Course Offerings of the EERC Master's Program in Economics

advertisement

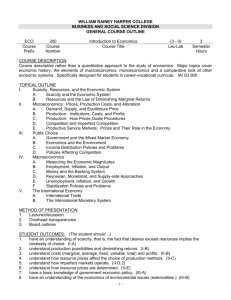

Course Plan, 2008–09 Academic Year First-Year Courses Term I Microeconomics (Robert Swidinsky) Macroeconomics (Hanna Vakhitova) Statistics and Econometrics (Tom Coupé) Mathematics for Economists (Volodymyr Vakhitov) II Microeconomics (Pavlo Prokopovych) Macroeconomics (Oleksandr Shepotylo) Statistics and Econometrics (Iryna Lukyanenko) Mathematics for Economists (Volodymyr Vakhitov) III Microeconomics (Pavlo Prokopovych) Macroeconomics (Olesia Verchenko) Statistics and Econometrics (Elena Besedina) Mathematics for Economists (Volodymyr Shportyuk) IV Microeconomics (Larysa Krasnikova) Macroeconomics (Lilia Maliar) Statistics and Econometrics (Hanna Vakhitova) Mathematics for Economists (Volodymyr Shportyuk) V Microeconomics (Olena Nizalova) Macroeconomics (Yuri Yevdokimov) Statistics and Econometrics (Denys Nizalov) Mathematics for Economists (Volodymyr Vakhitov) Note: First-year students must also take additional mandatory non-economics courses (English and Ukrainian Business Language) Term Second-Year Courses I Research & Economic Policy Analysis Workshop (T.Coupé, O. Shepotylo, V.Vakhitov) Issues in Microeconomics I: Information Economics (Denys Nizalov) Transition Economics I (Hartmut Lehmann and Gianpaolo Rossini) Issues in Econometrics I: Quantitative Methods (Hartmut Lehmann and Gianpollo Rossini) New Economic Geography (Oleksandr Shepotylo) Labor Economics I (Robert Swidinsky) II Research & Economic Policy Analysis Workshop (T.Coupé, O.Nizalova, TBA) Research & Economic Policy Analysis Workshop (T.Coupé, O.Nizalova, TBA) Economic Policy Analysis I (Denys Nizalov) Game Theory I (Pavlo Prokopovych) Financial Economics I (Olesia Verchenko) Money and Banking (Olesia Verchenko) Public Economics I (Hanna Vakhitova) International Trade I (Arne Melchior and Fredrik Wilhelmsson Emerging Capital Markets (Edilberto Segura) Financial Economics II (Olesia Verchenko) Advanced Microeconomics I (Andriy Zapechelnyuk) Industrial Organization I (Andriy Zapechelnyuk) TOP Professors: Issues in Financial Economics & Strategy (Kit Baum) Research & Economic Policy Analysis Workshop (T.Coupé, S. Maliar, P. Prokopovych) Economic Policy Analysis II (Iryna Akimova) Advanced Macroeconomics I (Lilia Maliar and Serguei Maliar) Issues in Financial Economics (Olesia Verchenko) TOP Professors: Issues in Micro II (Robert Pindyck and David Reiley) *** *** Thesis Workshop (R.Gardner, H.Vakhitova O.Verchenko) Economics of Europe (Roy Gardner) Development Economics (Oleksandr Shepotylo) Labor Economics II (Olena Nizalova) Transportation Economics (Yuri Yevdokimov) III IV V Note: TOP Professors: Issues in Micro II (Igor Livshits) TOP Professors: Issues in Financial Economics & Strategy (Bent Sorenson and Paul Gregory) *** *** Second-year students must take the Research and Economic Policy Analysis Workshop each term plus Thesis Workshop in the fifth miniterm. They must pass 15 additional elective courses in economics (at least 5 of which are from the core list of courses that are of importance for all concentrations, and 4 within the selected concentration), for a total of twenty courses (4 Research and Economic Policy Analysis Workshops + 1 Thesis Workshop + 15 electives), during the second year. CONCENTRATIONS 2008-09 No. Concentration Term I Term II Term III Term IV Term V 1. Firms, Consumers and Issues in Microeconomics I: Information Economics Game Theory I International Trade I TOP Professors Course: Issues in Microeconomics II Transportation Economics Market Structure Transition Economics I Issues in Econometrics I: Quantitative Methods Advanced Microeconomics I Labor Economics II TOP Professors Course: Issues in Microeconomics II Industrial Organization I Labor Economics I New Economic Geography 2. Total (13 courses) 5 courses 1 course 3 courses 1 course Financial Economics Transition Economics I Issues in Econometrics I: Quantitative Methods TOP Professors Course: Issues in Financial Economics and Strategy Financial Economics I Emerging Capital Markets Money and Banking Financial Economics II Advanced Macroeconomics I Issues in Financial Economics 3 courses Issues in Microeconomics I: Information Economics 2 courses 4 courses 3 courses 1 course Game Theory I International Trade I Economic Policy Analysis II Transition Economics I Issues in Econometrics I: Quantitative Methods Economic Policy Analysis I Advanced Microeconomics I Advanced Macroeconomics I TOP Professors Course: Issues in Microeconomics II Economics of Europe TOP Professors Course: Issues in Microeconomics II Total (13 courses) 3. Economic Policy Analysis Advanced Microeconomics I TOP Professors Course: Issues in Financial Economics and Strategy Public Economics I 3 courses TOP Professors Course: Issues in Microeconomics II TOP Professors Course: Issues in Microeconomics II Development Economics New Economic Geography Total (15 courses) 4 courses 3 courses 2 courses 3 courses 3 courses Note: In order to be assigned to one of the above concentrations, student should choose no less than 4 courses from the concentration he/she selects (2 - mandatory and 2 - electives). Courses that are mandatory for each of the concentrations are marked bold. CORE COURSES 2008-09 1. ADVANCED MACRO I 2. ADVANCED MICRO I 3. FINANCIAL ECONOMICS I 4. GAME THEORY I 5. INDUSTRIAL ORGANIZATION I 6. INTERNATIONAL TRADE I 7. ISSUES IN MICROECONOMICS II 8. LABOR ECONOMICS I 9. PUBLIC ECONOMICS I 10. TRANSITION ECONOMICS I Course Offerings for 2008-09 academic year First-Year Courses In the first year, all students take the same four economic courses, plus two non-economic courses Ukrainian Business Language and English. While the Ukrainian Language is not included in the grade-point average, it is prerequisite for the degree. Microeconomics I, II, III, IV, V. Five miniterms. Microeconomics is taught in a year-long sequence of five modules. An examination is given at the end of each miniterm. Modules I-III cover consumer theory, theory of production and costs, and market structures and competitive strategy. Modules IV-V cover advanced microeconomic topics, including extensive treatments of intertemporal choice, uncertainty and risk, game theory and strategy, general equilibrium and welfare, asymmetric information, public goods and market failure, public choice theory, law and economics, and the economics of information. Walter Nicholson’s Microeconomic Theory: Basic Principles and Extensions, 7th edition, Dryden Press, 1998 is the basic textbook being used. Other useful sources include the following: Hal R. Varian Intermediate Microeconomics, 5th edition, W.W. Norton & Company, 1999; Robert Pindyck and Daniel Rubinfeld Microeconomics, 4th edition, Prentice Hall, 1998; and a considerable array of outside readings. The modules can be defined more precisely as follows in terms of the corresponding chapters and sections in Nicholson. I. Consumer behavior; II. Production, the firm, and competitive markets; III. Market power and strategic behavior, and factor markets; IV. General equilibrium and economic efficiency, information and market failure; V. The role of government. Applications to specific policy areas—regulation, environmental problems, agricultural policy, trade policy, etc. The last module is only partially filled with material from Nicholson, and its content might vary from year to year. Macroeconomics I, II, III, IV, V. Five miniterms. This course covers macroeconomic theory with policy applications as it is taught at the international level in the West. The key textbooks are N.G. Mankiw, Macroeconomics, 6th edition, Worth, 2008; and R. Barro, Macroeconomics, 5th edition, MIT Press, 1997. The texts are supplemented by numerous outside readings from major economics journals and other monographs. The modules roughly fall according to the following pattern: I-II. The social accounts framework. The labor market and aggregate supply. Aggregate demand and macroeconomic equilibrium. Theories of consumption and saving. Theory of investment. Balance of payments. Role of the public sector. Money and the demand for money. Money supply in industrial economies. Inflation and inflation tax. The Keynesian model of macroeconomic equilibrium. Aggregate demand and aggregate supply. IS-LM model in the closed economy. Real business cycles models. Modern models of short-run fluctuations. III. Macroeconomic general equilibrium in a fixed exchange rate regime. General equilibrium in a flexible exchange rate regime. The two-period model. Dynamic programming approach to discrete time optimization. IV. Economic growth. One- and two-sector models of endogenous growth. Government spending, taxes and transfers. Dynamic mathematical tools in continuous time. SolowSwan and Ramsey models. V. Inflation and unemployment: the rational expectations approach to the Phillips curve. Expectations, especially rational expectations, more generally. The Lucas policy critique. Applications of rational expectations to pricing of stocks and bonds, and the signalling function of prices. Statistics and Econometrics I, II, III, IV, V. Five miniterms. Module I covers the basic concepts of probability and statistics. Modules II-V deal with regression and time series analysis, building on the statistical foundation established in the first module. Throughout, the emphasis is on learning by doing, and developing an intuitive understanding of the basis for statistical methods. The statistical package used as the basis for learning and practicing a number of techniques is EViews. The textbooks used in the course are Paul Newbold Statistics for Business and Economics, 4th edition, Prentice Hall, 1995; Peter Kennedy A Guide to Econometrics, 4th edition, MIT Press, 1998; Jack Johnston and John Dinardo Econometrics, 4th edition, McGraw-Hill, 1997; William H Greene Econometric Analysis, 4th edition, Prentice Hall, 2000. Mathematics for Economists I, II, III, IV, V. Five miniterms. The purpose of this course is to give students the mathematical tools they will need for the master’s program and further graduate work in economics. Module I covers calculus and linear algebra; Module II is concerned with linear programming, duality, simplex methods, applications; Modules III and IV cover topics in optimization—including unconstrained optimization, constrained optimization, concave and quasi-concave functions, numerical methods, applications. Module V deals with dynamics—differential equations, dynamic optimization, and applications. The text for the course is Carl Simon and Lawrence Blume, Mathematics for Economists, W.W Norton & Company, 1994. Second-Year Courses Since some second-year courses are being taught for the first time in 2008–2009, exact content and complete syllabi, will have to await further input from the instructors. The student workload is comparable to that of the first year, i.e. students will have on average four courses per term, one of which will be in the form of either the Research & Policy Analysis Workshop or the Thesis Workshop. Second-year students may choose among elective courses each term. The second year is also organized according to the following elective concentrations: Economic Policy Analysis, Financial Economics, and Firms, Consumers & Market Structure. In order to earn a master’s degree, each second-year student is required to take no less than fifteen elective courses (at least 5 of which are from the core list of courses that are of importance for all concentrations, and 4 within the selected concentration), four mandatory courses in Research & Economic Policy Analysis and one in Thesis Writing Methods, and to defend a thesis in English on topic related to the concentration area. The precise second-year courses offered each year vary, the following course descriptions are general. More detailed information is made available by course instructors. Research & Policy Analysis Workshop I, II, III, IV. Four miniterms. A course in economic research methods covers the specific aspects of research presentation: how to organize the research paper, how to cite references, how to make a proper table of contents, index, appendices, etc. It also addresses the issue of how to carry out research: whether to use experimental and/or surveys, and how to find proper techniques for use. Research and Policy Analysis Workshop course leads the students to examine research sources, tools and methods, as well as essays, outlines, precis, etc., explore the literature and start to devise a proper research agenda and methodology. Main text: Kate L. Turabian, A Manual for Writers, 6th edition, Chicago University Press, 1996. Collected readings. Thesis Workshop. One miniterm. Within this course students acquire the research presentation skills most essential in preparation to the thesis defenses that are held at the end of the second year. Students make presentations of their thesis in front of a group of students using PowerPoint and get experience making presentations, leading discussions, reasonably defending their own conceptions and making conclusions. Advanced Macroeconomics I. One miniterm. The course aims to introduce the students to dynamic macroeconomics. First, it covers basic theoretical concepts of economic dynamics such as dynamic (stochastic) programming, value function, Bellman equation, Euler equation, recursive equilibrium, etc. Second it reviews some topics of time series analysis that are particularly useful for applied macroeconomic research, e.g. Markov process, Hodrick-Prescott filter, etc. Finally, it discusses the issues of calibration of economic models and simulating the solutions by using numerical methods. The problem sets include both theoretical and computer exercises. The programming language is MATLAB. Collected readings. Advanced Microeconomics I. One miniterm. The course studies classical microeconomic concepts and models (preferences, choice, risk and uncertainty, utility maximization, etc.) from different angles and reevaluates the knowledge obtained in the basic microeconomic course. The problems of bounded rationality, decision making under asymmetric or incomplete information, incentive inducing schemes and optimal mechanisms are discussed. Main textbooks: Ariel Rubinstein, Lecture Notes in Microeconomic Theory: The Economic Agent, Princeton Univesity Press, 2006; Andreu Mas-Colell, Michael D. Whinston, and Jerry Green, Microeconomic Theory, Oxford University Press, 1995. Development Economics. One miniterm. This course aims at investigating issues in economic development that are particularly germane to both developing and transition economies. This class initiates students into the theories and policies that have become central to the development of less developed countries. Systematic study of the origin and development of institutions is the essential part of the course. The course also discusses the alternative views on economic development that emphasize the role of natural causes (resource endowment, geographical location, and climate) or the role of investments in infrastructure (i.e. roads and communications) and compares how they perform against the institutional approach. The course provides the students with an understanding of, and ability, to apply basic economic concepts to the study of development. Collected readings. Economics of Europe. One miniterm. The course covers the main macroeconomic processes of the EU. The students will study the European trading policy, including common market creation and development. Other macroeconomic issues, such as European budget, unemployment, EURO currency etc. are the points of intensive analysis during the course. Main text: Mike Artis and Frederick Nixson, The Economics of the European Union: Policy and Analysis. Economic Policy Analysis I, II. Two miniterms. This course explores economic policy from the point of view of policy practitioners. In particular, the course focuses on practical guidance for writing policy papers of different types. A framework theory of economic policy is presented, as well as an overview of the nuts and bolts of policy making and policy dialogue in practice. This gives students a framework for thinking about policy issues and policy design, which is realistic, implementable, and politically acceptable. It also encourages them to think about the policy relevance of primary empirical and theoretical economic research conducted for their master’s theses. The course then turns to a series of topical presentations and discussions of major macroeconomic and sector policy issues. Students are expected to be actively involved in discussions and question and answer periods, which are part of each lecture. This along with the lecture series prepares students to develop policy papers, which are graded. The term is graded according to a) a level of participation and involvement into discussion during the classes; b) policy relevance and quality of the students’ policy papers. Main texts: Nicola Acocella, The Foundations of Economic Policy: Values and Techniques, Cambridge University Press, 2000. James E.Meade, The Intelligent Radical Guide to Economic Policy: The Mixed Economy, London; George Allen & Unwin Amihai Glazer and Lorence S.Rothenberg, Why Government Succeeds and Why It Fails? Harvard University Press, 2000. Collected readings. The first part of the course is taught by a different professor, therefore the syllabus will be available at the beginning of the course. Emerging Capital Markets. One miniterm. Emerging Markets comprise all those countries that are “developing” or are in “transition”, including countries in Eastern/Southern Europe, East/South Asia, Latin America and Africa. They exclude the USA, Canada, Western Europe and Japan. The course provides with techniques and insights to handle successfully investment and related financial matters concerning Emerging Capital Markets. It deals with fundamental theoretical topics (such as foreign exchange determination) as well as practical issues (such as how to build an equity and debt portfolio in Emerging Markets). It covers such topics as Capital Outflows to Emerging Markets; Foreign Exchange Determination and Forecasting; Hedging Foreign Exchange Exposure; Emerging Markets Debt; Emerging Stock Markets; Financial Crises in Latin America, East Asia and Eastern Europe; Country Economic Analysis and Management (including macroeconomic stabilization and liberalization); Financial Sector Reform, Banking Crises and Privatization. Main text: B. Solnik, International Investments, Addison-Wesley, 2000. Collected readings. The first part of the course is taught by a different professor, therefore the syllabus will be available at the beginning of the course. Financial Economics I, II. Two miniterms. The course introduces students to a number of issues in financial asset pricing, concentrating on interestrate instruments and financial derivatives. The first part of the course deals with the fundamental notions and theories of interest rates. A number of different tools essential for understanding market for bonds and bills will be presented. The second part of the course focuses on derivative securities. The fundamental idea of no arbitrage principle will be introduced with application to pricing linear derivative assets. Then, risk-neutral valuation approach will be discussed on the example of option pricing, first within a simple binomial tree model, and then within the continuous-time framework. An example of how risk-neutral approach can be applied to project valuation will also be considered. Finally, the market for mortgages and mortgage-backed securities is overviewed. Main texts: Mishkin, F.S., The Economics of Money, Banking and Financial Markets; Hull, J. C. Options, Futures and Other Derivatives; Fabozzi, Frank J. and Franco Modigliani Capital Markets: Institutions and Instruments. Additional readings will be assigned throughout the course. Game Theory I. One miniterm. Non-cooperative game theory is an abstract framework for analyzing strategic situations that involve multiperson interdependent decision making. Conflict, cooperation, coordination, bargaining, auctions are all topics that can be successfully analyzed within this framework. This course will teach the fundamentals of game theory. Game theory emerged as a branch of applied mathematics and is still quite mathematical. Although students rarely use anything more than algebra, the course is analytically demanding. Though the hard part of game theory is not the math, but the logic and mastering this takes time and effort. Main text: Gardner R., Games for Business and Economics, Wiley, 2003. Collected readings. Industrial Organization I. One miniterm. The objective of the course is to give comprehensive knowledge of the basic theory of industrial organization. Main attention is given to the market structure and organization, models of perfect competition, monopoly, oligopoly, markets for homogenous and differentiated products, and models of entry and entry deterrence. Main textbook: Shy, O., Industrial Organization: Theory and Applications, MIT Press, 1996. International Trade I. One miniterm. Several questions are of interest. Why do countries generally trade? What are the benefits from trade? What determines the pattern of trade? What are the effects on income distribution? What are the main policy issues? The course develops a systematic framework for the analysis of these questions. It considers the Ricardian model, specific factors, factor endowments, and imperfect competition models of trade, along with empirical evidence. Some of the trade policy issues including protectionism, trade agreements and the current trade policy issues for Ukraine are also discussed. Collected readings. Issues in Econometrics I: Quantitative Methods. One miniterm. The course deals with empirical work using large micro data sets in the context of transition countries. This work has become more and more important. As large household-level data sets have become available also in transition economies, there is already a substantial empirical literature dealing with transition issues from the area of labor economics. Some of this literature relating to the Russian and Ukrainian labor markets will be discussed in this course. This discussion will take place after students will have been introduced to Limited Dependent Variables models and to Survival Analysis. Chapters of three texts will be used in the course. These are: Marno Verbeek, A Guide to Modern Econometrics, Wiley, 2003, 2nd Edition; William H. Greene, Econometric Analysis, Prentice Hall, chapter 22 (electronic version made available to students); Stephen P. Jenkins, Survival Analysis, typescript, 2005. Some seminal articles on the various topics will provide additional readings. Issues in Financial Economics. One miniterm. This course is a sequel to Financial Economics (Financial Instruments). The emphasis is on practical implementation of derivative pricing models, using option modeling in firm decision making, and employing derivatives in risk management and financial engineering. The purpose of this course is to provide students with the necessary skills to understand the structure of various financial derivatives, their uses and risks. First, mathematical and numerical tools required for implementing theoretical derivatives pricing models are reviewed. Then, the issues in empirical implementation of the models for the purpose of pricing and risk hedging are discussed. Next, the application of risk-neutral valuation approach to project valuation is presented. Finally, a new class of credit derivatives and mortgage-backed securities is surveyed. Main textbooks: Hull, John, Options, futures and other derivatives; Baz, Jamil and George Chacko, Financial Derivatives: pricing, Applications, and Mathematics; Rendleman, Richard J., Applied derivatives : options, futures, and swaps; Dixit, Avinash K. and Robert S. Pindyck, Investment under Uncertainty; Mun, Johnathan, Real options analysis: tools and techniques for valuing strategic investments and decisions. Issues in Financial Economics and Strategy: TOP Professors Course. Throughout the year. PLEASE NOTE THAT THIS COURSE HAS AN INTENSIVE SCHEDULE AS IT IS TAUGHT THROUGHOUT THE YEAR FOR THE TOTAL OF THREE WEEKS PER COURSE. This course is taught by professors from top universities and/ or professors who have well succeeded with publications in the top economic journals. It consists of three intensive blocks of one week each. Course blocks are: 1). Financial Econometrics by Dr. Bent Sorenson (University of Houston) – miniterm I 2). Comparative Economics by Dr. Paul Gregory (University of Houston) – miniterm I 3). Financial Economics by Dr. Kit Baum (Boston College) – miniterm III Note: Sequence counts as 1 credit, awarded in term III. Therefore, if you will sign up for at least one part, you will be required to audit the remaining two. Issues in Microeconomics I: Information Economics. One miniterm. The course builds on concepts of agency (principal-agent), asymmetric information and high exclusion costs of certain types of information. The concepts of transaction costs, hidden information, hidden action, signaling, screening, optimum contract, segmentation induced by differential information, pooling and separating equilibrium, and hierarchical internal organizations are also explored and formalized. Having successfully completed this course, the student will: 1. Become familiar with the current and classic literature on the subject; 2. Understand assumptions, strengths and weaknesses of different economic theories under asymmetric information; 3. Be able to use appropriate information economics concepts; 4. Develop skills in using information economics’ analytic tools, and be able to apply them in analysis of real world situations when information is asymmetric. Textbooks: Inés Macho-Stadler and David Pérez-Castrillo. (MSPC) An Introduction to the Economics of Information: Incentives and Contracts (New York: Oxford University Press, 2nd edition, 2001); Mas-Colell, Whinston, and Green. (MWG) Microeconomic Theory (1995) Ch. 13, 14, 23; Yujiro Hayami and Keijuro Otsuka. The Economics of Contract Choice: An Agrarian Perspective (Oxford University Press, 1993) Ch.15; Debraj Ray. Development Economics (Princeton University Press, 1998) Ch.12, 14, 15. Issues in Microeconomics II: TOP Professors Course. Throughout the year. PLEASE NOTE THAT THIS COURSE HAS AN INTENSIVE SCHEDULE AS IT IS TAUGHT THROUGHOUT THE YEAR FOR THE TOTAL OF THREE WEEKS PER COURSE. This course is taught by professors from top universities and/ or professors who have well succeeded with publications in the top economic journals. It consists of three intensive blocks of one week each. Course blocks are: 1). Applied Microeconomics by Dr. Robert Pindyck (Massachusetts Institute of Technology) – miniterm IV 2). Field Experiments in Economics by Dr. David Reiley (University of Arizona) – miniterm IV 3). Economics of Bankruptcy by Igor Livshits (University of Western Ontario) – miniterm V Note: Sequence counts as 1 credit, awarded in term III. Therefore, if you will sign up for at least one part, you will be required to audit the remaining two. Labor Economics I, II. Two miniterms. Labor Economics course is designed to cover several topics in labor economics focusing on the investigation of wage differentials. During the course both classic papers and recent contributions explaining existence and magnitude of the wage differentials in the neoclassical tradition are examined and several alternative theories are briefly reviewed. Much of the course material is empirical in nature. Most of the readings for the course are journal articles or book chapters. To provide an introduction to the various topics, the following introductory text is used: George Borjas, Labor Economics, 3rd Edition, Boston: McGraw-Hill, 2005. The first part of the course is taught by a different professor, therefore the syllabus will be available at the beginning of the course. Money and Banking. One miniterm. The course provides an overview of the issues central to the economics of money, banking and financial intermediation. , such as the role of financial sector in the real economy, the money demand and money supply analysis, and the current debate on the theory of monetary policy. In addition, a number of issues in the functioning of central banks, the regulation of banks, and some risk management techniques are considered. Main text: Frederic S. Mishkin, The Economics of Money, Banking and the Financial Markets, 7th edition, Pearson, 2004; Lewis, Mervyn K. and Paul D. Mizen. Monetary Economics, 2000. New Economic Geography. One miniterm. The goal of the course is to make students familiar with recent developments in spatial economics and new economic geography. The emphasis will be given to practical tools designed to analyze spatial processes – e.g. MATA programming language - and empirical work in spatial economics and new economic geography. In the end of the course students should be able to model and analyze economic problems related to the spatial distribution of economic activities. Collected readings. Public Economics I. One miniterm. Public economics (or, as other authors call it, ‘public finance’) is an applied microeconomics course about the role of the public sector in general and government in particular in an economic system. It discusses why we need public sector, when markets fail, what public goods are and how they are provided, what the social transfers are, and where to get funds for all those exciting spending programs. In short, the course focuses on government spending and taxing and their multiple effects on behavior of economic agents and economic system as a whole. Due to a shortage of local publications more attention is paid to theoretical and intuitive issues rather than on Ukraine-specific empirical findings. However, local documents are also used to the fullest extent possible. There is no any single textbook that would entirely satisfy the goals of this course. Main texts: Harvey Rosen, Public Finance, 2004; Joseph Stiglitz, Economics of Public Sector, 2000; John Cullis and Phillip Jones, Public Finance and Public Choice, 1998. Journal articles are also provided. Transition Economics I. One miniterm. This course is aimed at reviewing series of pertinent issues of central planning and the economics of transition with both an emphasis on theoretical work and on empirical evidence. Firstly, the course focuses on some basic features of the Classical Planning System (CPS) in the Soviet Union and the reasons for its inability to survive as a viable economic system even in its reformed version. Secondly, it covers such important topics in transition economics as: sequencing of reforms; privatization, restructuring and corporate governance; macro stabilization; the political economy of transition; and labor market adjustment in Central Europe vs. CIS. Main texts: Paul G. Hare, Central Planning, Harwood Academic Publishers 1991; Janos Kornai, The Socialist System: The Political Economy of Communism, Oxford University Press 1992 (reprint 2000); Olivier Blanchard, The Economics of Post-Communist Transition, Oxford University Press 1997; Gerard Roland, Transition and Economics, MIT Press 2000. Transportation Economics. One miniterm. Transportation economics is usually taught as applied microeconomics. However, recently other approaches to transportation economics have appeared. Therefore, the major goal of this course is to familiarize students with the traditional microeconomic approach to transportation economics and with new developments in this field. In addition, social and environmental issues in transportation will be introduced and discussed. Collected readings.