Three Steps for Reading the Wall Street Journal for an Economics

advertisement

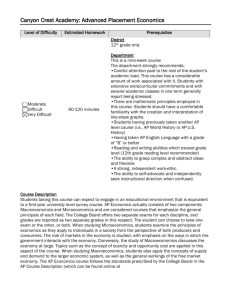

Reading the Wall Street Journal The Wall Street Journal, when you first look at it, is daunting. A likely first impression is “There is no way I am going to be able to read that whole paper every day and have time for anything else.” We agree; if you try to read every page it will take the entire day. If you are retired and looking to fill up your time, that may be a good strategy, but it isn’t a good strategy for most students. Most students have about 30 minutes a day to read the entire paper. Luckily, that’s enough time to extract the information that is most relevant for your course. Reading the Wall Street Journal quickly is good training for later life, because most successful business people are busier than students and seldom have more that 30 minutes to spend on reading the Journal. (Those who spend less, or more, often aren’t successful.) So, here’s a brief introduction to The Wall Street Journal for an efficient introductory economics student with about 30 minutes a day to spend on reading the paper. The key to getting the needed information in a short period of time is efficient information processing—scanning the headlines and the places in the Journal where the relevant information will likely appear and then reading carefully only those articles about those issues you are studying or need to know. This process of efficient information processing is central to succeeding as a student and as a businessperson. To process information efficiently, you must know what you are looking for. As an economics student you are naturally interested in economics, which means that 80% of the newspaper can be scanned briefly and is not directly relevant to the course. We focus here on the 20% of the journal that most directly relates to your economics class. Structure and Layout The first step in efficient information processing is to know the structure and layout of the information source, so let’s discuss that structure and layout. Note first that the Journal consists of four sections—A, B, C, and a fourth rotating section. Section A is the primary section. Section B, titled Marketplace, addresses lots of micro issues including advertising, distributing, packaging, law, and technology. The third section, Money & Investing, is an in-depth review of financial data and statistics. The fourth section changes depending on the day. The Personal Journal appears Tuesday through Thursday. On Mondays the fourth section is Technology and on Fridays it is the Weekend Section. Most principles of economics students need only look at the fourth section briefly. Exhibit 1 gives you the general layout of the six pages of the Journal that are of primary focus for economics students. Main Section Marketplace Money & Investing Page A2 International Editorial Page Let’s go through a general introduction, and then talk about specific strategies for reading The Wall Street Journal in reference to the pages listed above. For the general reader, or the beginning student of economics, the first page of the first three sections is the most important. That is why they are included as three of the crucial pages. Inside the subsections are of interest to particular subgroups. Economics students are interested in page A2 (page 2 of section A), the This chapter was in part written using information in The Wall Street Journal Student Guide. We encourage all instructors who require The Wall Street Journal as reading for the course to ask your Wall Street Journal representative for classroom copies of that guide, which provides a more in-depth look at the Journal. Additional resources available through the Educational Service Bureau of the Wall Street Journal include The Wall Street Journal Video Guide to Money & Markets, The Wall Street Journal Guide to Understanding Money & Markets and How to Read Stock Market Quotations and The Dow Jones Averages: A Non-Professional’s Guide. Reading the Wall Street Journal International page, and the Editorial page. That is why these three pages are shown in the above exhibit. There are other sections you should take a quick look at, but these are the six most important pages. Six pages should sound more manageable. Must Reading for Economics Students First Page, Section A The first page of section A is a central page for students enrolled in either macroeconomics or microeconomics classes. It often has articles on economic topics and also provides you with an overview of articles inside the paper. If you look at several front pages from different days you will notice that they are arranged in a similar way. The front page has six columns, each of which is home to a different set of columns, an index on the lower left, and another small box, Inside Today’s Journal, on the lower right. What’s News, in columns two and three, provides a glance at the contents of the newspaper and other summary stories. The leders (an old British term that implied a story that “led” the paper) appear in columns one, five and six. These are the leading stories about business and the economy. Column four is the A-hed, so named because the box around the headline and the asterisks below the main headline look something like an A. The A-hed is often an amusing report of a story that piqued the interest of a reporter. What’s News. Business executives are busy people without the time to read everything, so their news is predigested for them in the two-column What’s News. The right-hand column of What’s News is a rundown of world events — the rebuilding of Iraq, conflict between the Palestine and Israel, the latest action taken by Congress, etc. While knowledge of these events is only indirectly related to your understanding of economics, it is good to know what is going on in the world outside. There is more to life than economics. Really. But finding out that information is on your time, not on our 30 minutes. The left-hand column of What’s News is a summary of business and finance events that are covered in more complete stories in the paper. Skim this for topics that are covered in your courses, since these are likely to contain an article or two that is a must read. For example, a Friday June 6, 2003 issue’s list of events includes an interest rate cut by the European Central Bank, which is important information for any macro student. The articles related to this news item reinforce the explanation of monetary policy given in Chapter 28 of Colander’s Economics (Chapter 12 in Macroeconomics). So if you are in a macroeconomics class, you probably should read that article. Another item in the June 6th What’s News mentions a planned merger between Palm and Handspring, two hand-held computer makers. This raises issues regarding competition in a market of rapidly changing technology discussed in Chapters 14 and 15 of Colander’s Microeconomics and Economics. So if you are in a microeconomics class, you should probably read that article. What’s News, combined with the Index and the Inside Today’s Journal boxes at the lower right and the lower left are essential for you to mapping your exploration of the inside sections of the Journal. The Leders. After scanning What’s News, look at the titles of the right- and left-hand leders. These are the day’s feature stories and cover a wide range of topics, which may or may not be significant to an introductory class in economics. A glance at the title usually tells you. The June 4, 2003, issue’s right-hand leder, “U.S. and Europe Signal the Rates May be Cut Soon,” intertwines the subjects of inflation and weak currency, raised in your macroeconomics textbook, with a microeconomics discussion of the changing definition of the Russian middle class. The right-hand leder on June 6, 2003 is titled “Want to Lift Your Firm’s Rating on Governance? Buy The Test” provides some nice insights into incentives of rating firms’ governance procedures, and the way in which real business often works. That’s an important insight about incentives that you’re expected to learn in microeconomics. The June 5, 2003 right-hand leder, “Amid Shortages, New U.S. Agency Tries to Run Iraq” includes a discussion of the interaction of supply and demand in the electricity and gasoline markets. If there is a shortage, you can be sure that the pricing system is not being allowed to operate freely. This article is also relevant to macroeconomics because it shows the importance of a well-functioning government to growth. The various roles of government presented in the textbook make sense as one reads about the need for the protection of property rights for a market to function. The leders do not always apply to economics, but you should always look at the titles, and skim any article that looks pertinent, reading carefully any that are. 2 Reading the Wall Street Journal The A-hed. Next, take a look at the A-hed, the fourth column. This column is often offbeat and humorous. It may not address any economics concerns you thought you had, but you will probably enjoy the story. “Poultry in Motion: Chicken Catching Goes High-Tech” crows a June 4, 2003, A-hed. Laughing all the way through the commentary on the challenges of nabbing eight billion chickens from the coop by hand and a new mechanical chicken harvester, one also obtains an understanding of the incentive for technological innovation. But recognize that reading this fun stuff is generally on your time, and does not count for the 30 minutes. Editorial and Opinions Page After reading the front page, flip to the editorial page and glance at the opinion headlines. First, look at the editorials. This is supply-side conservatism at its strongest. Usually well written and well argued, but almost never objective, they are worthwhile to look at, especially if you are a liberal who needs some exposure to conservative arguments. (If you’re a conservative, we suggest you read The New York Times editorials for some exposure to arguments on the other side.) Despite their bias, once in a while these editorials directly address a topic relevant for the principles course, so they are worth a look. But remember these are opinion pieces and combine normative and positive arguments. After skimming the editorial titles, skim the op-ed article titles. An op-ed piece is so named because it is positioned opposite the editorial. Unlike the custom in many newspapers, most Wall Street Journal op-ed pieces are written from the perspective of a businessperson or economist, so a number of them may well be relevant to an economics course. The majority of these op-ed pieces generally have a strong conservative, supply-side, bias, although not as conservative as the editorials. But every so often, for a stab at fairness, a liberal piece is included. Whatever the political persuasion of the author, these pieces are usually skillful and knowledgeable. They are models for essay writing, with a well-defined theme, supporting arguments, and an animated and engaging style. The debates in these pages sometimes expand upon the economics principles presented in your textbook, so it is worthwhile to glance through the headlines and read the relevant pieces. For example, a June 4, 2003, op-ed is titled “Is the Euro Working?” The piece explores the political issues regarding the euro—whether Britain will leave open the door for joining the monetary union in the future and whether the euro has changed the welfare policies in Germany. The reader can draw on the textbook analysis to evaluate the columnist’s arguments, just as the columnist’s arguments challenge the reader to reevaluate the concepts presented in the textbook. Section A, Page 2 Now that you have made it through page A1 and the editorial pages, you need to follow up on the relevant portions of What’s News. For macroeconomics this usually means turning to page A2 where most macroeconomic issues are discussed. Page A2, June 5, 2004, provides an example of what you will find on this page. It contains four stories. Of these “Workers’ Productivity Beat Previous Estimate” leads at the top of the page, and is the most relevant to economics. This story reports on nonfarm business productivity data as well as raises questions about deflation, unemployment, business cycles, and activist monetary policy. The others are less relevant. On Mondays and Thursdays, look for two special columns. Monday’s Outlook contains information useful for macroeconomics. Articles in this column are both domestic and international in nature and cover mainly markets and investing. Articles here, unlike the others on page A2, are written with a specific point of view. They begin with a statement regarding a trend or policy and then provide evidence to support their perspective. This column is open to any Journal reporter, and articles are chosen by competition. An example of what you will find there is the Monday June 2 nd, 2003 column, “Developing World Enlivens Animation.” This article reports on ever-increasing competition among developing countries to produce goods and services products destined for the U.S. market, in this case animated films such as Scooby-Doo. Thursday’s “Capital” column, written by David Wessel, covers stories about growth and the health of economies. On June 5th, 2003 “Use Words Wisely When Moving Markets,” discusses the importance of rhetoric by government officials to policy. This story is definitely pertinent to the study of macroeconomics. 3 Reading the Wall Street Journal Not all of the stories on page A2 are worth reading for the principles course. Do not bother to read about the retirement of a firm’s chairman. Names, faces, and even dates are not usually as important as actions and ideas unless, of course, the names and faces are biggies. (Who is the Chairman of the Fed?) The articles you are primarily interested in should involve questions of policy—articles such as: What are the economic motives behind actions taken by companies, consumers, or the government? and: What patterns of behavior do the models and statistics demonstrate? Along with your print subscription you get an online subscription at www.wsj.com. Most articles is the same, but without the cost constraints of a printed newspaper, the online subscription can offers a few extras such as Tracking the Economy, a table published on Fridays that lists the key statistics scheduled to be released during the coming week. It will give the economic indicator, the period it covers, the release date, the indicator’s most recent value, and the consensus forecast for the release. For major economic indicators, make a note of the release date and look for an article covering the release on the day following the release. The following box lists the major economic statistics reported by The Wall Street Journal and their approximate release dates. Major Economic Releases Published in The Wall Street Journal Series Data Frequency Balance of payments and trade Conference Board’s consumer confidence Consumer credit Consumer price index Durable goods orders Employment Federal expenditures and receipts GDP Housing starts Industrial production and capacity utilization Inventories Leading economic indicators Manufacturers’ orders Personal income and consumption Producer price index Productivity Retail sales Appearance in the WSJ Q Midmonth* M M M M M M Q M 1st week of each month 2nd week of each month Mid-month (after PPI release) End of next-to-last week of each month Monday after 1st Friday of each month Last week End of the month Third week of each month M M M M Q M Q M Mid-month Second week of each month End of each month 1st week of each month Day after GDP report Mid-month End of the month** Middle of 2nd week of each month * Released only third month of every quarter. ** Released only first month of every quarter. Section A, International Page As is emphasized in Chapter 3 of Colander’s Economics, the U.S. economy is becoming increasingly linked to world economies and world events. This means that the International section is a key section for all students to read. It provides political, social, economic and cultural news from foreign countries. The first two columns present short summaries of events around the world. The Europe section on the June 5, 2003 reported that Germany’s deficit might exceed the limit set by the rules governing the European Monetary Union. This brings up issues about the costs and benefits of the euro as a common currency discussed in Chapter 33 in Economics (18 in Macroeconomics). Columns 4-6 are more in-depth articles, often with political interest, and sometimes of economic interest. Glance at these quickly. A June 6, 2003 article, “Chile Hopes Trade Pact Will Relaunch Its Economy” tells of Chilean officials’ hope that removing trade barriers with the United States will contribute to economic growth. This is a real-world example of the discussion about free trade in Chapters 2 and 21 in your textbook. If there’s a lot of international news, multiple pages are devoted to international issues, so be sure to skim the next couple of pages for a relevant article. 4 Reading the Wall Street Journal Section C, Page 1 Pages A1, A2, the International page, and the editorial pages will probably be the core of the required reading for a macroeconomics course. However, one other place to skim briefly is Section C, Money & Investing. Ahead of the Tape discusses recent reports about the economy or particular firms and how that will impact financial markets. Markets Diary, at the bottom of the page, charts recent activity in the stock, bond, and commodity markets. The remaining four columns present feature stories from the various articles inside this section. They usually report on what has happened to interest rates, stock prices, and bond prices. Articles in this section not only report information; they also provide explanations of why these prices did what they did, after the fact. They are not so good about telling you what will happen in the future, which should make you wary of the after-the-fact explanation. Of course, if you are sitting on a trust fund, like to play the stock market, or are interested in becoming a trader, you may well want to get into the bowels of this section with all the stock prices and such. But for the majority of introductory students this is much too detailed. Read it, but it is on your time, not on the 30 minutes for the course. Section B, Page 1 Microeconomics students can usually skip much of what is on page A2 and Section C, Money & Investing, and move directly to the first page of Section B, the Marketplace. The stories in this section often cover how market structure and characteristics change over time, as well as the implications of these ongoing developments. They can be highly relevant, but they often are only slightly relevant. Read through the first few paragraphs of the stories to determine which. By the third paragraph, you can usually tell whether the story has any application to anything you are learning in class. The Wednesday June 4, 2003 page is typical of what you will find. One story, “‘Destination’ Car Shopping” discusses the development of large auto malls as a method of selling cars. It gives you a sense of the inner bowels of supply and demand—somehow the suppliers have to entice the demanders to come in and look at their products. By placing a racecar museum in the mall, the developers hope to do just that. A second article on this page is a rotating column on the far left. The column for June 4, 2002 is Déjà Vu, (appearing on Wednesdays), which on this day gives the history of the income tax, and discusses the politics involved in its evolution. That’s relevant for both micro and macro. Another article reports of a dispute between the Jones Apparel Group and Polo Ralph Lauren about the marketing of designer clothing. It’s interesting, but only slightly relevant to a microeconomics course. The lead stories on that page concern the fight against SARs, and are not directly relevant to economics. The June 5, 2003 page has articles on the economics of horseracing, selling goods to the poor in India, and a drug company’s decision to transfer TB-Drug rights to poor nations. All are interesting and highly relevant to microeconomics courses. At the bottom of the page, the box, “Inside” directs you to fairly important stories inside the Marketplace. The Wall Street Journal assigns one page apiece to technology and health, industry focus, and media and marketing, with features on enterprise, industry and corporate focus, and personal profiles of the biggies in the business world. A quick survey of headlines should tell you whether any of these stories are worthwhile reading. And remember, the overall picture, rather than details about who is doing what where, is what you want to try to obtain first. Then you can concentrate you careful reading to those articles that are most directly relevant. Additional Sections In the past few years, The Wall Street Journal has changed its look; it’s added color and photographs as well as new sections to add interest for readers. One fun section is Friday’s Weekend Journal. Although this section won’t help you in your economics course, it is fun to read; it provides film reviews, a wine column, an exclusive real estate section and even sports coverage. Tuesday through Thursday editions have the Personal Journal, which is designed to help readers make decisions about finances and family. June 5, 2003 included an article about summer camps and preparing for deflation. In the lower-left corner is a feature much like Dear Abby, but about personal financial questions. Leave most of this for leisure reading. Reading the article that talks about deflation, however, might prove useful to a macroeconomics course. 5 Reading the Wall Street Journal Three Steps for Reading the Wall Street Journal for an Economics Class For a quick refresher on what parts of The Wall Street Journal to focus on for an economics class, we present three steps for reading the Journal on the following page. Your Strategic Map of The Wall Street Journal Step #1 Skim page A1 for top stories: What’s News (columns 2 and 3) presents a summary of domestic and world events. The leders (columns 1 and 6) are feature articles. The A-hed (column 4) covers offbeat topics. Step #2 Turn to the two editorial pages. Step #3: Students of Macroeconomics Turn back to page A2 to follow up on What’s News. Turn to the International page for world events. Flip to page C1 to review Money & Investing news. Step #3: Students of Microeconomics Turn to page B1 for Marketplace news for: top stories (columns 2 through 6) that focus on business and the consumer and the rotating column (column 1), which presents journalists’ expert viewpoints on personal and professional topics. Concluding Comments The more you practice the better you become. As you become more familiar with The Wall Street Journal, you will have an easier time separating what’s important to read from the less important articles. The time you take to read The Wall Street Journal should decrease, too, as you fine-tune your ability to skim the paper rather than read every word. Initially, it will probably take you longer than 30 minutes to go through all the relevant articles for an economics principles course, but eventually, you can get the time down to an average of 30 minutes. Of course spending more time is probably worthwhile; it’s definitely much more relevant to your economics course than watching some sitcom on TV. However, it is not more relevant than reading the text. Use The Wall Street Journal as a place to exercise your new tools from the classroom. While reading articles, think about which tools from your textbook apply. Apply these to analyze the articles critically. Take time to question the premises of the articles and form your own opinion. Finally, go a step further and consider what issues are left out of the article. The textbook will help you do this by presenting the framework within which economists think. Thinking about these articles critically will strengthen your ability to think like an economist. Not only will the text aid in your reading of the Journal, your Journal reading will raise questions for you about concepts covered in the text. Great! Now you are learning. The first stage of learning is to absorb information. But you only really make that information your own when you try to use it in a new situation and question it. 6