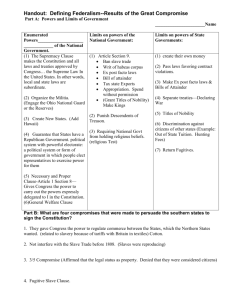

Ch 3 Vocab - Madeira City Schools

advertisement

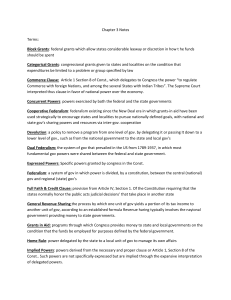

Federalism Key Terms

Federalism – System of government in which powers are divided and shared between different levels, e.g. national, state

and local. "Federalism" and "federal system" are used interchangeably. Both national and state governments exercise

power over the same geographical area.

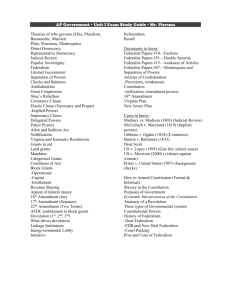

Unitary government - A system of government in which power is concentrated in the central government.

Confederation (government) Constitutional arrangement in which sovereign nations or states, by compact, create a

central government but carefully limit its power and do not give it direct authority over individuals.

Examples include the U.S. under the Articles of Confederation and the former Confederate States of America.

Sovereignty - Supreme or ultimate political authority; a sovereign government is one that is legally and politically

independent of any other government.

Vertical federalism - A description of the obligations between the states and the national government, as established by

the Constitution.

Horizontal federalism - A concept founded on the "full faith and credit" clause of the U.S. Constitution. It describes the

relationship between states, as opposed to the relationship between a state and the national government.

Creative federalism - coined by President Lyndon B. Johnson which was characterized by joint planning and decision

making among all levels of government (as well as the private sector) in the management of intergovernmental programs.

During his administration, Congress enacted legislation that further expanded the role of the federal government; during

the Great Society, the marble cake approach of intergovernmental relations.

Municipal Corporation or Municipality - A legal term for a city. It is characterized by the state to exercise certain

powers and provide certain services.

Centralists – people of favor national action over action at the state and local levels.

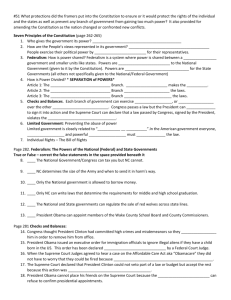

Cross-cutting requirements – A technique of Congress to establish federal regulations. Federal grants may establish

certain conditions that extend to all activities supported by federal funds, regardless of their source. The first and most

famous of these is Title VI of the 1964 Civil Rights Act, which holds that in the use of federal funds, no person may be

discriminated against on the basis of race, color, or national origin. More than 60 cross-cutting requirements concern such

matters as the environment, historic preservation, contract wage rates, access to government information, the care of

experimental animals, and the treatment of human subjects in research projects.

Crossover sanctions – A technique of Congress to establish federal regulations. These sanctions permit the use of federal

money in one program to influence state and local policy in another. For example, a 1984 act reduced federal highway aid

by up to 15 percent for any state that failed to adopt a minimum drinking age of 21.

Decentralists - people who favor state and local action rather than national action.

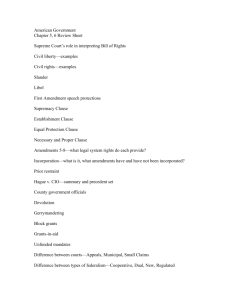

Supremacy Clause (National supremacy) - whenever constitutionally authorized actions of the national government and

those of a state conflict, the actions of the federal government prevail.

Devolution revolution - the policy to scale back the size and activities of the national government and to shift

responsibility for a wide range of domestic programs from Washington to the states.

Second-order Devolution - The flow of power and responsibility from states to local governments.

Third-order devolution - The use of nongovernmental organizations to implement public policy.

"Reagan's Revolution" (new federalism) - to restore to state governments the responsibility for making and

implementing policies.

Mandates – Rules imposed by the federal government on the states as conditions for obtaining federal grants or

requirements that the states pay the costs of certain nationally defined programs.

Unfunded mandate - Federal laws that require states to meet certain regulatory standards, but provide no money to help

the states comply. Congress enacted a law in 1995 to curtail the practice. New York spent $1.3 billion to make its

subways accessible to the disabled, without federal assistance.

Regulatory federalism - Term used to describe the emergence of federal programs aimed at, or implemented by, state

and local governments.

Direct orders – A technique of Congress to establish federal regulations. Direct orders must be complied with under

threat of criminal or civil sanction. An example is the Equal Employment Opportunity Act of 1972, barring job

discrimination by state and local governments on the basis of race, color, religion, sex, and national origin.

Project grant – allocated monies to state and local governments (sometimes nongovernmental agencies) based on

applications from those who wish to participate. ie. National Science Foundation to universities for research or grants to

states and localities to support training and employment programs.

Block grant - Federal grants to the states and local communities that are for general use in a broad area, such as

community development. States or local communities have discretion in deciding how to spend the money. Created

largely as a response to complaints from state and local governments about the paperwork and requirements attached to

most grants.

Formula grants - grants for specific programs distributed according to community demographic factors, such as

population or income. Examples include programs such as Medicaid and Aid for Families with Dependent Children,

where applicants automatically qualify for aid if they meet the requirements.

General purpose grants - the smallest category of federal grants which may be used by states and local communities

mostly as they wish. General revenue sharing (see below) was in this category, but was later discontinued.

Revenue sharing – A law providing for the distribution of a fixed amount or share o federal tax revenues to the states for

spending on almost any government purpose ended in 1986. Distribution was intended to send more money to poorer,

heavily taxed states and less to richer ones.

Grants-in-aid (categorical grant) – Federal grants to states and local communities that are earmarked for specific

purposes only, such as pollution control, schools (lunch program), airports, highways, education, major welfare services,

or hospitals. These funds are allocated by formula and are subject to detailed federal conditions, often on a matching

basis; that is, the local government receiving the federal funds must put up some of its own dollars. Categorical grants, in

addition, provide federal supervision to ensure that the federal dollars are spent as Congress wants. A categorical grant is

the main instrument the national government uses to influence a state’s governmental policy.

Enumerated powers – The powers explicitly granted to Congress by the Constitution [Art. I; section 8]. Synonymous

with delegated powers and expressed powers.

Delegated powers - The delegated (also known as expressed or enumerated) powers are granted to, and exercised ONLY

by the national government.

Implied powers – Powers not explicitly stated in the Constitution but which are suggested or implied by the "general

welfare," "necessary & proper," “elastic” and commerce clauses in the Constitution.

Inherent powers - Those powers that belong to the national government simply because it is the national government.

Prohibited powers - Expressly bar government from specific actions, e.g. state governments cannot coin money, no ex

post facto laws or grant titles of nobility.

Concurrent powers - Powers that the Constitution gives to both the national and state governments, such as the power to

levy taxes.

Reserved powers (10th Amendment) – Those powers retained by the states based on Amendment X which states, "The

power not delegated to the United States by the Constitution, not prohibited to it by the States, are reserved to the States

or to the people." Thus, state powers are called reserved powers.

Police Power - The power of a state to promote health, safety, and morals.

Necessary and proper clause - The last clause in Section 8 of Article I of the Constitution that gives Congress the means

to execute its enumerated powers. This clause is the basis for Congress’s implied powers. This clause is also known as

the elastic clause and is a significant power of Congress, granting Congress the ability to interpret its lawmaking ability in

a broad manner.

Elastic clause - grants Congress the power to choose whatever means are necessary to execute its delegated powers.

Nullification/states' rights doctrine– declaring something null or void. A theory first advanced by James Madison and

Thomas Jefferson that the states had the right to declare a federal law null and void. The theory was revived by John C.

Calhoun of South Carolina in opposition to federal efforts to restrict slavery. States' rights advocates in the South claimed

a state had the right to nullify a national law; they argued that ultimate power rested with the state governments.

Preemption – when a federal law or regulation takes over and prevents enforcement of a state or local law or regulation.

Total and Partial Preemption - A technique of Congress to establish federal regulations. Total preemption rests on the

national governments power under the supremacy and commerce clauses to preempt conflicting state and local activity.

Building on this constitutional authority, federal law in certain areas entirely preempts state and local governments from

the field. Sometimes federal law provides for partial preemption in establishing basic policies but requires states to

administer them. Some programs give states an option not to participate, but if a state chooses not to do so, the national

government steps in and runs the program. Even worse from the state’s point of view is mandatory partial preemption, in

which the national government requires states to act on peril of losing other funds but provides no funds to support state

action.

McCulloch v. Maryland – Supreme Court case which established the key concepts of implied powers, broad

construction of the Constitution, and national supremacy. The case presented two questions: Did Congress have the

authority to establish the bank? Did the Maryland law unconstitutionally interfere with congressional powers? Decision:

States can not tax an agency of the federal government; therefore Maryland could not tax the U.S. The Congress does

have the authority to charter the Bank of the U.S. using the “elastic clause”; the bank is necessary and proper.

Gibbons v. Ogden – This case determined that Congressional control over interstate commerce includes navigation. The

result was to broaden the definition of interstate commence to include all commercial exchanges.

Commerce clause – gives Congress the power to regulate all business activities that cross state lines or affect more than

one state or other nations [Article 1, section 8].

Full faith and credit –refers to a clause in Article IV of the Constitution which requires that each state respect the public

acts, records, laws, records and court decisions of another state. In practice, this means that a judgment obtained in a state

court in a civil (non-criminal) case must be recognized by the courts of another state.

Interstate compact – A formal agreement, largely in the form of financial arrangements, which are entered into between

two or more states. Congress must approve most such agreements.

Extradition – A constitutional provision which allows a state to request another state to return fugitives. It requires that

states must return a person charged with a crime in another state to that state for trial or imprisonment. {Article IV]

Privileges and immunities clause – No state can draw unreasonable distinctions between its own residents and those

persons who happen to live in other states (legal protection, access to courts, travel and property rights).

Enabling act - A congressional act that allows the citizens of a territory desiring statehood to frame a state constitution.

Competitive federalism – Views the national government, 50 states, and thousands of local governments as competing

with each other over ways to put together packages of services and taxes. Applies the analogy of the marketplace: we have

some choice about which state and city we want to “use”, just as we have choices about what kind of telephone service we

use.

Cooperative federalism & fiscal federalism – View that the national and state governments are partners, not

competitors, in the exercise of governmental authority. The various levels of government are seen as related parts of a

single governmental system, characterized more by cooperation and shared functions than by conflict and competition. In

cooperative federalism, responsibilities are mingled and distinctions are blurred between the levels of government.

Fiscal federalism – Through different grant programs, slices up the marble cake into many different pieces, making it

even more difficult to differentiate the functions of the levels of government.

Dual federalism (layer cake federalism) – Views the Constitution as giving a limited list of powers—primarily foreign

policy and national defense—to the national government, leaving the rest to the sovereign states. Each level of

government is dominant within its own sphere. The Supreme Court serves as the umpire between the national government

and the states in disputes over which level of government has responsibility for a particular activity.

Permissive federalism – implies that although federalism provides “a sharing of power and authority between the

national and state government, the states’ share rests upon the leniency of the national government.

Marble cake federalism – Refers to the three-layered system of government, i.e., national, state, and local governments

which are intermingled. All levels of government are involved in a variety of issues and programs, rather than a layer

cake, or dual federalism, with fixed divisions between layers or levels of government.