F.R. Part 7. Except for its never-used power under Section 518(b) of the Act [21 U.S.C. § 360f(b)] to order repairs or replacements of medical devices in strictly limited circumstances, FDA lacks the legal authority to compel an allegedly violative firm to conduct a recall. Thus, all recalls of FDA-regulated products are “voluntary.” 12 21 U.S.C. § 375 specifically confers on FDA the power to use publicity as a regulatory tool. 13 21 C.F.R. § 314.80. 14 21 C.F.R. Part 803. 15 21 C.F.R. 600.80. 16 While contractual language such as warranties, representations and indemnification clauses also are available to provide protection to the parties when a deal encounters significant FDA regulatory concerns, this article will discuss initiatives to ensure that a deal is not inked until both sides are confident that all FDA regulatory concerns have been satisfactorily addressed. 17 While many counsel will employ qualified consultants to perform such reviews, it also is not unusual for an acquiring company to use its own in-house regulatory or quality experts to conduct such audits. In deciding how to marshal resources, acquisition counsel will need to weigh the advantages – usually in the form of cost savings – of using in-house personnel versus those strategic edges provided by hiring the experts hired directly by counsel to conduct such reviews – e.g., the potential protection of the attorney work-product doctrine. In many cases, records reflecting FDA approval can be found on FDA’s webpage. For example, all drug products approved under § 505 of the Act [21 U.S.C. § 355] are listed in FDA’s publication, Approved Drug Products with Therapeutic Equivalence Evaluations (the “Orange Book”); see, http://www.fda.gov/cder/ob/default.htm. Similar data also can be found for approvals of medical devices requiring approved pre-market approval applications (http://www.accessdata.fda.gov/ scripts/cdrh/cfdocs/cfPMA/pma.cfm), devices subject to premarket notification clearances (http://www.accessdata.fda.gov/scripts/cdrh/cfdocs/ cfPMN/pmn.cfm), and biologics (http://www.fda.gov/cber/efoi/approve.htm). Notwithstanding the public availability of such approval records, a review of the actual FDA approval letter also can shed light on specific conditions of approval imposed on the applicant that may be of interest to the acquiring company. 18 19 See, e.g., for drugs, 21 C.F.R.§ 314.70 (Supplements and other changes to an approved application); for biologics, 21 C.F.R. § 601.20 (Changes to an approved license); for devices requiring prior approval, 21 C.F.R. §§ 814.39 (PMA supplements); and, for devices requiring FDACounsel.com FDA Aspects of Due Diligence in Biomedical Transactions Michael A. Swit Page 6 premarket notification under 21 U.S.C. § 360(k), see 21 C.F.R. § 807.81(a)(3) (When a premarket notification is required). 20 Failure to properly handle the regulatory aspects of changes to applications can render unapproved the “changed” product being marketed, even if a valid approval attached to it prior to the change. In turn, once discovered, whether by the company or FDA, correcting such errors can involve time and money. And, in the interim, the product being produced under an unapproved change may not be lawfully marketed. See, e.g., “FDA’s Generic Drug Approval Process (Part 3),” Hearings Before the Subcommittee On Oversight and Investigations of the Committee on Energy and Commerce, U.S. House of Representatives, September 11 and November 17, 1989, Serial No. 101-117. 21 To date, FDA has only posted a very limited number of 483’s and EIR’s on its public website. Counsel requiring detailed past regulatory histories of target companies may gain faster access to such documents through commercial information suppliers such as, for FDA documents, FOI Services, Inc. (http://www.foiservices.com). 22 FDA’s inspectional record of a company usually consists of at least two types of document. First, a list of “Inspectional Observations” given the company by the FDA inspector at the end of an inspection. Referred to as a “483” due to the Government Printing Office number assigned it, inspectional observation lists are usually freely disclosed under FOI by FDA soon after an inspection’s conclusion. The second document is the Establishment Inspection Report (“EIR”), a detailed report that includes a lengthy discussion of any of the observations in a 483 as well as other pertinent information relating to the inspection. While EIR’s also are disclosed under FOI, the agency usually defers their release if any open legal/regulatory issues remain with the company following inspection. If that is the case, the FOI requester often will be informed that the record is exempt from disclosure under 21 C.F.R. § 20.64 as a record the disclosure of which “could reasonably be expected to interfere with enforcement proceedings.” Such a reply is a red flag requiring follow-up to ensure that no continuing FDA regulatory concerns exist and should be monitored closely by the inspected company and counsel responsible for the due diligence inquiry. 23 24 Thomas Burton, Abbott Laboratories and Alza Call Off Their Deal, THE WALL STREET JOURNAL, December 17, 1999, at B10. Id. See also, Some Observers Say Eroding Value Led to Dissolution of Alza – Abbott Deal. DOW JONES BUSINESS NEWS. December 17, 1999. 25 26 See http://www.fda.gov/cdrh/ocd/abbott.html. 27 See Notes 14-16, infra. FDACounsel.com FDA Aspects of Due Diligence in Biomedical Transactions Michael A. Swit Page 7 For purposes of adverse event reporting, a drug event is “unexpected” if it is not covered by the existing labeling for the product. See 21 C.F.R. § 314.80(a). 28 FDACounsel.com