fafsa worksheet a

advertisement

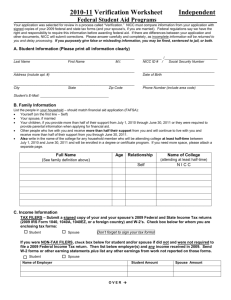

VANDERBILT UNIVERSITY MEDICAL CENTER PROGRAMS IN ALLIED HEALTH 2009 – 2010 Verification Worksheet Your application was selected for review in a process called “verification”. In this process, VUMC will be comparing information from your application with signed copies of your 2008 federal tax forms (and your spouse’s if you are married, or parents’ if you are considered dependent for federal aid purposes). Most applicants who receive this form have been selected for verification by the US Department of Education (DOE), which requires our office to ask you for this information before awarding Federal aid. The DOE allows our office to request this information from any applicant before awarding Federal aid. If there are differences between your application and documents provided, corrections may need to be submitted. Complete this form and submit to the Financial Aid Office within 15 days of receipt. Incomplete paperwork will be returned to you for completion thereby delaying the processing of your financial aid. Failure to return the requested documentation before you end your term of enrollment will result in the cancellation of your aid. PLEASE NOTE: If you give false or misleading information, VUMCPAH will cancel your financial aid and report conflicting information to the Office of Inspector General for investigation. For Federal Financial Aid, if you purposely give false or misleading information, you may be fined $20,000, sent to prison, or both. WHAT YOU SHOULD DO: 1. Collect your (and your spouse’s or parents’) financial documents (signed Federal income tax forms, W-2, Military LES, etc.) 2. Talk to your financial aid administrator if you have questions about completing this worksheet. 3. Read carefully and complete all sections that apply to you. Make sure you collect all required signatures. 4. Take the completed worksheet, tax forms, W-2’s, Military LES, etc to your financial aid administrator. 5. Your financial aid administrator will compare information on these documents and make corrections if necessary. A. STUDENT INFORMATION __________________________________________________________ Last Name First Name Initial _________________________________________ SS Number __________________________________________________________ Date of Birth Email address __________________________________________ Phone Number (include area code) B. FAMILY INFORMATION INDEPENDENT STATUS: You are independent IF you were born BEFORE January 1, 1986, OR are admitted into a degree BEYOND a Bachelor’s degree, OR are married, OR have children for whom you supply MORE THAN HALF of their support, OR have other dependents who live with you AND receive MORE THAN HALF of their support from you, OR are an orphan or ward of the court, OR are a veteran of or currently serving in the US Armed Forces. You are dependent if you do not meet ANY of the conditions listed above. Independent Students: List the people in your household, include (a) yourself, and your spouse if you have one; (b) your children, if you provide more than half of their financial support from July 1, 2009 through June 30, 2010; and (c) any other people if they now live with you and you provide more than half of their financial support and will continue to provide more than half of their support from July 1, 2009 through June 30, 2010. Include children who will be born prior to June 30, 2010. Dependent Students: List the people in your parents’ household, include (a) yourself and your parent(s) (including stepparent) even if you don’t live with your parents; (b) your parents’ other children, even if they don’t live with your parent(s), if (1) your parent(s) provide more than half of their support from July 1, 2009 through June 30, 2010, or (2) the children would be required to provide parental information when applying for Federal student aid; and (c) other people if they now live with your parents and your parents provide more than half of their support and will continue to provide more than half of their support from July 1, 2009 through June 30, 2010. Write the names of all household members. Also write in the names of the college for any family member, excluding your parent(s), who will be attending college at least half time between July 1, 2009 and June 30, 2010, and will be enrolled in a degree, diploma, or certificate program. If you need more space, attach a separate page. FULL NAME AGE RELATIONSHIP SELF COLLEGE C. TAX FORMS AND INCOME INFORMATION All tax filers must submit a SIGNED copy of all 2008 Federal Income Tax returns including the 2008 IRS Form 1040, 1040A, 1040EZ, or an RTFTP. If you did not file taxes, you must supply a signed statement or other certification of non-filing. If your total income is LESS THAN $3,000, you may be required to complete a Low Income Explanation. Both tax filers and non-tax filers must list any untaxed income received in 2008. Be sure to enter zeros if no funds were received. (Refer to Worksheet A, B and/or C of the FAFSA for additional items.) Failure to complete this section will delay the processing of your financial aid. Military personnel and their dependents need to submit copies of all 2008 Leave and Earning Statements. Student (spouse) Calendar Year 2008 Parent(s) (stepparent) FAFSA WORKSHEET A Earned income credit from IRS Form 1040 – line 66a; or 1040A – line 40a; 1040EZ – line 8a $ $ Additional child tax credit from IRS Form 1040 – line 68 or 1040A – line 41 Welfare benefits, including Temporary Assistance for Needy Families (TANF). Do not include food stamps. Social Security benefits received that were not taxed for members of the household listed on the other side. FAFSA WORKSHEET B Payments to tax-deferred pensions and savings plans (paid directly or withheld from earnings) including, but not limited to, amounts reported on W-2 Form Box 12a – 12d, codes D,E,F,G,H and S. Include untaxed portions of 401(k) and 403(b) plans. IRA deductions and payments to self-employed SEP, SIMPLE and Keogh and other qualified plans from IRS Form 1040 – total of lines 28 + 32 or 1040A – line 17. Child support received for all children. Do not include foster care. Tax exempt interest income from IRS Form 1040 – line 8b or 1040A – line 8b. Housing, food and other living allowances paid to members of the military (ex. BAH, COLA, cash value of on-base housing, etc), clergy, and others (including cash payments and cash value of benefits). Veterans’ non-education benefits, such as Disability, Death Pension or Dependency & Indemnity Compensation (DIC) and/or VA Educational Work-Study Allowances. Any other untaxed income or benefits, not reported elsewhere, such as workers’ compensation, untaxed portions of railroad retirement benefits, Black Lung Benefits, Refugee Assistance, etc. Do not include student aid, WIA benefits, or benefits from flexible spending arrangements, e.g. cafeteria plans. Other items not listed above from FAFSA worksheet B. Cash or any money paid on your behalf, not reported elsewhere on this form. FAFSA WORKSHEET C Education Credits (Hope and Lifetime Learning tax credits) from IRS Form 1040 – line 49 or 1040A – line 31 Child support PAID because of divorce or separation. Do not include support for children listed in your household on the other side of this page. Taxable earnings from Federal Work-study or other need-based work programs. Student grant, scholarship, fellowship, and assistantship aid, including AmeriCorps awards, that was reported to the IRS in your (or your parents’) adjusted gross income. $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ During most of 2008, did you (or parents if dependent) live in subsidized housing? During most of 2008, did you (or parents if dependent) rent your own apartment or own your own home? $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ ___Yes ___Yes ___No ___No What were your (and parents if dependent) main sources of financial support during 2008 (please check all that apply)? ___Income from work ___Student financial aid ___Child support/alimony ___Assistance from family/friends ___Food stamps ___Legal settlement ___WIC ___Savings ___Other (___________________________________) D. SIGNATURES By signing this worksheet, I (we) certify that all the information reported on this worksheet is complete and correct. If dependent, at least one parent must sign. WARNING: If you purposely give false or misleading information on this worksheet, you may be fined, be sentenced to jail, or both. _________________________________________ __________________ Student’s Signature Date ___________________________________ _______________ Parent’s Signature (Dependent Only) Date