county of riverside - Riverside Housing Authority

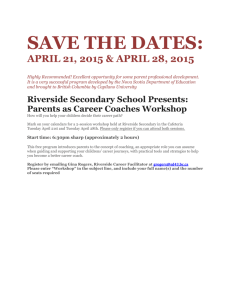

advertisement