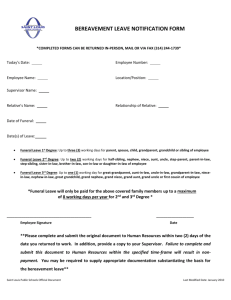

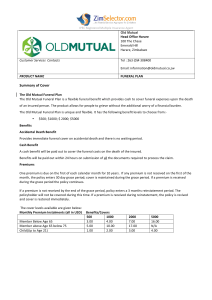

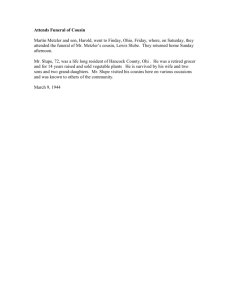

Document

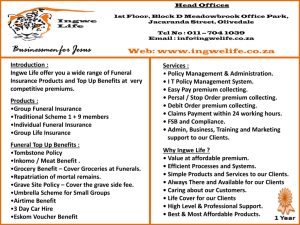

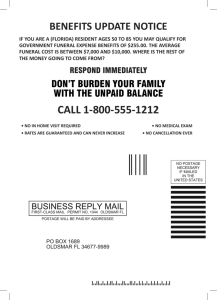

advertisement